Editor’s note: Seeking Alpha is proud to welcome Three Wood Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

nathanaparise

I am excited to start writing here at Seeking Alpha and bring everyone along on my journey to financial freedom. I’m a 31 year old financial professional with a new(er) portfolio. I’m married and my wife is staying at home to raise our first child (born this year!). I realized I was already doing a lot of work to research and write about my portfolio, and given that some of my favorite articles on Seeking Alpha are when others write about their portfolios, I decided to contribute my thoughts to the community. My time horizon is extremely long, since I have the intention of passing my portfolio down. Therefore, I always try to hold onto my positions long-term, which I believe is the best way to compound capital over the long run.

In my first post, I wanted to go over my portfolio, allocations, objectives, and thoughts about how I construct my portfolio. I included a high level look at the single-stock portion of my portfolio at the bottom of the post. In general, I group my stocks into one of five categories:

-

Core Dividend Growth — Expectations of mid to high single digit growth

-

High Dividend Growth — Expectations of an average of double digit dividend growth over the next few years

-

High Yield — Expectations of a yield in excess of 4% growing at low-to-mid single digits

-

Non-Dividend — Pretty self explanatory

-

Other Bets — Companies that don’t easily fit into the above four categories. Hilton (HLT) and The Walt Disney Company (DIS) were pre-pandemic dividend payers that suspended their dividend to shore up their balance sheet (both of which, in my opinion, were the correct decisions). HLT has resumed its dividend, but I’m not expecting any growth. DIS continues to prioritize its DTC offering, DIS does not expect to pay a dividend until it reduces its leverage ratio consistent with an A rating. Financial Institution A is the company I currently work for.

Note that the reason I’m not disclosing my current company is because it does not really fit into my overall investment strategy. My sales and purchases have nothing to do with my belief in the company over the short or long term. I receive a discount when purchasing shares and, while I try to hold on to shares long term to avoid short-term capital gains, I will sell shares for personal reasons. My purchase of shares is not just an investment opportunity; it’s part of my overall compensation. Being able to dump a nice chunk of my salary and instantly realize a low double-digit return can be attractive at times. I also don’t feel too comfortable having a large chunk of money in my own company’s stock since I already have a large exposure to them through my salary.

I also maintain a watchlist of companies that I will publish at a later time. One company I will note below that’s not a “real” portion of the portfolio is Olaplex (OLPX). It’s a micro position held in my wife’s Roth IRA. She has no desire to sell it, so it stays.

As you can see, there are a large number of positions. That is a feature, not a bug. While I’d love to hold a concentrated portfolio of my 10 highest conviction picks, I instead defer to quantity+quality. I’m a firm believer that quantity drives quality. Having a large number of positions with a focus on quality provides you with a greater chance of filling your portfolio with gems (and minimizing the impact of allocating capital to duds) while avoiding the left end of the curve where you experience permanent loss of capital. I’m not trying to get rich quick; I’m only targeting a comfortable “earlier” retirement.

Objective

The objective of my portfolio is to grow my dividend income by 10%+ yearly, with no bias towards where that growth originates (organic or new money). This will change in time to focus more on organic dividend growth, but at this time I’m just trying to rapidly increase sustainable dividend growth without sacrificing quality. The High Dividend Growth bucket may not add a lot of money year one, but if I’m still hitting my 10% target, those dividends will bear fruit five or ten years from now.

What I’m not trying to do is to “beat” the S&P 500. If I do, wonderful. I have money in my 401K and in my wife’s 401K and IRA that is tied to the S&P 500. I decided not to index my entire portfolio because I think researching companies and actively managing my portfolio is downright enjoyable. I like it. It’s one of my hobbies. At some point, I plan to convert all of my indexed money to single stocks in retirement to be able to live off the dividends and pass them down to my child(REN). I can’t do that successfully unless I’ve spent years managing my own portfolio. I also believe evaluating and picking stocks helps one become more decisive in other areas of life.

Dividend Reinvestments

Here is my dividend reinvestment “flowchart”:

-

If my projected dividend growth is less than 10% for the year, all dividends are reinvested into the Core Dividend Growth, High Dividend Growth, and High Yield buckets;

-

If projected dividend growth is in excess of 10%, but less than 20%, up to 25% of dividends can be invested into the Non-Dividend or Other Bets buckets;

-

If projected dividend growth is in excess of 20%, up to 50% of dividends can be invested into the Non-Dividend and/or Other Bets buckets;

-

Dividends are reinvested first by desired allocation and second by valuation; and

-

Dividends are pooled and reinvested on the first of the following month.

I found that I need to have a plan that I religiously stick to so that my portfolio objective can be met. By prioritizing dividend growth, I am setting myself up for long-term compounding while allowing my portfolio to allocate capital to non-dividend payers when the primary portfolio objective is met.

New Money Investments

New money added to the portfolio follows a similar flowchart from above, with projected dividend growth being the key factor to what bucket the money can be allocated. Instead of prioritizing allocation with new money, I am instead focusing on valuation first with allocation being considered second. New money tries to buy the best deals I see, unless that purchase would really blow out an allocation. I try to keep single stock allocations under 3% but, as you can see from below, the market does what it does. There are some companies I’m perfectly happy to live above that 3% target, including Microsoft (MSFT), Apple (AAPL), Visa (V), Mastercard (MA), Moody’s (MCO), S&P Global (SPGI), Texas Instruments (TXN), Costco (COST), and Alphabet (GOOGL).

Investments

As noted, I bucket my investments into five categories, but across those categories there are a lot of similarities with how I select which stocks to invest in. In general, I’m looking for companies with large competitive advantages in oligopolistic industries with track records of being friendly to shareholders. Idea generation is typically done from reading articles on Seeking Alpha, the WSJ, looking at the portfolios of some investors (Chris Hohn, Mohnish Pabrai, Li Lu, Warren Buffett, Bill Nygren, Chuck Akre, etc…), and other general reading. Below are some of the key investment areas.

Payment Rails, Northern Railroads, Rating Agencies

In markets where there are high barriers to entry and few big players, I find it easier just to own the whole market. I could spend hours, days or weeks researching markets and be unable to decide which company is “better.” Therefore, it’s easier to just own the whole market. Other markets in my portfolio that are similar to the above three (but not perfect comparisons due to competition or other factors) include home retailers (Home Depot (HD) and Lowe’s (LOW)), physical general retailers (Target (TGT) and COST), and cloud computing (MSFT and GOOGL, (Amazon (AMZN) will appear in this portfolio eventually)).

Compounders

I love companies that have been able to compound over decades through smart capital allocation. Examples of these companies include the companies listed above and AAPL, TXN, Broadcom (AVGO), Air Products and Chemicals (APD), Essex Property Trust (ESS), AbbVie (ABBV), Vulcan Materials (VMC), Starbucks (SBUX), American Tower (AMT), Automatic Data Processing (ADP), Danaher (DHR), and Old Dominion Freight Line (ODFL). This is the area of my portfolio that I’m looking to grow the most. These companies have proven to be stewards of shareholders’ capital and I’m more than happy to partner with the wonderful companies over the coming decades.

Others

Those are the two areas where I try to focus the majority of my money. Other areas are companies that I feel like I know very well or appear cheap relative to some metric of historical multiple, dividend yield, FCF yield, etc. These companies include beaten down giants (Comcast (CMCSA)), secular plays (ConocoPhillips (COP), EOG Resources (EOG), and NextEra (NEE)), bets on companies who freeze their dividend with the expectation of resuming (CVS Health (CVS), HLT, and DIS), and companies that I generally believe are cheap (Meta Platforms (META) and Netflix (NFLX)). All of these obviously won’t work, but I like to get as many swings as I can.

|

Company |

Ticker |

Allocation |

|

Core Dividend Growth |

39.691% |

|

|

Microsoft Corporation |

(MSFT) |

8.843% |

|

Apple, Inc. |

(AAPL) |

6.859% |

|

Essex Property Trust, Inc. |

(ESS) |

3.653% |

|

Canadian National Railway |

(CNI) |

3.490% |

|

AbbVie, Inc. |

(ABBV) |

2.709% |

|

Air Products and Chemicals, Inc. |

(APD) |

2.552% |

|

Canadian Pacific Railway |

(CP) |

1.903% |

|

Qualcomm Incorporated |

(QCOM) |

1.734% |

|

Comcast Corporation |

(CMCSA) |

1.340% |

|

Vulcan Materials Company |

(VMC) |

1.242% |

|

CVS Health Corporation |

(CVS) |

1.236% |

|

ConocoPhillips |

(COP) |

1.168% |

|

EOG Resources, Inc. |

(EOG) |

1.039% |

|

Starbucks Corporation |

(SBUX) |

0.946% |

|

The Coca-Cola Company |

(KO) |

0.532% |

|

NextEra Energy, Inc. |

(NEE) |

0.447% |

|

High Dividend Growth |

44.157% |

|

|

Broadcom, Inc. |

(AVGO) |

5.135% |

|

Moody’s Corporation |

(MCO) |

4.704% |

|

MasterCard Incorporated |

(MA) |

3.866% |

|

Visa, Inc. |

(V) |

3.673% |

|

Costco Wholesale Corporation |

(COST) |

3.471% |

|

Lowe’s Companies, Inc. |

(LOW) |

3.307% |

|

Texas Instruments Incorporated |

(TXN) |

3.199% |

|

S&P Global, Inc. |

(SPGI) |

2.947% |

|

The Home Depot, Inc. |

(HD) |

2.881% |

|

American Tower Corp. |

(AMT) |

2.479% |

|

Automatic Data Processing, Inc. |

(ADP) |

2.434% |

|

Danaher Corporation |

(DHR) |

2.383% |

|

Old Dominion Freight Line, Inc. |

(ODFL) |

1.762% |

|

Target Corporation |

(TGT) |

1.414% |

|

Estee Lauder Companies, Inc. |

(EL) |

0.499% |

|

High Yield |

4.284% |

|

|

Altria Group, Inc. |

(MO) |

2.311% |

|

Realty Income |

(O) |

1.972% |

|

Non-Dividend |

10.752% |

|

|

Alphabet, Inc. |

(GOOGL) |

4.392% |

|

Meta Platforms, Inc. |

(META) |

3.263% |

|

Netflix, Inc. |

(NFLX) |

2.953% |

|

Olaplex Holdings |

(OLPX) |

0.144% |

|

Other Bets |

1.116% |

|

|

Hilton Worldwide Holdings, Inc. |

(HLT) |

0.687% |

|

The Walt Disney Company |

(DIS) |

0.374% |

|

Financial Institution A |

— |

0.055% |

*No significant amount of cash is held in any of my accounts. My wife and I carry an emergency fund which could be deployed into the market if needed, but I don’t anticipate that happening. New money gets added and invested into the portfolio every two weeks.

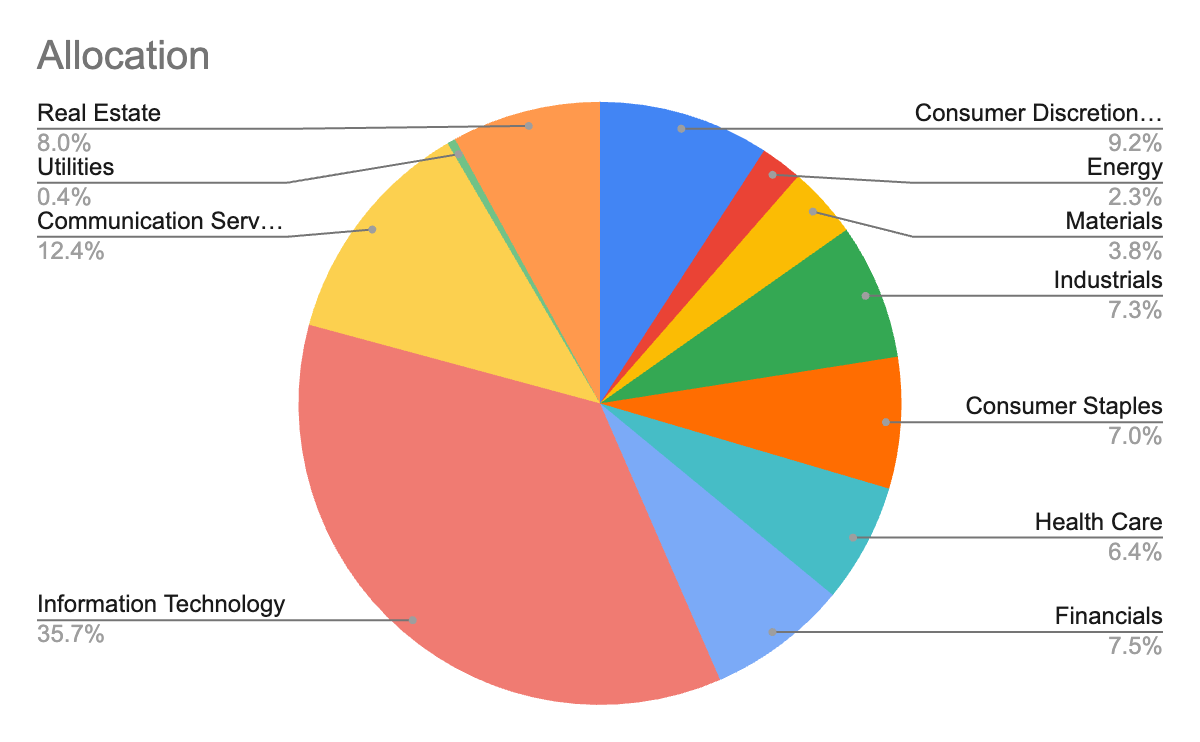

Below is a look at my allocations by sector:

My Allocation (Google Sheets)

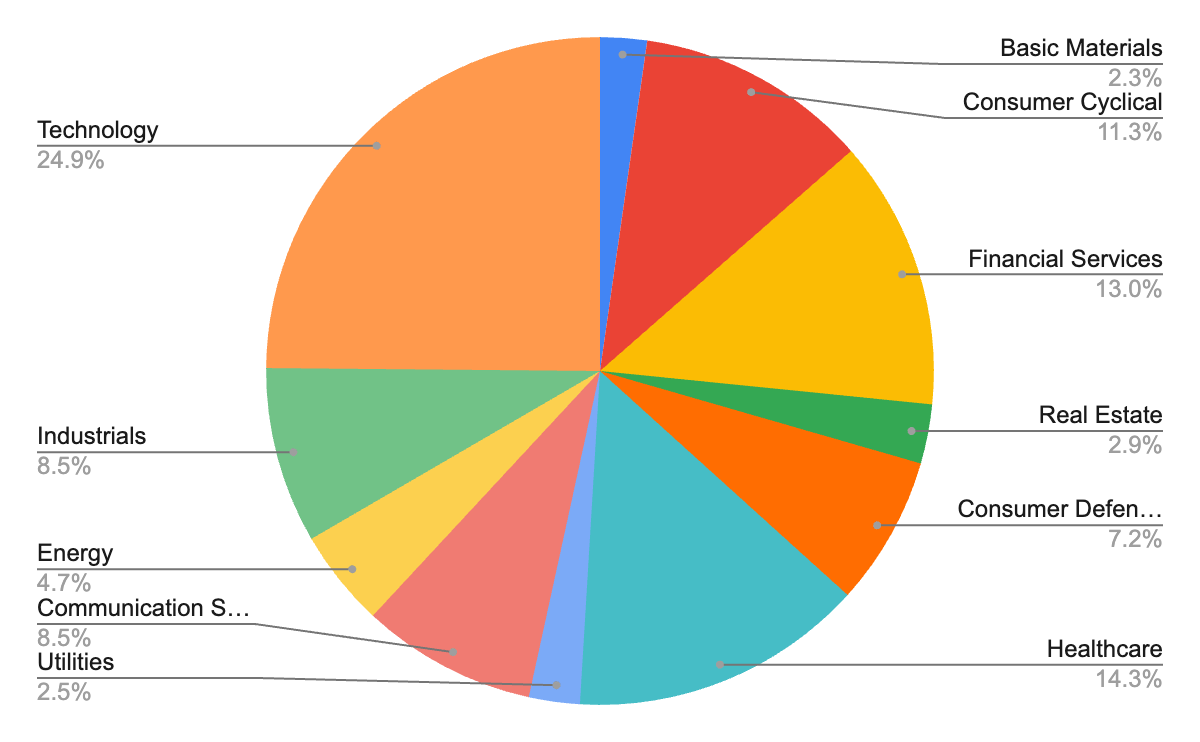

And here is the allocation by sector of VOO:

SP 500 Allocation (VOO)

You can see the key areas of divergence are (provided below) information technology (where I’m 1,123 basis points over the S&P 500) and healthcare (where I’m 765 basis points under the S&P 500). I’m generally fine with this, and some new positions I plan to add will mix these up a bit. In some areas, including materials, technology, and communication services, I want to be over allocated since I think the businesses I’m invested in are going to be great long term compounders. In other areas, including energy and utilities, I’m happy to be under allocated at this point because I’m having a harder time feeling comfortable increasing my allocations there. An area I’d like to reduce would be real estate, but I plan to do that by not adding new money or dividend reinvestments to that sector.

|

Delta (Basis Points) |

|

|

Basic Materials |

158 |

|

Consumer Cyclical |

-196 |

|

Financial Services |

-535 |

|

Real Estate |

516 |

|

Consumer Defensive |

-9 |

|

Healthcare |

-765 |

|

Utilities |

-198 |

|

Communication Services |

400 |

|

Energy |

-239 |

|

Industrials |

-111 |

|

Technology |

1123 |

Conclusion and Question

I’m looking forward to writing monthly articles here to bring the community along with me on my journey. I stack up the dividend payments throughout the month and selectively reinvest on the first of the next month. Hoping to provide some year over year % growth starting in January 2023!

One question to the readers, how do you bucket your own portfolio? Sectors, dividend growth, core holdings? I’d love to hear and learn from the community.

Be the first to comment