Bet_Noire

Introduction

It’s time to talk about energy. In this article, we’re going to dive into energy fundamentals, the Fed’s aggressive hiking cycle, and everything that leads me to believe that I do not own enough energy exposure going into 2023. While oil and energy stocks have run into some resistance after the latest rally, I believe we’re getting closer to new buying opportunities as the oil supply remains one of the biggest macro risks going forward. That’s bullish for oil equities, as we should not expect oil companies to shift their focus away from shareholder distributions to capital investments. Moreover, once the Federal Reserve is forced to pivot, commodities will benefit from a weakening dollar as well.

As an income (growth) oriented investor, I happily add some high-quality stocks to my portfolio for such a scenario.

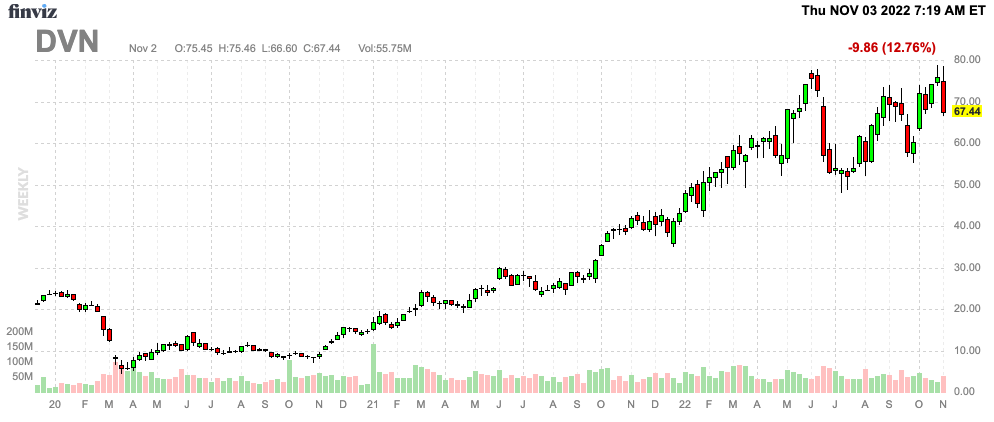

One of my all-time favorites is Devon Energy (NYSE:DVN) which achieves two things for its investors: outperforming capital gains and a high yield.

So, let’s dive into the details!

It’s All About Supply

We have discussed the energy bull case since 2020 before the market saw the light at the end of the tunnel. Back then, the vaccine announcement was the factor putting a floor under demand.

In 2020, discussing oil was fun. Gasoline was still cheap, and the bull case was mainly built on the return of demand.

Then, in 2021, things changed. The bull case was still fun for people who owned energy equities, yet energy became a driving force of macro developments like sky-high inflation. 2021 was the year I started using the word “supply” a lot more.

After all, supply growth is being subdued in an environment where demand is, in fact, not going anywhere but up. 2022 is the year of fossil fuels, as even progressive European countries are going back to coal. That’s caused by the war in Ukraine and the fact that energy exports to Europe have fallen off a cliff.

However, the fact that domestic fossil fuel production has declined for more than a decade is the factor that makes everything so much worse.

I have consistently made the case that oil is important. Even though I also support a move to renewable energy (mainly nuclear), I am strictly against forcing an energy transition. Forcing net zero to take place is simply not possible, as we’re now finding out the hard way.

OPEC seems to agree with me. Although there is a case to be made that OPEC is highly biased, I believe that its comments are reasonable. The other day, OPEC made the case that the world cannot live without oil as demand will keep rising.

As reported by Bloomberg, the group sees oil consumption rising by 13% to 109.5 million barrels per day in 2023. That level is expected to hold for a decade.

While organizations like the International Energy Agency, which advises governments in energy matters, expect this to be a chance to push even harder for renewables, OPEC makes the case that oil will still be 29% of the global energy mix in 2045. That’s down just 2 points from 31% in 2022. And that’s only oil, ignoring natural gas and coal.

OPEC Secretary-General Haitham Al Ghais reiterated the warning given at last year’s climate talks that a complete break with hydrocarbons is “potentially dangerous to a world that will continue to be thirsty for all energy sources.”

In this case, I agree with the statement above. Underinvestment in fossil fuels are dangerous. Affordable energy is the backbone of every single successful economy in the history of mankind. Cheap coal fueled the industrial revolution. Efficient oil drilling helped us to reach the next step. Natural gas is helping us to move away from coal without becoming dependent on unreliable renewables.

2022 was the year that affordable energy ended in a lot of developed nations.

This week, oil expert Javier Blas came up with a title that perfectly summarizes the current situation.

What he highlights is something I’ve made a core part of my bull case: subdued supply growth.

Essentially, the best cure for high prices is high prices. High prices give producers a reason to boost investments to benefit from higher prices and higher output. However, as this often means that total industry production rises, supply rises, causing prices to fall.

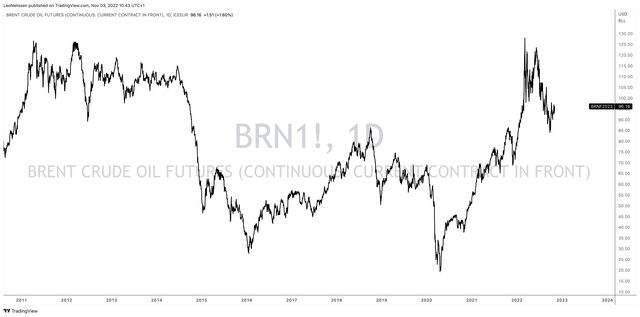

In the oil industry, that happened in 2014/2015 and 2020.

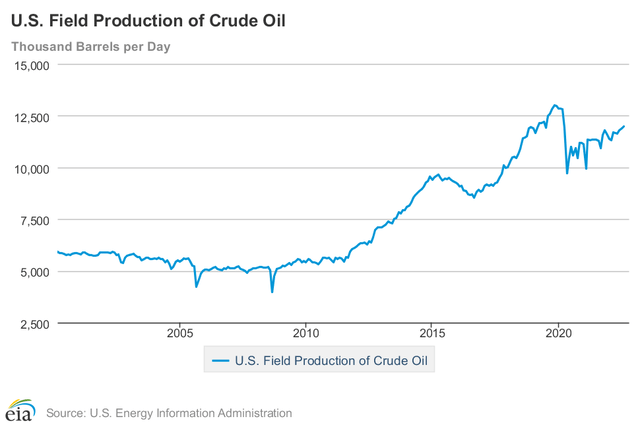

The chart below shows the shale revolution in the United States, which made it a new energy exporter. Before 2014, production growth was sky-high. After the 2015 oil price bottom, producers boosted output again to repair their balance sheets.

Then in 2020, even higher production met imploding demand, causing oil prices to implode.

Since then, oil production has increased again. However, it is still well below its all-time high, and the pace of growth has slowed.

Unlike in prior cycles, energy companies have decided they are not going to make their situation more difficult. Progressive governments have made it clear that they want oil production to eventually come to a halt – for the sake of climate goals.

They have made that case over and over again, as I have discussed in a lot of articles.

This is impacting governments and corporations. In October, the world’s largest reinsurance company made clear that it will halt support of fossil fuels.

The world’s largest reinsurer, Munich Re, has announced it will stop investing in and insuring new oil and gas fields, infrastructure, and power plants as of April 2023.

That’s a huge deal and the reason why energy companies know they will have to protect their interests.

None of the major oil companies have announced production spending beyond current plans.

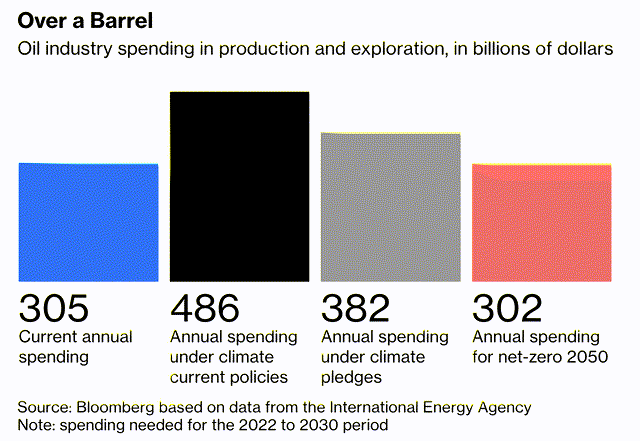

To give you a few numbers, last year, the oil industry spent $305 billion on oil exploration and production. The International Energy Agency estimates that spending of at least $466 billion in annual spending from 2022 to 2030 is needed to meet the world’s oil needs – based on current climate pledges.

If you think that’s bad, it gets worse. Even if big oil were to follow net zero pledges, it would have to grow spending by 25% from current levels until 2030!

As a consumer of energy, I am not a big fan of this situation. However, I cannot disagree with Blas’ takeaway:

Let’s not kid ourselves. Oil companies are doing what we told them to do: Spend less on fossil fuel production. From green philanthropists to big Wall Street investors, the message has been nearly unanimous. One can hardly blame the executives for doing as they were told. The industry, of course, soon realized that spending less was rather good business, particularly when very few deviated. Only a handful of state-owned oil companies in the Middle East are today boosting their fossil fuel spending meaningfully.

It also doesn’t help that politicians continue to double down. President Biden is now calling for a windfall tax on record oil and gas profits. Democrats have proposed these taxes for more than a decade – without success. The timing makes sense as we’re very close to important elections. However, the concept does not make sense, and it will only keep companies from investing a penny more in growth.

In 2015 and 2020, oil companies did not get any support when some were struggling to survive (weaker players went under). Now, energy prices are high, and oil companies are the bad guys. I haven’t heard any calls for windfall taxes when tech companies made record profits for a decade straight. Or when healthcare companies made billions on vaccines?

It’s all a political game, and oil companies are doing their part to manage risks.

Now, it’s up to demand to rebalance supply and demand, which is why prices are still elevated.

Brent oil is still trading at $96 despite the market sell-off, recession fears, and an aggressive Fed. While it’s impossible to prove, I believe oil would be trading at $60 or less if the supply situation was more supportive.

With all of this in mind, there’s another reason I’m looking to increase my oil exposure a bit more. Right now, we’re in the midst of an aggressive Federal Reserve hiking cycle.

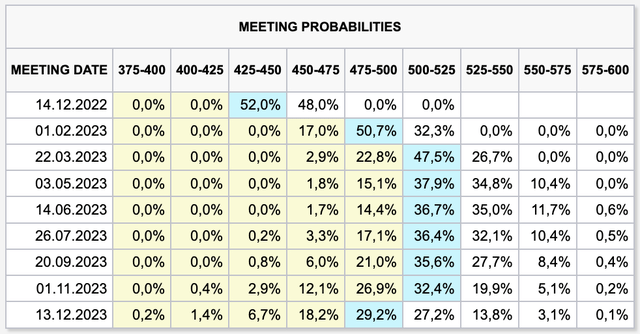

The current outlook is a terminal rate above 5.00%, with a rate cut in 4Q23.

Yesterday, Jerome Powell commented on a potential pivot. However, he took away all hopes that the Fed had a plan ready to end aggressive rate hikes.

As I commented in Seeking Alpha’s market close article:

“The market knows that the economy is too strong for the Fed to become dovish at this point. Job openings came in strong, ISM Manufacturing Index new orders rebounded, and overall inflation expectations remain high,” BN Capital’s Leo Nelissen told Seeking Alpha, explaining the negative reaction stocks had to the Fed announcement.

“The biggest risk is that the market is faced with high inflation readings going forward, which will make Powell’s (somewhat) dovish comments obsolete,” he said. “An early pivot could make the Fed’s job even harder as a weaker dollar would quickly fuel commodity prices, impacting producer prices and eventually consumer prices again.”

Especially the last part is important as I believe that once the Fed takes the foot off the brake, it will allow the dollar to weaken, and it increases economic demand estimates. That’s a good thing for the economy, but it will almost certainly cause commodities to fly again.

After all, the supply situation has not been solved. If anything, subdued demand makes it look like things are at least a little bit under control. That’s not the case.

Hence, I decided to continue buying energy stocks going into 2023, despite my already elevated exposure of almost 20%.

Needless to say, this title isn’t political clickbait. The same goes for the theoretical background. I’m not supporting any politician or party. I’m just observing the situation. And, right now, I need to protect my wealth against policies that I believe are harmful to economic prosperity.

I thought long and hard about it, but I decide to keep buying Devon Energy.

Devon Energy – Buy Any Weakness

There are a lot of good energy stocks on the market. I thought about incorporating a lot of them in this article. However, I decided against it and went with a stock that I believe offers something for everyone.

I’m also aware that I have covered the company somewhat frequently in the past. However, because of the just-released earnings and questions regarding its special dividend, I felt a strong need to cover the stock again.

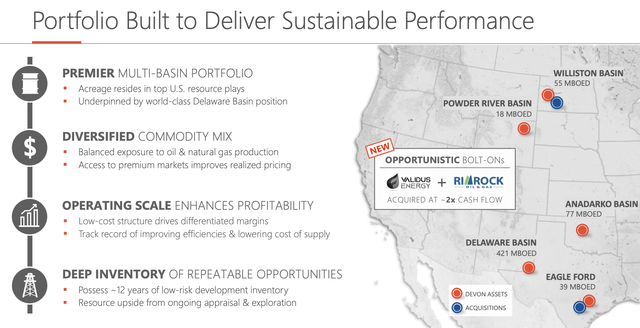

For the people who are new to the DVN ticker, Devon Energy is one of America’s largest onshore oil and gas drillers. This $44.2 billion market cap giant has major operations in low-cost Basins throughout the United States.

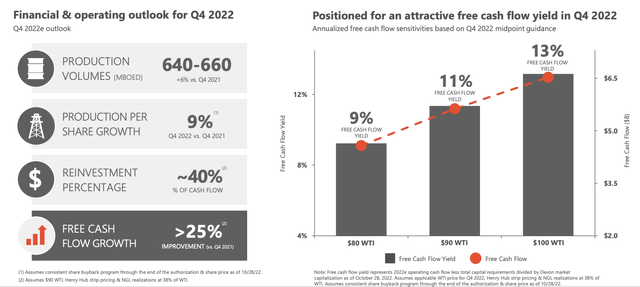

Most of the company’s production is located in the Delaware Basin, where it produces 421K barrels of oil equivalent per day. In the fourth quarter, daily production is expected to be between 640 and 660 thousand barrels of oil equivalent. Roughly half of this will be crude oil. The company expects to realize up to 100% of the WTI crude oil price due to very low hedging volume.

So far, the company has hedged just 87 thousand barrels of oil for the 2023 fiscal year at prices between $70 and $95.

The company can do that because it is free cash flow breakeven at $30 WTI. That’s the lowest breakeven price I’ve ever seen. Also, in this environment, the risk of oil prices imploding is rather low.

Some will know where I’m going with this. Having efficient operations (low breakeven prices), and a small hedging program translates to high free cash flow at current oil prices.

This year, the company is on pace to do $6.3 billion in free cash flow. A new record, and more than twice what the company did in 2021.

At $90 WTI, the company can achieve an 11% free cash flow yield. That’s as of October 28. Using the current stock price, we’re closer to 12%.

That’s very high, and good news for shareholders.

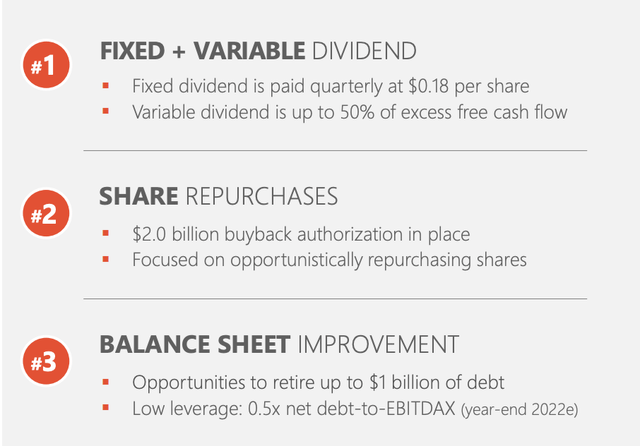

The company has three free cash flow priorities, and unlike prior to the oil bull market, balance sheet health isn’t on top anymore. After all, the company’s net leverage ratio has been below 1.0x since 2020.

The number one priority is to pay a dividend. The dividend is a combination of a fixed and a variable dividend.

This has caused a lot of confusion and I have to say that my inbox is filled with people who are not really aware of what this means.

First of all, the fixed dividend is a low dividend of $0.18 per share per quarter. That’s 1.1% per year based on the current stock price. Needless to say, that’s not a lot.

The variable dividend, however, is what makes a difference. Unlike the big guys like Exxon Mobil (XOM), and Chevron (CVX), who consistently hike their dividends, Devon will distribute almost all of its cash depending on the oil price. The variable dividend is up to 50% of excess free cash flow.

In other words, in some quarters, the dividend will be really high. In other quarters, it may be lower. It’s all depending on the price of oil, which drives free cash flow as we discussed in this article.

According to the company:

This dividend strategy is foundational to our capital allocation process, providing us the flexibility to return cash to shareholders across a variety of market conditions. Under this framework, we pay a fixed dividend every quarter and evaluate a variable distribution of up to 50% of the remaining free cash flow. Based on our strong third quarter financial results, the Board approved a 61% increase in our dividend payout per year-over-year to $1.35 per share.

This year, the company is on pace to distribute $5.00 in dividends. That’s a yield of 7.4% using the current stock price. On top of that, the company has bought back 4% of its shares over the past four quarters. The current program represents 5% of shares outstanding.

In other words, the emphasis is on dividends, and that’s great. There are some oil stocks that prefer buybacks, which we might discuss in the weeks ahead if there’s demand for that.

Unfortunately, people were a bit frustrated after the company cut its dividend from $1.55 to $1.35 per share. However, this 13% decline is perfectly in line with the decline in oil prices during this period. Bear in mind, it’s a VARIABLE dividend. Hence, a dividend cut is not comparable to a “traditional” dividend stock cutting its payout. Devon isn’t in a bad place. It just adjusted its dividend according to its policy.

The reason why Devon sold off is that 4Q capital spending of $845 to $915 million was much higher than analysts’ estimates ($778 million).

FINVIZ

Here are some sell-side comments, as reported by Seeking Alpha:

Jefferies analyst Lloyd Byrne, who rates Devon at Neutral, cited Q3 operating expenditure coming in above guidance and worries about future capital spending in an environment of high inflation.

Truist’s Neal Dingmann, who rates the stock a Buy, saw Devon’s Q3 beat as driven mostly by higher than expected natural gas prices, and considered the new guidance as “slightly negative,” according to Bloomberg.

Note that inflation is actually bullish on a long-term basis. Drilling has become more expensive, making the decision easier to just refrain from boosting output.

On a side note, the sell-off was made worse by the aforementioned comments from Powell, which were made after the earnings call.

I hope to add to my DVN position closer to $60. I believe the stock can get there if ongoing market turmoil continues to pressure demand expectations.

On a longer-term basis, I expect oil prices to continue to advance beyond $100-$110. Especially if China reopens its economy.

Takeaway

In this lengthy article, we discussed oil market fundamentals, which continue to put the focus on demand as supply growth isn’t happening. Oil companies are in full-blown defense mode, having shifted their priorities from production growth to free cash flow generation.

I do not expect this to change. If anything, it could get worse once demand expectations rebound again.

Moreover, this could be further fueled by a Fed pivot in 2023, weakening the dollar.

While I do have significant oil exposure, I am looking to expand my DVN position. The company has efficient oil production with a low breakeven price, very low hedging volumes, at least 12 years’ worth of inventory, a healthy balance sheet, and plans to distribute most of its cash via fixed and variable dividends.

Right now, the stock is a bit under pressure as a result of its earnings and market turmoil. Yet, the stock is still 15% higher since I wrote my last article a month ago.

I’m looking to buy more as close to $60 as possible.

I have zero doubt that DVN will provide investors with long-term income and protection against destructive global energy policies.

(Dis)agree? Let me know in the comments!

Be the first to comment