DNY59

Real estate is a complex asset that makes up a large portion of the economy. As such, there is a myriad of drivers that impact its value. At any given time, there are dozens of both headwinds and tailwinds, and I would encourage factoring in both when formulating an investment thesis.

On top of these legitimate factors, sentiment is frequently responsible for concocting additional headwinds and tailwinds. During times of euphoria, people extrapolate property price appreciation to extreme levels.

Today, however, sentiment on real estate has reached an extreme low. This also leads to wild myth generation, and there is a particular myth that I want to address because it has reached ubiquity in public discourse.

The Real Estate Bubble Myth

The story of the Great Financial Crisis has become quite well known, and it is also well known that a housing bubble was at least partially responsible.

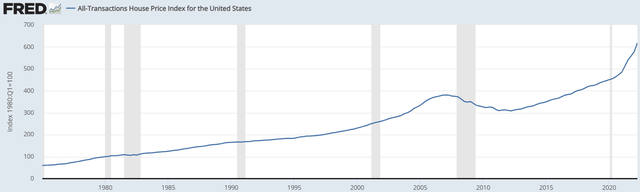

Prior to the housing bubble of circa 2005, home prices had appreciated consistently for a long time. It got extrapolated and people started to feel as if that would continue forever.

The subsequent crash was a rude awakening that real estate, along with everything else, is subject to the vicissitudes of the real economy. Damage from the GFC was so bad that it had lasting effects on people. Ever since that time, there has been an increased level of apprehension regarding real estate prices, particularly when they have risen to new highs.

Following the pandemic, home scarcity drove prices up rapidly to new highs. Importantly, the new highs have significantly surpassed the highs of the former housing bubble.

This, I believe, is the origin of the myth that we are currently in a real estate bubble. The same logic is being applied in other sectors where property prices have rapidly appreciated. Warehouses have doubled in value in just a few years, apartments are up around 50% and land prices depending on location are up materially with individual instances of appreciation over 1000%.

Such anecdotes contribute to the perception of a bubble.

In the following sections, I intend to thoroughly debunk this myth.

Not a Bubble

All squares are rectangles but not all rectangles are squares. Squares are a subset of rectangles.

Bubbles and high prices are similar. Bubbles usually or perhaps always involve rapidly increasing prices, but rapidly increasing prices are not always a bubble.

So how does one differentiate?

Well, it depends on the nature of high prices. If the prices are based on speculation and not justifiable by intrinsic value, it could be a bubble.

For real estate, however, the substantially increased prices are based on a combination of input costs, rental revenues and sustainable demand.

Input Costs

Buildings are not free. It seems strange to state something that obvious, but the concept of replacement cost seems to have gotten lost to those who think real estate is in a bubble.

When someone wants to use a particular type of property, they have three main ways of obtaining said property:

- Buy Existing building

- Build

- Rent

Building is the independent variable here. It drives both existing property prices and rental rates. People tend to like new properties, particularly when they are designed for their specific purpose. As such, the price of existing buildings tends to stay fairly close to the cost of construction. There is some wiggle room due to the time it takes to develop and the risks involved, but the two numbers are very much related.

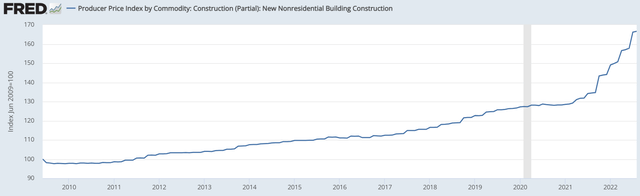

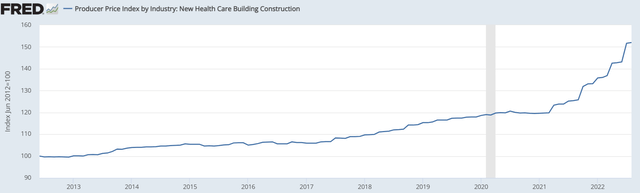

Thus, one of the main reasons real estate prices have risen is because the cost of construction has risen.

Similar charts can be seen across just about every real estate sector. Healthcare construction cost is up 50% since 2013 with most of the rise in the last two years.

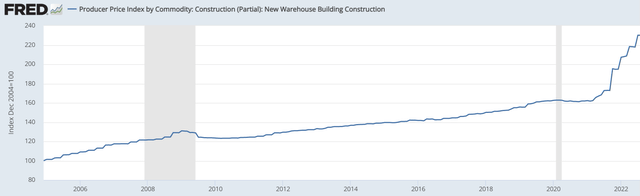

Warehouse construction cost has also shot up.

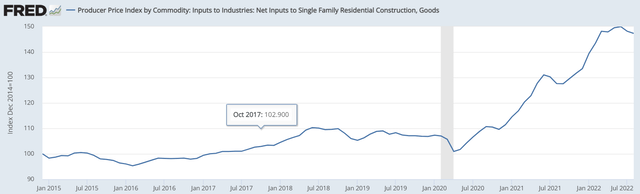

Single-family homes are also up materially, but interestingly, their graph has a slightly different shape.

Most commercial real estate is primarily metal while houses are made largely with wood. Construction costs surged along with lumber, but now that lumber has come back down, you can see that home construction costs have flattened.

Other key input costs are labor, land and interest expense to finance the construction. When wages go up at a broad level, they rarely come back down. Land prices also tend to stay up because land is getting increasingly scarce. Interest expense is continuing to rise with the Fed hiking.

Thus, I think construction cost is sustainably higher, which means property values are sustainably higher than they used to be.

When an individual or business needs real estate they have to pay what it costs and now that it costs more, real estate values are higher.

Rental Revenues

Rents work the same way as property values in that the alternative for the tenant is to buy or build their own property. If both of those options are more expensive, rents will naturally go up proportionally.

Most of us have experienced the same economic principles at work when procuring a vehicle. You get the option to lease or buy, but the lease rate is curated to be approximately the financial equivalent of buying. Occasionally demand shifts in such a way that one can glean an advantage one way or the other, but they tend to stay in the same ballpark.

In addition to the increased construction cost, rental rates have been pulled up by increased demand for real estate.

One can observe that the rental rates are in fact demand driven as rental rates have decreased in sectors where demand has dropped. Office rental rates in all but the most trophy or undersupplied locations have decreased. Just about every other sector, however, has experienced increasing demand and surging rental rates to go along with it.

Sustainable Demand

Sustainable demand is demand of a nature that can reasonably be expected to endure. Looking across the real estate spectrum, most of the demand appears to be of a sustainable nature.

- FedEx renting additional warehouses to expand its business

- Google renting additional data centers to fuel its cloud

- High-income families buying expensive homes

- Apartment rents approximating 20-30% of renter income

- Farmland rents approximating a normal percentage of farmer income

- Shopping center and mall rents at a lower-than-normal cost as a percentage of sales

There are of course individual instances one can point to in which demand for real estate is not sustainable, but demand is coming overwhelmingly from sustainable sources.

In contrast, the demand that caused the 2005-2007 housing bubble was not of a sustainable nature. Housing demand was being artificially stimulated by inappropriate loans. Low wage workers were granted loans to buy million-dollar homes. Such instances were on the extreme end, but generally, loans were far too large relative to incomes. Demand of that nature is not sustainable.

Given that today’s demand is sustainable, it provides continued support for property prices and continued support for rents.

The fact that rents are up in tandem with property prices leads us to another key point as to why it is not a bubble.

Economically Normal Ratios

One of the key characteristics of a bubble is that prices get detached from economically rational levels. In other words, the income generation of an asset does not match the price.

This mismatch between price and revenue was characteristic of both the dot com bubble and the more recent and still deflating crypto bubble. The dot com stocks in many cases did not generate revenue, and in others, only generated a tiny amount of revenue while market capitalizations swelled. As this went on, the economic return potential of such assets was no longer aligned with other potential investments. In contrast, real estate today has ratios that are economically normal. One can buy a 10-year treasury and get approximately a 4% yield with minimal risk, or they can buy a triple net leased manufacturing facility and get an approximately 7% yield with some risk.

That is a 300 basis point risk premium on the real estate asset. Depending on one’s outlook for the economy or individual geographies/sectors, one could argue that 300 basis points is either too big or too small of a risk premium, but it is certainly in the right ballpark. Pricing on real estate assets appears tethered to economic reality.

This is further backed up by the fact that rents for most sectors appear to be stable or increasing according to consensus forecasts. Thus, the revenue stream (upon which the economically normal return is based) seems secure.

Based on the above reasoning, I think it is quite clear that real estate is not in a bubble.

What About Publicly Traded REITs?

REITs of course consist of real estate, but the pricing is independent. It is therefore possible for REITs to be in a bubble even if real estate is not.

While there have been times when REIT prices substantially exceeded the value of their underlying real estate, this is not one of those times. In fact, it looks more like the opposite.

The median REIT is trading at 69.2% of net asset value. This means that REITs produce significantly more cash flow per dollar invested than one would get from investing directly in real estate.

- Median REIT FFO multiple: 12.3X

- Median REIT AFFO multiple: 12.9X

So while real estate assets have a going-in cap rate of about 6% (varying by property type, quality and location), REITs have a going-in cash flow yield of just over 8%.

I don’t think there has ever been a bubble with an 8% going in cash flow yield.

The fact that there is so much discussion about a real estate bubble when cash flow yields are so high is clear evidence that sentiment on the sector is extremely low. Rock bottom sentiment tends to be a great time to invest. I’m not sure if we are there right now, but it sure feels close.

Be the first to comment