Alena Kravchenko

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) will report third-quarter earnings on Tuesday, and expectations are low.

Having said that, I believe Google will retest its support level of $95-96, and the stock may even become oversold next week if Alphabet reports slowing growth in its advertising business.

While expectations are low, Google’s advertising business is likely to have suffered in 3Q-22 as a result of ongoing advertiser pullback, which could lead to a post-earnings selloff.

I’ll be ready to buy a potential 3Q-22 earnings drop and believe that any slowdown in advertising sales growth will be only temporary.

Long-Term Advertising Growth, But There Are Headwinds For The Stock Next Week

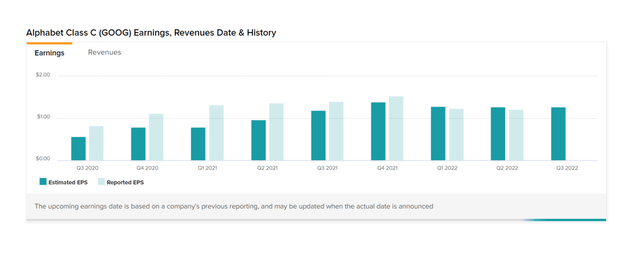

According to Tipranks, the market expects earnings of $1.27 per share in 3Q-22, which is the same level of earnings expected in 2Q-22.

Google fell short of Wall Street’s expectations in the fourth quarter due to slowing advertising spending. Google also missed expectations in the previous quarter, indicating that the market was slightly overly optimistic about Google’s earnings potential in 2022.

The issue with Google’s third-quarter earnings is that advertisers have likely reduced their spending on Google’s various advertising platforms, as evidenced by Snap Inc. (SNAP).

Snap was the first social-media company to report 3Q-22 earnings last week, and its results are usually regarded as a foreshadowing of how other companies in the online advertising industry’s earnings might look.

Snap did report a 19% YoY increase in daily active users to 363 million in the third quarter, indicating that the social-media company is still growing its user base.

Having said that, Snap’s sales only increased 6% YoY to $1.13 billion, the slowest rate of growth in the company’s history. Snap’s sales growth has slowed as advertisers cut back on spending, owing in part to inflation, which is weighing on the entire advertising market. The result has been a significant increase in operating losses, which, combined with other bad news reported by Snap, resulted in a 28% drop in Snap’s stock price on Friday.

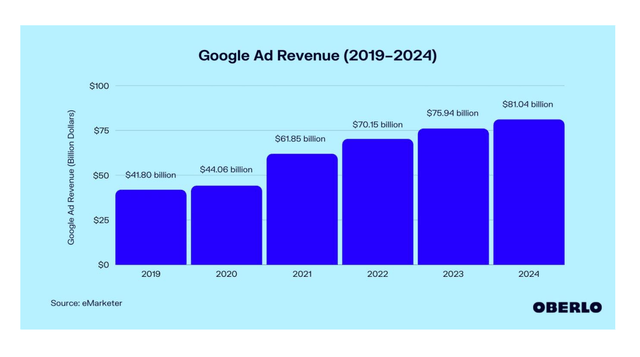

Google’s advertising sales, which include search ads, ads on the video-blogging platform YouTube, and ads on the Google network, increased only 12% YoY to $56.3 billion in 2Q-22.

Even though the forecast (from Oberlo) suggests that Google’s advertising sales will remain stable, I believe the third quarter will see a YoY slowdown to the single digits.

Google Stock May Be Set To Test Key Levels After 3Q-22 Earnings

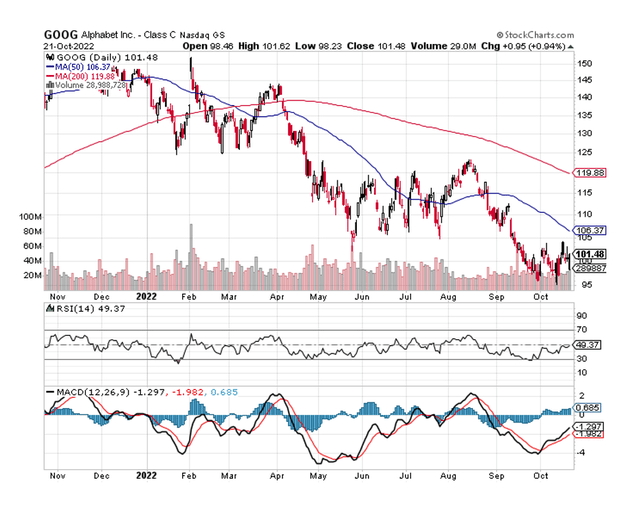

GOOG broke through the 50-day moving average in August, and the stock has yet to reclaim it. Dropping below the 50-day moving average is typically regarded as a bearish signal, as is Google stock dropping to a new 52-week low in October.

With Snap demonstrating that advertising remained soft in 3Q-22, I believe Google stock will fall after third-quarter earnings, testing support at $95-96 and dropping to new 52-week lows. If this occurs, I will be ready to profit from any unjustified and unreasonable selloff.

GOOG Share Price (Stockcharts)

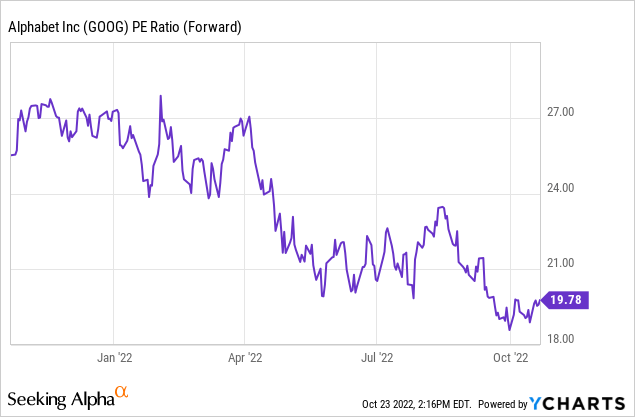

Google’s Valuation Has Been Hammered

Google stock has dropped 30% year to date. In terms of valuation, I believe Google has already established a compelling investment case for itself. Google’s stock currently trades at 17.4x forward earnings (based on $5.84 in earnings per share in 2023).

Why Google May See A Lower/Higher Valuation

In the short term, I believe Google’s prospects are primarily dependent on the search market, and Snap already showed investors the way last week when the stock dropped by up to 30% due to slowing advertising sales growth.

Google is the most popular search engine on the internet, and the company has a strong position in search, but an advertiser pullback can still hurt Google.

Google’s stock price may rise or fall depending on the performance of the company’s key search business, which continues to generate the most revenue.

For the time being, investors should expect Google’s advertising sales to grow in the single digits. If this is followed by a significant double-miss in earnings and sales, Google may indeed set new lows.

My Conclusion

If the slowdown in advertising sales growth is more severe than expected, investors should brace themselves for a sharp drop in the stock price of GOOG after the company reports earnings next Tuesday.

I think the online search company is likely to see a significant QoQ slowdown in sales growth in the critical search business, which will irritate investors. I am willing to double down on Google if the stock falls, as I believe the company is well-positioned to weather a temporary market downturn.

Based on earnings, the stock is already quite cheap, and any further drop, accompanied by a more negative chart setup, should be regarded as a strong buy opportunity.

Be the first to comment