ArtemisDiana Crispr

Whenever you invest in any company, you’re looking for its market cap to rise. This can’t happen unless buyers are paying higher prices for the shares, making your investment more valuable. – Peter Lynch

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on September 17, 2022.

In biotech investing, it’s a thing of beauty to see your early-stage investment bear fruits. Back in 2017 when I went against conventional wisdom to recommend CRISPR Therapeutics (NASDAQ:CRSP) to investors, the stock was a relatively unknown company that traded at $19.55. During the time, its revolutionary gene-editing assets were in their earliest pre-clinical stage. Fast-forward today, Crispr has now rewarded investors (who bought in early) with 260.7% by trading at $70.53.

Now, don’t shoot the messenger. I’m not bragging. I simply want to show you that despite the significant gains, there are much further upsides due to the aggressive pipeline advancement. Moreover, I want to emphasize that investing in a biotech early on can yield alpha profits. And, it’s ok to be a biotech contrarian when the data is likely to prove positive. In this research, I’ll feature a fundamental analysis/update on Crispr and share with you my expectation of this stellar growth equity.

Figure 1: Crispr stock chart

About CRISPR Therapeutics

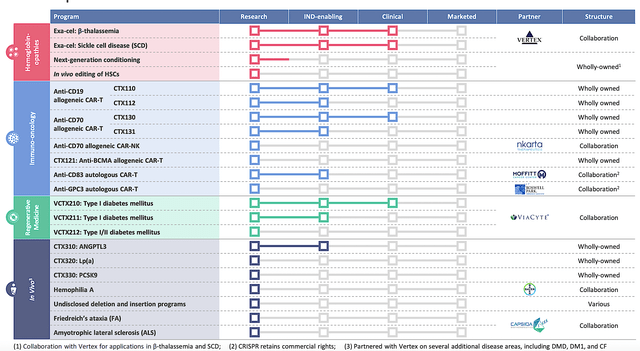

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. Operating out of Switzerland and Massachusetts, Crispr is focused on the development and commercialization of gene-based therapies to serve the unmet needs in serious conditions. Heralding a new era in gene-editing medicines, Crispr is innovating a deep portfolio of therapeutics servicing blood disorders, immuno/oncology conditions, and regenerative medicine. I noted in the prior research,

Instead of employing a hit/miss approach, Crispr zones in on disease targets based on specific criteria. They include unmet medical needs, technical feasibility, advantages of the editing platform (CRISPR/Cas9), and developmental time frame.

Figure 2: Therapeutic pipeline

Tracking Crispr Investment Thesis

Before taking a deep dive into this analysis, you should place your stock into the appropriate investment category. That way, you can better track its progress to know when to buy, sell, or hold.

Here, Crispr fits into the “growth biotech” category. The crucial technology of Crispr is its CRISPR/Cas9 gene-editing platform that has vast applications. So long as their portfolio — be it the I/O, gene-editing, and regenerative medicine franchises — continues to advance for molecules that uses CRISPR/Cas9, you know that your investing thesis (i.e., story) is working out. That is to say, you want most future development to be relating to gene-editing.

Previous Management Changes

Now, if you’ve been following my research on Crispr, you’d know that I was disappointed to see Dr. Tony Ho (i.e., the former Head of Research & Development) departed the company. Perhaps, he was forced by the Board of Directors to leave the company. Whatever the reasons remain unknown. What is known is that it’s typically a negative sign when a member of the senior management leaves.

Despite the said obstacle, Crispr has continued to advance its medicine. Interestingly, Crispr announced back in May that the company appointed Dr. Phuong Khanh (i.e., P.K.) Morrows as Chief Medical Officer to lead worldwide clinical and regulatory operations.

As a physician executive with decades of global leadership experience in drug development, I believe this is a positive sign for Crispr. You’d want to see more talent acquisition rather than disposition. After all, more powerful brains are better than less.

Gene Editing & Gene Therapy

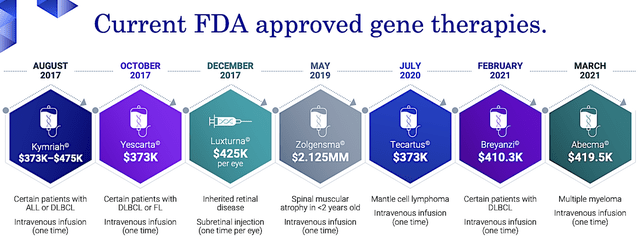

As you know, gene-editing and gene therapy have garnered huge interest in this decade due to various gene therapies being launched in recent years. As such, there was even a Hollywood movie featuring, “The Rock Johnson” battling animals that garnered special capabilities from gene-editing drugs.

Figure 3: Current FDA approved gene therapies

Regardless of the tremendous promises, the reality is that not all gene-editing and gene therapy would work. Whether it would work depends on the molecule itself. More importantly, the drug has to deliver a solution within the “disease context.”

An example where the disease context renders gene-based medicine ineffective is with Diabetes Mellitus Type 1 (i.e. T1D). After transferring the genes into beta cells of the pancreas, you’d still have to reconstruct the pancreatic duct for the cells to release insulin. Without the pancreatic ducts, it’s like you have a battery without the wire. There is nowhere for the electrical current (i.e., insulin) to flow.

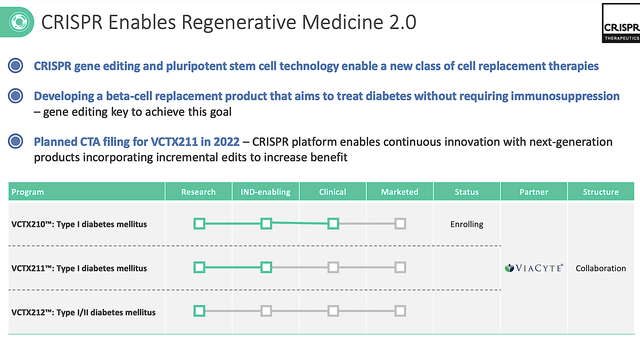

Regenerative Medicine

As you know, I doubt that gene-based medicine would work for diabetes. Nevertheless, you never know for sure because forecasting is a probability analysis. As such, let’s check into the latest development for Crispr’s regenerative medicine portfolio. Precisely speaking, Crispr is collaborating with its partner (Viacyte) to develop various molecules (i.e., VCTX210, VCTX211 and VCTX212) for diabetes.

Figure 4: Regenerative medicine portfolio

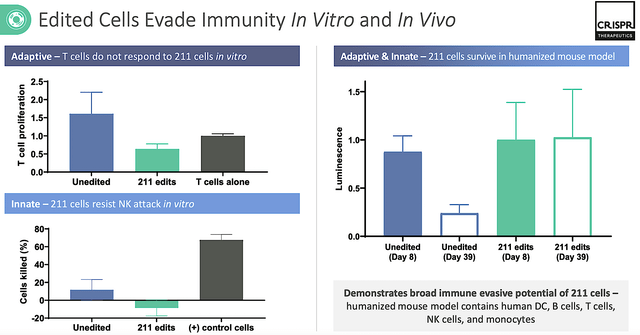

Early (i.e., pre-clinical data) showed that these edited-cells are able to escape immune detection. That is a crucial feature needed for such cells to exert efficacy. In T1D, beta cells of the pancreas are being destroyed by the patient’s immune (i.e., natural defense) system that had gone rogue. Without insulin, T1D exerts its devastating and life-threatening effects of hypoglycemia — a dangerously low blood sugar state that can lead to seizure and death.

Figure 5: Early data results

In contrast to T1D, my view strongly differs for gene-based drugs for Type 2 Diabetes (i.e., T2D). Specifically, T2D has not destroyed the pancreatic duct. Hence, you simply need to supply insulin and that would be provided by the edited cells. In other words, the pancreatic ducts have not been destroyed in T2D.

Leveraging my integrated system of forecasting, I predict with a 65% (i.e. more than favorable) chance that VCTX212 would generate positive data for T2D; whereas I ascribed only a 60% (i.e., slightly favorable) odds of VCTX210 & 211 to deliver positive results for T1D. I based my forecasting on decades of experience, my intuition, the molecule, the disease context, and early data results.

Blood Disorder Franchise

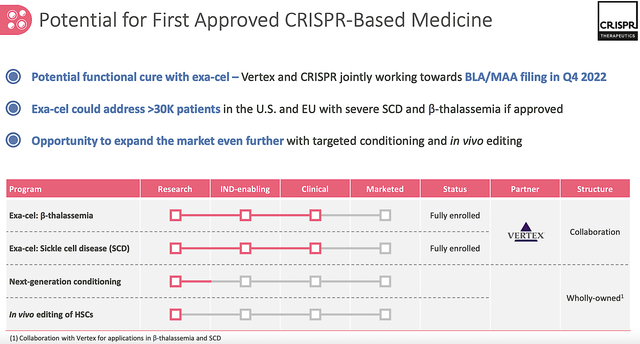

Shifting gears, you should assess one of the most promising CRISPR-based medicine franchises (i.e., exagamglogene autotemcel, exa-cel, or formerly known as CTX001). Notably, exa-cel was designed to functionally cure the blood disorders: transfusion-dependent beta-thalassemia (i.e., TDT) and sickle cell disease (i.e., SCD). Of this franchise, I prognosticated several years ago that the drug would generate positive results. I noted,

We prognosticate that the upcoming trial will post stellar results if the study focuses on patients with B+ thalassemia rather than B0 thalassemia. The rationale is that these patients are still producing HbA (and, the ramping up of their HbF should alleviate symptoms). This is a much easier hurdle to clear than trying to fix thalassemia major itself. Notwithstanding, we still expect promising results even if the company chooses to investigate CTX-001 in B0 thalassemia.

I based my rationale on exa-cel’s mechanism of action and the disease context. Simply put, both TDT and SCD are due to mutation in genes that are responsible for making a blood protein (i.e., a hemoglobin). Therefore, replacing the gene certainly works here.

As it turned out, exa-cel continues to deliver strongly positive early and advanced data. As of this writing, exa-cel is already in various Phase 3 clinical investigations, including the CLIMB-111, CLIMB-121, CLIMB-131, and CLIMB-141 studies. Notably, the latter two studies are geared for kids.

Interestingly, Crispr presented robust data at the European Hematology Association (EHA) for this franchise back in June. As such, I believe that Crispr and its partner Vertex Pharmaceuticals (VRTX) will file a BLA/MAA in Europe Q4 this year. Meanwhile, regulatory filing discussion with the FDA is ongoing.

Figure 6: SCT and TDT development

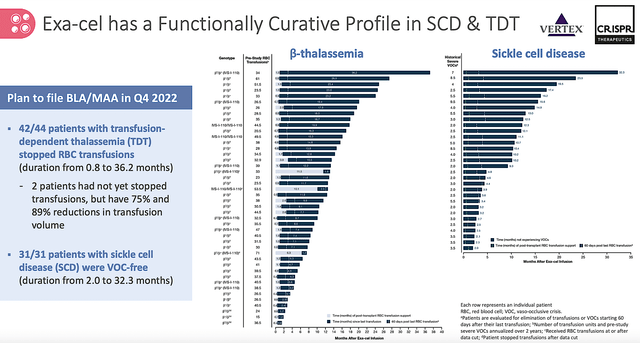

Given that the data for exa-cel is crucial to regulatory approval, you should take a closer look at its latest results. As shown below, the data comes from 75 patients (44 with TDT and 31 afflicted by SCD) who enrolled in the CLIMB-111 and CLIMB-121 trials. The results entail the follow-up period ranging from 1.2 months to 37.2 months after exa-cel treatment.

It is remarkable that all 31 patients having severe SCD — as characterized by vaso-occlusive crisis or VOCs — were free of the VOCs pretty much throughout the follow up duration. Now, the overwhelming majority of patients with TDT (i.e., 42 out of 44) were transfusion-free for the similar time frame. Simply put, exa-cel delivers the “functional” cure for these patients while posting a good safety profile.

Figure 7: Functional cure for SCD & TDT

Of note, I caution investors that the efficacy will wear off over time and more injection would be needed. My rationale is that those gene-transferred cells would die off over time. Commenting recent developments, the CEO (Dr. Samarth Kulkarni) remarked,

Strong progress continues across our broad portfolio of gene edited therapies and we remain on track to achieve important 2022 milestones. We and our partner Vertex presented new clinical data at EHA highlighting the potentially transformative profile of exa-cel in patients with TDT or SCD … In addition, we and our partner ViaCyte continue to enroll and dose patients in the Phase 1 clinical trial of VCTX210 for T1D. We remain well positioned and well capitalized to bring transformative medicines for patients suffering from serious diseases.

Immuno-Oncology

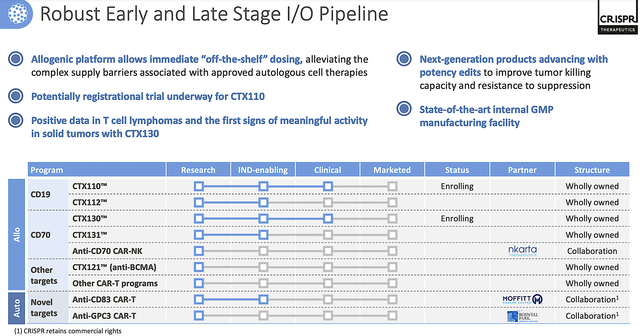

Perhaps, the I/O programs are most valuable in this pipeline. Viewing the figure below you can see a vast number of CAR-T (hitting various targets) are in development. Of those programs, I believe that CTX110 has a lower hurdle to success than CTX130. Nevertheless, CTX130 is being designed to treat solid tumors.

Figure 8: I/O molecules

As you can see, all currently approved CAR-Ts are geared for blood cancers. By expanding to cover solid tumors, Crispr could capture the huge $424.6B market that is growing at the 15% CAGR. Of course, that is provided the data would turn out to be robust.

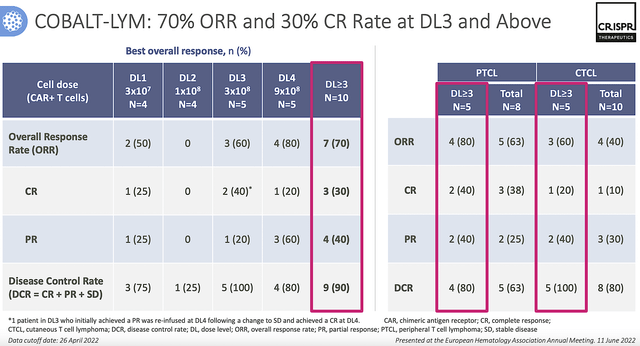

From the figure below, CTX130 generated positive responses with 70% overall all response rate (i.e., ORR) and 30% complete response rate (i.e., CR) in the Phase 1 (COBALT-LYM) trial. Those are remarkable responses for cancers.

Figure 9: COBALT-LYM results

Competitor Analysis

About competition, Crispr goes toe-to-toe with many other gene-based therapeutic innovators. They include Juno Therapeutics (JUNO), Kite Pharma (KITE), Sangamo Therapeutics (SGMO), Novartis (NVS), just to name a few. As to the SCD franchise, you can bet that the biggest competitor for Crispr is Global Blood Therapeutics (GBT) with its oxygen-binding affinity modular (i.e., Oxbryta).

Oxbryta demonstrated such robust efficacy and safety for SCD that the stock was recently acquired by Pfizer (PFE) for $5.4B. Despite the keen competition from Oxbryta, Crispr’s gene-edited drug has a different mechanism of action (i.e., MOA). As such, there is always a strong demand for drugs having different MOA.

As a side note, all three (Juno, Kite, and GBT) that I covered are acquired. Perhaps, one of the ways that big pharma takes out competition is via an acquisition. Now, I don’t mean big pharma is evil or anything like that. I simply alluded to the fact that merger/acquisition is a mean where competing firms could join forces. That way, they can better assist patients on a much larger scale. Could it happens to Crispr? That remains to be seen. You let me know your thoughts.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should analyze the 2Q 2022 earnings report for the period ending on June 30.

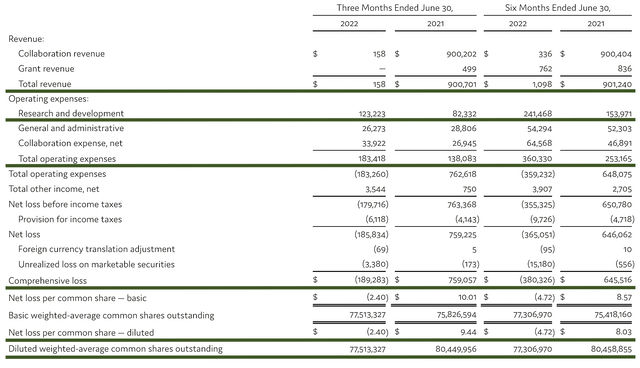

As follows, Crispr procured $158K in collaboration revenue compared to $900.7M for the same period a year prior. Notably, the $900M last year came from the collaborative agreement with Vertex Pharmaceuticals.

That aside, the research and development (R&D) registered at $123.2M compared to $83.3M for the same period a year prior. I viewed the 47.8% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $189.2M ($2.40 per share) net losses compared to a net income of $759.0M (+$9.44 per share) for the same comparison. As you know, the net income is due to the non-recurring collaborative payment from Vertex.

Figure 10: Key financial metrics

About the balance sheet, there were $2B in cash, equivalents, and investments. Against the $183.4M quarterly OpEx, there should be adequate capital to fund operations into 1Q2025 prior to the need for additional financing. Simply put, the cash position is quite robust relative to the burn rate.

While on the balance sheet, you should check to see if Crispr is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding decreased from 80.4M to 77.5M, there is no dilution. At this pace, Crispr clearly passed my 30% dilution cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Crispr to determine how much your shares are truly worth. Before running our figure, I would like to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 77.5M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Exa-cel for TDT and SCD |

$1B (Estimated from the

$8.2B SCD + $3.5B thalassemia market) |

$500M | $64.51 |

$48.38 (25% discount because the drug already passed its Phase 3 trial) |

|

I/O franchise |

$3B (Estimated from the $424.6B solid tumor market that is growing at the 15% CAGR plus the $61.2B blood cancer market) |

$1.5B | $193.53 |

$77.41 (60% discount because drugs are in their early phase of clinical investigations) |

|

Regenerative medicine franchise |

$2B (Estimated from the $61.6B diabetes market growing at the 8.4% CAGR) |

$1B | $129.02 |

$51.60 (60% discount because drugs are in their early phase of clinical investigations) |

|

In Vivo programs |

N/A (Too early to assess) |

|||

|

The Sum of The Parts |

$177.39 |

Figure 11: Valuation analysis (Source: Dr. TranBioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. Now the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for CRISPR is whether it can gain approval for exa-cel.

Moreover, the other risk is if other franchises would continue to post positive data results. As an aggressive young grower, Crispr may run into the potential cash flow constraint. Nevertheless, Crispr has an extremely strong balance sheet relative to the burn rate.

Conclusion

In all, I maintain my strong buy recommendation on Crispr Therapeutics with the 4.8/5 stars rating. Crispr Therapeutics is a special growth company that has a pipeline of tremendous depth. Riding its stellar gene-editing platform (CRISPR/Cas9), the company has fundamentally advanced by leaps and bounds since its early days in the market.

Data for the blood disorders franchises (TDT and SCD) proved strongly positive and thereby positioned exa-cel to gain regulatory approval in Europe (and then in the USA). In addition, regenerative medicine and the I/O programs are breaking new grounds. Though not perfect, you can expect excellent results from those programs (except for Type 1 Diabetes) for the reason that I mentioned above.

Be the first to comment