FilippoBacci

Buying shares of companies that are dealing with difficult times because of the economic environment can be risky but very profitable. Because economic conditions can change over time, and will likely improve at some point in the future, many of the companies that are experiencing pain today can turn around and become stellar prospects in retrospect. One candidate for this is a firm called Stitch Fix (NASDAQ:SFIX), an enterprise that has reimagined the way that retail shopping might be. In the years leading up to the current fiscal year, 2023, the picture has been generally positive for the company from a sales perspective. Unfortunately, profits and cash flows have seen better days. On the other hand, the company’s robust balance sheet does provide it a great deal of capital during these difficult times and shares have already fallen rather significantly. Ultimately, I do believe that the company does have some upside potential. But for those who don’t like risk that could be commensurate with their returns, there are certainly better and safer opportunities on the market to be had.

Stitch Fix – A niche retail play

As I mentioned in the opening of this article, Stitch Fix is a different type of retail company than what most individuals might be accustomed to. As a web-based retailer, the company connects users with clothing, shoes, accessories, and more, in two different ways. First, consumers use the company’s app or website to tell the business about their style. The company’s algorithm then sends clothing that it thinks would be appropriate to the customer in question. The second approach is to buy clothing directly from the company’s website of the customers choosing. Ultimately, clients can choose to schedule automatic shipments or they can order their clothing and other products on demand. Once they receive their shipment, they can easily return the items they choose not to keep.

Initially, the company’s business model centered around women’s apparel. But as time progressed, the company expanded its capabilities into men’s clothing, kids’ clothing, petite clothing, maternity clothing, and even plus-sized apparel. Shoes and accessories are also sold on its platform. The business does also generate some of its revenue from advertising activities. But the vast majority comes from its core operation that involves the aforementioned sale of goods to its clients.

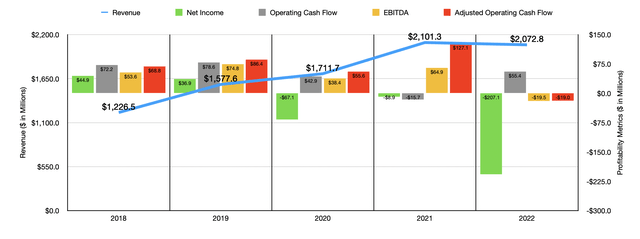

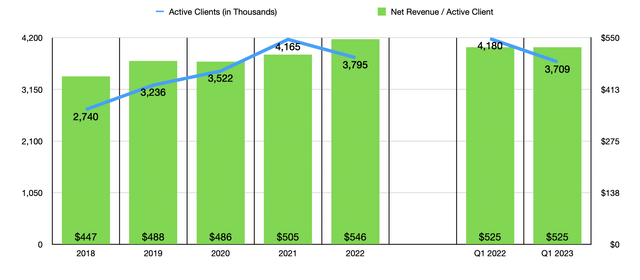

Over the past five years, the financial picture for Stitch Fix was quite positive. Sales shot up from $1.23 billion in 2018 to $2.10 billion in 2021. Then, in 2022, sales pulled back slightly to $2.07 billion. The company’s growth over these few years has really been related to two key operating metrics. The first, and ultimately most important, is the number of active clients who use its service. This number jumped from 2.74 million in 2018 to 4.17 million in 2021. During the 2022 fiscal year, this number declined to just under 3.80 million, with management attributing this to a slowdown in consumer discretionary spending that was most prevalent in the final quarter of that fiscal year. Client conversion challenges and lower site traffic, as well as the weaker-than-expected conversion of new clients caused by onboarding friction, all seemed to have played a role in this decline. The second contributor has been an increase in the average net revenue per active client. This number has risen in four of the past five years, ultimately climbing from $447 in 2018 to $546 in 2022.

Although the general trend for revenue prior to the current fiscal year was positive, profitability has long been a problem for the company. Back in 2018, the company did generate a profit of $44.9 million. This number declined slightly to $36.9 million in 2019. But in the years since, the company has consistently lost money, with its net loss in 2022 totaling $207.1 million. From 2021 to 2022, the company saw its gross margin decline by 1.3%, largely because of an increase in inventory charges for excess spring and summer inventory for the current fiscal year. And second, selling, general, and administrative costs managed to rise from 48.1% of sales to 53.9%. This significant move higher was mostly related to higher compensation and benefits expenses, including higher stock-based compensation as the company continued to make investments in additional technology talent. Restructuring and other one-time costs also impacted profits to the tune of $26.2 million. Unfortunately, net income was not the only area where the company struggled. As recently as 2019, the company generated operating cash flow of $78.6 million. This turned negative in 2021 before recovering some to $55.4 million in 2022. If we adjust for changes in working capital though, the picture looks really awful, with the metric peaking at $127.1 million and 2021 before plunging to negative $19 million in 2022. A similar trend can be seen when looking at EBITDA, with the metric turning from a positive $64.9 million in 2021 to a negative $19.5 million in 2022.

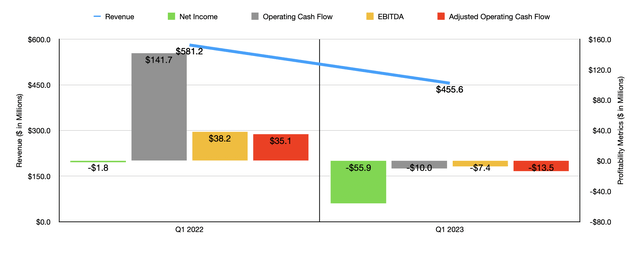

After the market closed on December 6th, the management team at Stitch Fix announced financial results covering the first quarter of the company’s 2023 fiscal year. By pretty much all accounts, the data was less than ideal. Revenue of $455.6 million missed the expectations set by analysts by nearly $4 million. In addition to missing analysts’ expectations, this also represented a meaningful decline compared to the $581.2 million in revenue the company reported the same time last year. Although net revenue per average client remained virtually flat at $525, the number of active clients for the company plunged from 4.18 million in the first quarter of 2022 to 3.71 million the same time this year. On top of this, the company generated a net loss of $0.50 per share. That missed the expectations set by analysts to the tune of $0.03 per share. In total dollar terms, the company’s net loss was $55.9 million. That compares to the $1.8 million net loss experienced the same time last year. By all other accounts, the picture worsened year over year. Operating cash flow plunged from $141.7 million in the first quarter of 2022 to negative $10 million the same time this year. Even if we adjust for changes in working capital, it would have gone from $35.1 million to negative $13.5 million. Meanwhile, EBITDA also worsened, dropping from $38.2 million to negative $7.4 million.

There was some decent news for shareholders. And that largely related to guidance. Unfortunately, management is now forecasting revenue this year of between $1.6 billion and $1.7 billion. That’s down from the $1.76 billion to $1.86 billion management previously forecasted. On the other hand, the firm is now expecting EBITDA to be between negative $10 million and positive $10 million. The prior expected range was from negative $45 million to negative $25 million. This improvement comes in response to cost-cutting initiatives engaged in by management. It’s also worth noting that inventory levels could have been worse. Compared to the same time last year, inventories are higher, but only to the tune of 19.6%.

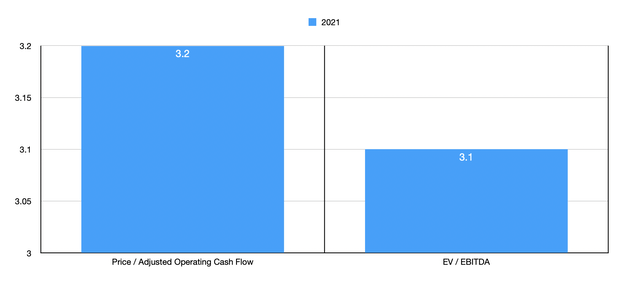

Generally speaking, I like to value companies when I write about them. But it’s difficult to value a business that not only generates negative cash flows and earnings, but that also is showing a trend that’s worsening year over year. If we were to value the company based on the results from its 2021 fiscal year, then the stock would be incredibly cheap. On a price to adjusted operating cash flow basis, we would be looking at a trading multiple of 3.2, while the EV to EBITDA approach should yield a multiple of 3.1. These members would certainly justify significant upside for shareholders should the company recover back to what it saw then. The big question is whether or not the company has the financial stability to wait through these difficult times. Fortunately, the business has no debt, and it has cash and cash equivalents of $203.4 million. Even if cash flow were three times worse than what it was last year, the business would still have enough capital on hand to last over 3.5 years. That’s quite a bit of wiggle room to work with.

Takeaway

Based on what data we have at our disposal, I will say that Stitch Fix is most certainly an intriguing opportunity. I don’t like a lot of the pain the company is experiencing and it’s unclear whether its clients are actually leaving for good or might come back online. This creates for investors a very risky opportunity that could play out either really well or really poorly for those involved. Given how much cash the company has on hand, I lean more in the direction of believing the business can pull off a recovery. But as a value investor who focuses on stability, I cannot in good conscience rate the enterprise any higher than a ‘hold’ at this time. In the event that we start to see more positive signs of a turnaround instead of continued signs of deterioration, my stance on the matter could change.

Be the first to comment