Pavel Byrkin/iStock Editorial via Getty Images

Summary

Embraer S.A. (NYSE:ERJ) is an aircraft engineering and manufacturing pioneer that is in transition from core regional jet production to higher seat narrow bodies, electric aircraft and modern turboprops, while service, defense and corporate segments provide slow growth and cashflow. The stocks valuation is well discounted, in my view, and if ERJ delivers results, the shares could double over the next three years.

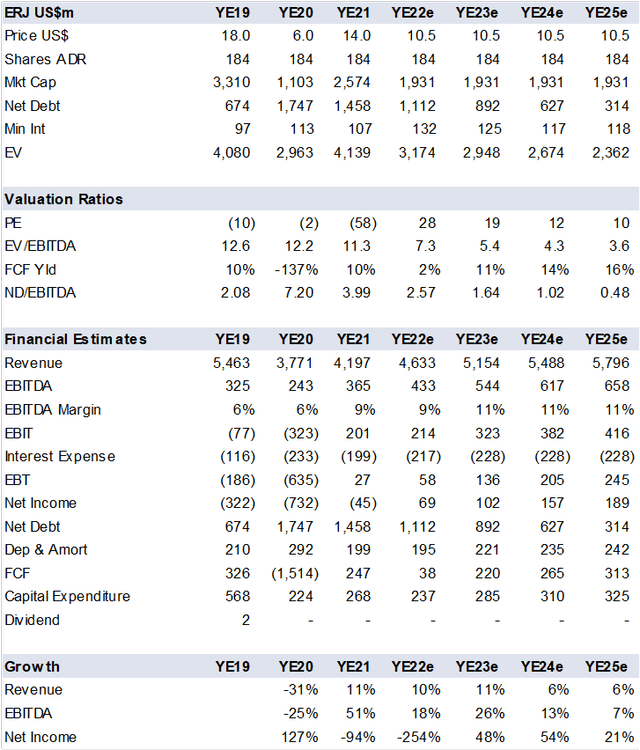

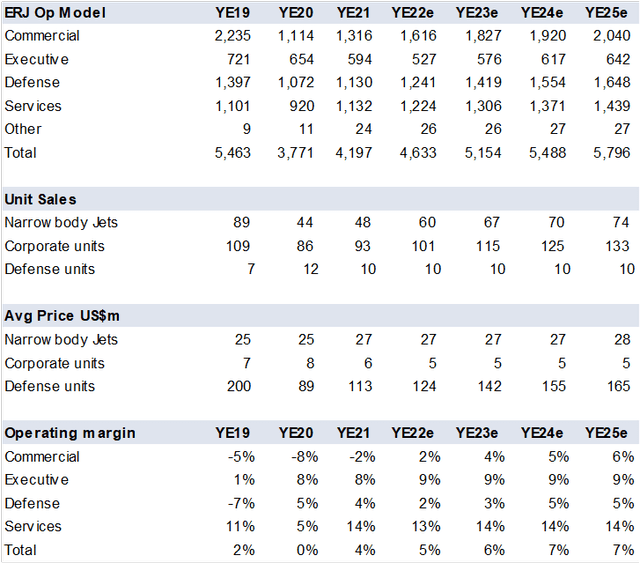

ERJ Summary Financial Estimates (Created by author with data from Embraer)

Commercial Airplane Strategy Changing

Regional Jets: Its bread-and-butter regional jet business has slowed significantly, the USA scope clause, that regulate what pilots can fly (lower wage regional vs higher wage larger jets) is limiting the expansion. The 175 E2, which would replace the 175, has not seen a single order, thus deliveries should be around 40 units per year for the 175.

Competing with Airbus (OTCPK:EADSF): Embraer launched the 190/195 E2 family with 110 to 150 seats in direct competition with Airbus. According to the company they compete on price and more importantly on maintenance cost, which are 15% lower than the Airbus 320. However, Airbus has far greater firepower, they can bundle different units to airlines making price competition lopsided and more importantly the EU provides export subsidies that Brazil will never be able to meet. This makes competition difficult for Embraer as seen in its margins for this segment. The failed Boeing (BA) JV has left this business at a disadvantage with airlines and leasing companies are the main buyers. I assume margins will improve at the expense of volumes. This foray into the big leagues is ERJs primary risk.

Corporate Jets: A bright spot with consistent growth and solid margins but relativity small vs the commercial segment. The company should sell 115 plus units a year, but the mix can lead to lower than consensus revenue/EBITDA.

Aircraft Services: Airplanes require systematic maintenance, parts, and overhauls, ERJ has built a global network of to service its and third-party aircraft. This is the company’s best business segment with high margins and should provide solid cashflow.

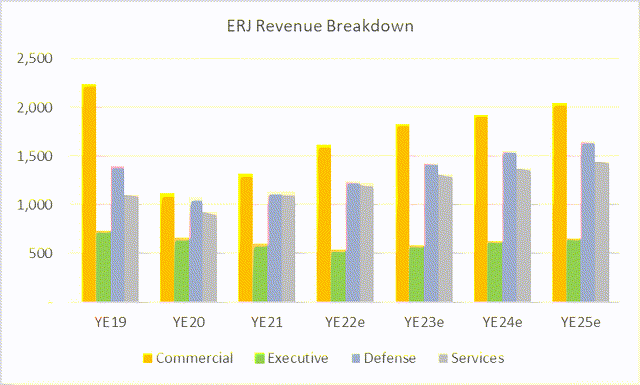

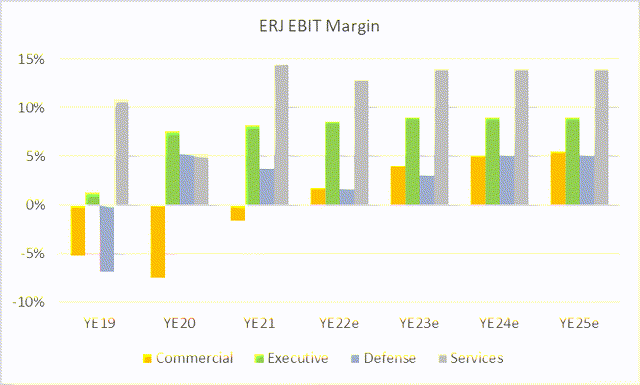

As seen in the charts below, commercial aviation is the largest revenue source but had a negative margin pre covid19 as regional jet demand fell and the company entered the over 100 seat segment with the strategy to build and sell these aircraft in partnership with Boeing.

ERJ Revenue Breakdown in US$m (Created by author with data from Embraer) ERJ EBIT Margin Breakdown (Created by author with data from Embraer)

Innovation

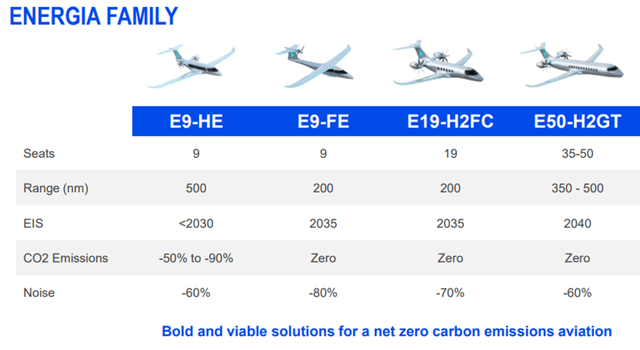

The Energia long shot: Turboprop executive/commercial airplanes that use sustainable fuel (SAE) looks great on paper. The competition is low, with very little innovation seen in the last 20yrs. According to Embraer this product is as quiet as a jet with far lower operating cost and great fuel efficiency. The development would cost US$1.2bn and the company is looking for a 50%/50% manufacturing partner, which should be an engine maker. The 400-unit non-binding order book is not enough to provide a launch commitment.

ERJ new Turboprop segment (Created by Embraer)

Eve Holding (EVEX): Urban air mobility via electric vertical take-off and landing aircraft, a mouth full and sounds futuristic. Not really, there are quite a few companies developing this segment, but Embraer has an advantage in its installed engineering, supply chain and certification capabilities. The 75% owned subsidiary (factoring in warrant conversion) has over US$7.1bn in orders that turn into firm backlog in 2024/2025 that could provide the capital for manufacturing. However, this depends on the pace of development, any delay would require a capital increase. Embraer would most likely not participate.

Financial Estimates

The company should see improved margins on cost initiatives, supply chain normalization. The engine supply chain may take to 2024 to normalize, the pandemic is still playing havoc on a lot of industries. The company should also raise prices on the commercial segment even if it means lower sales. EBITDA margins should recuperate to 11% and provide for debt reduction with leverage falling to 1x net debt / EBITDA by 2025.

ERJ Operating Model (Created by author with data from Embraer)

Valuation

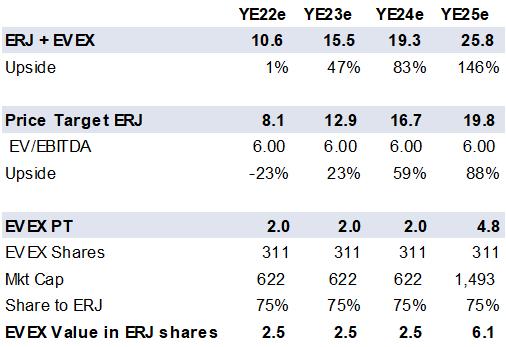

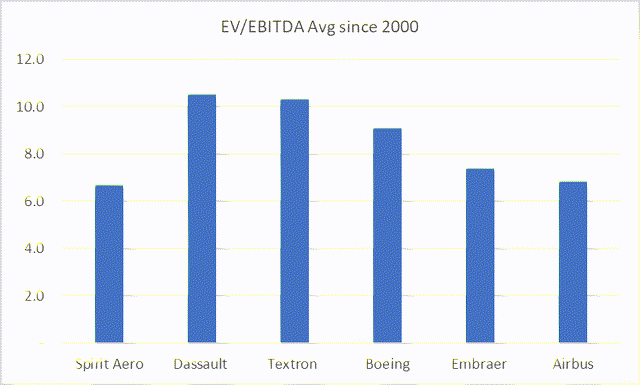

Given the weakness in commercial segment the market has discounted the shares below historical levels (7.5x) and vs peers at 5.4 EV/EBITDA 2023 estimates. In addition, the market has given zero value to its 75% stake in EVEX. Either ERJ begins to reflect this value or EVEX is set to fall to a more reasonable valuation for a pure development company. I am valuing EVEX at US$2 per share until the company is able to convert non-binding orders into firm orders with a 25% cash payment in 2024 and then in 2025 I assume they begin to deliver.

ERJ Valuation (Created by author with data from Embraer) Historic forward EV/EBITDA multiples (Created by author with data from Capital IQ)

Conclusion

ERJ shares have been greatly discounted to incorporate commercial jet concerns and an operating recovery. In addition, its stake in EVEX provides a free option that could double ERJ shares if things go as planned.

Be the first to comment