AlpamayoPhoto

It is time to begin taking advantage of a bear market selloff by investing in stocks and exchange-traded funds (“ETFs”) like Schwab U.S. Large-Cap ETF (NYSEARCA:SCHX) that can make a faster recovery and perform well in both bear and bullish market conditions. In particular, investors who are bullish on the U.S. stock market’s long-term dynamics should consider buying SCHX given its broader coverage of the U.S. equity market. Since markets appear to have already factored in rate hikes and economic uncertainty, the downside risk has declined significantly for an intense selloff in the short term. In December, the Fed is likely to ease its rate hike spree, which could boost investors’ sentiment and support dip-buying.

The Downside Risk is Limited

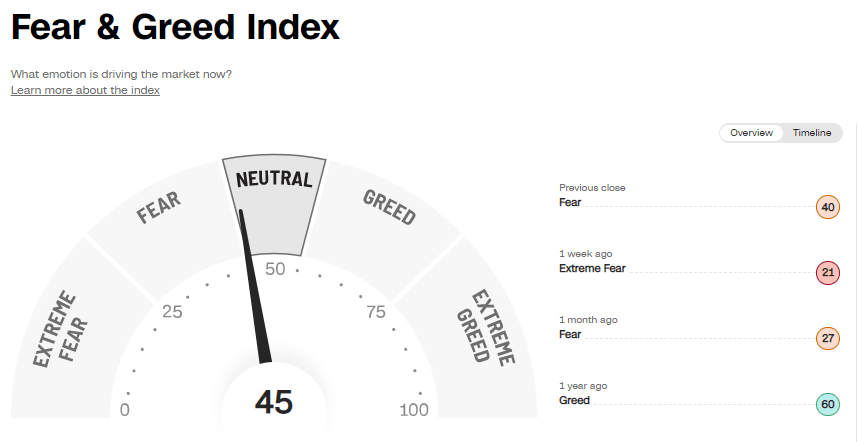

Fear & Greed Index (CNN.com)

Schwab U.S. Large-Cap ETF is still in the bear market territory after hitting new lows in the second week of October. In spite of this, market sentiment improved significantly last week, as shown in the fear and greed index, due to hopes that the Fed pivot is on the horizon. The Fed Whisperer Nick Timiraos of Wall Street Journal helped optimize investor sentiment by signaling that the Fed has raised the first white flag since it announced a war against inflation in early 2022. It is evident from discussions among Fed governors that rates have already been raised significantly and that more triple-digit increases could cause the economy to enter a deep recession. In the wake of the news, the odds for a 75 basis point increase in the December meeting plunged from 75% to 45%. I also believe the Fed’s rate hike policy, a key driver of the current bear market trend, is likely to ease in the months ahead. This is because November’s rate hike of 75 basis points will send Fed rates to 4%, the highest level since 2007. In addition, the Fed’s terminal rate of 4.60% in 2023 provides little room for rapid rate hikes after November.

To avoid a hard landing, the aggressive tightening policy needs to be slowed down. In the first half of 2022, U.S. GDP contracted more than expected, and data suggests fundamentals slowed further in the third quarter. For the third quarter, GDP is forecasted to grow by 2.9% mainly due to a decline in imports. A decrease in imports means worsening economic conditions and declining demand from households, governments, and businesses. If the high-rate policy is continued, there will be a deflationary outcome.

Cathie Wood’s concerns about Fed policy are worth considering. In an open letter to the Fed, she said energy and agricultural prices are rising because of the Russian invasion, and the Fed cannot fight the problem by raising rates. She also pointed out that the rest of the commodities prices have fallen significantly from their peaks while ballooning inventories could lead to negative inflation rates.

Why Ride the Potential Recovery With SCHX?

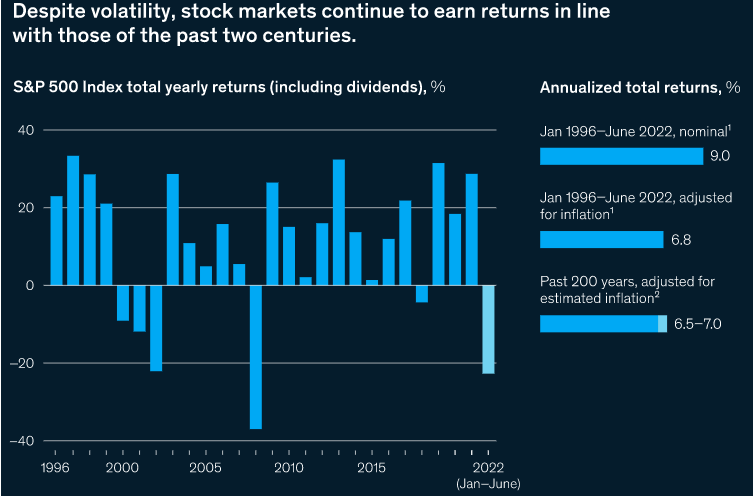

S&P 500 Performance (mckinsey.com)

Before moving on to SCHX, it is crucial to understand the U.S. stock market has a long growth history, and bear markets are a small part of that journey. There have been 14 bear markets between 1947 and April 2022, ranging from one month to 1.7 years. After every bear market, however, U.S. stocks reached new all-time highs, and bull trends lasted for years. For instance, U.S. stocks plunged 46% from 2007 to 2009, but they recovered all their losses by March 2013, and the bull market lasted another seven years before coronavirus-related volatility in the first half of 2020. Moreover, the U.S. stock market hit several new all-time highs in the following 18 months due to the zero interest rate policy and high economic growth.

In the case of SCHX, the ETF has generated total returns of over 330% since 2009, including losses in the two bear markets of 2020 and 2022. SCHX’s portfolio encompasses the 758 largest U.S. companies, which gives it broader coverage of the U.S. equity market than the S&P 500 index. The broader U.S. stock market coverage increases SCHX’s beta slightly over the S&P 500, a key element that makes it a great candidate to ride the recovery and generate healthy gains over the long term. While a high beta can increase volatility in a bear market, it can also help ETFs rebound faster during a recovery phase and achieve significant gains in bullish market conditions.

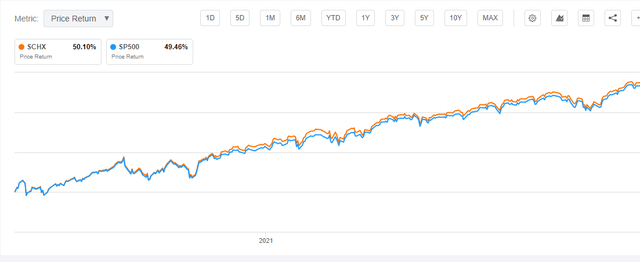

SCHX Price Return in 2021 (Seeking Alpha)

The chart above also shows that SCHX has outperformed the S&P 500 during the bull market of 2020-2021. Its exposure to a large number of companies with a market cap below $10 billion slightly increases its beta more than the S&P 500 and offers a potential to generate solid upside momentum in bull markets.

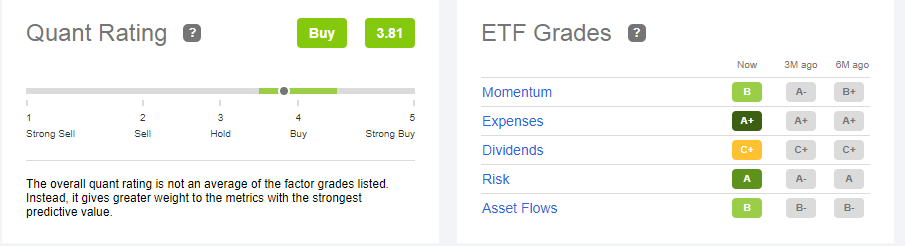

Quant Ratings

Quant Ratings (Seeking Alpha)

Using quantitative analysis to predict future performance is prudent because it relies on real data and eliminates emotions. Based on Seeking Alpha’s quantitative analysis, SCHX gained a buy rating with a quant score of 3.81. SCHX is rated based on five key factors: momentum, expenses, risk, dividends, and asset flows. When it comes to long-term investing, expenses matter, and SCHX’s expense ratio of 0.03% is significantly lower than the median expense ratio of 0.45%. Even though it received a low grade on the dividend factor, its dividend yield of 1.6% and history of mid-single-digit growth still appear promising. Moreover, a B grade on momentum and asset flows indicates improving confidence while an A grade on the risk factor suggests low downside risk.

In Conclusion

Despite a 75 basis point rate hike in November, I expect a limited downside from here given the probability of a shift in Fed policy in December. Since markets are likely to recover over the next month, the dip in SCHX price has provided an opportunity to take a long-term position in the broader U.S. equity market. Long-term investors could also benefit from its low expense ratio, higher diversification, and potential to outperform the S&P 500 during bull markets.

Be the first to comment