NicoElNino

Investment Thesis

Cybersecurity threats have increased over the past decade, and as the world becomes even more digital, the threat of cyberattacks is only going to keep increasing. Businesses know the risks posed if their cybersecurity provider is not up to scratch, and so cybersecurity is an industry where you want to be the very best – enter, CrowdStrike Holdings, Inc. (NASDAQ:CRWD).

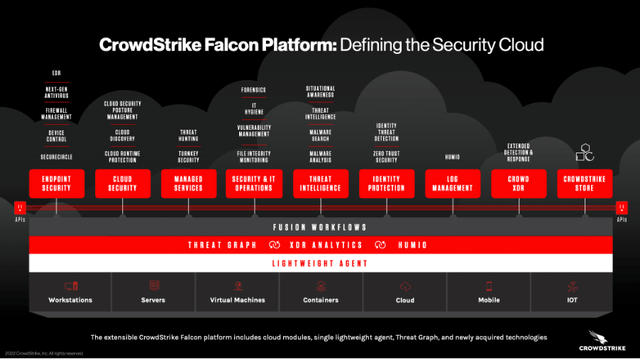

Founded in 2011, CrowdStrike is a cloud-native cybersecurity company operating a software-as-a-service business model. Due to this cloud-native approach, CrowdStrike’s core offering, the Falcon platform, has been able to scale rapidly whilst delivering impressive results that legacy players struggle to compete with.

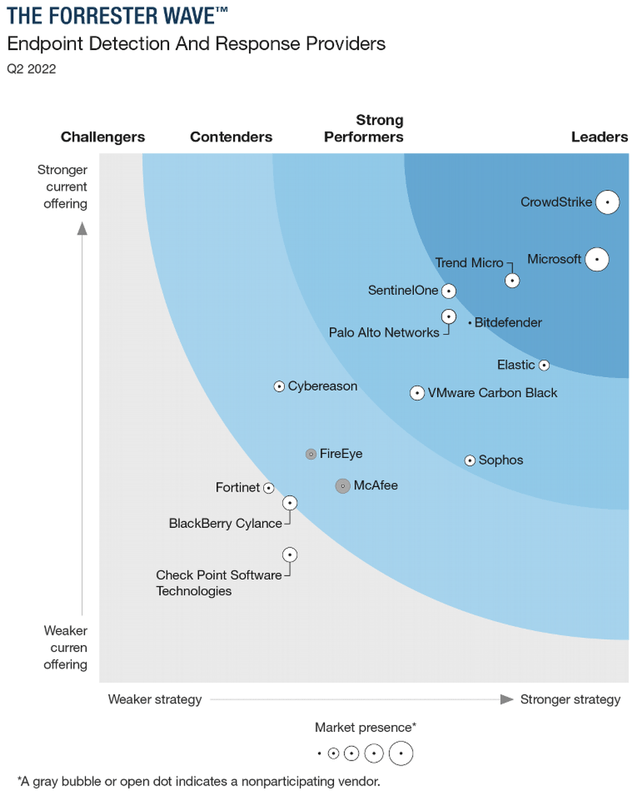

Forrester Research

This platform specializes in endpoint and cloud workload protection, meaning that it can protect endpoint devices (laptops, desktops, mobile phones, IoT devices, etc.) operating in both on-premise and cloud-based environments. CrowdStrike is consistently adding new solutions to the Falcon platform, giving customers an excuse to spend more and more money with this business.

CrowdStrike August 2022 Investor Presentation

I outlined in a previous article exactly why CrowdStrike was (and still is) the highest conviction investment in my portfolio: it has powerful economic moats that will only get stronger, it is founder-led with plenty of skin-in-the-game, it has an attractive margin profile, and it is a leader in an industry that is only going to get bigger and more important.

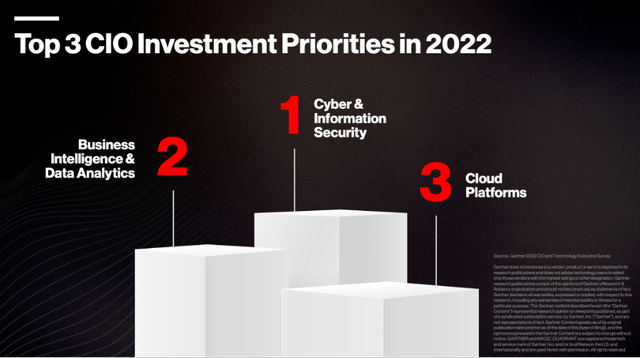

Perhaps the most enticing aspect about CrowdStrike right now is its industry. Plenty of companies are cutting back on expenses due to the difficult macroeconomic conditions, but cybersecurity remains the top investment priority for Chief Information Officers.

CrowdStrike September 2022 Investor Briefing

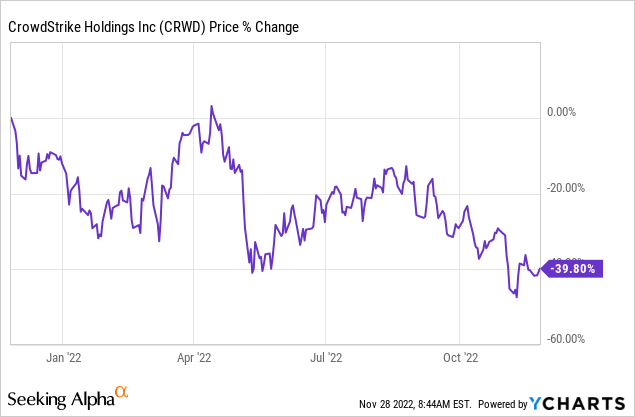

Despite all the positives, and CrowdStrike’s consistently brilliant business performance, it’s been a tough year for shareholders. CrowdStrike’s shares have tumbled 40% over the past twelve months, as valuation multiples have contracted in a market that doesn’t have time for unprofitable technology stocks.

All CrowdStrike can do is keep putting up strong results, and with the company poised to announce its Q3’23 earnings shortly, here’s what I’m watching out for.

CrowdStrike’s Latest Expectations

CrowdStrike is set to report its Q3’23 earnings on Tuesday, November 29, after the market closes, and there are several key items that investors should keep their eyes on.

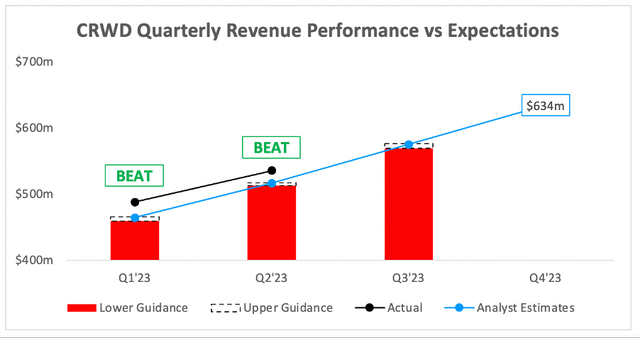

Starting with the headline numbers, where analysts are expecting Q3’23 revenue of $575m, representing YoY growth of 51%. Whilst this growth may sound impressive, I would not be surprised if CrowdStrike continues its habit of beating analysts’ expectations and delivering even more impressive revenue growth.

Seeking Alpha / Author’s Work

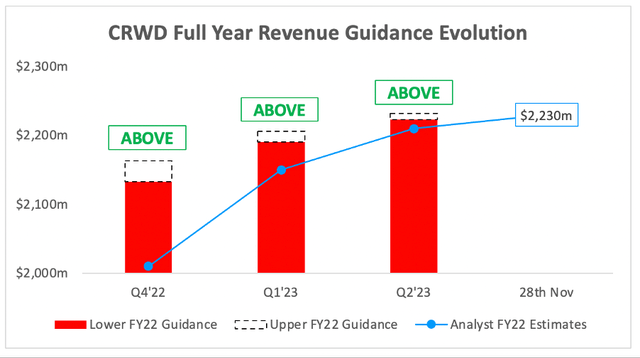

Looking ahead to the full year, and analysts are expecting CrowdStrike to bring in revenue of ~$2,230m, which would represent YoY growth of 54%. Once again, CrowdStrike has always given full year guidance that is ahead of analysts’ expectations – I certainly wouldn’t bet against them doing so again, despite a tough macroeconomic environment.

Seeking Alpha / Author’s Work

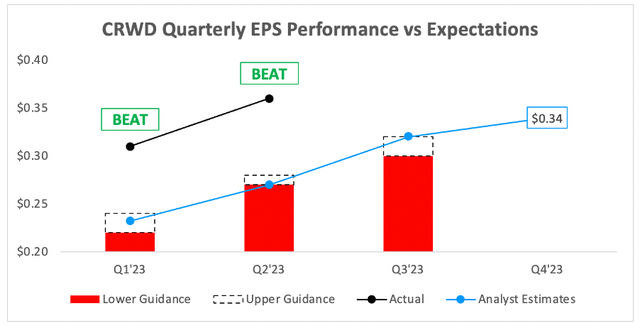

Moving onto the bottom line, and analysts are expecting Q3’23 EPS of $0.32, which is at the top end of management’s $0.30-$0.32 guidance. Whilst adjusted bottom line earnings shouldn’t be a core focus for investors in CrowdStrike at this stage, it has been nice to see the company consistently beat Wall Street’s expectations.

Seeking Alpha / Author’s Work

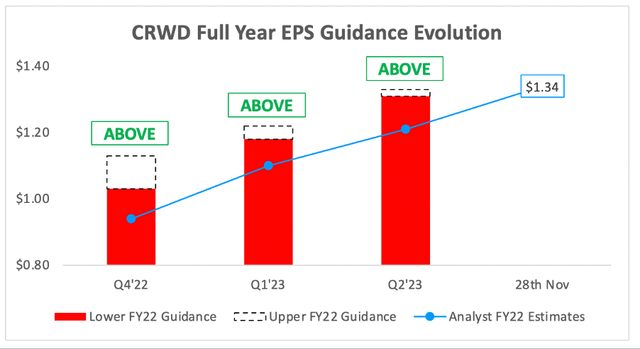

Time for the final graph demonstrating CrowdStrike’s excellence so far in a year where many companies have struggled; its full year EPS guidance has been consistently raised above analysts’ expectations. Right now, analysts are expecting CrowdStrike to deliver FY23 EPS of $1.34, sitting just ahead of management’s latest $1.31-$1.33 guidance.

Seeking Alpha / Author’s Work

All in all, it’s clear that analysts are expecting strong results from CrowdStrike, as am I. Yet despite these fairly high expectations, I would still be looking for CrowdStrike to deliver yet another quarter full of beats across the board, with another raise of its full year revenue guidance.

Anything less will be somewhat underwhelming, but I don’t foresee any struggles for CrowdStrike when it comes to pleasing investors and analysts alike by beating these headline estimates.

Key Metrics: Land-and-Expand

One of the cornerstones of my investment thesis for CrowdStrike is its ability to land-and-expand with its customers. Once a customer joins CrowdStrike’s platform, it makes it a lot easier to upsell them with multiple additional products and services – in this case, known as modules.

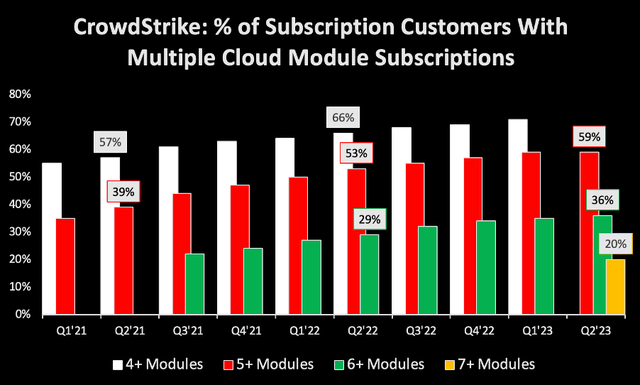

CrowdStrike offers up some details on the percentage of its subscription customers with multiple cloud module subscriptions, and these figures have all been trending in the right direction.

As of Q2’23, the percentage of customers with five or more modules was 59% (vs 53% in Q2’22) and the percentage of customers with six or more modules was 36% (vs 29% in Q2’22).

Author’s Work / CrowdStrike’s Earnings Calls

Management recently changed its way of reporting these; rather than stating the percentage of customers with 4+, 5+, and 6+ modules, investors can now see the percentage of customers with 5+, 6+, and 7+ modules.

It will be very interesting to see how the growth of this new ‘7 or more modules’ category trends over the upcoming quarters, as it’s currently sitting at 20%. If previous trends are anything to go by, we should see more and more customers taking up more and more modules, thereby enhancing CrowdStrike’s moats of switching costs (more modules = more hassle to switch) and its network effect (more data = better threat detection and prevention).

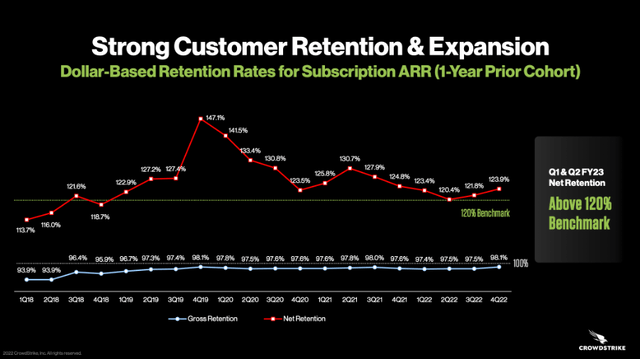

The successful land-and-expand strategy can also be seen in CrowdStrike’s dollar-based net retention rates, which are consistently above its benchmark of 120%. It’s worth noting that CrowdStrike has not released exact figures for Q1’23 and Q2’23 net retention rates, but CEO and Co-Founder George Kurtz had this to say on the Q2’23 earnings call:

Gross retention climbed to a new record for the second consecutive quarter, and dollar-based net retention reached its highest level in seven quarters.

CrowdStrike August 2022 Investor Presentation

Even from what we can see, the gross retention has been extremely strong, hitting 98.1% in Q4’22. This is no surprise, as cybersecurity is a business-critical product, and no customer will willingly want to leave CrowdStrike’s industry leading platform.

CrowdStrike September 2022 Investor Briefing

In short, outside of the headline figures, I will be looking closely at CrowdStrike’s ability to continue pulling more customers into its 5+, 6+, and 7+ module categories. I’m also expecting its dollar-based net retention rate to remain above 120%, although I would love some exact figures from management this quarter.

Quick Take: CrowdStrike’s Core Financials

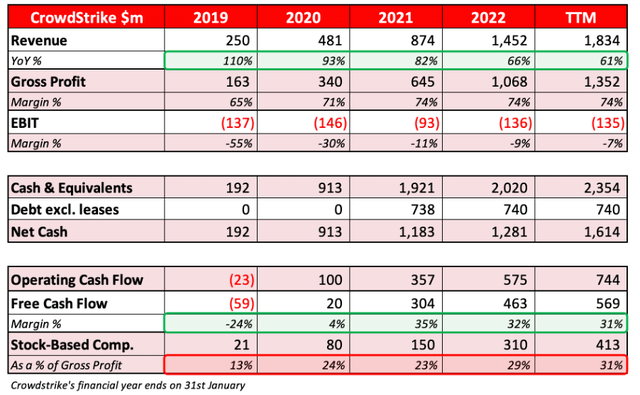

I’d also like to touch on some of CrowdStrike’s financials, starting by looking at the trailing-twelve-month trends.

Starting from the top, and we can see extremely strong revenue growth from this company since its IPO in 2019. Even when looking over the past twelve months, revenue has still grown at a staggering 61% to exceed $1.8 billion – not too shabby considering all the difficulties that businesses across the globe are facing.

Perhaps one of the negatives is CrowdStrike’s EBIT margins, which have been at -7% over the past twelve months despite continually improving. This has been driven by CrowdStrike’s stock-based compensation, which represents a whopping 31% of its gross profit over the past twelve months.

Author’s Work

I’m usually lenient on companies when it comes to SBC, but CrowdStrike does need to put in more effort to get this under control. As the above table shows, stock-based compensation has consistently increased as a percentage of gross profit, despite the impressive gross profit growth. In my eyes, these numbers should be at least stable if not decreasing.

On the plus side, this has helped CrowdStrike to deliver impressive free cash flow margins exceeding 30%, even if it is somewhat subsidised by this shareholder dilution.

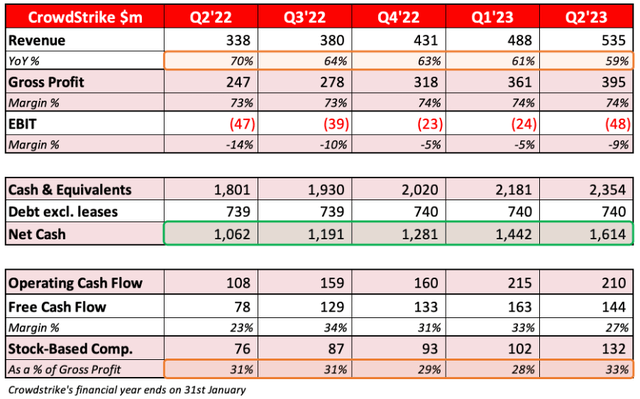

Moving onto the quarterly trends, and some investors may be concerned by the apparent revenue growth slowdown. Whilst I understand this concern, a company that brings in more than $1.8 billion in revenue over the past twelve months can’t be expected to grow at 60% in perpetuity. The company continues to deliver strong growth rates, with revenue growing by 59% YoY in Q2’23.

Author’s Work

The other attractive aspect about CrowdStrike’s financials is the company’s net cash position, which has been growing each quarter and now stands at just over $1.6 billion. This puts CrowdStrike in an even stronger financial position, especially if it needs to withstand any shock.

All in all, CrowdStrike continues to have a very strong financial profile with plenty of items trending in the right direction; but, I do hope to see that SBC fall over time.

CRWD Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether CrowdStrike is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

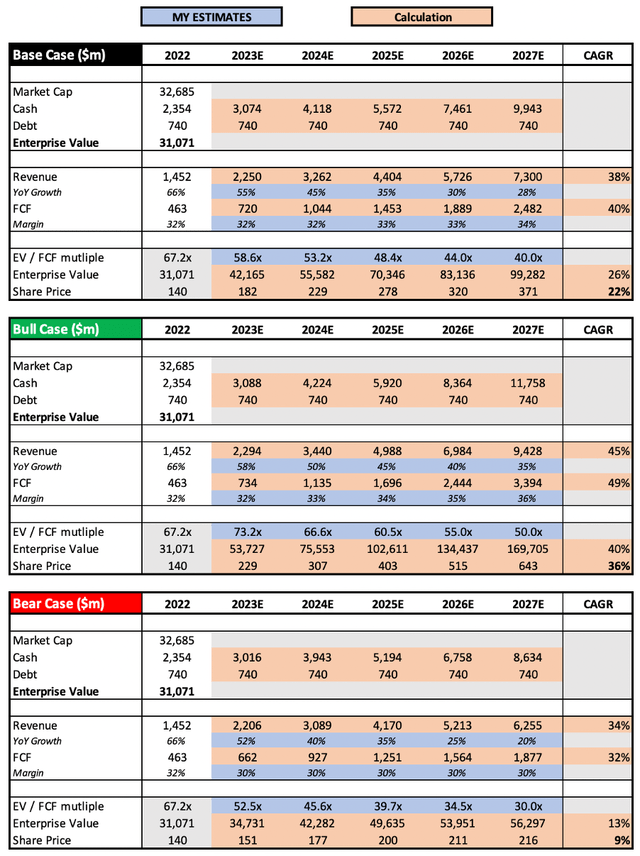

Author’s Work

I haven’t actually changed any assumptions from my previous article, which can be used as a reference point for the details within this model.

Put it all together, and I can see shares of CrowdStrike achieving a CAGR through to 2027 of 9%, 22%, and 36% in my respective bear, base, and bull case scenarios.

Bottom Line

There are few companies that I feel as confident in heading into earnings as CrowdStrike, since this business has delivered stellar results time and time again. The share price may fluctuate, but that’s not a bad thing for long-term investors who watch the business rather than the stock – especially now, as I currently see an attractive share price for an outstanding business.

I’ll be watching eagerly to see how CrowdStrike performs when it reports Q3 earnings on Tuesday after the market closes, but for now, I will reiterate my previous ‘Strong Buy’ rating.

Be the first to comment