alfexe

Cumulus Media Inc. (NASDAQ:CMLS) currently offers a stable financial situation, and most investment analysts expect FCF growth. I believe that more podcasts, streaming offerings, and clever utilization of CMLS’ broadcasting stations will likely bring significant revenue growth and FCF generation. Let’s also keep in mind that the company can reach a quarter of a billion listeners all over the country, which will likely help negotiate with advertisers. In sum, even considering the existing risks, Cumulus Media appears to have significant upside potential in its stock price.

Cumulus Media

Cumulus Media offers broadcast and on-demand digital platforms, among other services to advertisers. The company claims to reach over a quarter billion people monthly thanks to 405 owned-and-operated radio stations and across 86 markets.

After the recent reorganization of Cumulus that took place in 2018, I believe that it is the right time to review the company’s business model. Right now, the total amount of financial debt appears under control, and many analysts out there are expecting significant free cash flow generation. The following words are from the annual report:

Our predecessor, CM Wind Down Topco Inc. (formerly known as Cumulus Media, Inc., “Old Cumulus”), and certain of its direct and indirect subsidiaries filed voluntary petitions for bankruptcy relief in November 2017. Old Cumulus and its debtor subsidiaries emerged from Chapter 11 bankruptcy on June 4, 2018 and, prior to winding down its business, it transferred substantially all of its remaining assets to an indirect wholly owned subsidiary of reorganized Cumulus Media Inc.

Quarterly EBITDA Increase And Annual Expectations Include 4%-5% Sales Growth And 17% EBITDA Margin

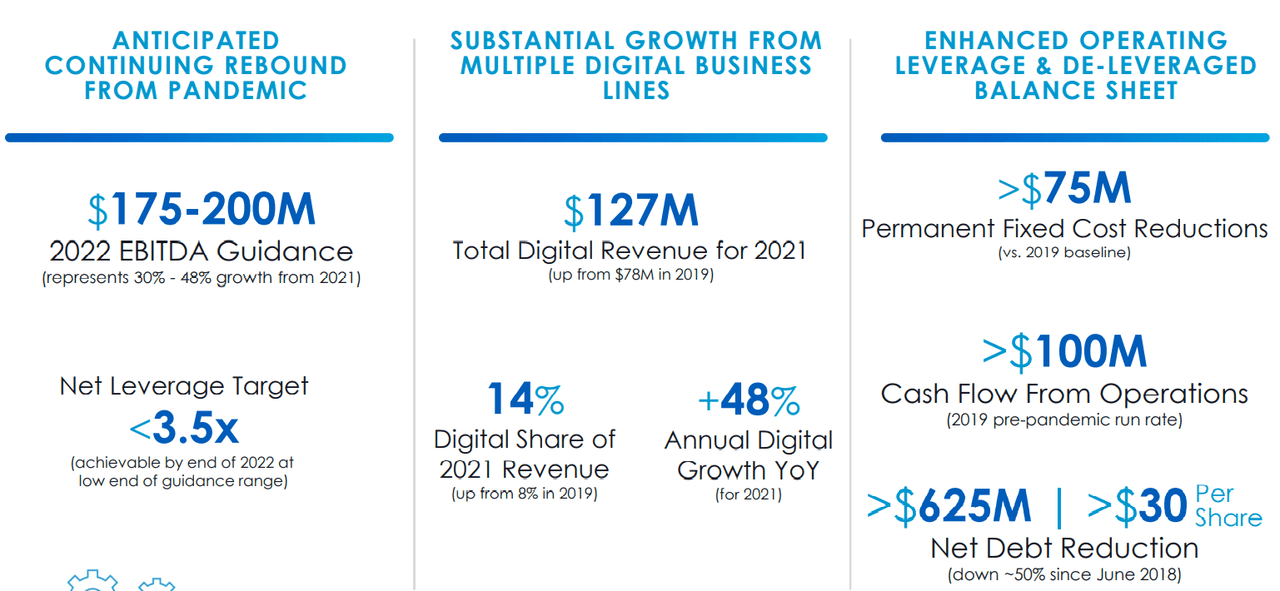

According to the company’s investor presentation, Cumulus Media reported 2022 EBITDA guidance of $175 to $200 million, with leverage target greater than 3.5x. Net debt stands at close to $625 million. In this regard, it is worth considering that net debt has decreased significantly since 2018. The company has made a lot of efforts to reduce its debt obligations. I believe that the market will one day recognize these efforts, and will offer a decent valuation for the stock.

Source: Investor Presentation

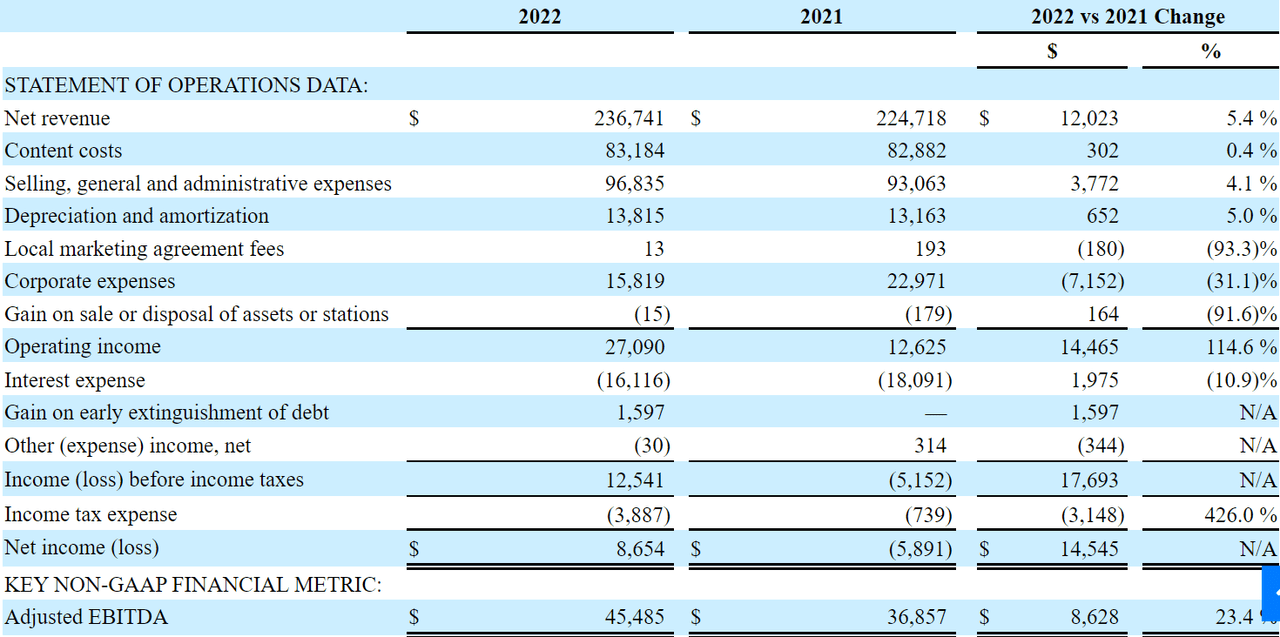

In my view, the most recent numbers delivered for the three months ended June 30, 2022 are optimistic. Net revenue was equal to $236 million, with a change of 5.4% q/q, including content cost of $83.184 million, selling, general, and administrative expenses of $96.835 million, and depreciation and amortization of $13.815 million.

The company also reported a gain on sale or disposal of assets or stations of $15 million, which may be considered an extraordinary event for some readers. Interest expenses worth $16.116 million do not sound worrying. Finally, net income before taxes was equal to $12 million with net income of $8.6 million and quarterly adjusted EBITDA of $45 million, 23% more than that in the same quarter in 2022.

Source: 10-Q

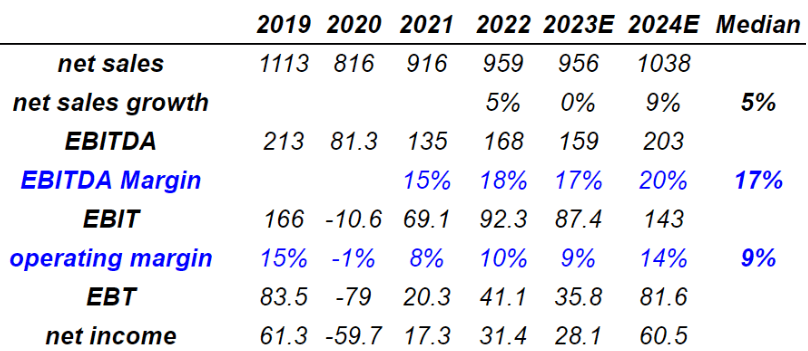

Analysts expect that net sales will, by 2024, likely stand at $1.038 billion with a net sales growth of 9%. In addition to an EBITDA of $203 million, with an EBITDA margin of 20%, estimates include EBIT of $143 million and an operating margin of 14%. Finally, 2024 net income would be around $60.5 million.

Source: Marketscreener.com

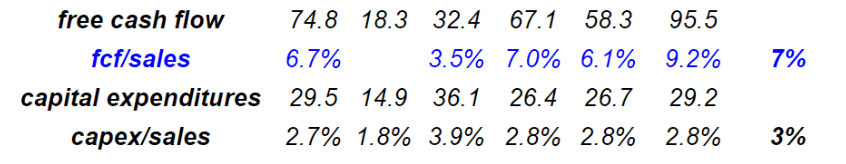

With that about the income statement, in my view, the most interesting is the cash flow statement. Estimates include 2024 free cash flow close to $95.5 million, with an FCF/sales ratio of 9.2%. Finally, capital expenditures of $29.2 million are expected with a capex/sales ratio around 2.8%.

Source: Marketscreener.com

Stable Financial Situation

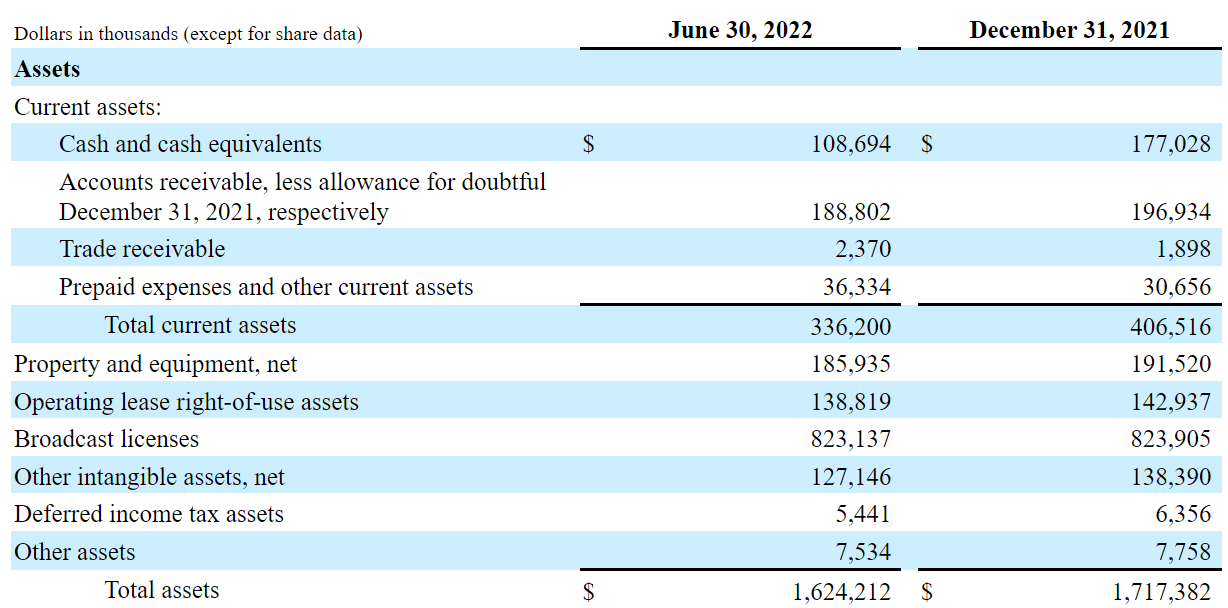

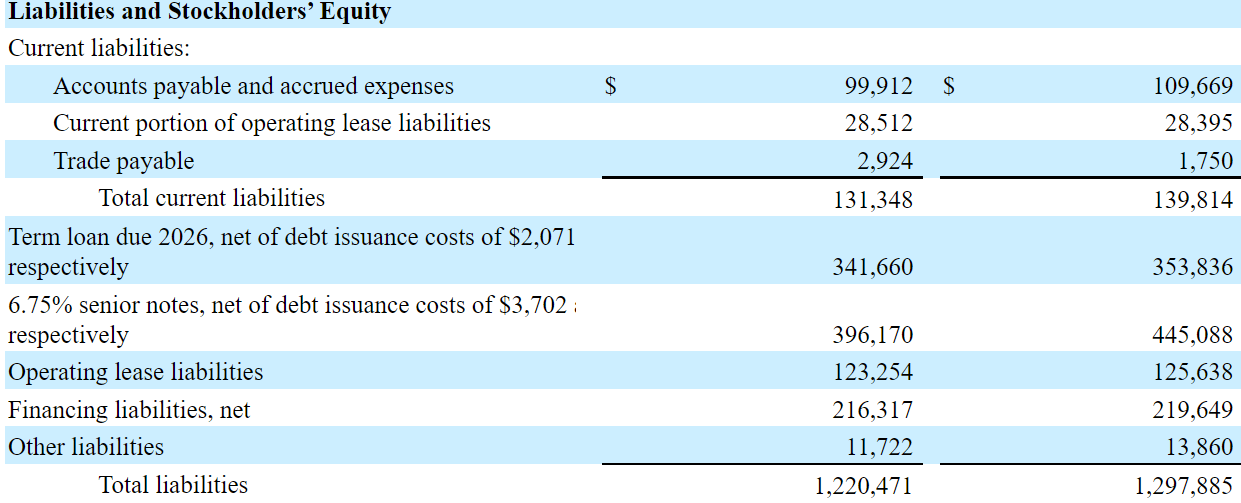

As of June 30, 2022, Cumulus Media reported cash and cash equivalents of $108 million with accounts receivable worth approximately $189 million and total current assets of $336 million. Let’s also note that total current assets are significantly larger than total current liabilities.

The company also noted property and equipment worth $185 million and broadcast licenses of $823 million, which appear to be the most valuable assets owned by Cumulus Media. Finally, total assets stand at $1.624 billion, 1x-2x the company’s total amount of liabilities.

Source: 10-Q

Regarding the company’s liabilities, the following number were reported. Accounts payable and accrued expenses stand at $99.912 million, with current portion of operating lease liabilities of $28.512 million and total current liabilities of $131.348 million.

Financial debt is not small, so I did have a close look at the company’s figures. Term loans due 2026 were $341 million, and 6.75% senior notes stand at $396.170 million. Let’s move on to operating lease liabilities, which were around $123.254 million. In addition, the financing liabilities were equal to $216.317 million with other liabilities worth $11.7 million. Finally, the total liabilities were $1.220 billion.

Source: 10-Q

Under Normal Circumstances, I Obtained A Valuation Of $14 Per Share

I reviewed the company’s strategy. In my view, if management successfully improves efficiency thanks to new innovative initiatives related to their broadcasting stations, free cash flow will likely trend north. The following words were obtained from the most recent 10-K:

The Execution of a range of initiatives across both our radio station and network platforms to maintain or grow market share, reduce costs and improve efficiency.

Besides, Cumulus will likely deliver fantastic financial figures thanks to further improvement in its growth digital businesses and new audio formats. Podcasting, streaming, and many other new digital alternatives to the radio could bring significant revenue in the coming years. These initiatives were established by management in the last annual report:

Expanding high growth digital businesses in local marketing services and new audio formats such as podcasting and streaming optimizing our asset portfolio by taking advantage of opportunities to strengthen our position in markets where we are, or can become, leaders and to exit markets or dispose of assets that are not supportive of our objectives if we can do so accretively.

Finally, let’s note that the most relevant thing about Cumulus Media is its access to over a quarter billion listeners and the company’s accumulated know-how in the industry. With these invaluable assets, I believe that future free cash flow will likely grow in the coming years.

Currently, we offer advertisers access to a broad portfolio of 406 owned and operated stations, operating in 86 markets and more than 9,500 network affiliates with an aggregate monthly reach of over a quarter billion listeners.

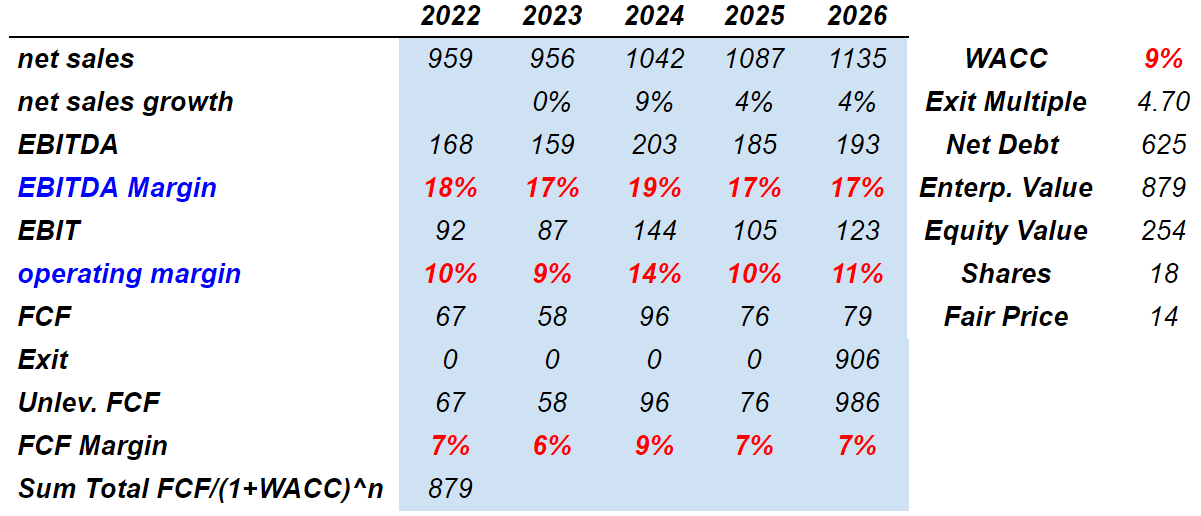

Considering sales growth of 4% obtained in the past, which is a conservative sales growth, 2026 net sales would be $1.13 billion. If we also include an EBITDA margin of 17%, operating margin of 11%, and FCF margin of 7%, my DCF model implied an enterprise value of $879 million. Finally, the fair price would be $14 per share.

Source: Author’s Work

Worst Case Scenario

There are some risks, which may destroy the company’s future profitability and expected sales growth. First, according to the last annual report, the company is an affiliate of Westwood One network, which offers the company access to 9,500 broadcast radio stations. If the other party decides to renegotiate the agreement with Cumulus, the company’s free cash flow margin would decline. Besides, if Cumulus loses its connection to that network, I believe that revenue growth would be lower than expected. In sum, Cumulus’ stock price may decline.

We have approximately 9,500 broadcast radio stations affiliated with our Westwood One network. The loss of network affiliation agreements by Westwood One could adversely affect our results of operations by reducing the advertising inventory available to us to sell and the audience available for our network programming and, therefore, its attractiveness to advertisers. Renewals of such agreements on less favorable terms may also adversely affect our results of operations through reductions of advertising revenue or increases in expenses.

The company competes with large technological companies for advertising. Other large media companies may also have more resources than Cumulus, and may acquire other stations in the United States, and even become larger. The company discussed in its last 10-k that competition in the industry is fierce:

Some competing media companies are larger and have substantially more financial and other resources than we do, which could provide them with certain advantages in competing against us. In addition, any future relaxation of ownership rules by the FCC could remove existing barriers to competition from other media companies who might purchase radio stations in our markets.

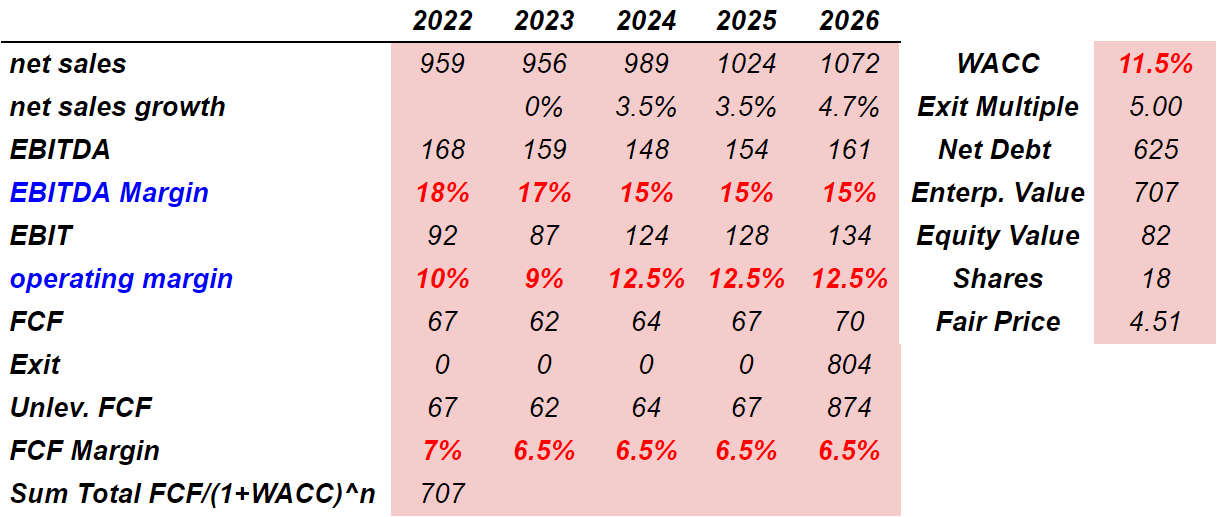

Under my most bearish case scenario, I used 3.5% sales growth in 2024 and 2025, EBITDA margin of 15%, and operating margin close to 12.5%. If we also include a FCF margin close to 6.5%, the implied enterprise value obtained would be $707.5 million. The equity value would result in $82 million, and the fair price would be $4.5 per share.

Source: Author’s Work

Conclusion

Cumulus Media has gone through a strong reorganization phase very recently, so the company’s financials appear stable. In the coming years, Cumulus Media also expects to deliver revenue growth, and most financial analysts are expecting free cash flow generation. In my opinion, successful implementation of Cumulus’ strategy with more podcasts and streaming services will likely bring stable revenue growth generation. I also believe that the company has the ability to reach a massive number of listeners, and counts with a lot of accumulated know-how. In sum, under conservative assumptions, my DCF model indicated that Cumulus is a buy.

Be the first to comment