yuelan

Trade Thesis

The trade thesis for this pairs trade is to take advantage of rising interest rates while simultaneously hedging out macro risk factors. This can be achieved by buying banks whose earnings will benefit from higher rates while shorting banks whose earnings will suffer during a deep recession.

In my opinion, Ally (NYSE:ALLY) is a bank that is already going for a cheap valuation, has organic earnings growth, and has a positive macro tailwind due to rising rates and widening credit spreads.

On the other hand, Credit Suisse (NYSE:CS) is an investment bank that has been unprofitable for half of the last ten years and with a worsening macro environment, the management will have to turn the company around with a larger focus on wealth management and less on M&A.

The timeframe for this trade is 12-18 months; the reason for the 12-18 month timeframe is that as rates continue to go higher, we’ll see a major divergence within the financial sector between stronger banks who can profit from the rate hikes and banks with large losses from higher default rates on loans issued.

The Double-Edge Sword of Interest Rates Hikes For Financials

Hikes in interest rates are a double edge sword for financials in this current environment.

On one hand, interest rate hikes are great for banks because they loan at significantly higher rates while still paying lower rates on their deposits; the spread between the two expands exponentially during a rate hiking cycle. Because of this, banks that trade cheaply on a P/E basis are a great buy in this environment.

On the other hand though, when interest rates go up the chance of a recession goes up significantly, especially in a high-leverage economy. This means that the chance of default on the loans that banks make goes up significantly. Along with this, in a rising rate environment, the loans already made go down in value, so the book value of the bank is consistently going down.

This is where a pairs trade comes in. We can short unprofitable, high-risk banks while simultaneously getting long high-quality banks with high ROAs and low P/E ratios. This kind of trade has a positive carry and a mean reversion aspect.

How Much Banks Are Paying On Deposits Relative To How Much They’re Lending For

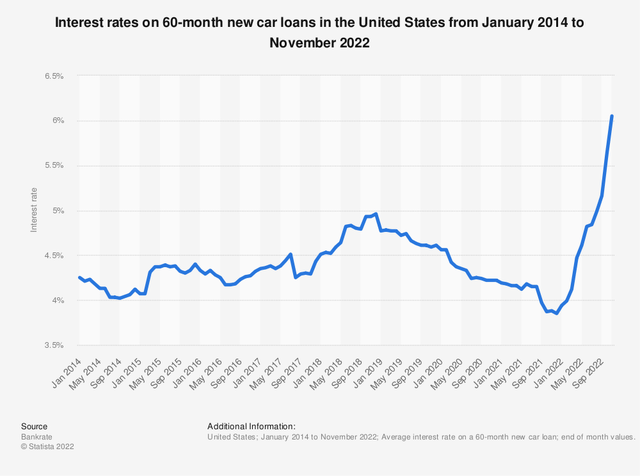

One of the main reasons I’m bullish on high-quality banks is because the spread between how much they’re paying on deposits and how much they’re lending for is widening significantly. Below is a chart of auto loans rates:

Interest rates on 60-month new car loans in the United States (Statista)

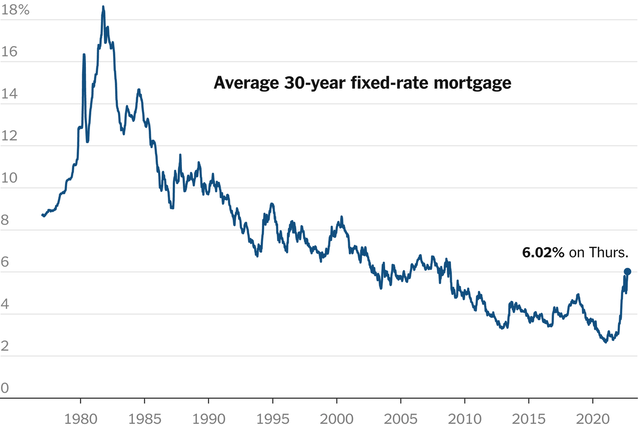

Below is a chart of average 30-year fixed-rate mortgages:

Average 30-year fixed rate mortgage (New York Times)

Just a year ago rates on auto loans were about 4% and mortgages at 3%. This was all while banks were paying zero in deposits. So the spread they made was 4% and 3% respectively. Since then, the spread has expanded.

To get a good view of how much the spread has expanded we need to look at the current rates that banks are paying depositors:

| Product | Credit Unions (National Average Rate) | Banks (National Average Rate) |

|---|---|---|

| 5 Year CD-10K | 1.61 | 1.12 |

| 4 Year CD-10K | 1.46 | 1.00 |

| 3 Year CD-10K | 1.32 | 0.95 |

| 2 Year CD-10K | 1.16 | 0.87 |

| 1 Year CD-10K | 0.91 | 0.71 |

| 6 Month CD-10K | 0.62 | 0.46 |

| 3 Month CD-10K | 0.40 | 0.31 |

| Money market account-2.5K | 0.24 | 0.18 |

| Interest checking account-2.5K | 0.08 | 0.10 |

| Regular savings account-2.5K | 0.11 | 0.15 |

| Credit card, Classic | 11.64 | 13.05 |

| 30 Year fixed-rate mortgage | 6.07 | 5.99 |

| 15 Year fixed-rate mortgage | 5.37 | 5.35 |

| 5/1 Year adjustable rate mortgage | 4.85 | 5.05 |

| 3/1 Year adjustable rate mortgage | 4.83 | 4.92 |

| 1 Year adjustable rate mortgage | 4.18 | 4.84 |

| Unsecured fixed rate loan, 36 months | 9.15 | 10.16 |

| Home equity loan, 5 year, 80% | 5.04 | 5.42 |

| Home equity loan, LOC, 80% | 5.43 | 5.56 |

| Used car loan, 48 months | 3.77 | 5.49 |

| Used car loan, 36 months | 3.64 | 5.44 |

| New car loan, 60 months | 3.72 | 5.15 |

| New car loan, 48 months | 3.60 | 5.07 |

Source: National Credit Union Administration

This data is from the U.S. National Credit Union Administration; they compile together data on all the above products to come out with averages for both credit unions and banks on a quarterly basis. This report is from September 2022. An updated report will come out in a month for December 2022.

Now with both mortgage rates and auto loan rates above 6% and the average bank still paying close to zero on deposits, the previous credit spread that the banks made has doubled. Banks will still continue to pay very little on deposits since they have record amounts in reserves, which is why rates on deposits aren’t up. As loan rates continue to go higher the spread will widen; this is primarily why I’m bullish on banks.

Which Banks To Buy and Which To Avoid

It’s important to know which banks to buy and which to avoid.

Below are the requirements I’m looking at:

1. Trading at a Discount To Book Value

2. Trading at a Low P/E Ratio

3. Consistently Returning Capital To Shareholders via Stockbuys and Dividends

4. Aggressive Growth

The reason I’m looking at banks that are trading at a discount to book is that as rates go higher the loans on their balance sheet go down in value, hence the book value goes down, so to create a “margin of safety” only banks trading at a discount to book should be considered. This is also important since P/B ratios are one of the top ways that banks are valued.

Both points 2 and 3 work well together. If a bank is trading for a low P/E and consistently buying back stock, they compound at a high enough rate to offset the reduction in book value. For example, the book value per share for a hypothetical stock is $100, and the stock is trading for $80, with an EPS of $25. Over the next year, rates go up, so the book value goes down 30% to $70, but over that year the EPS of $25 is added onto the book value, so the book value is actually $95, which is only 5% lower than it was a year prior even with a 30% mark to market drawdown in book value. So by trading at a low P/E ratio while consistently buying back stock the loss in book value can be offset. On top of that, the EPS will grow as stock is bought back but also because rates go up over that period of time. This is why a combination of buying below book, at a low P/E ratio, and consistently returning capital to shareholders via a stock buyback works well in this rising rate environment.

The fourth requirement is aggressive growth. If a bank isn’t growing its lending, then the only assets in its portfolio are loans made years ago at lower rates which are going down in value due to rising rates. On the other hand, if a bank is rapidly growing by making more loans now at higher rates than they were at lower rates it means that the average interest rate in their loan portfolio is going higher so it isn’t as impacted by the rise in rates.

Ally Is A Bank That Meets All The Requirements

Ally is trading at a trailing P/E of 4 and at a P/B of 0.7; this meets the requirements of buying below the book value and with a low P/E.

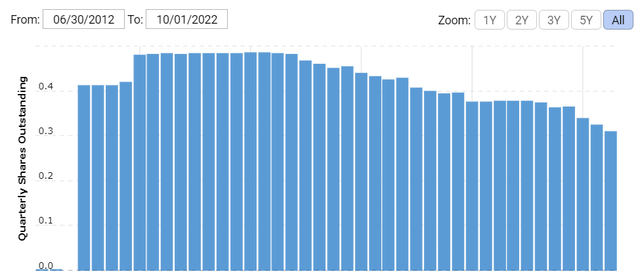

It also meets the requirements for returning capital to shareholders. Below is a chart of outstanding shares:

Ally Outstanding Stock

Over the last 6 years, Ally has bought back 25% of its outstanding shares. With earnings expected to grow and a now lower stock price, I expect there to be even more aggressive stock buybacks than those in the past.

Ally also checks the last requirement which is aggressive growth.

Below is the revenue per share:

| 2018 | 2019 | 2020 | 2021 |

| $13.91 | $16.22 | $16.51 | $23.91 |

The revenue has consistently grown over the last few years, with average growth being 20% per year. Moreover, the TTM revenue for 2022 is higher than in 2021. This growth is due to their expansion into auto loans which now makes up over 80% of their revenue. They are looking to continue this growth which will allow for higher revenue and wider margins due to higher rates.

Another way to know if a bank is aggressively growing or not is to look at the interest rate being paid on deposits. Higher interest rates on deposits show that the bank is encouraging depositors to deposit more capital into their savings accounts; the only reason for a bank to encourage more depositors to put in more capital is if they believe that they can use that capital to make more loans. Ally pays 3% on deposits at the time of writing. This 10x higher than the average bank; I suspect the reason that Ally pays a higher interest rate while other banks pay significantly lower rates is that the other banks aren’t making as many loans so they don’t need the capital while Ally is issuing more loans so they do. This makes sense since most banks focus on mortgages which have slowed down as homeowners don’t want to let go of a lower fixed-rate mortgage for a higher one, while Ally focuses on auto loans which are still in high demand. This is another way of seeing that Ally is looking to aggressively grow in comparison to other banks.

Hedge Out Macro Risk With Credit Suisse

The main risk in buying Ally is the possibility of a significant recession with higher unemployment making it difficult for consumers to pay off consumer debt owed to Ally. To hedge out this risk I would look to short an unprofitable bank with lower-quality assets that is preferably an investment bank rather than a commercial bank, as investment banks are more cyclical. The best example of this we currently have is Credit Suisse.

The objective of such a hedge is that if a deep recession were to occur the lower-quality bank, in this case, Credit Suisse, would go bankrupt(less likely) or through significant restructuring(very likely); so even if Ally’s share price were to pull back significantly it would be less than Credit Suisse’s stock price drop. This trade also comes with a positive carry since Credit Suisse is cashflow negative while Ally is cashflow positive and buying back stock rather than diluting like Credit Suisse.

Risk Management Issues With Credit Suisse

Credit Suisse focuses on two main areas: investment banking and wealth management. The investment banking unit is where most of the recent issues have been. The first division where there were major risk management failures was the prime brokerage division, which is due to working with clients like Archegos Capital Management by not selling margined stock they had quickly enough. This has led to large losses and is now causing the company to shut down its prime brokerage division. The company had to issue large amounts of debt to shore up cash reserves after the incident.

I’ve linked a WSJ article called “Inside Credit Suisse’s $5.5 Billion Breakdown” which goes over a more in-depth analysis of their risk management. I’ve also linked a report from Credit Suisse itself.

Another area of investment banking that the company is struggling with is the M&A division. Since rates are up in 2022 and equity markets are down, it’s not attractive to raise capital due to the high cost of capital. This means that very little revenue is coming into Credit Suisse for capital raises and M&A.

This leaves the company with only its wealth management division. This division will continue to stay profitable as long as they have substantial AUM.

In my opinion, Credit Suisse’s only road to profitability is to pivot completely to wealth management; this will likely take many years to happen. Over those many years, I believe it will continue to burn cash and will need to dilute its stock.

Value Trap

I believe Credit Suisse is a great example of a value trap.

It’s currently trading at 0.2x book which looks cheap, but when looking under the hood there are many issues.

The first issue is stock dilution. The company has already diluted its stock by 27% over the last month in an equity raise to shore up its balance sheet. The company had a negative net income of $8bn over the last year with a market cap of $11.8bn. Even with significant layoffs for cost reduction net income will continue to be negative in 2023 with the hope that 2024 will be a breakeven year or slightly positive. At the current cash burn rate, the company will have to dilute its stock by 73% in 2023, which comes with the assumption that the stock price stays the same, which it likely won’t since more supply of stock will lower the price. This quickly raises the P/B ratio from 0.2x to 0.4x a year from now. It’s also likely that as rates go higher the book value goes down raising the P/B ratio more.

Even if Credit Suisse once again becomes profitable its P/E won’t be very low. The most profitable year for Credit Suisse over the last decade was 2019 where net income was $3.5bn; at the current market cap that would be a price-to-net-income ratio of 3.4x which is in value territory, but isn’t that low when compared to many smaller banks(such as Ally) which are going for similar multiples without the same risk. On top of that, 2019 was the best year for Credit Suisse over the last decade, because if we were to look at their average year, we’d see that it’s around breakeven since 5 out of the last 10 years have been unprofitable, showing that Credit Suisse has significant structural damage from the subprime mortgage crisis that it is still is struggling with today.

Diagonals As An Alternative To Shorting

Options can be used as an alternative to shorting the stock outright. The current borrow rate is 5.1% but has gone as high as over 8% over the last week. Current borrowing costs along with what percentage of the float is short can be found on Fintel.

Since the stock is already down a lot increasing the likelihood of a short squeeze and there is a high borrowing cost, options can be used as an alternative. The issue with just buying naked puts is that the IV is extremely high, so a diagonal spread can be used as an alternative that provides positive time decay. A long put diagonal also works well as the current IV is in backwardation.

Summary

To summarise, I believe Ally will benefit from higher rates as the spread between deposit rates and rates at which they lend will go higher. Shorting Credit Suisse against it will help to hedge out macro risk. I believe this trade will also benefit from positive carry as Ally continues to return capital to shareholders while Credit Suisse is diluting shareholder equity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment