Shutter2U

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was published to members of the CEF/ETF Income Laboratory on October 20th, 2022.

BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund Inc. (DCF) is in an interesting situation where there is quite a large discount on the fund. Closed-end funds often trade at wide discounts, but for DCF, it is a term fund – and, more specifically, a target term fund.

That means they anticipate liquidating this fund and returning NAV back to investors “on or about December 1st, 2024.” That is the termination or term date. For the last several years, term funds have been the standard coming to market. It allows investors to eventually cash out at NAV one way or another instead of trading at discounts perpetually.

With DCF’s large discount to NAV, there could be an opportunity presented for investors here. However, as always, there are some things you need to be aware of, as we’ll touch on through this piece.

The Basics And A Look At The Portfolio

- 1-Year Z-score: -1.56

- Discount: 8.41%

- Distribution Yield: 8.89%

- Expense Ratio: 1.87%

- Leverage: 35.88%

- Managed Assets: $161.19 million

- Structure: Target Term (anticipated liquidation on or about December 1st, 2024)

DCF’s investment objective is to “seek to provide high current income for today’s yield-challenged market.” Of course, with rates rising rapidly, a yield-challenged market isn’t so prevalent anymore. To achieve this, the fund is essentially a multi-sector bond fund. They will invest in a “dynamic, multi-asset portfolio designed to access multiple sub-investment grade credit opportunities for enhanced yield potential with active risk management.”

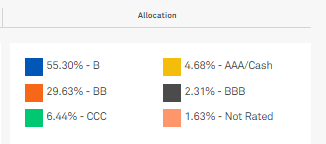

DCF Credit Allocation (BNY Mellon)

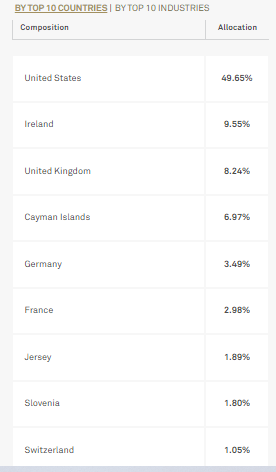

They also have a global focus but primarily look for “expanded opportunities in the U.S. and Western European credit markets.” In fact, this fund has a fairly high representation of asset allocation outside of the U.S. While it might seem unusual, we can often see “global” funds with 60, 70 or even 80% allocated to U.S. holdings.

DCF Geographic Exposure (BNY Mellon)

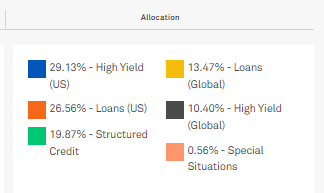

With this dynamic approach, they invest primarily in high-yield debt and senior loans. Though they also have structured credit. This includes collateralized loan obligations primarily or CLOs.

DCF Allocation (BNY Mellon)

When including the leverage expenses, the expense ratio comes in at 2.64%. We should expect to see the leverage expenses climb further as their borrowings are through a credit facility. Some of this is hedged due to their underlying portfolio having a tilt towards floating rate investments that provide a natural hedge. I don’t see any interest rate swaps in their portfolio, as that is often the go-to to provide a hedge against rising borrowing costs. Overall, it is a higher expense ratio than we would typically see, even for CEFs.

However, they are not so expensive when considering global funds or other multi-asset funds for comparisons, such as PIMCO funds, or relative to other CLO funds. CLO funds can have total expenses of 10%+. It isn’t anything to see a PIMCO fund with total expenses pushing near 3%, either.

‘Target Term’ Vs. ‘Term’ Fund

However, DCF is a bit more unique in that it has an actual target of returning the inception NAV back to shareholders too. DCF they are looking to return at least $9.835 back to investors at its termination date. This is a small but important distinction in the way the fund will operate or should operate heading into liquidation. There is no guarantee that it can achieve this, just to be sure.

A regular term fund has no expectation of returning the original NAV back to shareholders. This means they will tend to invest more aggressively, which tends to mean less cash allocation heading into the term date and keeping leverage for longer. Another characteristic of a target term fund is the declining distributions heading into liquidation. That helps boost their NAV when they are coming in light.

A past example of this is the Eaton Vance High Income 2021 Target Term Trust (EHT). In our coverage of the fund, you can see the trajectory of the distribution was trimmed several times. In fact, the trims began in 2018, heading into the termination of 2021. They also had a limited decline in the COVID crash because they started to trim back on their leverage. In the early part of 2021, they had no outstanding leverage at all.

Effective February 11, 2021, the Agreement was terminated by the Trust in anticipation of the Trust’s termination and the unamortized upfront fees were fully amortized. At March 31, 2021, the Trust had no borrowings outstanding under the Agreement. Facility fees for the year ended March 31, 2021 totaled $79,000 and are included in interest expense and fees on the Statement of Operations.

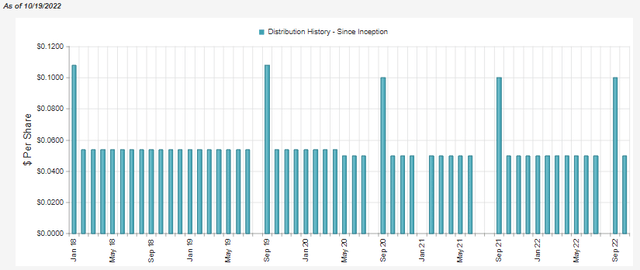

The distribution for DCF has held up with only one cut up to this point.

DCF Distribution History (CEFConnect)

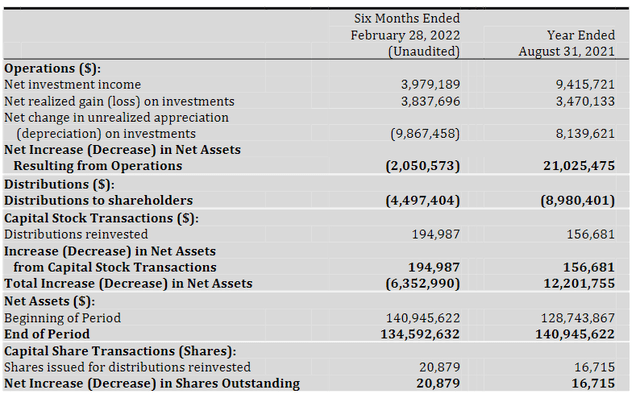

In looking at the distribution coverage, we can see it is coming in a bit shy in their previous semi-annual report.

DCF Semi-Annual Results (BNY Mellon)

That was before the rate hikes started kicking in. With the sizeable allocation of floating-rate debt, it is likely that they have received a boost in net investment income – with the total investment income only partially offset by the rising costs of their leverage. That being said, they are still below their target NAV of $9.835, with the last closing NAV of $7.37. To close that gap, they are likely to retain whatever income they can over the next couple of years. At least, if they are concerned with returning NAV back to shareholders – as is the goal of the fund but not an assurance.

All that being said, Eaton Vance is a top fund sponsor with generally more conservative management that does the right thing. That isn’t to say DCF isn’t, but they are still looking at an almost 36% leverage ratio at this point. Though admittedly, some of this has just come up due to the massive declines this year. So to deleverage now, in a big slump, could probably be more detrimental. Additionally, they still have just over 2 years to play with, which is plenty of time for them.

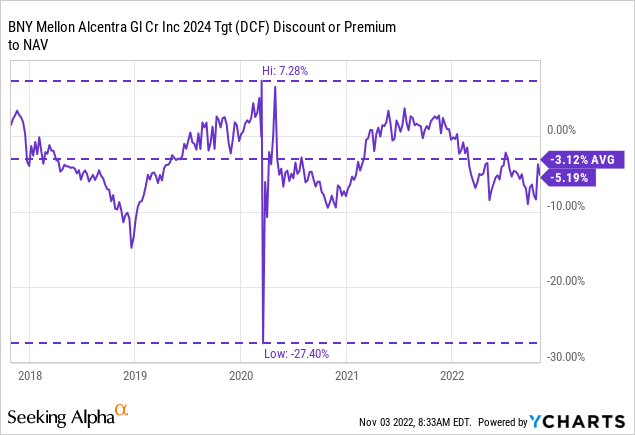

Attractive Discount

This brings us to the primary opportunity in DCF. It would be to capitalize on the fund’s current discount at this time over the next several years. The discount of 5%+ will be realized – in one shape or another. Just a short couple of weeks ago, the fund was at an over 8% discount. Of course, that would represent an even better opportunity. The wider the discount, the better the chance of success and the higher alpha generation.

The main risk here is that the NAV falls to catch up with the fund’s share price instead of the other way around. A better outcome would be if the share price catches up to its NAV if the NAV can stay flat from here on out. If the NAV rises and we realize the current discount, that would be the ideal situation.

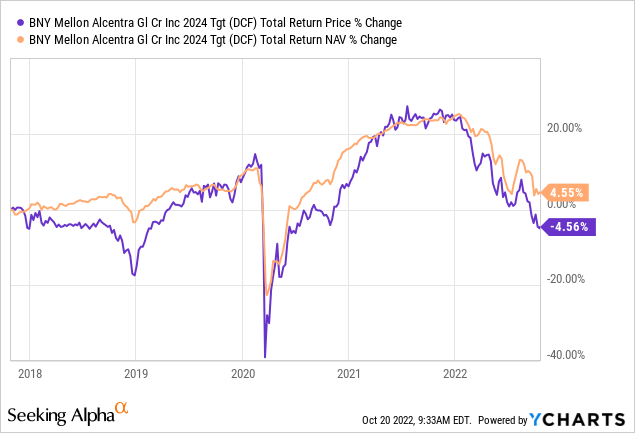

Since the fund’s inception, results don’t necessarily look encouraging. However, I will say that it has been a tough period that we are in now due to what is anticipated to be a recession in 2023. On top of this, it went through a 2018 slump and a massive drop in 2020.

Ycharts

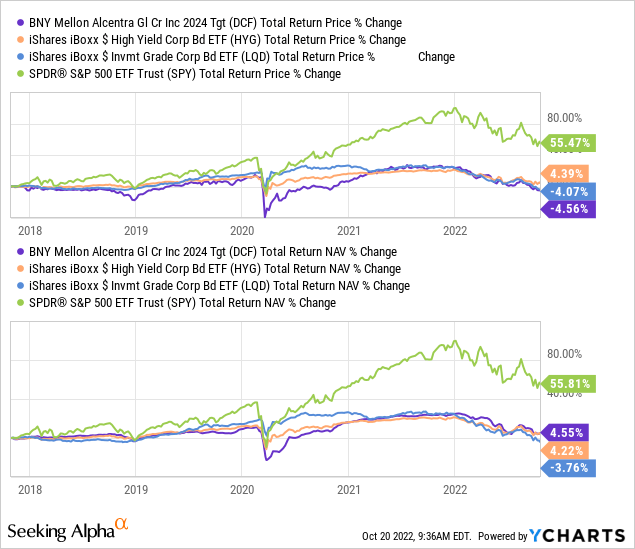

So it certainly hasn’t been a kind operating environment for junk-rated fixed-income with rates rising and weak economic periods. Here is a look at some comparisons to provide some context. Bearing in mind that these aren’t leveraged ETFs, DCF is leveraged.

We can see that DCF has held up similarly on a total NAV return basis to both (HYG) and (LQD). (SPY) has blown these fixed-income measurements out of the water during this arbitrary period. Also, remember that DCF carries global exposure that has been even more challenging than their U.S. counterparts.

Meaning that overall, the fund hasn’t done too terribly, considering the circumstances. It’s just been brutal for fixed-income. I don’t think that investors holding investment-grade bonds expected negative returns over the last 5 years. Since they are more sensitive to rising rates, they are in a tougher situation now. If defaults tick up, then high-yield bonds can join them.

Ycharts

All this is to say that there is guaranteed alpha here but not guaranteed returns. If you have two exact ‘DCF’ funds, one keeps the target term where they liquidate as expected, and one continues to trade perceptually, the term fund will realize the discount and generate alpha.

Let’s say both DCF and this fictitious exact same make-believe fund drop 99.9% because we have the worst economic crisis this world has ever seen; then the DCF term fund would still generate an additional ~5% above a non-term counterpart.

Management Changes

On a side note, away from the rest of the discussion of this fund, there seem to be some management changes going on. BNY Mellon and Alcentra have entered into a definitive agreement with Franklin Resources (BEN). They are selling all their indirect equity interest in Alcentra to Franklin Resources. Along with this move, there was some shuffling of the managers but no investment policy changes.

On May 30, 2022, The Bank of New York Mellon Corporation (“BNY Mellon”), the parent company of BNY Mellon Investment Adviser, Inc. (“BNYM Investment Adviser”) and Alcentra NY, LLC (“Alcentra”), the investment adviser and sub-adviser, respectively, for BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund, Inc. (NYSE: DCF) and BNY Mellon Alcentra Global Multi-Strategy Credit Fund, Inc. (each, a “Fund” and, together, the “Funds”) entered into a definitive agreement to sell all of its indirect equity interest in Alcentra (the “Transaction”) to Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton. The Transaction is expected to be completed on or about November 1, 2022, subject to customary closing conditions, including certain regulatory approvals (the “Closing Date”).

Conclusion

According to CEFConnect, the average bond price of DCF’s portfolio is $80.58. That means combining that discount with the funds discount can be fairly attractive. Although I’d be too cautious of the fund realizing the underlying portfolio’s discount entirely. To generate higher returns for the fund, they go out with maturities beyond their termination date. This isn’t just DCF but is a problem I see across the board with term and target term CEFs.

From what I can see, DCF hasn’t shared any maturity breakdown exactly, but they provide an average effective maturity of 5.67 years with a duration of 1.64 years. Due to the floating rate exposure, the duration is nice and low. However, 5.67-year maturity means that most securities mature well beyond the next 2 years and 1 month that the fund has. That being the case, it would seem they will have to offload a sizeable portion of their bonds and loans below par.

DCF presents a potential opportunity for investors to gain some alpha over the next two years. Whether that results in returns or not is yet to be seen.

Since the fund’s launch, despite the global investment approach, they’ve still outperformed the high yield and investment-grade ETF counterparts on a total NAV return basis. That hasn’t meant strong returns, but it is a good sign that even in this slump, things could turn around with the opportunity to capture the discount.

Be the first to comment