piranka

As highlighted in GDS Holdings’ (NASDAQ:GDS) latest quarter, the data center demand recovery in Chinese tier-1 markets has been slow coming out of the Shanghai lockdowns. The muted move-in pace also remains an issue in H2 2022, as the company revised its adjusted EBITDA guidance lower on increased utility costs and their negative margin impact. Still, the long-term growth potential remains intact, in my view, and should shine through as transitory headwinds like the higher power costs and tightening financial conditions fade over time.

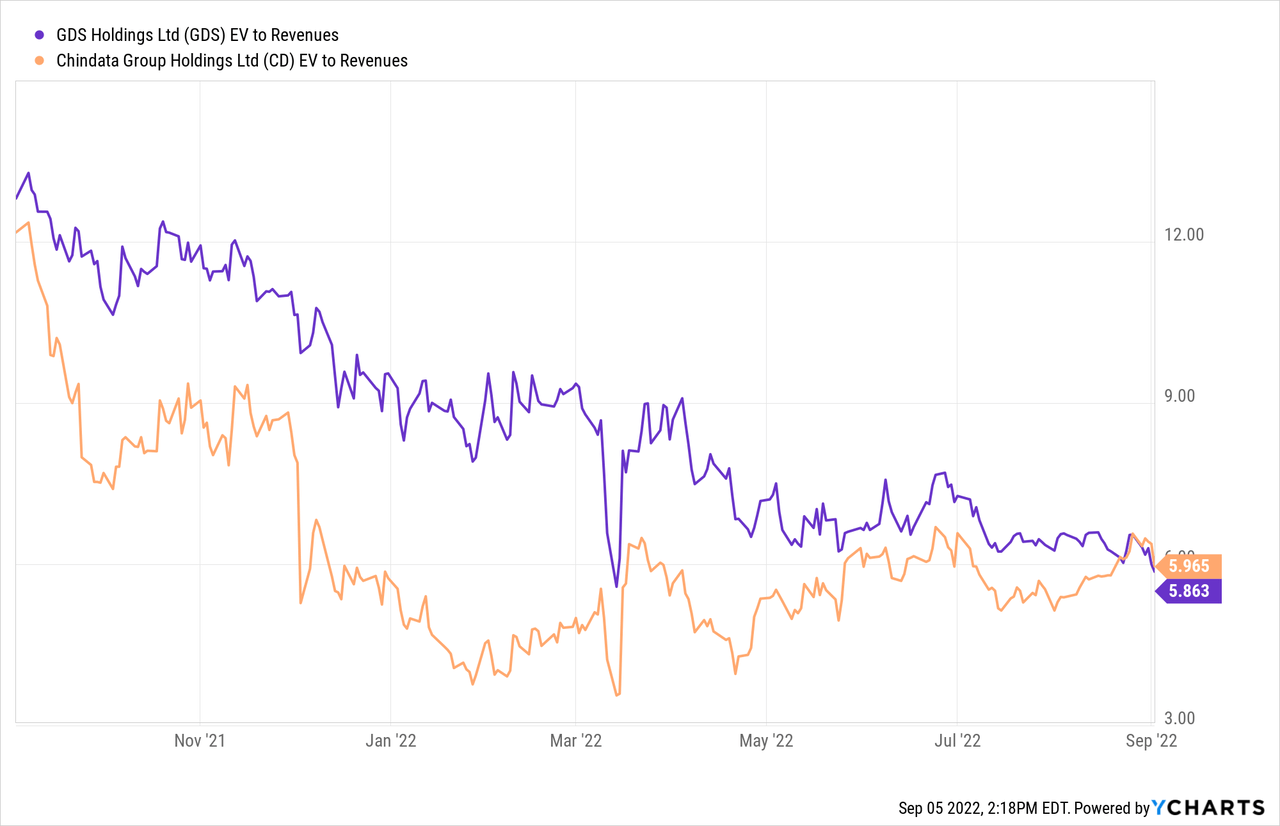

Plus, GDS is positioned well for the long term, emphasizing overseas expansion as well as setting up an offshore data center fund to recycle capital and facilitate financial self-sufficiency. The stock is now trading at a relative discount to key peer Chindata (CD) at current levels (vs the historical premium), likely on account of its China concentration, but with its exposure becoming increasingly more diversified via overseas expansion, there is a clear re-rating path from here.

Ongoing Headwinds Weigh on the P&L

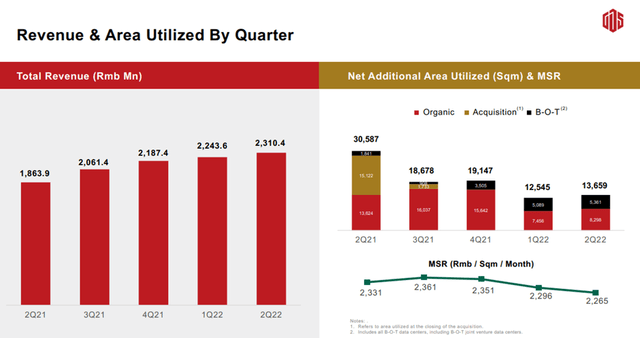

GDS posted Q2 2022 revenue and adj EBITDA of RMB2.3bn and RMB1.1bn respectively, largely in-line with (lowered) expectations heading into the print. New bookings (i.e., net additional area committed) were the highlight, coming in above guidance at 13k sqm (-28% QoQ) on contribution from three major hyperscale orders (two cloud customers and a major Chinese bank). The increased contribution from enterprise and financial institutions at ~40% of new organic bookings is another key positive and bodes well for the long-term diversification of its customer base (vs the current cloud services concentration). The move-in pace also improved modestly to 13.7k sqm (up from 12.5k sqm in Q1 2022 but still well below the 19.1k sqm level in Q4 2021) – an impressive result given the COVID restrictions during the quarter as well as the challenging macro backdrop.

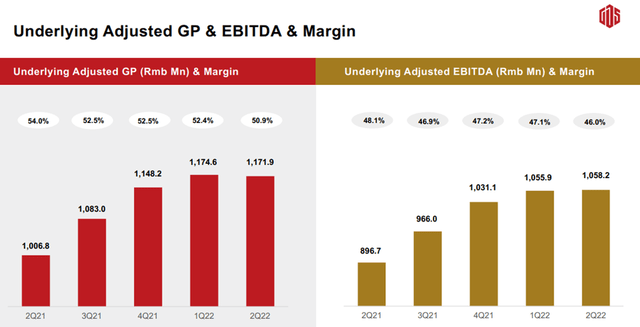

Unsurprisingly, margins were pressured by headwinds such as rising utility costs (+3.1%pt YoY) at ~30% of service revenue. Key drivers include seasonality (i.e., hotter temperatures in China this summer) and higher power tariffs, with prices across all tier-1 cities reaching the upper cap of the benchmark electricity price. With monthly service revenue numbers also declining by 2.8% YoY due to dilution from customer move-in for build–operate–transfer projects, GDS’ gross margin was down 1.4%pt sequentially (or down 3.3%pts YoY) to 20.3%. While the margin drag from higher power consumption and higher power tariffs should eventually normalize lower, operating conditions have not improved yet and thus, margins could continue to suffer into the back half of the year.

Near-Term Guidance Adjusted Lower; Long-Term Expansion Remains Intact

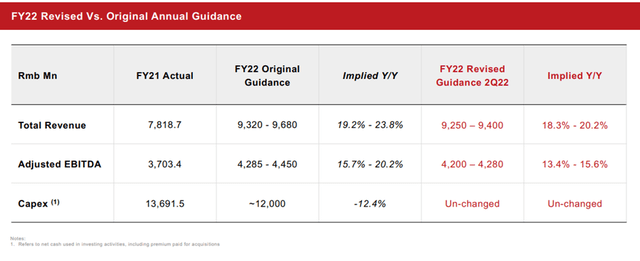

In light of the impact from COVID lockdowns in China and slowing economic growth, GDS has lowered its guidance for full year revenue growth to 18%-20% YoY (down from 19%-24% YoY) and its adjusted EBITDA growth to 13%-16% YoY (from 16%-20% YoY previously). The downward revision makes sense, in my view, given the slower bookings growth and sluggish move-in results in recent quarters.

Assuming the headwinds extend into the next two quarters as well (and possibly into 1H 2023), a delay in the ~39k sqm of capacity delivery into 2023 or beyond seems likely. In the mid to long term, though, the backlog of 240k sqm capacity signals underlying robustness and a return to the 80k-90k sqm organic booking target as GDS ramps up its presence in Southeast Asia remains on the cards (the Malaysia and Indonesia facilities are currently under construction). Of note, regional capex is set to receive a higher allocation, with GDS now planning to double its regional capex in 2023 to ~RMB4bn (vs <RMB7bn capex in mainland China) – this should hopefully offset any domestic slowdown going forward.

Taking Another Step Towards Self-Financing via New Data Center Fund

As part of GDS’ aim to achieve self-financing for its mainland China operations in a few years (excluding M&A), the company will, subject to regulatory approvals, form an offshore China Data Center Fund with a sovereign wealth fund. The offshore fund will entail ~RMB6.7bn (or ~$1bn) of capital commitment, with 30% coming from GDS and the remaining 70% from private equity, to acquire mainland China data center projects. Acquisitions will be made from either the GDS portfolio or 3rd parties, with GDS in charge of asset management and compensated via recurring fees. In the initial phase of deployment, the fund will focus on late-stage projects from GDS to recycle capital, with one project already targeted for this year. Over the long-term, the fund will be open to third party funding for external data center acquisitions as well.

I view this development as a positive for GDS. The short-term capital recycling from GDS projects in the early/ramping up phase (subject to approval from its sovereign wealth fund partner) allows accelerated monetization by releasing the equity value locked up in these projects. Meanwhile, GDS reaps the benefit of a recurring income source via management fees. Any impact will take time to meaningful flow through the P&L, though, as capital recycling activities are guided to be minimal in 2023/2024. Yet, as these projects stabilize closer to 2025/2026 (per management projections) after substantial front-end capex has been incurred, there will be ample room for value creation. With GDS also in early talks with several domestic institutional investors to setup an onshore version of this fund structure, future updates here could catalyze incremental upside.

Best-In-Class Operator Trading at a Discount

With the data center demand recovery in tier-1 markets still sluggish following the recent Shanghai reopening (after two months of COVID lockdowns), GDS’ Q2 2022 weakness came as no surprise. In the near-term, COVID risks remain – cases are still far from zero and thus, different levels of COVID restrictions could be triggered across tier-1 cities such as Beijing, Shanghai, and perhaps even Shenzhen. In turn, the growth outlook of GDS’ major public cloud clients (e.g. AliCloud (BABA) and Tencent Cloud (OTCPK:TCEHY)) is cloudy, particularly against a challenging inflationary backdrop.

That said, there are silver linings – even on the demand side, select end-markets such as financial services has been relatively resilient. Over the mid to long-term, many of the current headwinds (e.g., higher power costs and tighter financial conditions) should ease as well, paving the way for an eventual re-rating. GDS’ competitive positioning as the best-in-class IDC operator also remains intact and with the stock down to an attractive relative valuation (vs its historical average and peers) despite an intact expansion/diversification outlook, the risk/reward seems compelling.

Be the first to comment