Marina113

Ford (NYSE:F) is facing growing risks to its earnings and free cash flow guidance for FY 2022. The car brand warned that higher supplier costs are posing a challenge for the company in the third-quarter and that some revenue and EBIT will move into the fourth-quarter because of it. Although Ford confirmed its previous outlook for FY 2022 — adjusted EBIT of $11.5B to $12.5B — supply shortages, inflation and a growing inventory raise the risks for Ford and its near-term outlook. Given the current setup of Ford and the very real risk of a weaker full-year guidance in the fourth-quarter, Ford’s shares may experience some weakness going forward!

Cost headwinds are posing a challenge to Ford’s FY 2022 guidance

Ford warned that the car brand is seeing higher costs related to the supply of certain car parts which the company didn’t specify. In a release on its website on Monday, Ford said that it expected to pay $1.0B more than budgeted for supplies as inflation is driving up costs and creating shortages that are affecting the company’s vehicle production in the third-quarter. Ford also said that its inventory will rise by 40-45 thousand units — mostly trucks and sport utility vehicles — in Q3’22 due to shortages that are holding Ford back from completing the production process. Sales associated with those units are expected to be pushed into the fourth-quarter, however, meaning Ford is not going to miss out on revenues.

However, on the positive side, Ford confirmed its earnings outlook for FY 2022 which at least provides a bit of relief for now. Ford has confirmed its adjusted earnings (before interest and taxes) target of $11.5B to $12.5B for the current fiscal year with Q3’22 EBIT expected to be between $1.4B and $1.7B. Ford’s current (and confirmed) adjusted EBIT guidance for FY 2022 implies 11.5-12.5% year over year growth in earnings, but risks are clearly growing if Ford fails to contain its cost pressures. Right now, I believe the car brand can achieve its EBIT guidance… as long as the supply/inventory situation doesn’t get worse and supply shortages don’t hamstring Ford’s production. Regarding free cash flow, Ford has not made an update to its FY 2022 guidance, so I would believe the car brand continues to stick to its expectation of $5.5B to $6.5B.

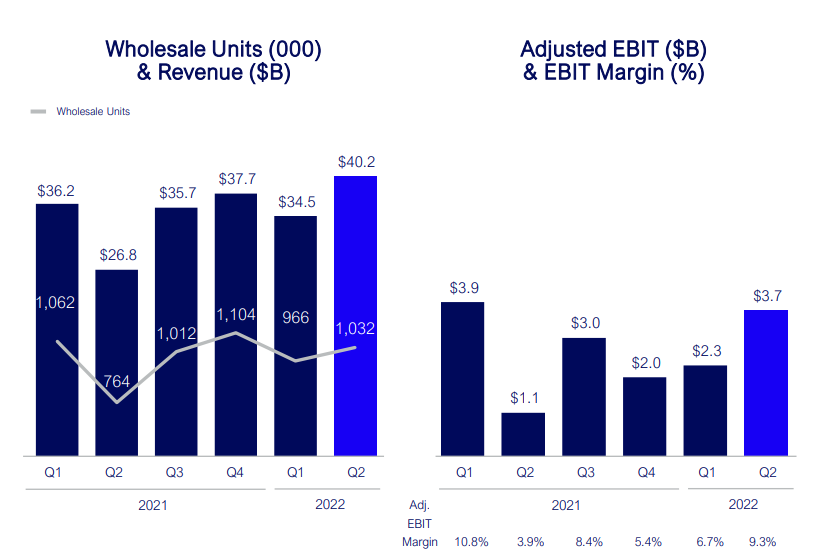

Ford’s adjusted EBIT in the first six months of FY 2022 was $6.0B with especially strong performance taking place in Q2’22: Ford generated $3.7B in adjusted EBIT in the second-quarter, showing 236% year over year growth. The strong increase in earnings was due to a variety of factors including an easing supply shortage of vital car components (an issue that just recently resurfaced for Ford), higher wholesale volumes due to the ramp of new models — such as the Bronco and Maverick — and higher net pricing.

Ford: Q2’22 Adjusted EBITDA

Estimates may come under pressure

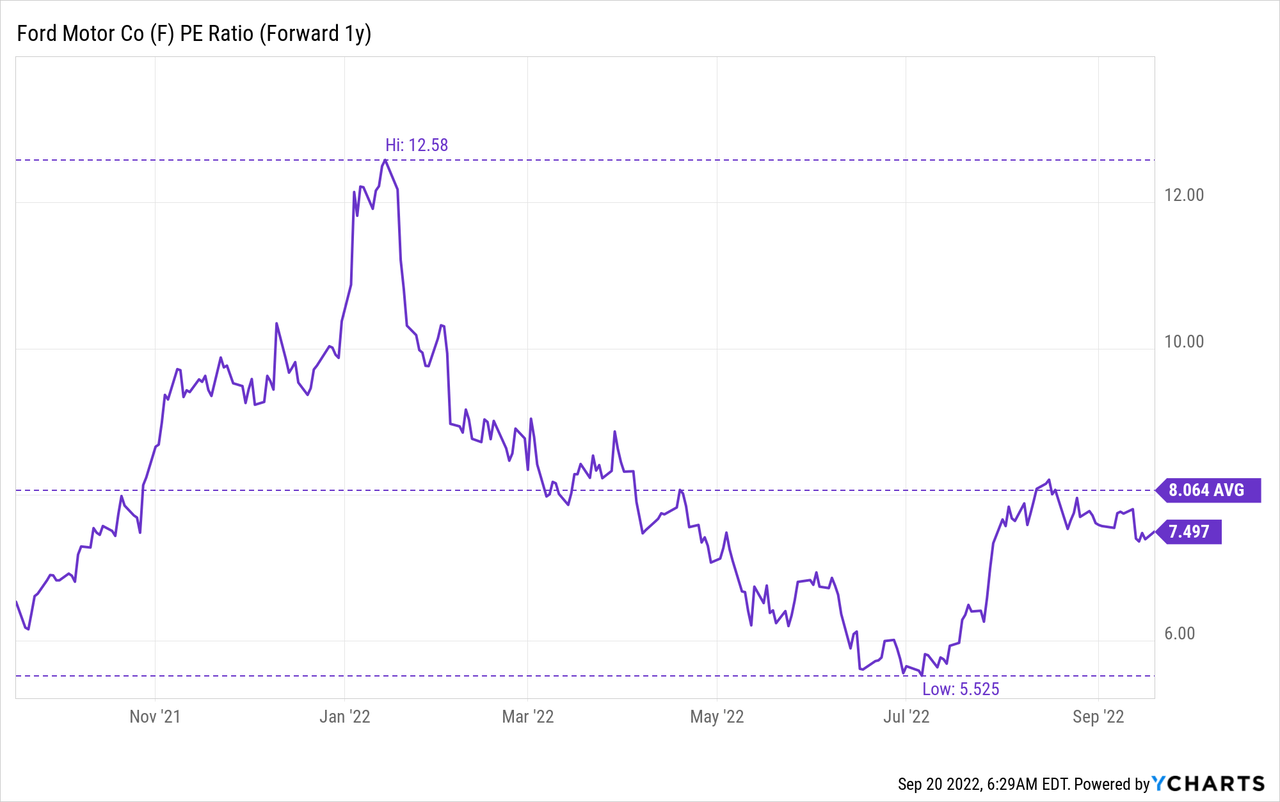

Ford is cheap. The stock is trading at a P-E ratio of 7.5 X which is less than the 1-year average P-E ratio of 8.1 X.

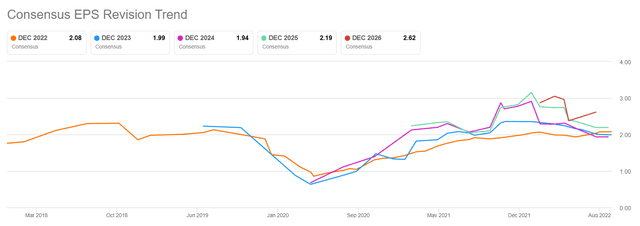

Ford’s cost warning could result in the submission of more cautious earnings predictions for the car brand going forward, but the EPS trend so far is inconclusive. There were four (full-year) EPS up-ward revisions in the last 90 days and two down-ward revisions, suggesting that most analysts expect Ford to meet its earnings target.

Seeking Alpha: Ford’s Full-Year EPS Estimates

Risks for Ford

The supply chain is obviously Ford’s biggest commercial risk factor, because if Ford has problems sourcing parts for its vehicles, then those issues are going to have a financial impact as well. Higher inventories, fewer sales and potentially a down-grade of the FY 2022 guidance may be the consequence for Ford and its shareholders if the supply situation doesn’t improve. Worst of all, Ford may be forced to raise prices on its products which may negatively impact the firm’s demand and revenue outlook in the near term. In the case that Ford has to diminish its own earnings and free cash flow guidance for FY 2022, Ford’s shares are up for a revaluation and may go into a new down-leg.

Final thoughts

Ford’s release about higher supplier costs represents a new headache for the car brand. The release, therefore, should be read and understood as what it is: a warning. With inflation/materials costs going up and production seeing delays, Ford may ultimately have to downgrade its FY 2022 EBIT and free cash flow guidance. Although Ford believes that it can absorb higher supplier costs right now, margin pressure in Ford’s operations is increasing. If Ford is forced to increase its pricing, customers may be more hesitant to place reservations which would affect the near-term revenue and earnings outlook negatively as well!

Be the first to comment