landbysea/iStock via Getty Images

Note:

Tidewater Inc. (NYSE:TDW) has been covered by me previously, so investors should view this article as an update to my earlier publications on the company.

Last week, leading offshore support services provider Tidewater reported much better-than-expected third quarter results and reiterated its constructive industry outlook (emphasis added by author):

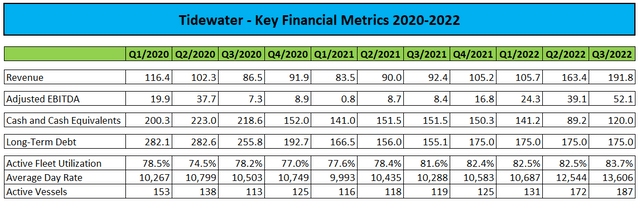

Our third quarter performance reinforces our previous commentary that the offshore vessel industry had reached an inflection point. Revenue improved by 17% sequentially, partly driven by a full quarter of the Swire Pacific Offshore (SPO) acquisition. Active utilization increased from 82.5% in the second quarter of 2022 to 83.7% and our average day rate, despite a material strengthening of the U.S. dollar, improved by nearly $1,100 per day sequentially, or approximately 8.5%. The combined improvement in utilization and average day rate provided an approximately 11.5% improvement in revenue per average active vessel. Vessel level cash margin improved to nearly 41%, up 240 basis points. It is also worth mentioning that we generated net income during the third quarter, the first quarterly net income since emergence from bankruptcy in 2017, which represents a satisfying milestone in the continued recovery of our business.

(…)

As we look forward to the remainder of 2022 and 2023, we remain confident that the fundamentals for the offshore vessel market will remain robust.

In Q3, results continued to benefit from the recent acquisition of Swire Pacific Offshore, which contributed approximately 30% of the combined company’s total revenues.

Company Press Releases and SEC-Filings

Active fleet utilization, average day rate and active vessels all increased to new multi-year highs. After some meaningful investments in working capital in H1, Tidewater managed to generate $21.9 million in free cash flow in Q3.

On the conference call, management was confident regarding the company’s free cash flow generation potential going forward:

We do expect to continue to make necessary investments in working capital as the business continues to grow. However, we believe the investment will be proportional to revenue growth and that we’ve now reached a point where the business is positioned to generate meaningful free cash flow on a quarterly basis.

As a result of anticipated reactivations and ongoing efforts to dispose of non-core vessels, Tidewater is targeting 100% fleet utilization by year-end.

Backlog for Q4 was stated at $171 million. Keep in mind that Q4 and Q1 tend to be somewhat weaker quarters as North Sea activities are reduced in the winter months.

For 2023, backlog increased by almost 20% sequentially, to $475 million, despite the company’s stated preference for spot market employment at this point in the cycle.

Commercial momentum continues as our customers plan for what, by all accounts, appears to be another leg up in offshore activity in 2023. We plan on remaining committed to our chartering strategy of staying sure to take advantage of continued attractive supply and demand fundamentals. This will allow for continued day rate improvement and drive earnings and cash flow generation that will ultimately accrue to our shareholders.

In addition, during Q&A management pointed to potential further acquisition activity:

(…) But yes, there’s still a lot to be done to clean up the industry. And we’re very excited to be able to participate in it. We do have the ongoing integration with SPO that we talked about on the call, but none of that is at the point now where it’s a distraction from us doing our next deal. So looking forward to being able to execute as we go through the remainder of 2022 and into ’23.

Indeed, with the share price having almost doubled from recent lows, Tidewater’s stock could prove to be a valuable currency in potential M&A activity going forward.

According to the company’s most recent presentation, the appraisal value of the fleet amounts to $1.76 billion, slightly above Tidewater’s enterprise value of $1.64 billion.

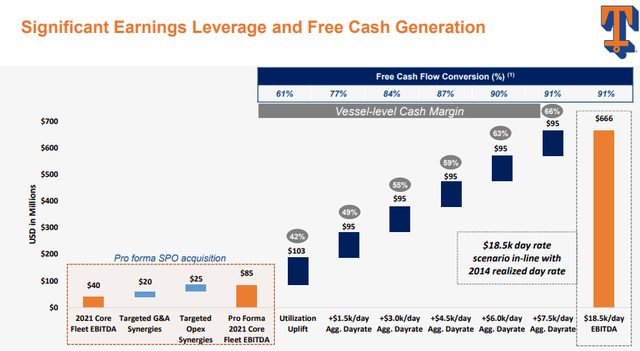

The company also highlighted its significant earnings leverage and free cash flow generation potential:

Assuming Tidewater achieves the anticipated $45 million in merger synergies and average day rates increasing by another 20% until the end of FY2023, the company’s annual EBITDA run rate would increase to approximately $500 million, with anticipated free cash flow of well above $400 million.

Bottom Line

Tidewater’s shares ascended to new 52-week highs as market participants cheered decent third quarter results and strong industry prospects going into 2023.

Should Tidewater indeed achieve the $500 million annual EBITDA run rate outlined above, I would expect the company to initiate a quarterly dividend of approximately $0.75 per share in early 2024.

Even at multi-year highs, Tidewater shares are still trading just slightly above 3x my estimated EV/EBITDA run rate at the end of 2023.

After the 90%+ rally from recent lows, shares might be ripe for a breather in the short term. However, with the offshore drilling industry likely in the early innings of a multi-year growth cycle, investors should consider adding Tidewater on any major pullbacks.

I am keeping my “Buy” rating on Tidewater shares with a medium-term price target of $50 based on an assumed 5x EV/EBITDA run rate at the end of FY2023.

Investors looking for other opportunities in the space should consider building a position in competitor SEACOR Marine Holdings Inc. (SMHI), as the shares offer similar upside potential.

Be the first to comment