blackred

Danaher Corporation (NYSE:DHR) is a well-diversified conglomerate with an attractive cash flow profile. Its portfolio is exposed to secular growth drivers such as increasing environmental, healthcare, and food safety regulatory requirements. Farther out, China offers Danaher numerous expansion opportunities. We also applaud Danaher’s free cash flow conversion efforts (we define free cash flow as net operating cash flow less capital expenditures) as its free cash flow consistently exceeds net income. Readers should keep Danaher on your radar as a potential capital appreciation idea. Shares of DHR yield a modest ~0.3% as of this writing as the firm’s management team has historically favored investing in the business as compared to allocating capital to Danaher’s dividend program.

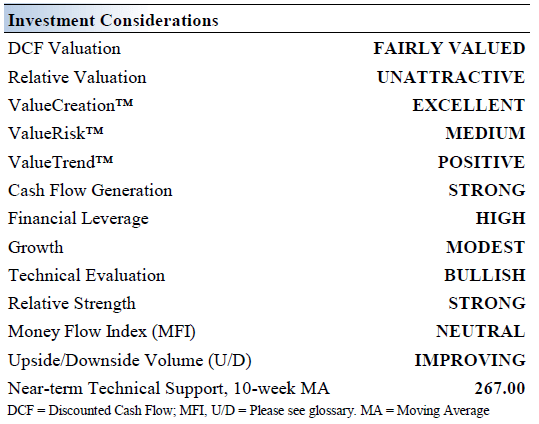

Danaher’s Key Investment Considerations

Image Source: Valuentum

Danaher makes innovative products and provides services to professional, medical, industrial, and commercial customers. Its portfolio of premier brands, including Pall, Cepheid, and Beckman Coulter, is among the most highly recognized in each of the markets it serves. The company was founded in 1969 and is headquartered in Washington, D.C.

The company spun off its ‘Dental’ segment into an independent, publicly-traded company in the second half of 2019 into a new firm, Envista Holdings Corp (NVST). In 2020, Danaher bought General Electric Company’s (GE) BioPharma unit (a leading provider of instruments, consumables, and software that support biologic production workflows) for ~$21 billion and $0.1+ billion in annualized cost savings are expected within three years after closing.

Danaher boasts a strong portfolio of brands and an extensive installed base that helps it drive recurring revenue. Recent portfolio optimization efforts have created a company with a stellar cash flow profile as ~70%-75% of Danaher’s revenues are recurring, providing ample visibility as it concerns the firm’s future financial performance (in 2021, ~74% of Danaher’s $29.5 billion in total revenues were considered recurring in nature).

Financial Analysis

On July 21, Danaher reported second quarter for fiscal 2022 (period ended July 1, 2022) earnings that beat both consensus top- and bottom-line estimates. Its GAAP revenues rose by 7% year-over-year to reach $7.8 billion last fiscal quarter, with management citing its life sciences and environmental and applied solutions segments as key growth drivers for Danaher during the firm’s latest earnings call. Please note that the strong US dollar seen of late has weighed quite negatively on Danaher’s reported revenues, though underlying demand for its offerings remains strong.

Danaher’s GAAP operating income rose by 10% year-over-year last fiscal quarter. Economies of scale resulted in its GAAP operating margin rising by ~65 basis points year-over-year to hit 28.4% in the fiscal second quarter, with its GAAP gross margin coming in broadly flat during this period. Unfavorable non-operating items and a slightly larger provision for corporate income taxes saw Danaher’s GAAP diluted EPS come in at $2.25 last fiscal quarter, down 1% year-over-year.

Looking at its non-GAAP organic sales performance (removing foreign currency headwinds and A&D activities from the picture), Danaher’s core sales were up 9.5% year-over-year in the fiscal second quarter. That includes 8.0% year-over-year growth at its base businesses and a 1.5% uplift from COVID-related testing activities. As the worst of the COVID pandemic fades, so too will sales of its COVID-related testing activities, though Danaher’s base businesses are holding up incredibly well. In our view, its growth runway remains firmly intact when removing pandemic-related effects from the picture.

Danaher forecasts that its base businesses will report high single-digit revenue growth during the current fiscal quarter, with its core businesses reporting low single-digit growth and its COVID-related testing activities reporting mid-single-digit growth on a year-over-year basis. We appreciate the firm’s confidence in its near term performance.

The company generated $3.4 billion in free cash flow during the first half of fiscal 2022 while spending $0.4 billion covering its dividend obligations. It exited the fiscal second quarter with $16.1 billion in net debt on the books (inclusive of its negligible short-term debt position). As Danaher had $4.0 billion in cash-like assets on hand at the end of this period, the firm has ample liquidity to meet its near term funding needs.

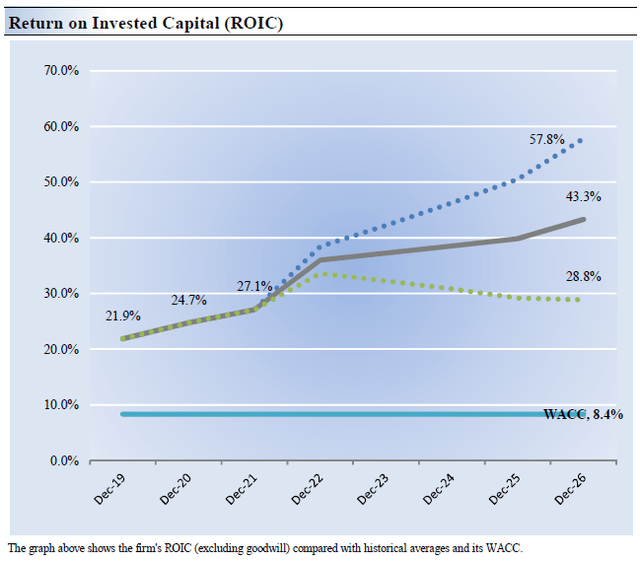

Danaher’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Danaher’s 3-year historical return on invested capital (without goodwill) is 24.6%, which is above the estimate of its cost of capital of 8.4%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Danaher has historically been a solid generator of shareholder value and we forecast that will continue being the case going forward, aided by its recent portfolio optimization efforts.

Danaher’s Cash Flow Valuation Analysis

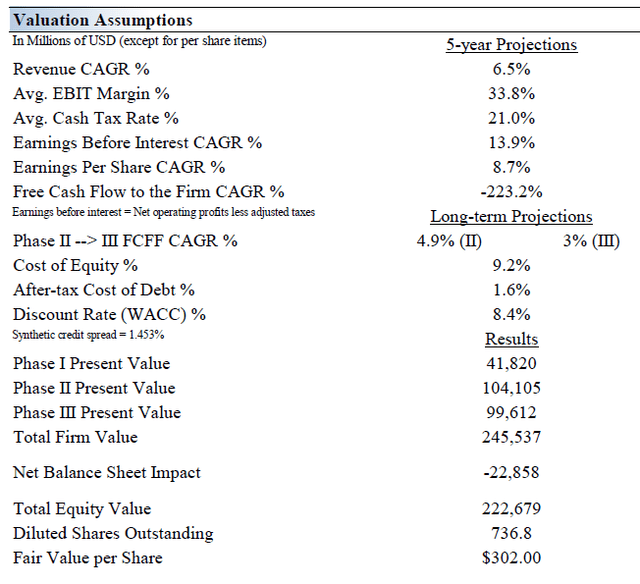

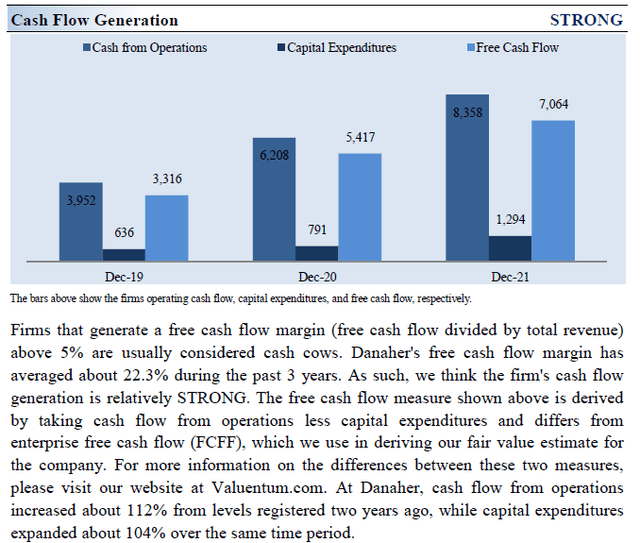

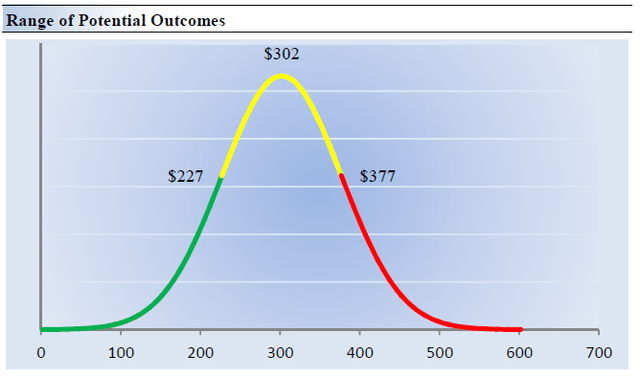

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of its balance sheet considerations. Please be aware that our enterprise cash flow models assume Danaher realizes material margin expansion and nice revenue growth over the coming years, and if the firm should stumble for any reason, its intrinsic value would face serious headwinds. We think Danaher is worth $302 per share with a fair value range of $227.00 – $378.00. Shares of DHR are trading just below the midpoint of our fair value estimate range as of this writing.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 6.5% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 20%.

Our valuation model reflects a 5-year projected average operating margin of 33.8%, which is above Danaher’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 4.9% for the next 15 years and 3% in perpetuity. For Danaher, we use an 8.4% weighted average cost of capital to discount future free cash flows.

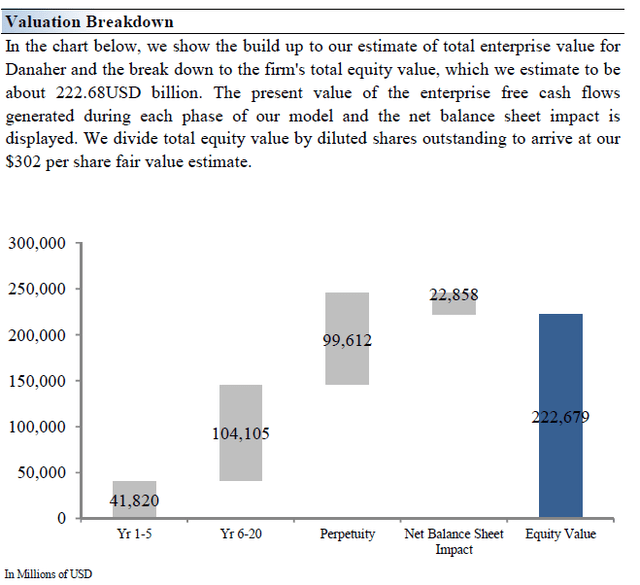

Image Source: Valuentum Image Source: Valuentum

Danaher’s Margin of Safety Analysis

Although we estimate Danaher’s fair value at about $302 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Danaher. We think the firm is attractive below $227 per share (the green line), but quite expensive above $378 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Danaher is a solid enterprise with an attractive cash flow profile and a portfolio of assets that are exposed to activities supported by secular tailwinds which should drive meaningful demand growth for its offerings over the long haul. At the right entry point, Danaher represents an attractive capital appreciation idea for investors with its dividend growth potential offering incremental upside. We like Danaher’s focus on recurring revenue streams.

Be the first to comment