Sergey Nazarov/iStock via Getty Images

Introduction

The Honest Company (NASDAQ:HNST) develops innovative solutions for baby and beauty products selling them in over 40,000 retailers and on their website. Honest has over $306 million in revenue, and currently maintains a net income loss of $48.8 million. Honest is currently a $308 million company and offers significant upside potential. It was initially founded by actress Jessica Alba and IPO’d about one year ago, raising $412.8 million. Since its IPO, Honest has fallen over 82% to $3.35 a share due to a selloff in small caps and disappointing earnings, subsequently presenting a significant opportunity for this upcoming year with over 231% upside. The primary factors that contribute to their significant upside is rapid margin expansion, continually expanding operations, stealing market share, and disgustingly low valuation.

Investment Thesis

Honest has enormous potential regarding its future due to its rapidly expanding consumer segments, a phenomenal management team, and a relatively low valuation regarding its growth. The primary reason that Honest has significantly fallen from its highs is missing analyst expectations on earnings and remaining unprofitable for longer than analysts had anticipated. Although HNST is currently not profitable, they appear to have enough cash on hand ($78.1 million) to sustain any losses and eventually break even by 2023. Their management team, led by Nick Vlahos, has significant experience in other companies such as Clorox (CLX), Amazon (AMZN), and other cosmetic companies; therefore, I believe they will accelerate growth with Honest due to that prior experience. Additional factors further propelling their growth are:

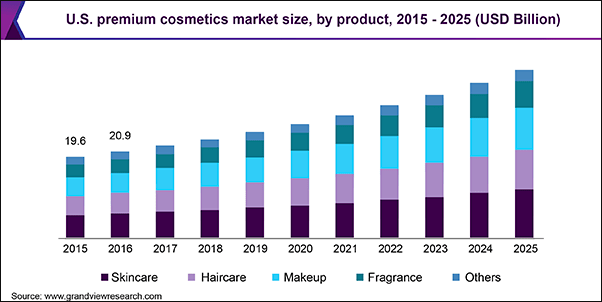

- The baby products and beauty industry is rapidly growing (5%).

- An extremely large total addressable market of over $582.7 billion, baby products account for $18.7 billion and the beauty market’s TAM is $564 billion.

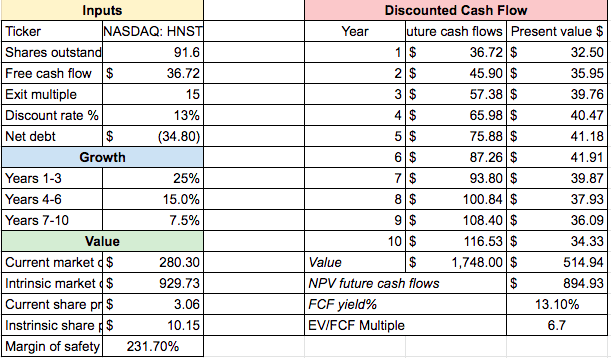

Lastly, when considering these multitudes of aspects, utilizing a DCF model, Honest has over 231% upside with a price target of $10.2 at a valuation of slightly less than 1 billion.

Financial Analysis

Honest currently has revenue of $306 million, slightly declining by 1% YoY due to extremely high comparables. They are projected to increase revenue by an additional 10% next year, bringing their forward sales to 346 million and a forward P/S ratio of less than 1. Now, this multiple isn’t particularly low considering their depressed gross margin of just 35%, which is much lower than the industry average of 58.14%. Luckily, they make up for their abnormally low gross margin with fast growth rates. Over the past 3 years their CAGR was just over 30%, while their projected forward CAGR is conservatively 15% for the next three years. Lastly, assuming they can maintain the industry average FCF margin of 12% with growth rates of 25%, 15%, and 7.5% over the next ten years, we can produce a DCF model for this phenomenal company giving us a price target of $10.15 with 231% upside.

HNST DCF model (Hossin Rasoli: Seeking Alpha Financials)

From a fiscal perspective, it appears that Honest is significantly undervalued at these levels and presents us with potentially monumental returns that will substantially outperform the market if these assumptions play out. It’s also essential to examine HNST’s balance sheet to ensure they don’t dilute shareholders or enter bankruptcy. Honest currently has over $78 million of cash on hand. Considering they lost $42 million in the TTM and are projected to lose a similar amount again, they should be able to afford this loss without issuing more shares. It’s imperative to note that this upcoming year, companies such as Honest will be significantly more motivated to issue shares rather than take on additional debt due to the significant interest rate hikes that are being anticipated. Additionally, HNST has no net debt; therefore, the risk of bankruptcy is extremely low unless an abnormal event occurs. In conclusion, Honest seems to be in a tremendous fiscal state, with the only worries being sustaining their substantial growth rate.

Business Operations

The Honest Company sells a variety of innovative beauty and baby products that are sustainable for the environment and unique to their marketplace. They are in over 40,000 retailers throughout the U.S., Canada, and Europe while continuing to expand their operations throughout the world. Honest has achieved this success so far with its phenomenal management team led by numerous people who had prior experience in Clorox, Amazon, and countless other companies. They have nurtured an environment that encourages innovation in an ethical method, therefore, dwarfing the competition and stealing market share. Lastly, the beauty and baby products industries have an extremely large TAM continuously growing. When considering these factors, it seems that Honest has enormous upside potential due to its fast growth rates and smooth business operations.

US premium cosmetics market size (grandviewreasearch)

Risk Factors

Regarding Honest, due to the smaller nature of their business’s overall operations in relation to their competitors and overall industry, many detrimental risks are present.

Competition

Some considerable risk factors regarding Honest are that they may forfeit significant market share and innovative edge to competitors such as Sephora due to their more substantial R&D investments. This would significantly decrease their earnings and further net income losses. Another aspect to consider is how Honest is still sustaining somewhat significant losses every year. If they incur these losses for an extended period, it may force them to dilute shareholders, ultimately obliterating shareholder value. The last and most probable risk for Honest shareholders to consider is their growth rates. Suppose HNST cannot sustain its high growth rate in the upcoming years. In that case, the stock will most likely deflate at a highly rapid rate because its valuation is propped up on generous growth estimates regarding the future.

Challenging Macroeconomic Climate

Over the past few months, due to aggressive Federal Reserve rate hikes, quantitative tightening, and hyperinflation, a potential recession is on the horizon of the US economy and this will have a significant impact on the Honest Company. Essentially, most of the Honest’s revenue stems from the baby products sector or the beauty sector. First, their revenue stemming from the baby product’s sector should remain somewhat constant or experience a slight decline. Baby products tend to have in-elastic demand as they are essential and parents won’t forfeit them as alternatives are not readily available. Additionally, during times of economic downturn, we have experienced significant declines in birth rates which will most likely transpire once more and hurt Honest. Regarding the beauty market, a recession will most likely hurt sales as it’s not an essential product but most of Honest’s revenue stems from baby products. Lastly, Honest has displayed strong pricing power in the recent inflationary environment and the effect of the Russia-Ukraine crisis also has a minimal impact on them.

Conclusion

Overall, The Honest Company is phenomenal from a qualitative and fiscal perspective. They are expanding into numerous consumer segments, often innovating to beat their competition, and maintaining a great management team with lots of prior experience in large companies. Although there are some risk factors regarding Honest, if they can weather the challenging macroeconomic environment and overcome competition they are phenomenally undervalued at these current levels and have over 231% upside making it a phenomenal investment.

Be the first to comment