Justin Sullivan/Getty Images News

A reader of my Portillo’s article told me he ran over for lunch after reading it. This morning, I yearned for an original glazed Krispy Kreme, Inc. (NASDAQ:DNUT). But the irony is that while we are bullish on the stupendous donuts, cookies, and brownies, Krispy Kreme, Inc. is not, in our opinion, a tasty investment for retail value investors.

Company Profile

The company’s revenue generates from sales at company-owned stores, royalties from franchise fees from new stores, and sales of mixes, customized equipment, ice cream, and coffees to franchised stores.

Krispy Kreme, Inc. makes and sells primarily baked goods treats and doughnut-making equipment. They have 1,810 Krispy Kreme and Insomnia Cookies-branded shops in approximately 30 countries worldwide. 971 are company owned. There are 839 franchises.

In 2021, JAB Holding, the Europe-based conglomerate, announced a three-year total return swap agreement with BNP Paribas for up to a total of 6.5M shares of Krispy Kreme Inc. Krispy Kreme went public in June ’21 after about five years of private ownership by JAB Holding. JAB holds about 45% of outstanding shares.

Fortune Business Insights suggests the donut business has growth potential despite a healthy-eating craze. There is a rise in “the consumption of snacks and indulgent foods as sensorial food.” Second, the industry is innovative; it moved to gluten and dairy-free, handcrafted, and smaller offerings to publicize lower calories, sugar, and nut-free, and keto donuts.

The company is shifting strategy from heavy capital expenditures in favor of building the company’s DFD growth driver, “delivered fresh daily doors;” e.g., strategically placed carts and food trucks, increasing placements in retail shops, etc. CEO and President J. Michael Tattersfield wants to have “50K global points of access” to fresh donuts and cookies for sale, up an estimated 11K presently. This revenue-generating strategy will lower capital expenses and lead to profitability. The risk is DFD requires a substantial investment in technology to track inventory and control delivery costs. According to The Wall Street Journal, food delivery tech is a burgeoning industry.

Better Taste than Profit

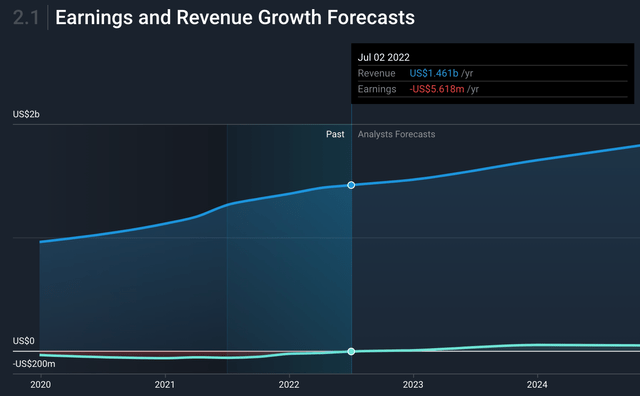

Krispy Kreme products are in demand. Organic growth is vigorous, and overall revenue growth is noteworthy. Revenues hit $1.12B in ’20 and $1.38B in ’21. Revenue might top $1.5B in ’22. We forecast revenue to climb to $1.68B in ’23. In the second quarter of 2022, sales grew 7.4% year-over-year.

Investors expected a good Q2 report but it disappointed them when the numbers missed estimates. Shares dropped from $14.79 in August to $11.70. The Q2 Non-GAAP EPS of $0.08 was below the expected $0.10. Though organic revenue grew total revenue, the company missed estimates by $10.69M. Analysts’ estimates can be more impactful than the realities of running a business.

Missed estimates are not underlying our fear for future weakness in the stock, just as accelerating revenue is not a reason to invest. Krispy Kreme needs consistent positive net profits. Stakeholders want better returns. Their trailing 12-month profit margin is a ~0.3% loss.

The dividend yield is an unimpressive 1.1%. It is well below the industry average yield of others in the industry. Cash flow is strong enough to cover interest and the debt payments, around $1B in total debt. However, rates are rising and consumer spending will mitigate if a recession takes hold.

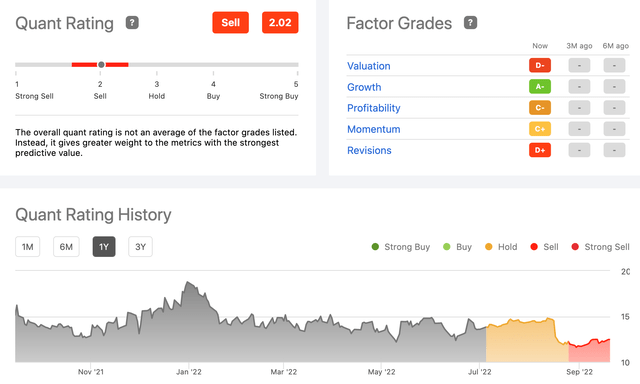

Seeking Alpha lowered its Quant rating to “strong sell” following release of the Q2 ’22 earnings report.

Quant And Factor Ratings (Seeking Alpha)

Last year’s EPS in Q3 was 6 cents. We expect the same in Q3 ’22 (to be reported November 8th) or perhaps 5 cents EPS. If they report an EPS higher than last year’s, our expected average price target for the stock is $16 over the next three- to six months.

The shares hit $21 on July 1, ’21 and stumbled or tumbled in almost every quarter since going public. The shares are -17% through mid-September ’22. There are no risks we can determine that will precipitously push down the price, but the prevailing economic miasma does not portend any reasons the stock will pop back to $21.

If they cannot seem to produce a net profit in good times, it will be all the more difficult in a miasma of economic struggles ahead. Costs of goods are rising uncontrollably, interest rates are on the rise, and labor shortages abound particularly in low-paying industries. We are concerned about the management’s compensation that unseemly outstrips company earnings.

Future Growth (Simply Wall St)

Positive Tidbits

The company is in excellent financial health. Total assets are +$3B. Short-term and long-term liabilities together are less than $2B. Corporate insiders bought shares throughout 2021 and bought again but in small quantities this year. JAB Holding once tried buying the other donut giant. Perhaps this activist investor will make a move to bring the two together.

Hedge funds increased their holding in the last quarter by about 70K shares. The stock is not any more or less volatile than the stock market. There is the potential for growth and profitability with low risk; we remain concerned about the debt-to-equity ratio (55.5%) that is on the top side. It is down from almost 80% over five 5 years.

The cash flow is positive, and if the debt continues shrinking, there should be no worries about the cash runway. Krispy Kreme Inc looks tastier, perhaps even mouth-watering, but we do not think it is healthy for the portfolios of retail value investors at this time. Don’t dump them. Hold any shares in the freezer for a couple of more years.

Be the first to comment