djgunner

On August 9th, the leading tanker operator International Seaways, Inc. (NYSE:NYSE:INSW) released its Q2-2022 earnings: results beat market expectations and the stock surged above $27/share during trading hours. After quarters and quarters of losses, the Company finally announced a positive net income and a strong balance sheet.

In this article, I will analyze International Seaways results and I will explain my BUY recommendation. If you are not familiar with International Seaways, you can have a look at my previous article where I provided a general overview of the company.

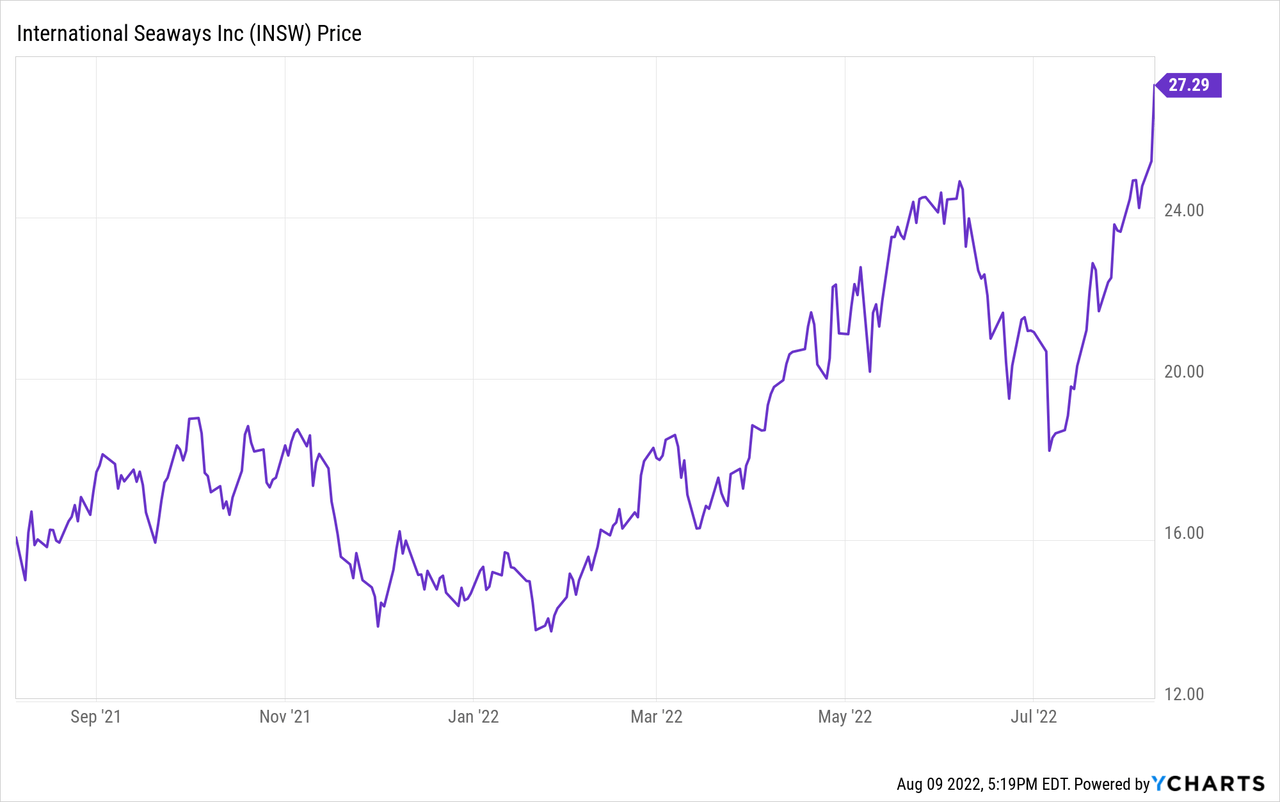

Stock performance

International Seaways is currently trading at $27.18/share, equivalent to a market capitalization of $1.3bn. The stock is up 85% year-to-date and 81% year-on-year with the 52-week low being $13.4/share (January 26th, 2022) and the 52-week maximum being $27.18/share, recorded at the closing trading hours of August 9th, 2022.

When I wrote my previous article about International Seaways (May 6th, 2022), the stock was trading at $22.1/share, and, therefore, the stock has since then increased by ca 23%. However, the share is affected by some volatility with the standard deviation equal to $3.0/share, or 11% of the current stock price.

Q2-2022 results

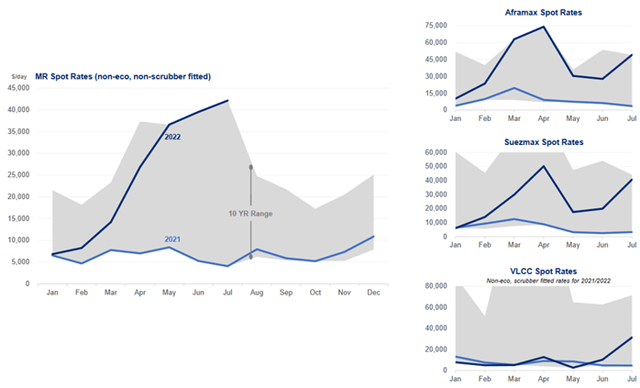

Total revenues for Q2-2022 were $185M, more than four times the revenues recorded in Q2-2021 ($45M). The growth was mostly driven by product carriers that saw revenues increase by ca 800%, from $14M to $126M: the $112M growth is mostly a result of the year-on-year increase in the average daily rate earned by the medium range (MR) and LR1 vessels (+$76.5M) with the remaining +$35.5M generated by the increase in fleet size after the merger with Diamond S Shipping.

Revenues from crude tankers almost doubled, from $31M in Q2-2021 to $59M in Q2-2022, thanks both to the increase in the Suezmax fleet (+13 vessels obtained in the merger) and to higher rates.

Focusing on the first half of 2022, all trends are confirmed: total revenues reached $284M, up 216% from$194M, with product carriers generating 66% of the total turnover.

Moving to the cost side, as one might expect, total operating expenses increased as well, from $64M in Q2-2021 to $101M in Q2-2022, driven almost exclusively by vessel expenses.

Overall, after some quarters of losses, International Seaways was finally able to report a net income of $69M.

Cash flow from operations for H1-2022 was $15M, mostly thanks to the positive net income. Cash flow from investing activities was $164M and it was generated by the disposal of some vessels ($79M) and the divestment of the 50% stake in the FSO Joint Venture that owned two FSO vessels in Qatar ($140M). These cash inflows were in part offset by a $54M capital expenditure for new vessels (3 VLCC carriers) and other properties. Cash flow from financing was -$46M, with International Seaways carrying out a refinancing activity whereby three senior facilities were replaced by a $750M secured facility with $530M drawn and $220M undrawn. Overall, net cash flow was $98M leading to a cash balance of $231M, up from $133M at the beginning of the year.

At the end of Q2-2022, the total outstanding debt was $1.1bn and the net-debt was $0.9bn.

Market Overview

As anticipated when discussing revenues, 2022 vessel rates have been on a completely different level than 2021 rates with Q2-2022 that saw a huge increase in daily rates across all vessel categories. The current rates have not been seen since the 2004-2008 commodity super-cycle and the main reason behind this is to be found in some market imbalances. Indeed, oil demand is continuing to increase with expectations for 101 Mboe/d for H2-2022 while, on the other side, oil inventories are at historic lows with the capacity to cover just 57 days of demand.

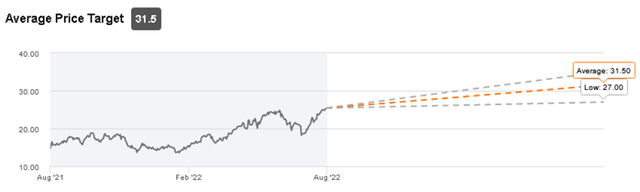

Wall Street Analysts’ Rating

International Seaways does not have extensive coverage from bank analysts. Only 7 analysts have rated the stock with 6 of them recommending a Strong Buy and 1 analyst issuing a Buy rating. The average target price is $31.5/share, which would offer a 16% from the current trading price of $27.18

Conclusion

At the current stock price of $27.18 per share, I believe that International Seaways is a stock worth buying. With a well-executed merge coupled with a strong capital discipline, top management was able to lead the company through difficult waters finally steering International Seaways back to profit. The current commodity market and the tanker day rates offer the perfect context for large vessel operators like International Seaways to continue with the generation of healthy profits and strong FCFs.

Be the first to comment