piranka

Cash is King in more ways than one, especially when it comes to taking advantage of bargain basement opportunities during market sell-offs. The recent market downturn has been a double-whammy for stocks that were already cheap with elevated dividend yields.

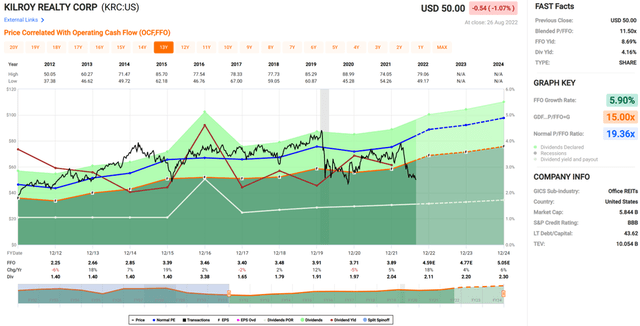

Such I find the case to be with Kilroy Realty (NYSE:KRC), which as seen below, is now trading well below its 52-week high of $79 from as recently as March. For a company of KRC’s quality and size to lose billions of market capitalization in a matter of months seems irrational. In this article, I highlight why this mispricing presents a great opportunity for dividend growth investors.

Why KRC?

Kilroy Realty is an internally-managed REIT that’s been around for over 7 decades, well longer than most other REITs in the market today. It’s also a member of the S&P MidCap 400, and is focused on acquiring, developing, and managing office and mixed-use properties. KRC is led by long-term CEO and namesake, John Kilroy, who’s served as CEO since it was a private company prior to the mid-1990s.

What sets KRC apart from other office REITs is its heavy focus on owning newer Class-A buildings in high barrier-to-entry West Coast urban markets. At present, it owns 115 properties consisting of 15 million square feet, and it’s positioned itself to benefit from the fast-growing life sciences sector.

The average age of its property portfolio is just 11 years, well below the 30-year average among its peers. This combined with premium locations in life sciences hubs such as San Diego, San Francisco, and Seattle enable KRC to charge a premium on its rents.

Meanwhile, KRC has continued to demonstrate robust fundamentals, with revenues growing by 20% YoY to $271 million in the second quarter, and importantly, FFO per share grew by 33% YoY to $1.17. Portfolio metrics appear to be strong, with a 91% and 93.7% occupancy and leased rates, respectively.

These metrics were driven by strong demand for its premium quality properties, as supported by a healthy venture capital environment for tech and life sciences companies. This is reflected by the fact that $144 billion of VC capital invested during the first half of this year alone, roughly matching the full year deployment levels of 2018 and 2019.

Looking forward, KRC should be well-positioned to continue driving higher rents on its relatively newer and high-quality properties. This is supported by analysis from CBRE, which points to top tier office building rents being up 8% since 2020.

KRC is also well-positioned to fund its pipeline as it maintains a BBB rated balance sheet with a safe net debt to EBITDA ratio of 5.9x. It also has a long-weighted remaining debt term of 7 years, with no maturities until 2024, and has $1.1 billion in available capacity on its revolving credit facility plus $210 million in cash on the balance sheet.

Moreover, KRC maintains plenty of retained capital to fund growth, with a dividend payout ratio of just 44% (based on Q2 FFO per share of $1.17). At present, KRC yields a respectable 4.2%, and the dividend has a 5-year CAGR of 6.1%.

Risks to KRC include ongoing uncertainties with return to office for some workers, as flexibility has become the primary concern compared to COVID two years ago. However, many companies now increasingly want their employees back in the office and I believe a hybrid work environment serves as a good middle ground. Moreover, Morningstar’s analysis shows that the “death of the office” has been grossly overstated, as noted in its recent analyst report:

The dire predictions about the death of office space in the early days of the pandemic have not really materialized. Multiple surveys have shown that employers want their employees to come back to the office. We are already starting to see companies sign long-duration leases demonstrating confidence in the long-term future of the office. In the long run, we believe that offices will continue to be the centerpiece of workplace strategy and will play an essential role in facilitating collaboration, harnessing innovation, and maintaining the company culture.

We are seeing an increasing number of companies requiring their employees to return to the office. In the long run, we believe that remote work and hybrid remote work solutions will gain increasing acceptance, but offices will continue to be the centerpiece of workplace strategy and will play an essential role in facilitating collaboration, harnessing innovation, and maintaining the company culture.

Lastly, I find KRC to be undervalued at the current price of $50, with a forward P/FFO of just 10.9x, sitting materially below its normal P/FFO of 19.4 over the past decade. Sell side analysts have a consensus Buy rating on KRC with an average price target of $64.27, implying a potential one-year 32% total return including dividends.

Investor Takeaway

KRC is a premium office REIT that is positioned to continue benefiting from the strong demand for office space, especially among tech and life sciences companies. It also has a healthy balance sheet and has plenty of liquidity and retained capital to fund its growth pipeline. With a respectable dividend yield and a low valuation, KRC presents an attractive long-term opportunity for income and value investors alike.

Be the first to comment