olm26250

By Walt Czaicki, CFA

When buying a car, a washing machine or a piece of furniture, verifying the product’s quality is usually high on a shopper’s checklist. The same goes for stocks. Just as a big-ticket purchase is expected to function well for years, the companies in an equity portfolio should also stand the test of time.

But how can an investor know if the stocks held in a portfolio are truly durable? It’s not as simple as searching for consumer reviews about a TV. Instead, you need to find out how a fund manager evaluates the business attributes of the underlying companies and chooses the stocks for your portfolio. Dominant businesses, competitive advantages, innovation and management skill are just some of the features that define high-quality businesses that can deliver dependable cash flows over time.

Quality Features Underpin Long-Term Return Potential Quality

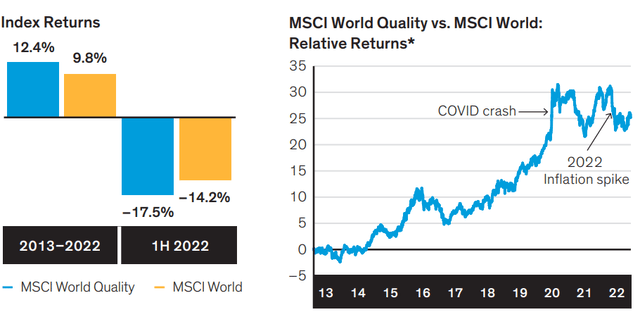

in stocks can be measured in different ways. Yet the characteristics of resilient companies have something in common—they tend to underpin consistent, long-term equity return potential. Over the last decade, the MSCI World Quality Index returned 12.4% annualized, outperforming the MSCI World Index (Display 1). And during past market crises, quality stocks usually fell less than the broader market, a pattern that we’ve observed over longer time periods and in both US and global stock markets.

Display 1: Quality Stocks Have Outperformed The Broad Market Over Time (Source: FactSet, MSCI and AB)

Past performance does not guarantee future results. All returns shown in US dollar terms. | *Relative geometric performance. As of July 31, 2022

Yet no equity portfolio is immune from weak spells, and even high-quality stocks may falter from time to time. In the first half of 2022, stocks tumbled as surging inflation, rising interest rates, Russia’s invasion of Ukraine and China’s COVID-19 lockdowns threatened to tip the world economy into recession. Quality stocks fell by 17.5%, underperforming the broader market.

But following past crises, quality stocks have rebounded over time. When it comes to equities, we believe the long-term benefits of quality stocks aren’t necessarily illustrated by short-term return patterns. In our view, the early 2022 performance of quality stocks was an aberration, driven by an extreme confluence of extraordinary events. When the dust settles, we believe the benefits of a quality-focused approach will reassert themselves. In this paper, we aim to show how investors can find companies that provide exposure to quality, which should ultimately reward them through a challenging period ahead.

What Distinguishes True Quality?

High-quality stocks can be found in diverse sectors and industries, and range from companies that are more sensitive to economic cycles to those that enjoy profitable growth drivers. We believe investors who prioritize quality in their everyday stock-picking processes are better equipped to identify durable companies that have what it takes to get through uncertain times and thrive in a recovery.

When markets are volatile and the economic outlook is cloudy, investors need to be discerning when they look at a company’s underlying dynamics. By studying industry conditions, demand drivers and company business models, investors can assess quality through these three lenses:

- Persistent earnings and profit growth. These characteristics are usually a sign that a company has a differentiated and durable business that can do well through changing macroeconomic cycles.

- Strong free cash flow. Good businesses generate excess cash, the lifeblood of economic activity. This gives companies more financial flexibility to enhance shareholder returns.

- Healthy balance sheets. Companies with ample cash and low debt levels have a healthier foundation to invest for the future and execute strategy without being subject to the moods of capital markets.

The three characteristics above are interconnected. Companies that generate consistent free cash flows are in a better position to cover their debt-servicing costs—even when there’s less cash to keep the business afloat. And low earnings volatility is a good indicator of a company’s ability to perform through complex and changing business conditions.

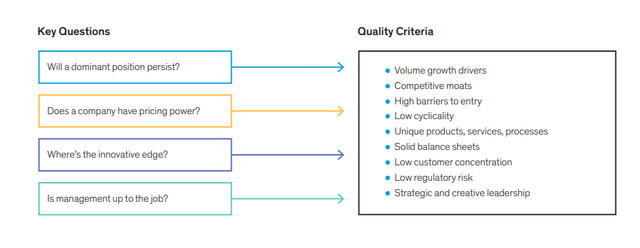

Companies with all three of these features have much more flexibility to navigate short-term market stresses and longer-term challenges. By asking the right questions, investors can find companies with high-quality fundamentals that can persist over time (Display 2). We believe an investment approach focused on quality can help position a portfolio to cope well with inflation, slowing growth and geopolitical risk—the three major hurdles facing investors today.

Display 2: How To Identify Companies With Stronger Fundamentals (Source: AB)

Inflation Shock Hits Quality Stocks

To understand why quality stocks didn’t perform well in early 2022, it’s helpful to rewind to the beginning of the pandemic.

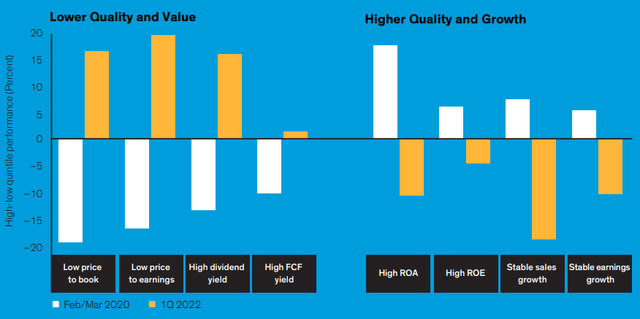

In February and March of 2020, stock markets collapsed as COVID-19 triggered a shutdown of economic activity around the world. In this environment, lower-quality stocks, such as those with low price/book value sold off sharply (Display). Investors flocked to companies with quality features such as high and consistent profitability, measured by return on assets (ROA) or return on equity (ROE), as well as to companies with stable earnings and sales growth. Shares of companies with the ability to deliver consistent profits and revenues through tougher economic times were in high demand, given their scarcity.

Two years later, the world faced an inflation shock. After decades of low inflation, spiking prices in 2022 drew investors to sectors such as energy, utilities and financials (especially in the first quarter). These sectors are typically more heavily weighted with value stocks—relatively cheap names, often with more indebted balance sheets—which tend to do better when inflation and interest rates rise. By June 2022, with US inflation reaching a 40-year high of 9.1% annualized, the Federal Reserve began aggressively hiking rates. Growth stocks, whose valuation multiples are hurt more when rates rise, fell sharply. Quality features such as high ROA and ROE are more prevalent in the growth cohort. As a result, quality stocks suffered in the sell-off as well.

The inflation shock will influence business outcomes and stock return patterns for some time. But not forever. Eventually, efforts to combat inflation will curb rising prices, slow economic growth and constrain earnings. Inflation is likely to remain higher than in previous years but will ultimately settle into a more reasonable range.

Our research indicates that quality stocks perform well over most economic regimes but can lag the broad market in periods of higher interest rates and in more speculative market environments. Through a moderation of economic activity and inflation, we expect investors will reward businesses with higher-quality features that have the potential to perform well in tougher conditions.

Anatomy Of An Inflation Vs. An Economic Growth Scare

Radically Different Factor Performance over Distinct Sell-Offs (Source: AB)

Past performance does not guarantee future results. FCF: free-cash-flow. Factor performance difference between highest-ranked and lowest-ranked quintiles. As of March 31, 2022

Inflation and Rising Rates: Pricing Power Can Prevail

Rising prices will affect companies in diverse ways. But in every sector, rising input costs, from raw materials to wages, will pressure a company’s profit margins. Companies that can raise prices—without sacrificing demand for their goods or services—will be able to better protect margins despite higher input costs. While pricing power is always an important quality feature, in a world of higher inflation, we believe it has become an essential differentiator for companies to deliver sustainable growth in earnings and profitability.

What determines a company’s pricing power? Many ingredients, including the company’s competitive position in its market, how essential its customers perceive its products to be and how resilient the supply/demand dynamics are within a given sector and industry.

Technology companies with ubiquitous programs or services are among those able to raise prices, in our opinion. Increasingly, technology firms have migrated to subscription-based business models, where the switching costs for exiting users is typically high. These elements combined allow companies with such traits to command pricing flexibility while retaining a large portion of their customer base. Providing convenience also facilitates pricing power. In the construction business, for example, few contractors want to own and maintain heavy equipment. Equipment rental firms can handle the ownership burden, and have found that as their fleets become greener, customers are willing to pay higher rents to help meet emissions regulations.

On the flip side of pricing power, quality companies tend to be able to manage rising costs more effectively. In the new inflation cycle, tight labor markets have become a major headwind for businesses, pushing up wages in many sectors. While technology and automation can sometimes be deployed to help reduce labor costs, it’s usually a long process. Look for companies with creative plans to cope with labor costs. For example, one semiconductor manufacturer plans to recruit more aggressively at entry-level positions to replace older, more expensive employees. However, companies that choose this route must ensure that productivity and the quality of their goods or services isn’t compromised by replacing experienced workers with more junior staff.

Rising wages means companies must work harder to retain staff. Companies that are better at workforce retention and skills development may have an edge. To evaluate “softer” corporate practices like these, investors should engage regularly with management teams and scour other sources of information such as Glassdoor.com.

Of course, labor is just one component of a company’s cost structure. In industries that are less labor intensive, companies should consider whether cheaper inputs and alternative raw materials are available to lower production costs. We also look to see if a company’s manufacturing processes can be streamlined. Outsourcing can help trim costs in industries that haven’t done so yet. And scientific innovations such as synthetic biology could open paths to completely new sources of raw materials used in products ranging from cement to cosmetics to food.

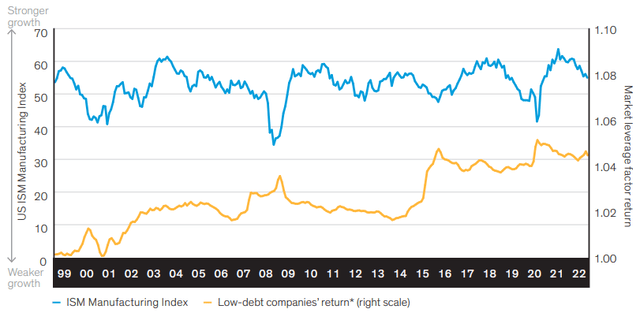

Inflation has prompted rising interest rates in the US and other major economies, which could impair low-quality companies. In particular, companies with heavy debt burdens could be vulnerable if growth slows while interest rates rise. The low-rate environment of recent years encouraged companies to take on additional debt, as the cost was so low. But as the pendulum swings back, lower leverage is likely to become an important quality feature, in our view. In this environment, we believe companies with solid growth drivers and low debt levels should command a premium. Indeed, during economic slowdowns in the past, companies with lower leverage performed better, as illustrated by high-yield bond returns over more than two decades (Display 3, page 5).

Display 3: Quality Balance Sheets Support Performance In Weak Economies (Source: Bloomberg, Piper Sandler and AB)

Past performance does not guarantee future results. *Based on the market leverage factor, which favors low-leverage companies over high-leverage companies. It is computed as net debt/(net debt + market value of equity). The chart shows the DTS (duration times spread) adjusted cumulative return of a factor-weighted, industry-neutral long/short portfolio in the US high-yield bond universe. Through June 30, 2022

Coping with a Slowdown: Competitive Advantages and the Innovation Edge

When economic growth slows, it often seems like companies are subject to forces beyond their control. Yet not all companies are equally vulnerable to unpredictable market forces. Some exercise a much greater degree of control over their fate than their peers by virtue of having fundamentally sounder businesses, strong market positions and better products, as well as superior leadership and operating execution.

Dominant market positions often support sustainable growth. Wide competitive moats and high barriers to entry are key ingredients for a market-leading position. Yet it’s important to make sure that a company’s products aren’t being competed away. Does a new technology threaten to upend a successful incumbent? How might changing consumer and corporate behavior unsettle a dominant business model?

These questions take on added importance in a world where economic (cyclical) growth will be harder to come by. At the same time, some business trends are more resilient to a slowdown, especially those that benefit from long-term secular growth trends with long runways.

Consider the cloud in the technology sector. Companies around the world and across sectors are migrating data to the cloud. This need is becoming more acute as labor costs and security concerns grow, and it’s unlikely to be derailed by an economic slowdown. In our view, companies that are integral to the cloud migration are likely to continue benefiting from this shift—even in a tougher economy.

Innovation is another antidote to slowing growth. New technology and information systems allow companies to take advantage of massive data on customer behavior. Companies that recognize this potential and invest accordingly are using these tools to deepen their relationships with customers—and to gain an edge over their rivals that haven’t. These advantages will become particularly valuable during a period of decelerating economic growth.

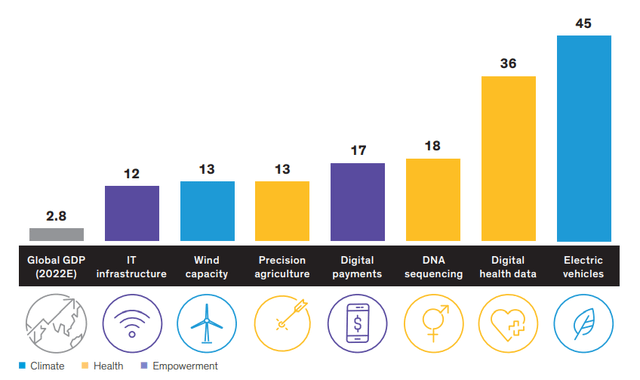

Compounded Annual Growth Rates (Percent)

Display 4: Some Growth Trends Should Persist Through A Slowdown (Source: BCC Research, BloombergNEF, Cisco Systems, Flex, Global Wind Energy Council, Grand View Research, International Data Corporation, Morgan Stanley, Statista and AB)

Current forecasts do not guarantee future results. Global GDP estimate from AB economists as of March 31, 2022; IT infrastructure 2021–2024; wind capacity 2020–2030; precision agriculture market size 2022–2030; global digital payments 2020–2024; global DNA sequencing 2021–2024; digital health data 2018–2025; and electric vehicle units 2020–2025. As of June 30, 2022

Companies seeking to maintain margins when sales growth is slowing will need to improve productivity. By automating processes or upgrading machinery, companies can streamline their operations to support profitability. Digital health data and electric vehicles are expected to proliferate at annual rates of 36% and 45%, respectively, in the coming years (Display 4). Thematic growth trends in areas such as combating climate change, improving healthcare and empowering weaker segments of society aren’t tethered to growth in the economy. Some of these trends may in fact be accelerated by the global increase in remote working, learning, shopping and healthcare that has taken root in the post-pandemic era.

In the healthcare sector, innovation is a powerful disruptive force. Robotics are changing surgical procedures. Treatments for Alzheimer’s disease and cardiovascular disorders will help combat the physical and economic costs of demographic change.

In every industry, quality companies need sound leadership to tackle new micro challenges for businesses created by the macroeconomic environment. When conditions deteriorate, experienced management can better steer companies through trickier business and market environments, and unpredictable circumstances created by geopolitical events.

Geopolitical Risk: Avoid the Unpredictable

From elections to war, it’s inherently challenging to assign reliable probabilities to geopolitical outcomes. Investors generally keep an eye on political trends, but we believe that a fundamental analysis of stocks and a focus that’s more on business drivers will lead to a more favorable return experience. The war in Ukraine and the scale of the West’s sanctions have reminded investors that low-probability, high-impact geopolitical events happen, with massive consequences for businesses and capital markets.

Portfolio managers may need to rethink how to apply risk premiums to major geopolitical events. In some cases, we might conclude that low-probability risks are too hard to assess and should simply be ignored by investors (which may be the right approach to truly cataclysmic events). In other cases, will potential outcomes previously thought to be low probability render some high-risk assets uninvestable, or at least subject to significantly higher risk premia?

Supply chains offer a good example of how active investors can address geopolitical risk as part of a fundamental approach. After decades of globalization, when companies scoured the planet for the cheapest locations to source components and produce goods, the race is now on to redesign supply chains. Company initiatives to rethink the logic of offshoring operations have been accelerated in recent years by geopolitical developments including the US-China trade war and pandemic-driven shutdowns, and this year by Russia’s invasion of Ukraine.

This throws up a whole new set of questions for investors. How do you identify the weak points in a chain that may include dozens, hundreds or even thousands of suppliers? Should investors demand a greater “offshore discount” to compensate for escalating supply chain risks? What can investors do to understand whether a company is moving in the right direction, given that reporting on supply chains is often short on detail? Questions like these are a starting point for understanding how current disruptions could affect near-term earnings forecasts and how companies are addressing the broader challenge of reimagining a supply chain for long-term resilience.

We believe three key aptitudes are required for an investing team to rise to the supply chain challenge. First, deep fundamental research is essential to understand whether a company can redesign its supply chain to withstand shifting macro- and microeconomic dynamics. Second, data science will play an increasing role in understanding the vulnerabilities of existing supply chains. And third, engagement with management is vital for gleaning insights that can’t be found in standard reports. By applying this disciplined approach, investors can find out whether a company has a high-quality supply chain that should be capable of withstanding geopolitical surprises.

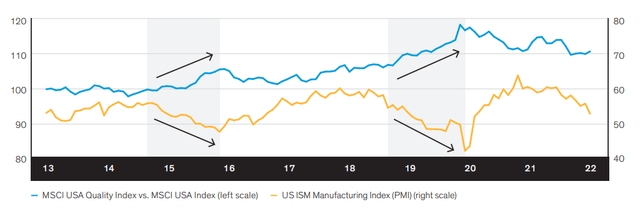

Risks such as the war in Ukraine or election outcomes are inherently unpredictable and may have surprising effects on markets. Trying to predict geopolitical outcomes isn’t a prudent investing strategy, in our view. However, we can focus on stocks that have more predictable earnings patterns than others, even in difficult times with limited visibility. Our research suggests that companies like these tend to outperform the market over time, and have better risk characteristics, lending stability to a portfolio. This has been especially true during periods of uncertainty and slower economic growth (Display 5).

Display 5: Quality Stocks Are Often More Durable In Economic Slowdowns (Source: Bloomberg, MSCI and AB)

Historical analysis and current forecasts do not guarantee future results. For blue line, January 31, 2013 = 100 Through June 30, 2022

Energy stocks are a case in point. It might seem tempting to pile into shares of oil and gas producers, the only sector that generated gains in the first half of 2022. But energy companies typically don’t have high-quality features, and their shares are driven primarily by oil and gas prices, which are extremely erratic because they are often determined by geopolitical events and decisions. The direction of energy prices—and stocks—can change dramatically overnight.

Persistence Creates Quality Portfolios

Following these guidelines can help equity investors identify business models and competitive advantages that can withstand heightened external pressures. Companies that are profitable today and can maintain that profitability are more likely to withstand the effects of rising interest rates, which tend to push down the share prices of stocks that have more cash flows coming in the distant future.

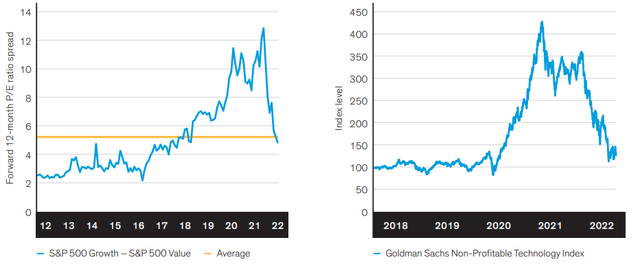

During the first half of 2022, valuations of growth stocks came down sharply (Display 6, left). And unprofitable technology companies were especially hard hit (Display 6, right). In our view, companies without proven profit-generating businesses are risky investments that generally shouldn’t be included in a higher-quality equity allocation. When volatility eventually subsides, we believe markets will refocus on fundamentals and give credit where it is due to companies that demonstrate the ability to deliver growth against the odds of a tougher economic environment. Investors who identify these companies may find an attractive entry point for quality growth stocks following the rerating of valuations in early 2022.

Display 6: Rerating Of Growth Valuations Opens Quality Opportunities (Source: Bloomberg, Goldman Sachs, S&P and AB)

Past performance does not guarantee future results. Forward 12-month P/E ratio is based on Bloomberg estimated P/E ratios. Through June 30, 2022

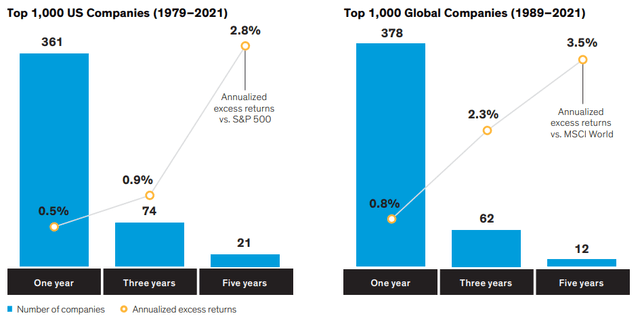

Companies Persisting with ≥10% YoY Earnings Growth

Display 7: Persistent Earnings Growth Is A Rewarding Approach (Source: Center for Research in Security Prices, FactSet, S&P Compustat and AB)

Historical analysis and current forecasts do not guarantee future results. Left: Universe consists of the top 1,000 companies by market cap each year from 1979 through 2021 with annual rebalancing. Right: Historical data for informational purposes only. Universe consists of the top 1,000 companies by market cap each year from 1989 through 2021 with annual rebalancing. As of December 31, 2021

Searching for companies with persistent earnings growth is a rewarding investment approach, in our view. Companies that are capable of growing earnings by at least 10% over a five-year period are extremely rare, but those that do typically deliver strong excess returns.

In fact, between 1979 and 2021, only 21 US companies were able to grow by 10% or more a year for five years straight on average (Display 7, left). These companies outperformed the S&P 500 by 2.8% a year. Global stocks exhibit similar trends (Display 7, right). By creating a high-conviction, concentrated portfolio with a small number of high-quality companies like these, we believe investors can enjoy the benefits of consistent earnings growth potential in their return streams.

In addition to focusing on persistence of earnings, investors can focus on measures of business profitability, such as return on assets (ROA). By putting profitability metrics at the center of company research, we believe investors can discover not only whether a company is growing, but also how it is growing—i.e., whether a company is investing intelligently to generate profits (Display 8).

ROA provides a strong measure of economic performance. By assessing if a company’s investment returns exceed its cost of capital, investors can determine whether its growth is sustainable or requires external financing. Ultimately, the efficient and effective use of capital, and profitability, impact stock prices, as companies with persistent profitability outperform by a wide margin over time.

The approaches described above are some of the most effective ways to capture quality stocks in growth-oriented portfolios, in our view. But there are other ways to apply a quality approach in equity portfolios, in line with different investing philosophies or allocation needs.

Net Operating Profit After Tax/Average Net Assets

Display 8: Return On Assets – A Good Signpost For Quality ROA (Source: AB)

For example, although value stocks are often considered lower quality assets, here too a quality approach can augment risk-adjusted return potential. By focusing on companies with solid free-cash-flow yields, more resilient balance sheets and fundamental business strength, we believe portfolios of attractively valued stocks can be created, with clear catalysts for a rerating and less risk than peers.

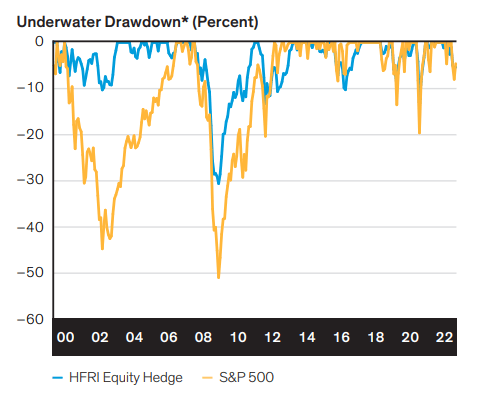

Display 9: Long/Short Strategies With A Quality Focus Can Help Reduce Risk (Source: Hedge Fund Research, S&P and AB)

Past performance does not guarantee future results. Historical information provided is for illustrative purposes only. An investor generally cannot invest in an index. *A drawdown is the peak-to-trough decline during a specific record period of an investment. A drawdown is usually quoted as the percentage between the peak and the trough. Through June 30, 2022

In investors’ portfolios, a long/short equity strategy with a quality bias can offer attractive defensive characteristics. Deploying long positions in higher-quality businesses alongside short positions in lower-quality stocks (reflecting a view that their shares will fall) can help create appealing return patterns. When implemented with a disciplined stock-picking process, we believe this type of strategy can help reduce losses in down markets (Display 9, page 10) while also capturing market upside.

What’s the Right Quality Portfolio for You?

Different quality equity portfolios have different risk and return characteristics. Choosing the right one depends on an investor’s individual risk and return appetite, investing beliefs and philosophy, and how a portfolio fits into the investor’s broader allocation (Display 10).

Investors who seek to align their capital with long-term secular growth trends, such as broadband communications innovation or advances in healthcare, may find quality-focused thematic and growth portfolios appealing. For those who prefer a concentrated portfolio, a quality growth approach of investing in companies with a low degree of business overlap can help underpin confidence that a relatively small number of holdings won’t be too vulnerable to the disappointing performance of an individual holding.

We believe investors who have suffered severe underperformance in their core positions, or from highly volatile asset classes and equity strategies, may want to consider upgrading their portfolios by shifting part of their allocation toward strategies anchored by a quality approach.

In a time of unprecedented uncertainty, we believe that quality is the key to investing in equities. A well-defined focus on quality companies can provide a cushion for downdrafts that does much more than just dampen the pain from a falling market. It can actually help investors feel more confident about staying invested through market volatility instead of locking in losses by selling in a downturn. Allocations of handpicked quality stocks based on methodically vetted businesses will provide a solid foundation for excess return potential through a period of macroeconomic and market challenges, and into a future recovery.

Display 10: Quality Equity Portfolios – A Strategic Road Map (Source: AB)

Past performance, historical and current analyses, and expectations do not guarantee future results. There can be no assurance that any investment will be achieved.

An investor cannot invest in an index. Index figures do not reflect the deduction of management fees and other expenses an investor would incur when investing in a fund or separately managed portfolio.

Note to All Readers: The information contained herein reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any projection, forecast or opinion in this material will be realized. Past performance does not guarantee future results. The views expressed herein may change at any time after the date of this publication. This document is for informational purposes only and does not constitute investment advice. AllianceBernstein L.P. does not provide tax, legal or accounting advice. It does not take an investor’s personal investment objectives or financial situation into account; investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by AllianceBernstein or its affiliates. References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AB. The specific securities identified and described in this presentation do not represent all the securities purchased, sold or recommended in our portfolios, and it should not be assumed that investments in the securities identified were or will be profitable.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

© 2022 AllianceBernstein L.P., 501 Commerce St., Nashville, TN 37203

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment