myboxpra

Investment summary

From the Portfolio Manager’s desk

Following the market’s reaction to Artivion, Inc. (NYSE:AORT)’s [formerly CryoLife] decision to pull its PROACT Xa (“Proact”) trial last week, we’ve revisited the company to identify if the sharp pullback represents an alpha opportunity, and also what the decision means for AORT looking ahead. We had exited all speculative growth in medtech in Jan-Feb 2022 – including AORT – by reallocating exposure to alternatives instead, and it has turned out to be a smart move, clamping equity drawdown substantially. Hence, we’d be restarting long exposure to AORT if buying the stock today.

Following AORT’s recent decision and subsequent downside, I’ve decided to avoid re-allocating any equity risk to AORT in our equity bucket. Fundamentals are soft and technicals point to a difficult period for speculators hoping to nab AORT shares up at a bargain. As such, I rate the stock a hold until we have further evidence of a turnaround, or another factor rotation into growth in medtech.

AORT pulls PROACT Xa trial

Last week, the company pulled its Proact trial following recommendations by the Data and Safety Monitoring Board (“DSMB”). This isn’t a decision the company would have taken lightly – the DSMB is an independent group of experts that advises medical institutes with expertise and recommendations. Its primary functions is to review accumulated study data and make recommendations around the continuation or termination of clinical trials.

Recall, the Proact trial was investigating if patients with an On-X Prosthetic heart and/or aortic valve can be maintained safely and effectively Apixaban. There were 3 co-primary endpoints:

- To determine if Apixaban is non-inferior to Warfarin for patients with an On-X mechanical heart valve implanted in the aortic position, for the primary composite outcome of valve thrombosis and valve related thromboembolism.

- To determine if apixaban provides acceptable anticoagulation for patients with an On-X mechanical heart valve implanted in the aortic position for the primary composite outcome of valve thrombosis and valve-related thromboembolism compared with an objective performance criterion

- Number of major bleeding events over 2-year time frame.

The trial was stopped after the DSMB’s review found higher risk of adverse events in patients receiving Apixiaban. This is somewhat of a disappointment, seeing there is an unmet clinical need for an alternative to warfarin. There’s a number of underlying reasons from this, ranging from hypersensitivity to warfarin, associated symptoms, and contraindications with diet and other medical interactions. There’s also associated issues with aortic tissue valves that raise questions over safety of this alternative in younger patients.

AORT’s potential to create a remedial breakthrough unsurprisingly in this area saw investors become galvanized in the trial’s early days. An alternative to warfarin would have, in my estimation, sent the share price into the stratosphere. The study’s completion date was due for July 2024, and AORT had committed c.$10 million (“mm”) in annual funding to the study up until this point. However, the DSMB determined the study was unlikely to meet its primary endpoint[s] without placing patients at risk of unnecessary harm.

Fallout from decision

The economics of AORT’s business model remains largely unchanged in real terms following the decision, by my estimation. The company now has an extra ~$20mm to allocate to various other initiatives, or retain the cash to feed to the bottom-line in coming years. The study was also pulled early, without too far of a progression into the more expensive, pivotal stages of the pipeline. Nevertheless, the company was certainly adamant on creating the Proact segment a reality. The word “proact” caught a strong mention in the last earnings call. Firstly, it anticipated the Proaxt, NEXUS THRIOMPHE and AMDS PERSERVERE trials were to “expand [its] total addressable market by $1.3 billion in late FY24 and early FY25“.

In addition, James Mackin said on the call:

“So we’ve talked about PROACT Mitral as a $40 million opportunity for us just taking mechanical share. We would be the only – assuming we get FDA approval in the second half – we’ll be the only mitral valve in the mechanical space that has a low INR. And we’ve showed you what we’ve done with the PROACT aortic. We’re the market leader in the mechanical aortic space at this point. So at least in the U.S., where we have good share data, we expect to do the same thing with the PROACT Mitral.”

From the press release concerning the decision to pull the trial, CEO Pat Mackin said:

“We are disappointed to stop the PROACT Xa trial as a successful trial would have significantly benefited patients and significantly increased our addressable market opportunity beginning in 2025.

Despite stopping the trial, we are reiterating our 2022 outlook of delivering double-digit top-line growth and we remain committed to delivering the financial expectations we communicated in our March investor meeting: Double-digit top-line growth, expanding gross margins, and accelerated adjusted EBITDA growth through 2024.”

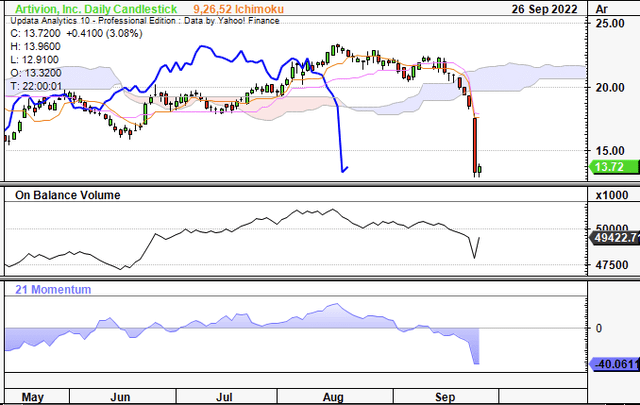

The market didn’t agree and pulled the rug from the share price, sending it to 52-week lows in vertical fashion. As seen in Exhibit 1, shares broke the recent uptrend that had coincided with the June bounce in equities. The ascending triangle that was squeezing hard at the mouth is now null-and-void unless there’s a rapid reversal from some heavy buying activity at these prices [we are now at 7-year lows]. The stock did gap down at ~$18.20, and there’s a question if the market will re-fill this gap to the upside following the extended down-leg on Sep 23.

This is often the case in the unprofitable end of med-tech, whereby price distribution is often a reflection of trial results/readouts rather than underlying fundamentals. As much is true considering the lack of tangible value in earnings growth and return on invested capital to buy into. Therefore, in my estimation, in order to reverse this current downside in quick succession, one of 2 things needs to happen. Either the company produces another set of positive readouts [in the same or another segment], or we see another factor rotation into speculative growth in broad equity markets before the end of FY22. My educated guess is that neither of these scenarios will eventuate.

Exhibit 1. Shares have broken near-term uptrend forming since June in coincide with bear-market rally in equities.

Probability of clawing back gains

Management are adamant that nothing’s changed fundamentally for the company, particularly in terms of forward-looking earnings. It still forecasts “double-digit top-line growth, expanding gross margins and accelerated adjusted EBITDA growth through 2024.” In addition, the $10mm per annum in annual study funding will be accretive to operating income, if not invested elsewhere. I’m satisfied with this and don’t see any material changes to our own internal forecasts.

What does change, however, is the market’s psychology around the stock, the price action, and multiples. Multiples representing earnings and investment are particularly important, as they are shorthand for the company’s performance [historical, expected] at these 2 levels. However, I’ve decided to see what the charts are saying in order to gauge what the next moves might be for AORT.

As seen on the daily cloud chart in Exhibit 2, following the announcement, shares have broken through the cloud and are now trading at a distance from any cloud support. The lag line has followed suit and will need to retrace the last 3 candles to today’s levels in order to hit these levels again. Long-term trend indicators have also taken a sharp reversal as well. Leading into the announcement, on-balance volume (“OBV”) and momentum had both curled upwards from lows in June in support of the near-term uptrend. This relationship has been broken down also with the latest price action. The below chart indicates to me that price action is in fact bearish at the time being, and buying now would be a contrarian play.

Exhibit 2. Price action and near-term uptrend broken down with latest down-leg in the AORT share price

I also wanted to give insight into what investors are actually buying in AORT if intending to enter or extend a position at these prices. With a lack of earnings profitability to date, it becomes a case of what’s to be expected for the company looking ahead. In my previous analysis on the company, I rated AORT a speculative buy on a number of regulatory catalysts in the form of clinical trials and product approvals that were on the horizon.

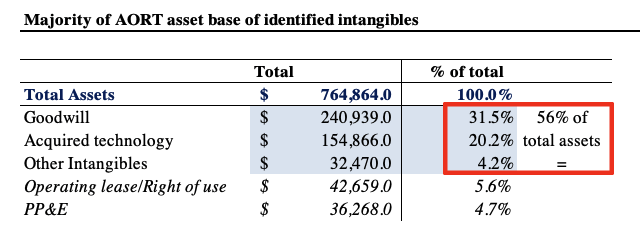

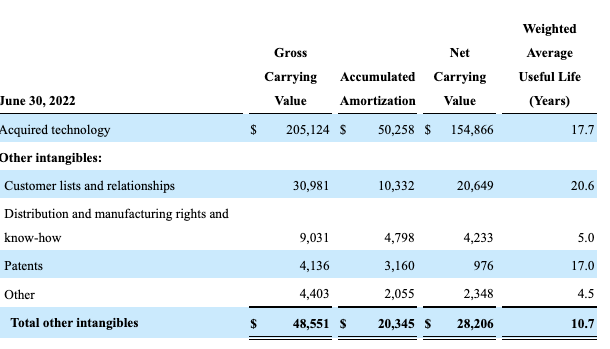

As can be seen, the market is searching for this kind of company-specific drivers in order for the stock to attract buyers, given the lack of earnings/return on investment – hence why the downside on the ‘bad’ news. But if buying AORT today, we still need some understanding of what’s on offer as equity holders. The company’s book value is made up of $764mm in assets and $483.35mm in liabilities, as seen in Exhibit 3. However, also observe that of the c.$765mm asset base, more than 56% of this is made up of non-tangible sources of value. In particular, 31.5% of total assets and 85.3% of the company’s book value is comprised of goodwill, and, another 4.2%/11.5% is made up of “other intangibles,” as seen in Exhibit 3 and 4.

Exhibit 3. Over 85% of book value is determined by goodwill on the balance sheet

Data: HB Insights, AORT 10-Q Q2 FY22 [see: Note 5 “Goodwill and Other Intangible Assets” pp. 11-12.]

Exhibit 4. ‘Other intangibles’ booked as assets and contributing to equity value

Data: HB Insights, AORT 10-Q Q2 FY22 [see: Note 5 “Goodwill and Other Intangible Assets” pp. 11-12.]

Valuation and conclusion

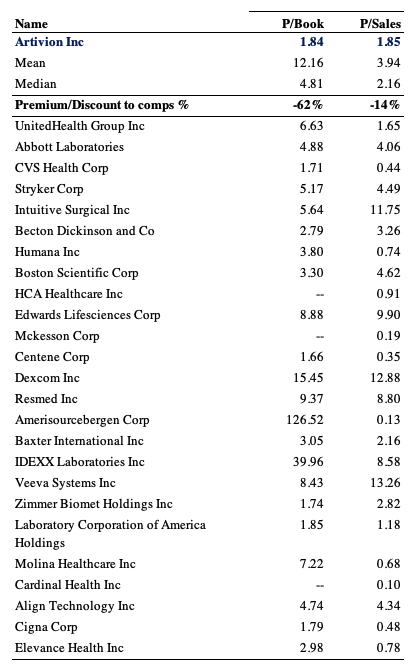

Following the pullback, shares have re-rated to the downside and now trade at a deep discount to GICS industry peers. The question on our minds immediately turns to whether the discount is warranted or not. I view it this way: here we have a company without quality earnings, return on invested capital or fundamental momentum heading into a weakening economic climate.

We are looking to position against long-term cash compounders with high returns on capital, and therefore AORT doesn’t fit the bill here. Despite the respective discount, I don’t believe there is compelling value on offer, or that shares will re-rate to the upside any time soon based on anything related to fundamentals.

Exhibit 5. Multiples and comps

Data: HB Insights, Refinitiv Datastream

Net-net, I’ve reduced my rating on AORT to a hold. The market has had enough of rewarding top-line growth and paying exorbitant multiples for unprofitable medtech names. It, therefore, remains a story of regulatory and clinical trial tailwinds for AORT, two factors that I’m not comfortable speculating on whilst there are numerous other opportunities on offer for those of us wanting to shift up in the quality spectrum. With these points in mind, I rate AORT a hold, and don’t provide a price target for this reason.

Be the first to comment