piranka

U.K. listed cybersecurity firm Darktrace (OTCPK:DRKTF) has seen its share plummet lately after a putative bidder walked away from the firm. I remain upbeat about the company’s prospects but will not be adding the company to my portfolio. Here’s why.

Possible Bid Does not Materialise

Last month, the company had told the market that it had received a number of unsolicited, preliminary and conditional proposals from the Canadian private equity firm Thoma Bravo. However, Darktrace updated the market this month to say that Thoma Brave did not intend to make an offer for Darktrace and that discussions between the two companies had ended.

Under U.K. takeover rules that effectively disbars Thoma Bravo from making an offer in the coming six months.

On one hand, the fact that Thoma Bravo had been considering the firm as a possible takeover target to start with may be seen as positive. It could be taken to suggest that there is some value in Darktrace, possibly more than had been reflected in the share price up to the date of the first announcement.

What of the failure of a bid to materialise, though? Here we do not know the details, not indeed what Thoma Bravo was seeking from an acquisition (though can speculate) or what prompted it to end discussions.

Overall I would say at this point the talk of a bid is best seen as a distraction now in the rear view mirror. It pushed the price of Darktrace shares up and they fell back accordingly when a bid failed to materialise. So as investors we are back to where we stood a couple of months ago, in asking: what might be a fair valuation of Darktrace on its fundamentals?

Valuing Darktrace is Challenging

For this the most useful starting point is the full-year results, which were published this month.

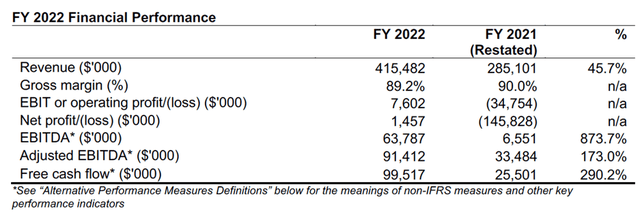

Headline revenue growth was strong, with the firm increasing revenues by almost half.

There was also an impressive uptick in free cash flow.

At the earnings level, the company moved from a $146m loss to a net profit of $1m. That is small, but the direction of travel is in the right direction. I see it as positive that Darktrace has moved into profit. Taken alongside the free cash flow number, the profit number though small is a positive sign of the business moving towards its long-term potential.

Meanwhile, Darktrace has a market cap in excess of £2bn. So while the move into profitability is welcome, the valuation still looks massively expensive on a P/E basis.

That said, given the growth stage of the company, it seems reasonable to hope that earnings will grow sharply in coming years, meaning that the prospective P/E ratio may be more reasonable.

Looking at the convoluted language in the “outlook” section of the company’s annual report already raises a small red flag for me as an investor. It is unnecessarily complicated and dwells at tedious length on things like exchange rates, which while certainly pertinent I simply see as part of the course of business for a multinational company listed in London and reporting in U.S. dollars, at a time that the pound is weakening and the dollar strengthening, both generally as well as against each other.

Actually the outlook is full of what I see as junk measures, such as “an adjusted EBITDA margin” which as an investor I feel gives me zero useful information as it contains so much wiggle room from an accounting perspective.

So, what might like revenue look like in the 2023 financial year? Here is what Darktrace guides:

For constant currency ARR, the Group confirms its expectation for FY 2023 year-over-year growth of between 31% and 34%. Measured against its rebased FY 2022 ARR, this implies year-over-year growth in net constant currency ARR added of between 4% and 14%.

What on earth is “ARR”? One needs to look to the announcement’s “Alternative Performance Measures Definitions” (uh oh!). There, ARR is revealed to stand for annual recurring revenue. So, is that revenue that recurs annually (and how would a firm know what will happen in future years?) Not so fast. ARR is defined as:

The sum of all ARR, at the period’s constant currency rate, for customers as of the measurement date. The ARR for each customer is the annual committed subscription value of each order booked for which it will be entitled to recognise revenue. In the small number of cases where a customer has an opt-out within six months of entering a contract, Darktrace does not recognise ARR on that contract until after that opt-out period has passed.

Blow away the cybersecurity smoke and mirrors: Darktrace is a B2B service business, something that has been around for decades. So as a private investor with limited time or interest in exploring the niceties of a company’s account before potentially helping capitalise it with my hard-earned money, the overwrought language here strikes me more as obfuscatory than explanatory.

What we do know from last year’s results is that Darktrace has been growing sales fast and I expect that to continue. Last year, its customer base grew 32% year-on-year to 7,437. I expect further growth in the customer base, but also an increase in the average value of each customer, in line with last year’s “average contract ARR” of 8%. But the rate of growth remains unclear to me when it comes to what to expect next. Even less clear is the earnings outlook.

I’m not Buying

I like the business area Darktrace is in and I think its revenue growth has been impressive. I expect it to continue to grow its customer base and revenues. Hopefully that should also tend towards earnings growth in the long-term.

However I do not feel the current earnings justify the valuation and future earnings prospects are so oblique at this point that I am not convinced enough by the investment case to add the company to my portfolio. Darkrace shares have lost 65% of their value in the past year but, given the lack of earnings visibility, I remain bearish.

Be the first to comment