designer491/iStock via Getty Images

Intro

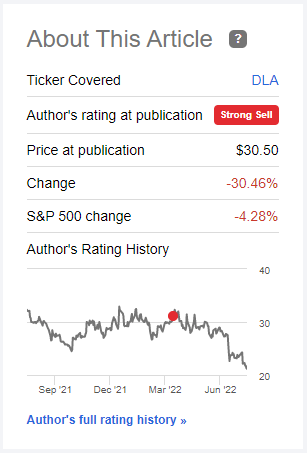

Back in April, after a deep dive into Delta Apparel’s (NYSE:DLA) revenue drivers and its valuation, I wrote an article rating the stock a “Strong Sell”, despite the overall Seeking Alpha consensus rating the stock a “Buy”. My thesis centered around rising input costs, most notably the significant rise in cotton prices, and DLA’s FIFO cost method creating a cost recognition delay. This delay resulted in record margins in 2021 and the H1 of FY22. I argued that as higher cost inventory comes up to the top of the pipeline, gross margins would shrink. Surely enough, Delta Apparel saw slower growth and shrinking margins in Q3 compared to Q3 FY21. Since writing my controversial “strong sell” article, the stock has plunged ~30% whereas the rest of the market is only down ~4%.

DLA Performance vs S&P500 (SeekingAlpha)

Despite my contrarian arguments in the beginning of the year, I do not believe that Delta Apparel shares are headed for further significant decline. Trends that contributed to my bearish viewpoint have recently reversed. Also, Delta Apparel has demonstrated better than expected pricing power over the competition. However, as the future macroeconomic environment remains uncertain, I am not bullish on sales and earnings growth; at least not enough to assign a “Buy” rating. Instead, it is my belief that shares are fairly valued at $22/sh.

Q3 Earnings Recap

As mentioned in my previous article, and recently confirmed by management during the Q3 Earnings Call, higher cost inventory incurred at the beginning of the year has begun to flow through COGS. Below are two statements made by Delta Apparel’s VP, CFO, and Treasurer, Simone Walsh:

(1) Gross margins at Delta Apparel declined from the prior year fiscal third quarter by 130 basis points to 24.2% for the third quarter of fiscal 2022. This decline was driven by inflationary cost pressures, including rising prices of cotton, energy and continued labor cost pressures.

(2) In the Delta Group’s gross margins were 19.1% for the June 2022 quarter, a decline from the prior year June quarter margins of 21.7%. Gross margins were most negatively impacted by higher cost inventory flowing through cost of sales. These costs include the rising cost of cotton, energy, dyes and chemicals and freight and wages.

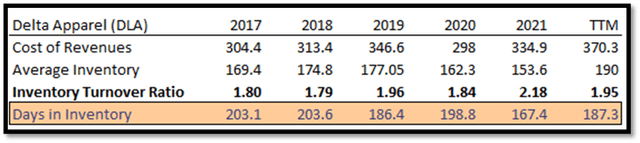

Delta Apparel’s TTM inventory turnover is ~1.9x. This means that it takes Delta Apparel around 6 months to sell their inventory. While this would not be a problem when input costs are stable, the rapid rise in prices experienced over the past 12 months leads to a wider gross margin. This is because sales reflect current selling prices while costs reflect 6-month-old input costs.

DLA Inventory Turnover/Days In Inventory (Author Using Data from Financial Statements)

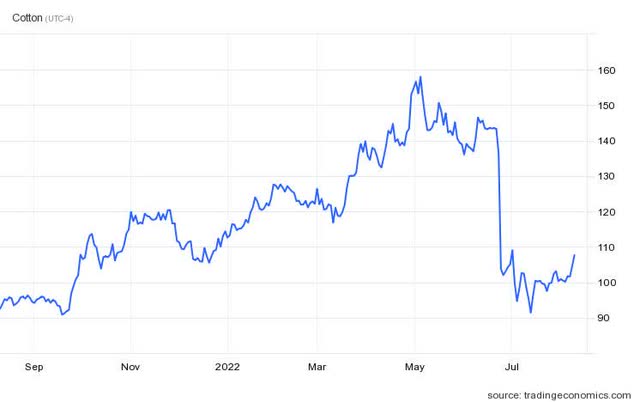

While higher input costs are beginning to flow through COGS, raw material costs, most notably cotton, have dropped significantly as of late. The chart below shows cotton price movements over the past year:

Cotton Prices (USD/LBS) (TradingEconomics)

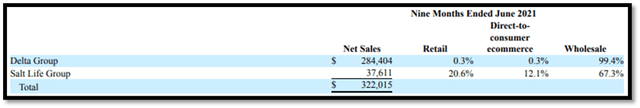

While cotton remains higher than it was a year ago, and still above pre-pandemic levels, ~$1/lbs has less of an impact on margins than $1.40+/lbs. All things equal, this implies better gross margins for DLA in the future. Some may argue that cotton prices should not have a significant impact on costs because Delta Apparel could just raise prices. While this may be possible for an established brand that sells through retail and ecommerce channels, Delta Apparel instead relies on their wholesale channel. Wholesale sales do not usually garner the price markup that established and differentiated brands do from retail and ecommerce channels. In addition, as retailers are currently dealing with higher inventory levels, there very well could be less demand from businesses for Delta Apparel’s products. Therefore, I do not believe Delta Apparel has the ability to completely push along their costs to their customers going forward. If the Delta Group segment may not be able to offset higher costs, what about Salt Life?

Salt Life’s Expansion

Salt Life has added 4 new locations in Q3 to bring their total to 20 retail locations from 12 in Q3 ’21. Despite increasing their fleet size by two-thirds, Q3 sales for Salt Life were only up 30% y/y and 22% comparing 9 months ended. This leads me to believe that although the Salt Life group has better margins than the Delta Group segment (51.6% vs 19.6% 9 months ended), the Salt Life brand is not going to be the growth driver that investors may have hoped it would be. In addition, most of Salt Life’s sales comes not from their new locations, but rather from their wholesale channels.

Salt Life Sales by Channel (Q3 22 10Q)

This implies that the majority of Salt Life’s revenue comes from selling their branded shirts in bulk to other retailers. There would not be any cause for concern given a thriving economic environment, but as previously mentioned, persistent inflation along with unpredictable consumer demand has caused excess inventory levels at many retailers. If retailers start dialing back on purchases right after Salt Life’s record expansion, Salt Life may be forced to turn to heavy discounting to clear their merchandise. Therefore, it is possible that Salt Life may be an operating margin liability given growing consumer uncertainty.

Valuation

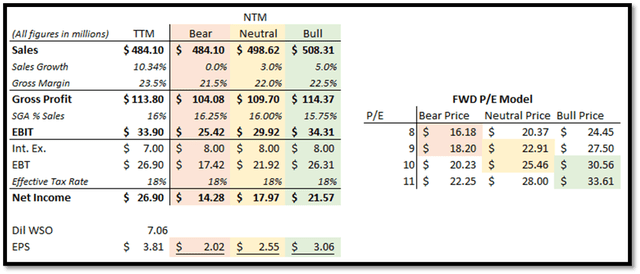

Given the trends shown in the new earnings report, I have created 3 scenarios for the next twelve months. The details of each scenario are shown below:

- Bear Case (0% sales growth, 21.5% gross margin, 16.5% SGA/Sales)

- As Q3 sales growth y/y came out to 6%, there is a possibility that demand for DLA’s products could stagnate or even decline given macroeconomic uncertainties. This would lead to less pricing power as the higher input costs, that were confirmed by management, make their way to the top of the inventory pipeline. This would lead to gross margin contraction and higher SGA/Sales deleveraging.

- Neutral Case (3% growth, 22% gross margin, 16.25% SGA/Sales)

- While the future of the economy is still uncertain, consumer spending remains resilient. Although persistent inflation and higher interest rates may eventually force consumers to dial back on discretionary purchases, Delta Apparel has demonstrated adequate pricing power. Therefore, DLA may still see some sales growth the next 12 months. However, high-cost inventory still remains and Q3’s report foreshadows further margin compression. I believe this scenario to be the more likely of the 3.

- Bull Case (5% growth, 22.5% gross margin, 16% SGA/Sales)

- Being reasonably optimistic, consumer spending could continue defying expectations. If the demand for custom apparel still remains strong relative to other discretionary categories and/or the DTG2GO subsidiary announces another lucrative partnership, this scenario would imply little to no change in Delta Apparel’s pricing power and higher cost inventory having less of an impact on margins.

Below is a FWD P/E model accounting for these 3 scenarios and their assumptions:

FWD P/E Model (Bear, Neutral, Bull) (Author using data from 10Qs and ECs)

I used a range between 8-11x for the P/E multiple. This was due to 2 main reasons. 1) Delta Apparel’s total net debt increasing by 40.7M y/y to $162M and 2) lower growth expectations set by Q3’s reported sales growth. Higher net debt and lower expected sales growth going forward could very well result in a lower P/E multiple assigned by the market.

The bear scenario I outlined in the model would imply a 15-20% decline in share price from current levels. I believe this scenario to be less likely than my base case but still a possibility given the macro environment and the trends foreshadowed by Q3’s reported figures. The base case would imply a 5-20% upside with the above assumptions. I believe that this scenario is most likely and that a 9-10x P/E multiple to be reasonable. My bull scenario would imply that DLA shares return to the highs seen earlier in the year. This would imply an upside of up to ~60% with the above assumptions. It is my opinion that in order for this scenario to play out, most of the macro-specific and company-specific headwinds affecting DLA will have to dissipate.

Risks

Although I outlined 3 possible scenarios, I lean closer to the neutral scenario and its assumptions. The risks to my “hold” rating can be divided between risks causing DLA’s shares to either underperform or outperform the market.

The risks causing DLA to underperform include: gross margin compression via higher input costs; shrinking industry demand; and reversal of input cost downtrend. To elaborate, if demand for DLA’s products shrinks significantly, DLA will not have the pricing power to offset the higher cost inventory incurred at the beginning of the year. In addition, while input costs recently coming down means less margin compression in 2023, a reversal of that trend due to war, new supply chain disruptions, etc could mean no margin expansion for the foreseeable future.

The risks causing DLA to outperform include: inflation coming down considerably in the next 12 months; federal funds rate being cut in 2023; further declining input costs; and more unexpected partnerships with the DTG2GO subsidiary. Trends in disposable income usually affect consumer demand which means inflation coming down and/or Fed cutting rates may lead to a surge in demand for discretionary items including DLA’s products. Also, if raw material and freight costs continue to fall, this would actually mean margin expansion for Delta Apparel as low costs are coupled with higher prices. Finally, there is the possibility that DLA’s digital printing subsidiary, DTG2GO, could announce a high-profile partnership similar to that of the Fanatics partnership.

Conclusion

Although for the majority of the article I focused on near-term challenges for Delta Apparel, that does not necessarily mean DLA is overvalued. Although macroeconomic uncertainty is high for the US economy, macro trends are currently positive (July CPI, unemployment rate, June consumer spending, etc). I am not optimistic that Delta Apparel will match their past sales growth figures, implied by my 5% sales growth assumption in a bull scenario, but I do not believe negative sales growth in the NTM to be likely. There is also the possibility of another DTG2GO partnership that may be soften any blow from contracting margins or unexpectedly weak product demand. Furthermore, the sharp decline in cotton, energy, and freight costs should translate to lower costs and higher margins in early 2023, as long as these trends do not reverse.

As far as valuation goes, the market’s expectations seem to be more reasonable than earlier on in the year. The issue is that total net debt increasing y/y and lower than expected sales growth in Q3 may imply a smaller P/E multiple going forward. Still, a low single-digit growth rate and a slightly lower y/y operating margin these next 12 months would imply an adequate 5-20% upside, given a P/E multiple between 9-11x. So there is still some upside for investors. Therefore, I believe Delta Apparel is fairly priced and should perform in-line with the rest of the market on a 12-month investment horizon.

Be the first to comment