oatawa

Cars.com Inc. (NYSE:CARS) delivered beneficial guidance for the rest of 2022. Management recently reduced its debt obligations, and reports sufficient liquidity for more investments in traffic generation and perhaps M&A efforts. In my opinion, under a conservative discounted cash flow model, the fair price is significantly higher than the current market price. Yes, there are some risks, however I don’t believe that the downside risk in the valuation appears worrying.

Cars

Incorporated in Delaware and headquartered in Chicago, CARS is an automotive online marketplace platform that connects car shoppers with sellers. The company created its first brand in 1998, called cars.com. Right now, the group also includes Dealer Inspire, DealerRater, FUEL, Auto, PickupTrucks, CreditIQ, and NewCars.

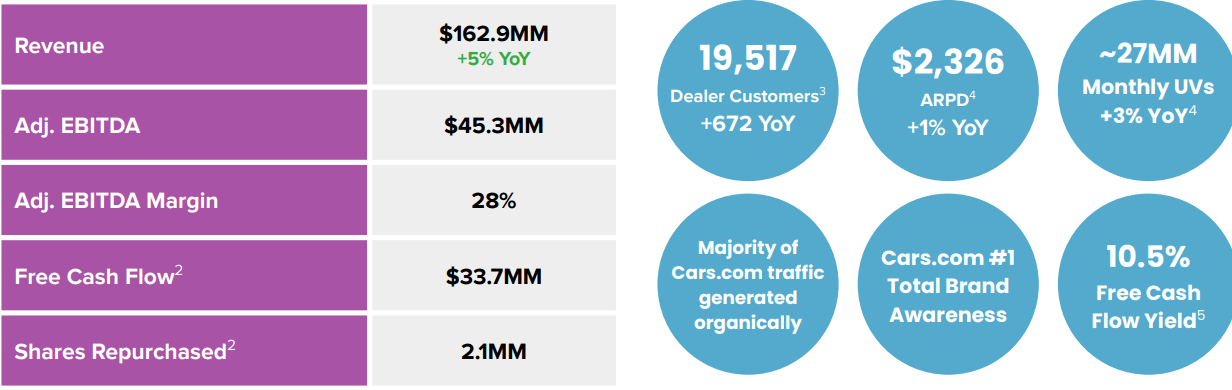

In my view, the company’s figures are quite solid. In the last quarterly report, revenue was equal to $162.9 million, in addition to an adjusted EBITDA of $45.3 million, with an EBITDA margin of $28%. Free cash flow was $33.7 million.

Source: Q2 2022 Fact Sheet

I also appreciate quite a bit that CARS is currently repurchasing a significant amount of its own shares. With the previous figures and the stock repurchase program, I would expect stock demand to grow soon.

Beneficial Outlook For The Rest Of 2022

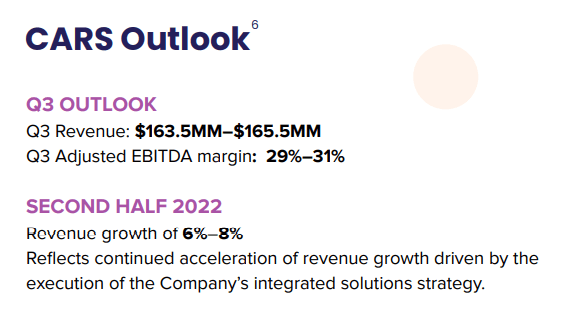

For the third quarter, the company expects revenue between $163.5 million and $165.5 million and an adjusted EBITDA margin of 29%-31%. Besides, for the second half of 2022, revenue growth of 6% to 8% is expected thanks to some of the company’s integrated solutions.

Source: Q2 2022 Fact Sheet

Balance Sheet

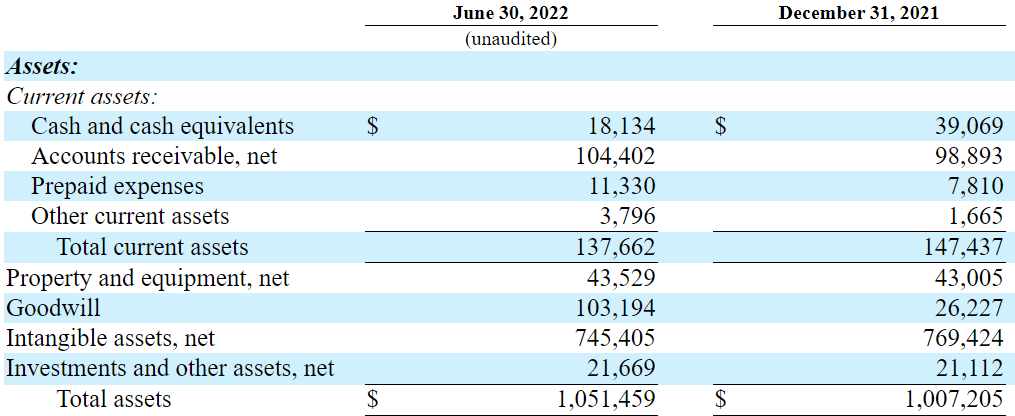

I believe that the company’s balance sheet appears in good shape. As of June 30, 2022, cash and cash equivalents were $18.134 million, accounts receivable worth $104.402 million, and prepaid expenses worth $11.330 million. Total current assets were $137.662 million, which is larger than the total current liabilities. I would say that liquidity is not a problem for CARS.

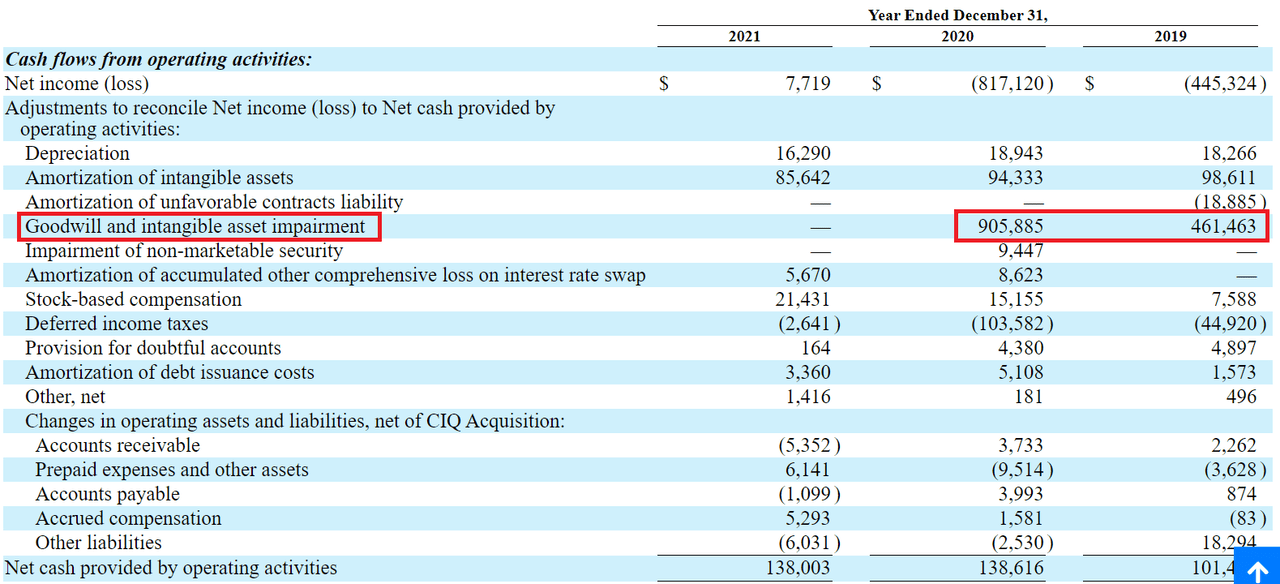

Property and equipment stands at $43.529 million, with goodwill worth $103.194 million and intangible assets of $745.405 million. With this information in mind, I would say that impairment in intangible assets could occur in the future. A drastic reduction in intangible assets would most likely bring the stock price down. Note that in the last 10-k, management reported significant impairments in 2020 and 2019.

Source: 10-k

The total assets are equal to $1.051 billion, and the asset/liability ratio stands at close to 1x-2x, so I wouldn’t worry much about the total amount of liabilities.

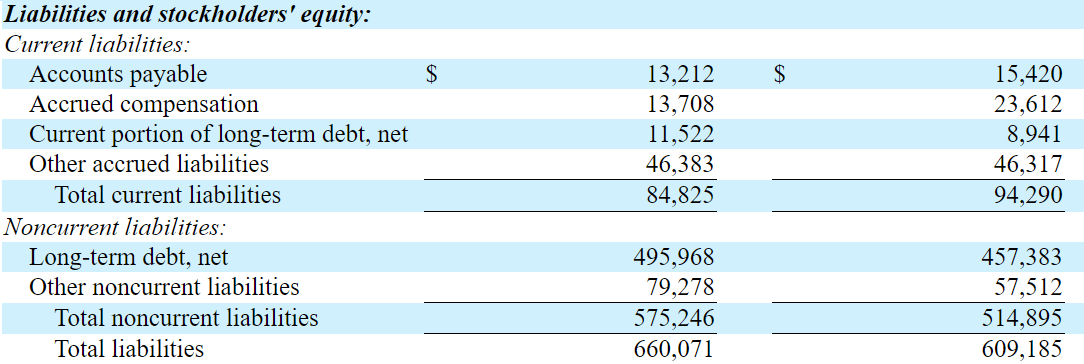

Source: 10-Q

As for liabilities, accounts payable were equal to $13.212 million and accrued compensation of $13.708 million, in addition to the current portion of long-term debt of about $11.522 million. Total current liabilities were $84.825 million. Long term debt was equal to $495.968 million, and total liabilities were worth $660.071 million.

Source: 10-Q

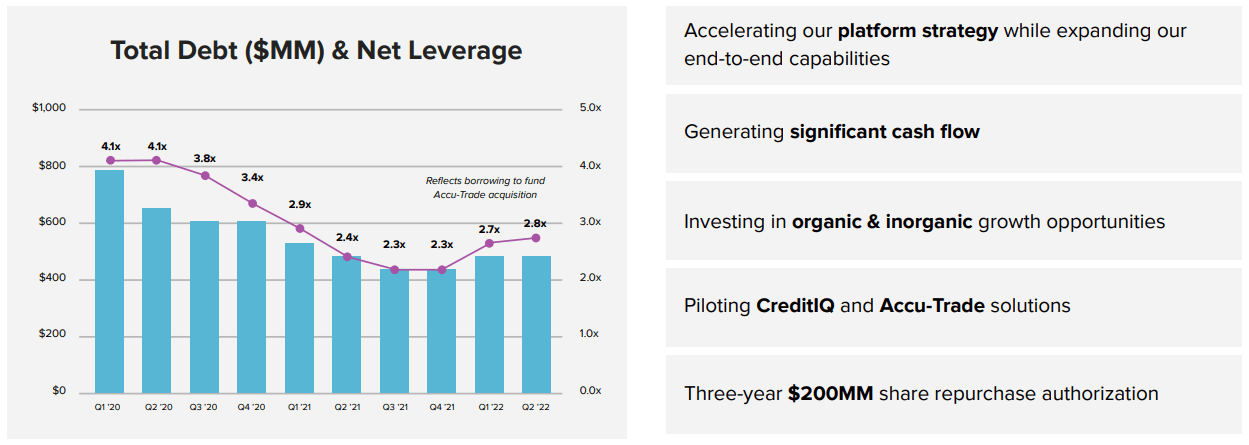

In my view, it is worth mentioning that the total amount of debt decreased significantly since Q1 2020. The total debt was $800 million in the first quarter of 2020, and for the first quarter of 2022, it was approximately $500 million. Further, decrease in the debt level would lead to less interest expenses, which may increase the company’s fair value.

Source: Q2 2022 Fact Sheet

Further Investments In Traffic And More Research And Development Will Likely Lead To Revenue Growth And Efficient Performance

CARS receives a significant number of visitors per year, close to 600 million in 2021. In my opinion, with this level of traffic, the company will most likely facilitate deals between buyers and sellers. CARS talked about some of its traffic numbers in the last annual report.

In 2021, we had nearly 600 million site visits and 25 million average monthly unique visitors. As the owner of a category website with a trusted consumer brand, we generate the majority of our traffic organically.

I believe that CARS has a lot of expertise in investing in marketing and sales to generate leads. The company has a significant amount of cash to further invest in marketing, so I would say that traffic will likely not slow down in the near future:

Marketing and sales expense primarily consists of traffic and lead acquisition costs (including search engine and other online marketing), TV and digital display/video advertising and creative production, market research, trade events and compensation costs for the marketing, sales and sales support teams.

CARS makes significant investments in technology and marketing to offer sophisticated tools to car owners. Thanks to these investments, management notes that clients buy cars faster than on other platforms. If good performance continues, I expect the number of clients to grow. The following words are from the annual report:

We have made strategic investments in technology and marketing to deliver what we believe is the industry’s most qualified car shopping audience. Further, approximately 85% of our audience is in-market to buy a car, compared to a fraction of the general population. The average time to purchase a car is less than 50 days, while approximately 51% of our audience plans to buy within 30 days.

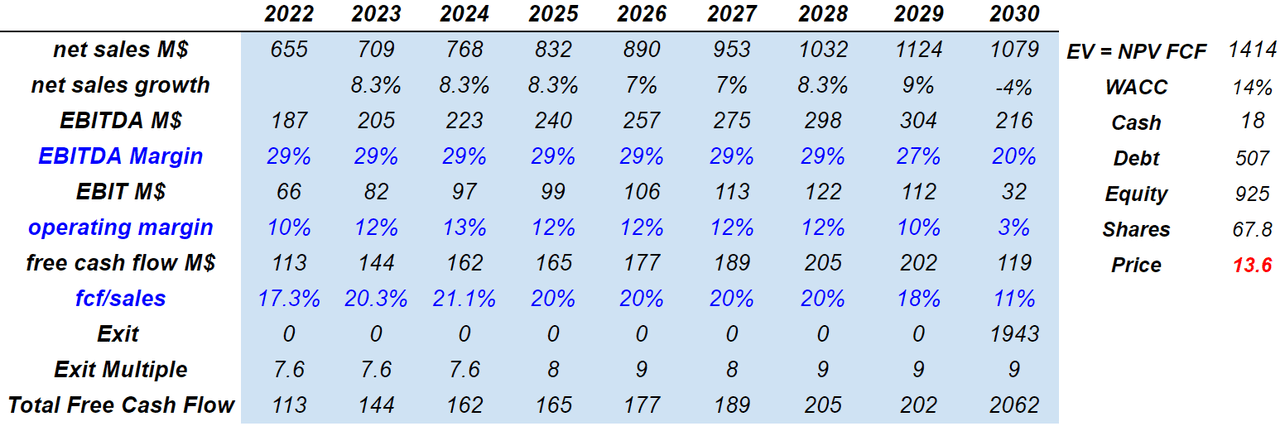

Under this case scenario, sales growth would range between 8.3% and 7% from 2023 to 2028. I also assumed a small decline in sales in 2030, an EBITDA margin close to 29%-20%, and operating margin close to 12%. The free cash flow would grow from around $144 million in 2023 to close to $202 million in 2029. If we also assume an exit multiple of 9x and a WACC of 14%, the implied equity valuation would be close to $924 million, and the fair price would stand at $13.6 per share.

My DCF Model

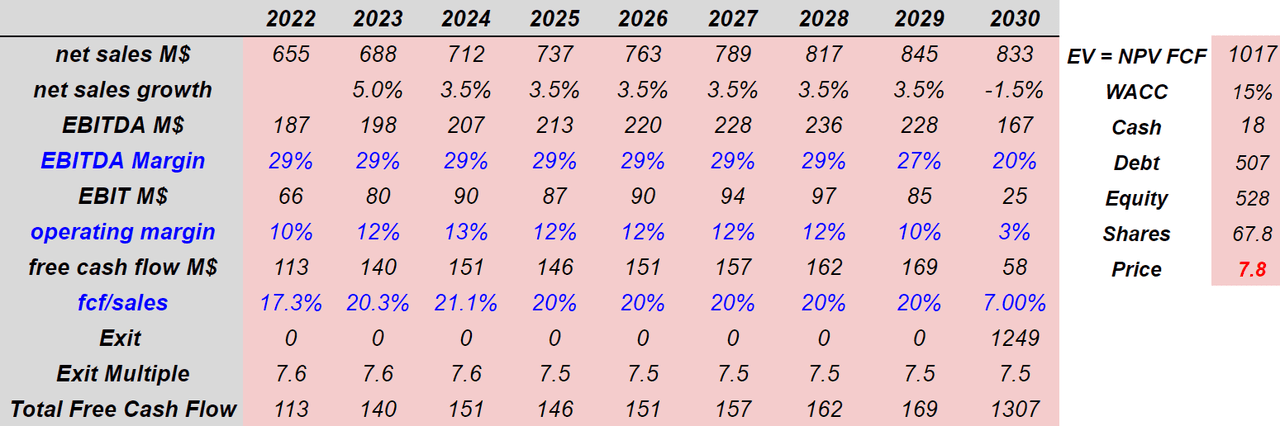

Negative Publicity Or Consolidation Of Dealers Could Bring The Stock Price Down To $7.8 Per Share

Consolidation of dealers could cause major harm to the company’s revenue growth. Keep in mind that fewer dealers may reduce the overall demand for services, so the number of transactions may decline. Management was clear about these risks in the last 10-k:

Despite our market position, consolidation or closures of automobile dealers could reduce the aggregate demand for our services in the future and limit the amounts we earn from our solutions. In addition, advertising purchased by OEMs accounts for a meaningful portion of our revenue.

CARS may receive negative publicity from journalists or equity researchers about the company’s technology, customer services, or its marketing practices. As a result, clients may decide to use the services of competitors, or may visit less CARS’ websites. In sum, sales growth and free cash flow growth may be lower than expected. Management highlighted these risks in its annual documentation.

If we experience persistent negative publicity, or if consumers otherwise perceive that content on the CARS sites or mobile applications is not reliable, our reputation, the value of our brands and traffic to our sites and mobile applications could decline.

Under these bearish assumptions, I included sales growth close to 3.5%, an EBITDA margin around 29.5%, and FCF margin close to 20%. My results, which are shown below, include free cash flow worth approximately $115 million and $170 million. With a discount of 15% and net debt close to $500 million, the implied equity valuation would be $528 million with a fair price of $7.8 per share.

My DCF Model

My Best Case Scenario Includes Aggressive Mergers And Acquisitions

In my view, with sufficient acquisition of small competitors or other websites, CARS could increase its market share, and economies of scale could benefit the P&L. Under my best case scenario, I also assumed that those acquisitions would be made at a very convenient price for CARS, which will likely enhance free cash flow generation. The following words are from the last annual report:

We are pursuing a product-first growth strategy, which includes targeted M&A to cement our position as the destination for car shoppers and sellers. We believe this strategy will ultimately deliver above market results including sustainable high growth revenue, earnings, and cash flow.

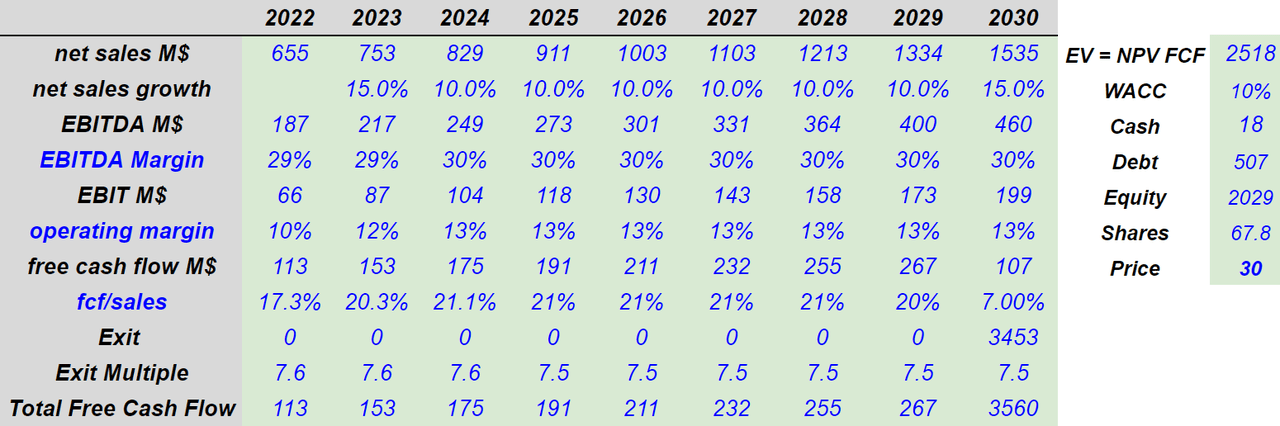

Under the best case scenario, net sales growth around 10%, an EBITDA margin of 30%, and FCF/Sales ratio of 21.2% resulted in 2028 FCF close to $255 million. Finally, with a WACC of 10%, the implied market capitalization would be close to $2 billion, and the fair price would be $30 per share.

My DCF Model

My Takeaway

After a significant decrease in debt levels and with beneficial guidance for the rest of 2022, CARS looks promising for investors. In my opinion, with sufficient investment in marketing, more traffic, and investments in new tech developments, further free cash flow will likely come. I also believe that new acquisitions could also increase economies of scale, and may justify a total valuation of $30 per share. In my view, even considering risks from negative publicity or lower traffic generation, CARS looks quite undervalued at the current market price.

Be the first to comment