Sundry Photography

Thesis

Leading memory wafer fab equipment player Lam Research Corporation (NASDAQ:LRCX) stock has come under pressure recently after staging its lows in early July.

We are confident that LRCX has likely bottomed out over the medium-term, despite the recent sell-off, in line with its broad semi peers. Notwithstanding, concerns over its supply chain situation and worsening macroeconomic headwinds have also impacted its downstream peers. Furthermore, Lam Research’s significant exposure to the more volatile memory players could continue to pressure its revenue visibility.

However, we posit that the nearly 50% drubbing from its January highs to its July lows has reflected its near-term challenges, as memory’s growth for FQ4 came in well below its trend. The company has also diversified its revenue base with its TAM expansion in advanced packaging for logic processes driving growth for Lam Research. Furthermore, we are confident that some near-term headwinds relating to weaker macros and lower freight and logistics costs should abate further through FY23.

Moreover, the company’s FQ1’23 guidance has also reflected the headwinds relating to the sub-14mm export controls to China, which we postulate has de-risked its forward outlook.

Therefore, we believe the recent pullback from its August highs represents a solid opportunity for investors who missed the July lows to layer in/dollar-cost average. Accordingly, we rate LRCX as a Buy.

Memory Headwinds Should Subside Over Time

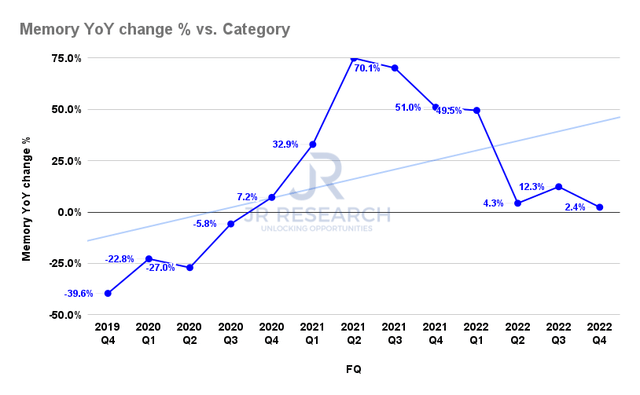

Lam Research memory revenue change % (Company filings)

As seen above, Lam Research posted a 2.4% YoY growth in its memory segment revenue in FQ4, down from FQ3’s 12.3%. Therefore, it marked another below-trend growth for the company after lapping the above-trend growth metrics from FY21. Accordingly, investors are reminded yet again of the cyclicality of memory revenue, despite the secular tailwinds that have expanded the TAM for its memory customers.

However, we posit that the market had already adjusted its expectations on Lam Research’s memory business, which accounted for about 54% of its FQ4’22 revenue (60% of its FY22 revenue base). Despite the CapEx revisions by Micron (MU) and elevated inventory at other downstream customers, we are confident that the industry is adjusting appropriately to the cyclical downturn while retaining its secular growth drivers.

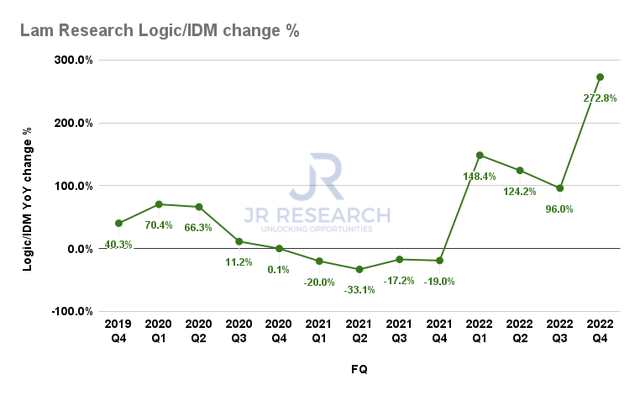

Lam Research logic/IDM revenue change % (Company filings)

Furthermore, the company’s expansion into its logic segment has been remarkable, as seen above. Its ability to leverage the secular drivers underpinning advanced packaging should help Lam Research mitigate the cyclical slowdown in memory, providing more robust revenue visibility into FY23 and beyond.

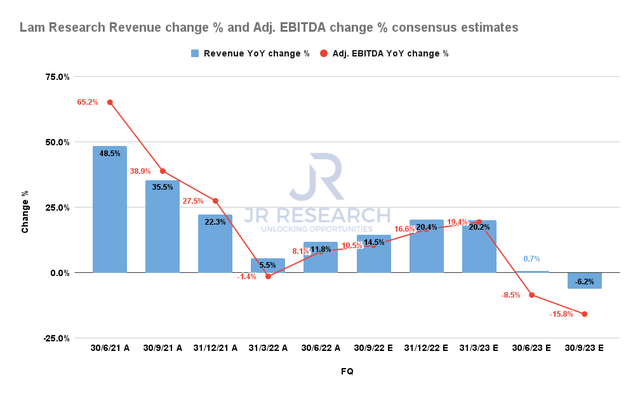

Lam Research revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Accordingly, we are confident that the consensus estimates (bullish) are credible, as it indicates that Lam Research should climb out of its nadir through FY23.

Even though the company did not provide explicit guidance for the full year, it continues to see improvement in its supply chain environment, which should drive its revenue growth recovery. CEO Tim Archer articulated:

We expect to see incremental improvement in supply chain conditions in the September quarter, but our view is that industry-wide output will continue to be constrained through the rest of this year. (Lam Research FQ4’22 earnings call)

Notwithstanding, we must highlight that the company also cautioned that the demand situation could weaken further through FY23, even though it has yet to observe any material impact. Therefore, we urge investors to continue monitoring the supply chain dynamics and sell-through in the downstream customers as a barometer of the bottoming process of the current cyclical adjustments.

Despite that, we are confident that LRCX’s valuations have been de-risked adequately to reflect these headwinds.

LRCX’s Valuations Have Been Battered

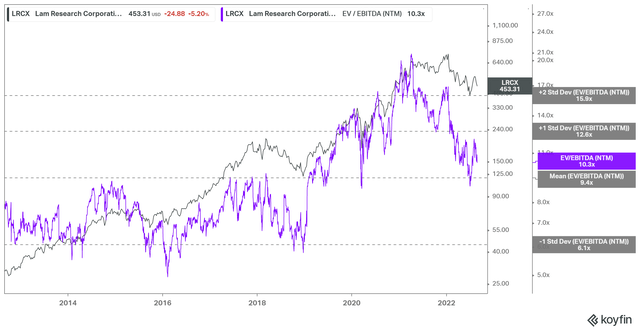

LRCX EV/NTM EBITDA valuation trend (koyfin)

LRCX’s NTM EBITDA multiples fell from its 10Y mean at its recent July lows. Still, some bears could argue that LRCX’s valuations were even lower in its pre-COVID days. However, we posit that the company’s TAM expansion into logic/foundry should offer higher revenue visibility and diversification than its pre-COVID days. Therefore, investors should not understate the success as it broadens its market share gains in the ex-memory segments.

Moreover, Lam Research highlighted that it still sees its gross margins expansion path remains intact, despite the near-term headwinds. Therefore, the accretion should also drive operating leverage moving ahead, as these headwinds normalize over time. As such, we are confident that the market had re-rated LRCX above its pre-COVID valuation zones and posit that its July lows should hold resiliently.

Is LRCX Stock A Buy, Sell, Or Hold?

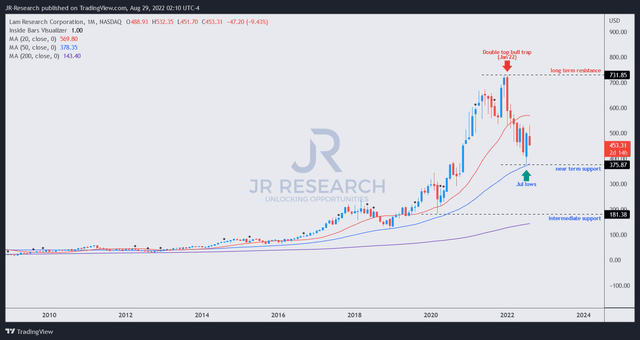

LRCX price chart (monthly) (TradingView)

LRCX traded close to its 50-month moving average (blue line) at its July lows. It has consistently supported LRCX’s long-term uptrend over the past ten years, including the downturn in 2018/19 and the COVID bear market in 2020.

Therefore, we are confident that LRCX has already formed its medium-term bottom. As such, we encourage investors to use the recent pullback as an opportunity to add more positions as the market digests the recovery from its July lows.

Accordingly, we rate LRCX as a Buy.

Be the first to comment