Alex Wong

Mark Zuckerberg’s desire to transform Meta Platforms (NASDAQ:META) into a metaverse company could either make or break its ability to continue to generate shareholder value in the following years. The latest earnings report shows that as the advertising market is in a cyclical decline now might not be a good time to significantly increase capital expenditures and spend resources on a money-burning project that has no guarantee of succeeding anytime soon.

Meta’s CEO already faces a shareholder revolt as open letters by investors that call for greater financial discipline are being flown throughout the web. Even though those letters are unlikely to shape the boardroom, as Mark Zuckerberg has the majority of the voting power in the company, they nevertheless highlight the overall dissatisfaction by a large pool of investors who believe that the business is moving in the wrong direction. Therefore, as the street loses confidence while the share price craters, this article aims at highlighting the latest earnings results, showing Meta’s remaining competitive advantages, and trying to figure out whether pouring billions into the metaverse could yield any results and reward the shareholders in the future.

The Metaverse Dilemma

A month ago, I wrote a bullish article on Meta in which I highlighted the growth of the company’s Reels product and how it’s able to help the business to improve its performance amidst a decrease in advertising spending due to the turbulent macroeconomic environment. Then, two weeks ago, Meta released its Q3 earnings report and provided a long-term outlook, which pretty much disappointed everyone. The report showed that Meta’s revenues in Q3 were only $27.71 billion, down 4.5% Y/Y, its net income was 4.4 billion, down 52% Y/Y, and its average price per ad was down 18% Y/Y. After the results came in, Meta’s shares tumbled and are currently down over 30% in comparison to a month ago.

1-Month Price Return Of Meta’s Stock (Seeking Alpha)

While some of the decline could be attributed to the decrease in the overall advertising spending that negatively affected Meta’s core business, most of it nevertheless was caused by Mark Zukerberg’s relentless ambition to make Meta a metaverse company, which continues to come at a high price tag for shareholders. What the Q3 report also showed is that Meta’s Reality Labs department, which is responsible for the creation of the company’s metaverse projects, generated only $285 million in revenues, down from $558 million a year ago. At the same time, the poor performance of Reality Labs was also responsible for the decline of the company’s overall income, as the department’s net loss for the three months was $3.67 billion. The total losses of Reality Labs for the first 9 months of the year were $9.4 billion, and they would undoubtedly cross the $10 billion mark by the end of the year.

What’s worse is that as Meta’s core business experiences a cyclical decline, Mark Zuckerberg continues to double down on Meta’s metaverse ambitions. Here’s what he stated during the latest conference call:

We expect Reality Labs expenses will increase meaningfully again in 2023, with the biggest drivers of that being the launch of the next generation of our consumer Quest headset and hiring that has been done in 2022, but for which we are going to be paying the first full year of salaries next year.

To understand the extent of future expenses we should take a look at Meta’s historical CapEx and compare it with the company’s forecasts for the following years. Back in 2020 and 2021 when the advertising market was booming despite the pandemic and Meta’s revenues were aggressively growing at a double-digit rate, the company’s annual capital expenditures were $15.1 billion and $18.6 billion, respectively. Now that the advertising spending is being cut and the company is about to report a Y/Y decline in revenues, Meta guides for the capital expenditures in 2022 and 2023 to be $32-$33 billion and $34-$39 billion, respectively. At the same time, total expenses in 2023 are expected to be in the range of $96 billion to $101 billion, up from the expected $85 billion to $87 billion in 2022, as the company believes that the Reality Labs’ losses would grow significantly Y/Y.

Considering these numbers and such a bleak outlook, it’s no surprise that we’ve experienced such a depreciation of Meta’s stock in recent weeks. However, considering that Mark Zuckerberg is more than likely to continue to push for the realization of Meta’s metaverse ambitions, the question now is whether such spending is justified.

On the one hand, there are reports, that state that the metaverse market would be growing at an annual rate of ~40% and will be worth nearly $1 trillion by the end of the decade. On the other hand, we have opinion pieces written for respected outlets, which state that nobody even knows what metaverse is exactly, as for some it’s some avatar within a particular artificial universe, while for others it’s a game that you play by using a physical headset. For Meta, the metaverse is a combination of both.

Last year the company has released a headset version of its flagship metaverse app Horizon Worlds, and it plans to release a web version of the app in the future. The problem is that according to Meta’s internal leaks, the company’s own employees are barely using Horizon Worlds and the app itself is too buggy at this stage. Considering this, there’s a possibility that all of the capital that’s been spent and is about to be spent on building Meta’s metaverse projects could be easily wasted if the company fails to improve Horizon Worlds and increase its engagement there to attract new advertisers. In the past, Meta has already struggled with successfully launching new products from the non-core businesses, the latest of which was its own stablecoin Facebook Diem, which has been canceled after regulatory scrutiny.

This is something that lots of investors fear since instead of improving the company’s core business, Meta’s management with Mark Zuckerberg at the helm is trying to build a virtual world that’s about to cost shareholders over $10 billion in losses this year alone without the clear understanding of how to recoup all that money in the future.

Due to this, some of Meta’s big investors already began to write open letters to Mark Zuckerberg calling to focus on the company’s core business, while others voiced their frustration at the shareholder meeting. The problem is that Mark Zuckerberg holds a majority of voting power in Meta, and as a result, even a shareholder revolt wouldn’t be able to change the situation if the CEO decides to continue to double down on the metaverse.

Core Business Continues to Deliver

The good thing about the latest earnings report is that the core business nevertheless managed to improve its major metrics and as a result eased the pressure that the company faces due to the poor performance of Reality Labs. Despite the decline in revenues and the average price per ad, Meta nevertheless managed to increase the number of its daily and monthly users across the ecosystem of its family apps, which include Facebook, Instagram, and WhatsApp, in comparison to the same period last year.

At the same time, a month ago I was writing that Meta’s Reels, which is a short-form video product within Facebook and Instagram similar to TikTok, was on track to generate $1 billion in revenues this year, then during the latest conference call, Mark Zuckerberg announced that Reels had already hit $3 billion in annual revenue run rate. This is a big deal for Meta since the revenue from Reels is able to at least ease a potential $10 billion loss in revenues, which the company’s management said that they would incur this year due to Apple’s (AAPL) change of the privacy policy that limits the tracking of iPhone users. To continue to scale Reels, Meta has recently announced the release of a new set of tools and monetization options for content creators, which could attract new users, increase overall engagement across Facebook and Instagram, and in the end improve the current annual revenue run rate even more.

In addition, considering that there are already calls by U.S. officials to ban TikTok due to its connections with Beijing, there could be a window of opportunity for Meta to accelerate the scaling of Reels if the ban goes through, which could help the business to improve the overall performance and overshadow Reality labs losses. Time will tell whether that’s going to be the case.

What we do know now is that due to the losses of Reality Labs, the overall upside of Meta’s stock is smaller than it was before. If a month ago, my DCF model showed that Meta’s fair value was $203.03 per share – then with new assumptions, the value is lower.

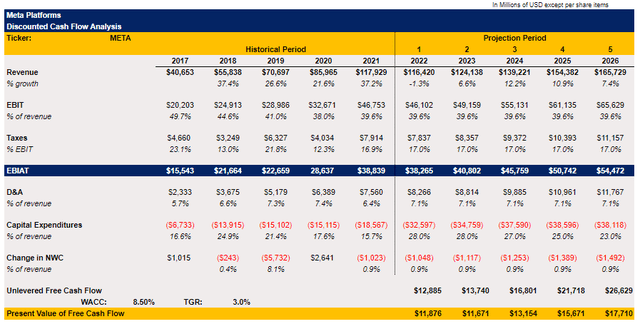

The full new model is shown below and several things in it have changed from a month ago. First of all, it appears that the cyclical decline of the advertising industry is greater than was previously expected, so the top-line growth assumptions were revised in accordance with the new reality and are mostly in line with the new street estimates. The EBIT, taxes, and D&A assumptions remained untouched in the new model.

The capital expenditure assumptions for FY22 and FY23 have been significantly increased in accordance with the management’s updated forecast due to the increase in Reality Labs expenses, while in the remaining years the spending starts to decelerate as a percentage of revenue, but is still higher in comparison to the previous historical periods. The change in the net working revenue as a percentage of revenue has been lowered due to it being positive from time to time and is in line with the latest historical period in the following years. The WACC and the terminal growth rate remain unchanged.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

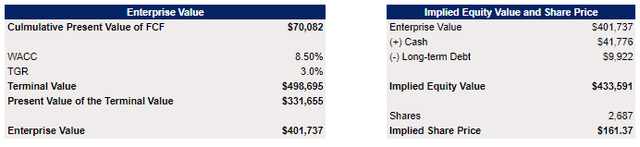

The model shows that Meta’s enterprise value with the new assumptions is $401 billion, while its fair value is $161.37 per share, which still represents a significant upside from the current levels. However, if the company had the greater financial discipline and wasn’t spending so much money on an unprofitable metaverse project, which has no guarantee to succeed in the future, then the upside would’ve been much more attractive.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

After the latest depreciation, some might consider Meta’s stock to be a bargain at the current levels. In part, that’s true considering that the company is undervalued solely based on the current fundamentals. However, the upside is smaller than it was a month ago, and there’s always a risk that a prolonged decline in advertising spending and/or a possible additional increase in capital expenditures would lead to another change in assumptions and an even lower fair value.

The good news though is that Meta has several catalysts going for it, which could help the business to improve its performance in the following months. Therefore, I continue to hold Meta’s stock in my portfolio, and I only wish that the spending for the unprofitable metaverse project were decreased until things normalize in the first place.

Be the first to comment