Andreas Rentz

Investment Thesis

Palantir (NYSE:PLTR) is a leading software company helping organizations to make sense of the massive amounts of data they ingest on a daily basis – transforming billions of data points into actionable information. It started off predominantly by serving governments, but in recent years Palantir has been expanding rapidly into the commercial market, opening up a much larger opportunity.

Palantir Q3’22 Business Update

My investment thesis for Palantir is the following: the amount of data that businesses have to work with is only going to increase exponentially, and they need a way of coping with this data and making use of it – this is where Palantir comes in. I want to see continued expansion within Commercial customers, a strong dollar-based retention rate implying high switching costs, and continued execution of Palantir’s ‘land and expand’ strategy, as well as margins improving over the long term.

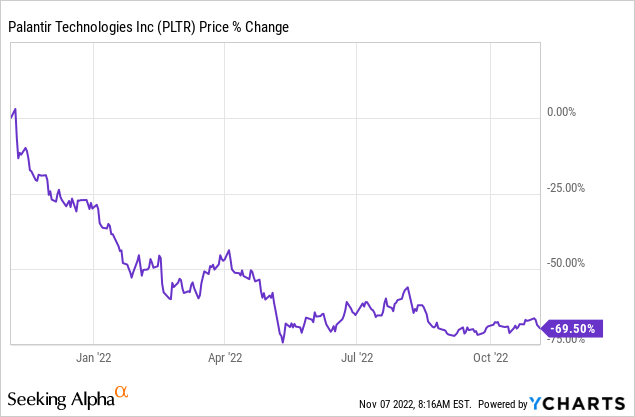

Sadly, 2022 has not been a great year for Palantir shareholders, with shares falling a painful 70% over the past twelve months. Its results in Q2 were underwhelming to say the least, combined with disappointing guidance that has weighed down shares for the last few months.

Yet it’s worth remembering that Palantir works with large contracts, and this can cause substantial fluctuations in results from one quarter to the next; don’t get me wrong, this doesn’t excuse the poor results last quarter, but it’s something that investors have to bear in mind.

In a difficult environment, shareholders were now looking to Palantir’s Q3 results to deliver some much-needed good news – or, perhaps, just less bad news than the market was expecting.

So, how did Palantir fare when it reported its Q3 earnings? Let’s take a look.

Palantir Q3 Earnings Overview

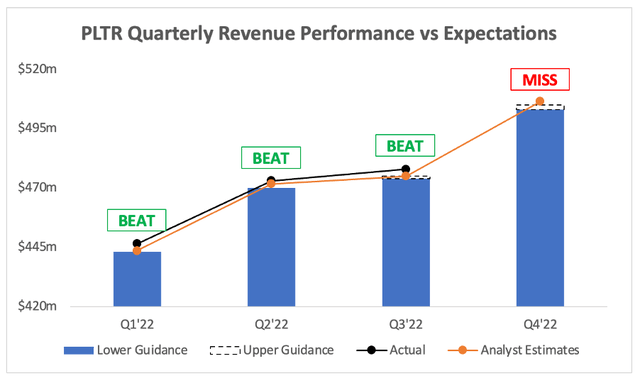

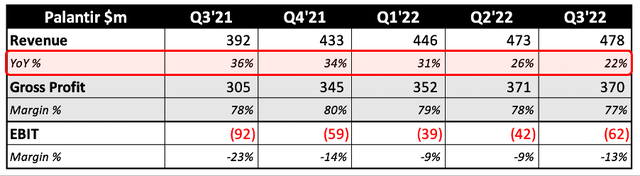

Starting from the top, and Palantir’s Q3 revenue grew 22% YoY to $478m, coming in ahead of analysts’ estimates of $475m. Given the tough macroeconomic environment, 22% would seem like a very strong growth rate, yet it only represents 1% growth QoQ as the below chart demonstrates.

Seeking Alpha / Author’s Work

But we can also see that revenue should be jumping again sequentially in Q4, with management’s guidance of $503-$505m coming in slightly below analysts’ consensus of $507m. Whilst this is a jump QoQ, Q4 revenue of $503-$505m implies YoY growth of 16-17%, representing a further slowdown in revenue growth for Palantir.

Author’s Work

On the plus side, the number of deals closed by Palantir this quarter grew 63% YoY, and total billings increased by 47% YoY; this should give investors some encouragement about Palantir’s future revenue growth potential.

It’s also worth highlighting that management had to reduce Palantir’s Q4 revenue outlook by ~$5m due to a negative foreign exchange impact thanks to the strong US dollar, but that does not fully explain the slowdown.

As a shareholder, I am fairly content with these figures; the business environment right now is difficult for Palantir, as companies are shying away from substantial investments, and all the macroeconomic headwinds have unsurprisingly resulted in a slowdown. The big question is whether or not the business itself is continuing to execute, but more on that later.

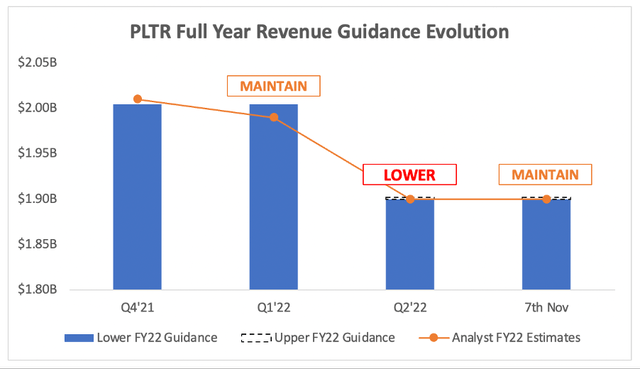

Despite coming in slightly below analysts’ Q4 revenue estimates, Palantir has maintained its full year revenue guidance of $1,900-$1,902m, which remains in line with analysts’ $1,900m estimate. The slight beat in Q3 offsets the slight miss in Q4 guidance.

Seeking Alpha / Author’s Work

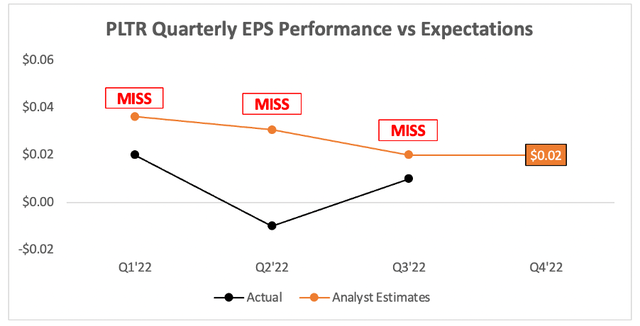

Moving onto the bottom line, and Palantir posted EPS of $0.01, which came in just below analysts’ estimates of $0.02.

Seeking Alpha / Author’s Work

This doesn’t mean too much to me; Palantir doesn’t give EPS guidance, and this isn’t a company that’s focusing on bottom line profitability. Looking at EPS performance against analysts’ expectations can still be useful to assess whether or not a company’s margins are deteriorating, but a small miss like this doesn’t tell us much.

All in all, these headline figures were pretty unexciting – nothing great, nothing terrible, pretty much all as expected; but given the terrible Q2 earnings report released a few months ago, combined with the struggles of some other software businesses this earnings season, I think Palantir shareholders should be breathing a sigh of relief; it could’ve been much worse.

Palantir CEO Alex Karp’s Q3 Shareholder Letter

Every quarter, CEO Alex Karp releases a letter to shareholders outlining his view on the quarter, and some of the key trends that Palantir is seeing. This quarter was no different, and there were plenty of eye-catching highlights.

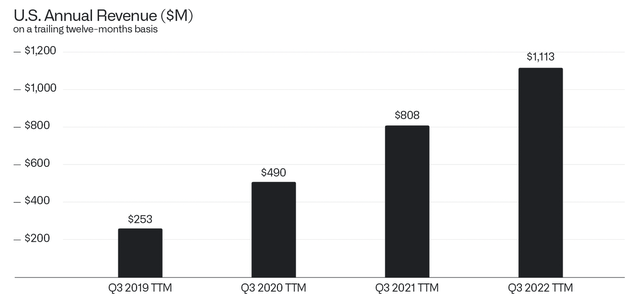

The biggest story in this letter, as it was in the previous earnings release, is Palantir’s impressive momentum within the United States. It crossed the billion-dollar mark in terms of TTM revenue from the US this quarter, more than doubling Palantir’s US business in two years, and achieving a 64% CAGR over the past three years.

Palantir Q3’22 Shareholder Letter

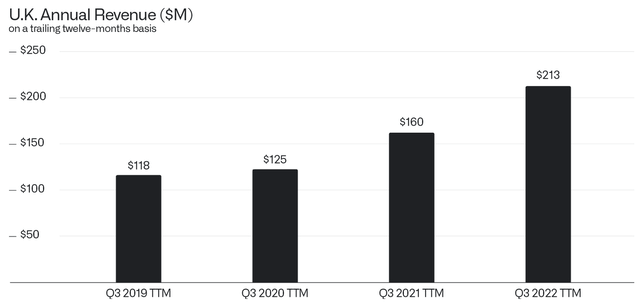

Karp also pointed out that Palantir was gaining traction in some other markets, specifically calling out the impressive momentum in the United Kingdom – which is where I’m writing this article from. Over the past twelve months, Palantir has grown its UK revenue by 33% YoY, and the below graph shows clear momentum over the last couple of years.

Palantir Q3’22 Shareholder Letter

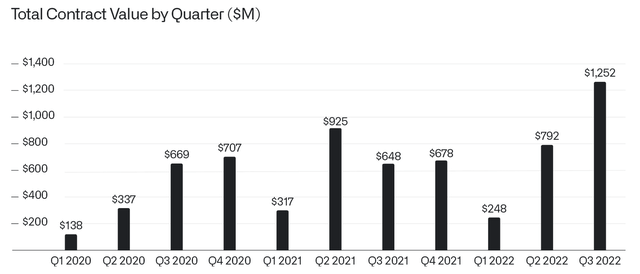

Another positive indicator for Palantir’s revenue over the next twelve months was its TCV (Total Contract Value) in Q3, which was a whopping $1,252m. The majority of this boost is coming from the United States Government, totaling $987m, of which a significant amount is driven by the expansion of Palantir’s work with the US military.

Palantir Q3’22 Shareholder Letter

Clearly, Karp found plenty of positives to talk about – and given the nightmare quarter that Palantir saw in Q2, I don’t blame him for taking the chance to show off some of these very positive trends. Combine this with the strong growth on deals closed (+63%) and billings (+47%), and I think Karp has much more to smile about this quarter.

Strong Commercial Customer Growth Despite Weak Revenues

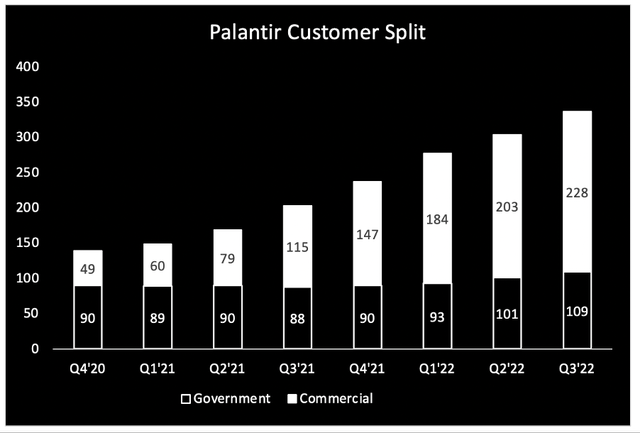

Palantir continued to add more customers once again this quarter, with a strong performance across both its Government and Commercial segments. Government customers grew 24% YoY, or 8% QoQ, to reach 109; Commercial customers grew an impressive 98% YoY, or 12% QoQ, to reach 228.

Author’s Work

The Commercial customer growth is starting to slow down slightly, which is no surprise; I’d expect Commercial customers to feel more of the macroeconomic pain than Government customers. Yet this growth rate remains extremely impressive, and is crucial for the long-term investment thesis in Palantir.

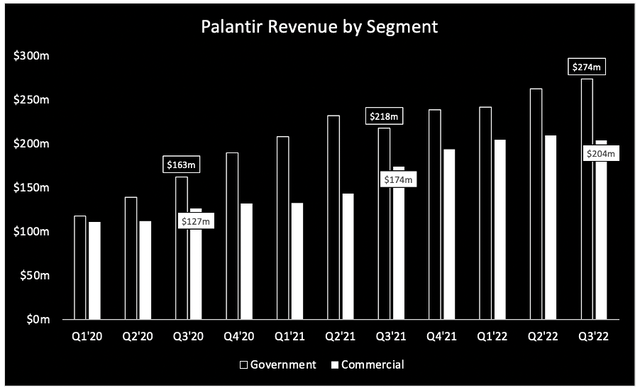

Whilst the growth in Commercial customer numbers was fairly strong, the growth in Commercial revenues was not. These revenues only grew 17% YoY in Q3, and actually declined sequentially by 3%.

Author’s Work

One thing to remember with Palantir is that it has lumpy revenue recognition due to the nature of the business. I’m writing this article before Palantir’s earnings call, but I do hope that management talks about this unimpressive Commercial revenue growth. I’m not completely disappointed, because the momentum within Commercial customers is clearly strong, but there needs to be an explanation offered.

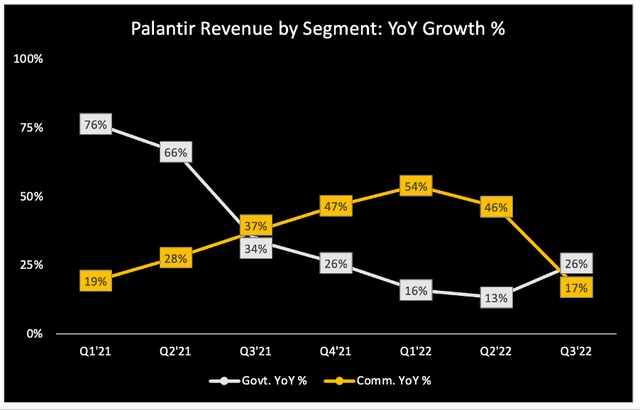

On the plus side, Palantir’s revenues are fairly well diversified between Government and Commercial, and it seems that when revenue growth slows on one front, it accelerates on the other.

Author’s Work

In fact, this was the first quarter since Q2’21 that Palantir’s YoY Government revenue growth outpaced its Commercial revenue growth; this is probably due to a combination of factors, like a strong US dollar, and macroeconomic headwinds impacting Commercial customers more severely.

Given that Commercial customers are still growing at a healthy rate, this doesn’t really change my thesis, but I will certainly be watching out for an explanation from management as to why Commercial revenue growth fell substantially this quarter.

PLTR Stock Is Enticingly Valued

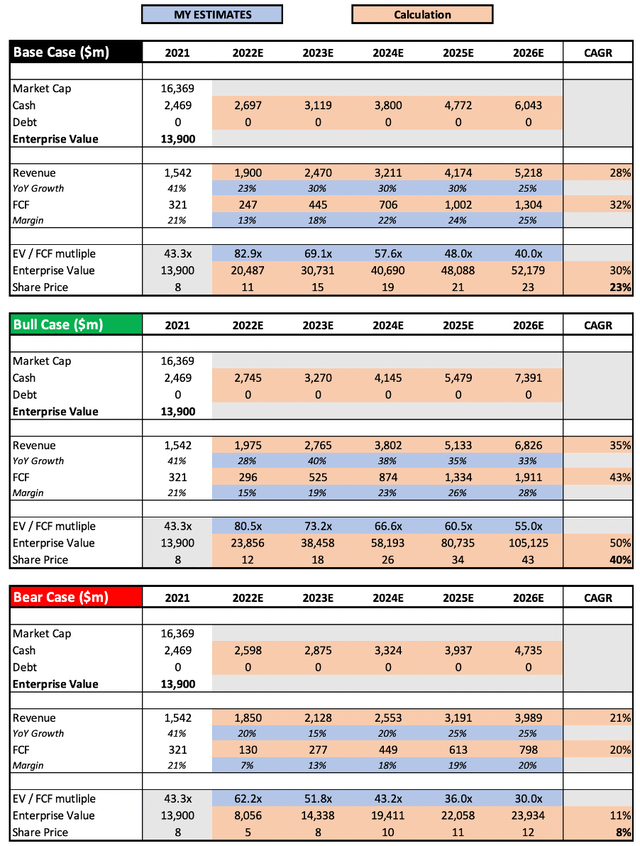

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Palantir is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

Author’s Work

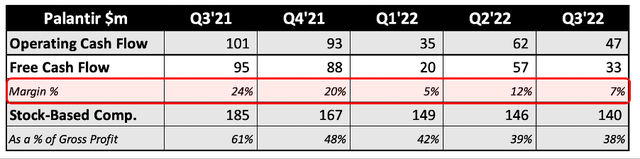

I have made very few changes from my previous article, just updating the inputs for Palantir’s current enterprise value. The only assumption I have changed is a minor reduction in free cash flow margins for 2022 and 2023, as this quarter showed FCF margins deteriorating slightly.

Author’s Work

Put all that together, and I can see Palantir shares achieving a CAGR through to 2026 of 8%, 23%, and 40% in my respective bear, base, and bull case scenarios.

Bottom Line

Whilst the headline numbers for Palantir this quarter were neither great nor terrible, I believe that there were plenty of reasons for shareholders to be optimistic when looking at the underlying business. Momentum in the US is fantastic, Government contracts have provided a real boost, and more Commercial customers continue to be added at a rapid clip.

It wasn’t all sunshine and rainbows; the slowdown in Commercial revenue is clear, but perhaps not unsurprising due to the difficult global macroeconomic conditions. Whilst it was a slightly disappointing quarter from that perspective, it certainly could have been worse, and the long-term investment thesis for Palantir remains very much intact.

Combine all these factors with an extremely enticing share price, and I will reiterate my previous ‘Buy’ rating on Palantir shares following a solid Q3 earnings report.

Be the first to comment