greenbutterfly/iStock via Getty Images

Crowdstrike (NASDAQ:CRWD) remains a Wall Street darling even amidst a tech crash. While the stock has dipped from all time highs, it still trades at rich multiples even today. Crucial to the thesis is CRWD’s ability to continue executing at a high level as the cybersecurity company adds to its addressable market. CRWD is generating positive free cash flow and has a cash-rich balance sheet. Even amidst a very bearish environment for tech stocks, the future of cybersecurity remains very promising and as relevant as ever. I continue to find CRWD highly buyable as part of a higher quality tech allocation.

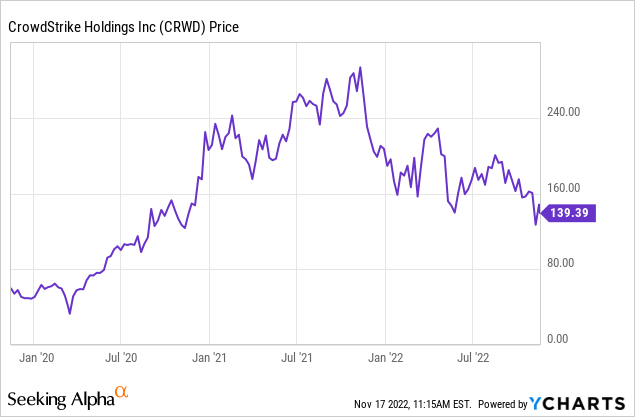

CRWD Stock Price

It seems that most tech stocks are down in excess of 70% from all time highs. In that regard, CRWD is down “only” 53%.

I last covered CRWD in July where I rated the stock a buy on account of the strong growth prospects. The stock is down another 24% since then as the rally in tech stocks proved short-lived. Investors would be wise to look carefully in the tech sector for bargain buying opportunities.

CRWD Stock Key Metrics

CRWD has been the rare tech company able to balance hyper-growth with positive cash generation.

2022 Q2 Presentation

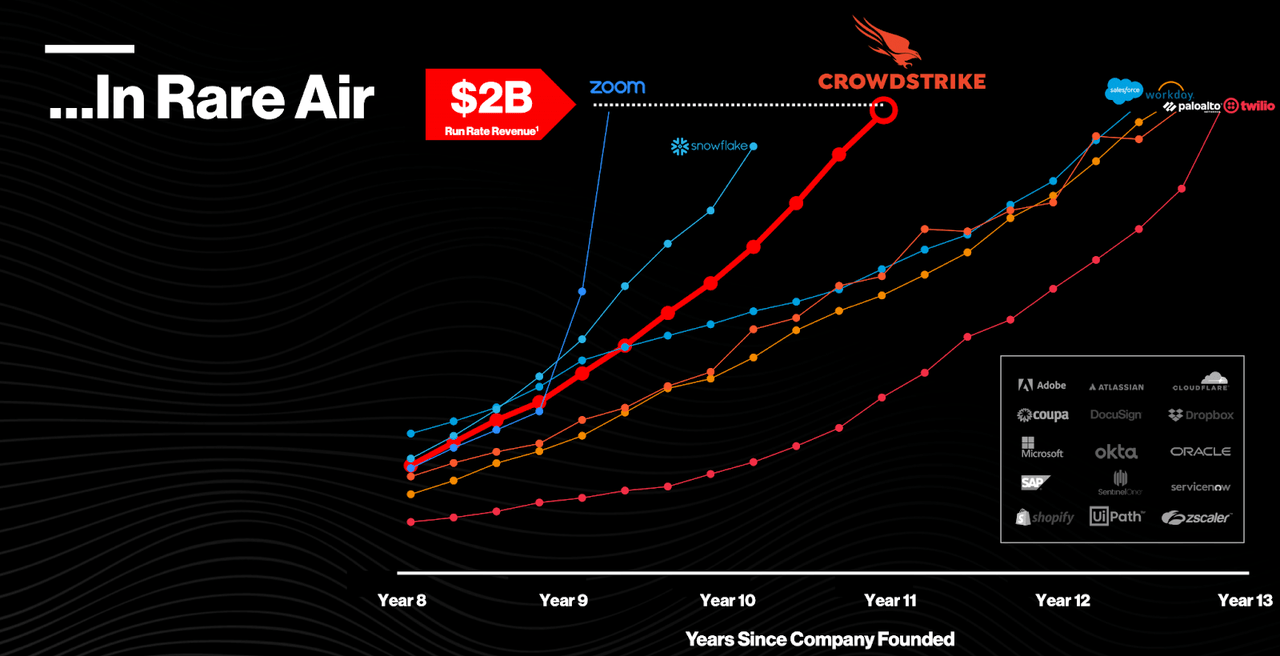

CRWD ranks as one of the fastest growing tech companies ever, as seen below.

2022 Q2 Presentation

The latest quarter saw CRWD report $535.2 million in revenue, representing 58% year over year growth and comfortably exceeding its prior guidance of $516.8 million. While CRWD is still not yet profitable on a GAAP basis, the company did generate a 16.3% non-GAAP operating margin in the quarter, representing some expansion from the 10.5% margin in the prior year. The main difference between GAAP and non-GAAP operating margin is, unsurprisingly, equity-based compensation. Free cash flow of $135.8 million exceeded the $87.3 million in non-GAAP operating income due to deferred revenues. CRWD ended the quarter with $2.32 billion of cash versus $740 million of debt.

Looking ahead, CRWD has guided for the next quarter to see up to 51.5% revenue growth to $575.9 million and for the fourth quarter to see up to 46.9% growth to $633.1 million – both representing an increase in prior guidance. While CRWD stock is still not obviously cheap, that premium appears to be placed for a good reason as this is a company that continues to beat and raise guidance even while many companies are feeling the brute force of inflation and other macro headwinds.

Is CRWD Stock A Buy, Sell, or Hold?

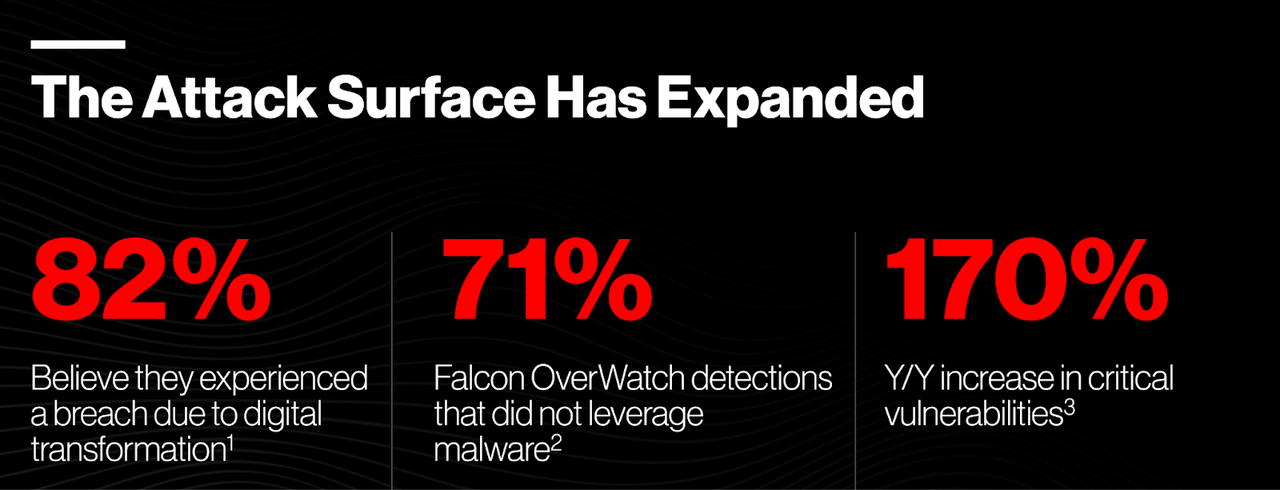

CRWD remains a compelling investment on the growth of cybersecurity. CRWD is best known for its endpoint protection products (you can think of Crowdstrike as offering cybersecurity protection on specific hardware devices). As more and more companies are moving more and more of their businesses online and to the cloud, the cybersecurity risk has only improved: therein lies CRWD’s opportunity.

2022 Q2 Presentation

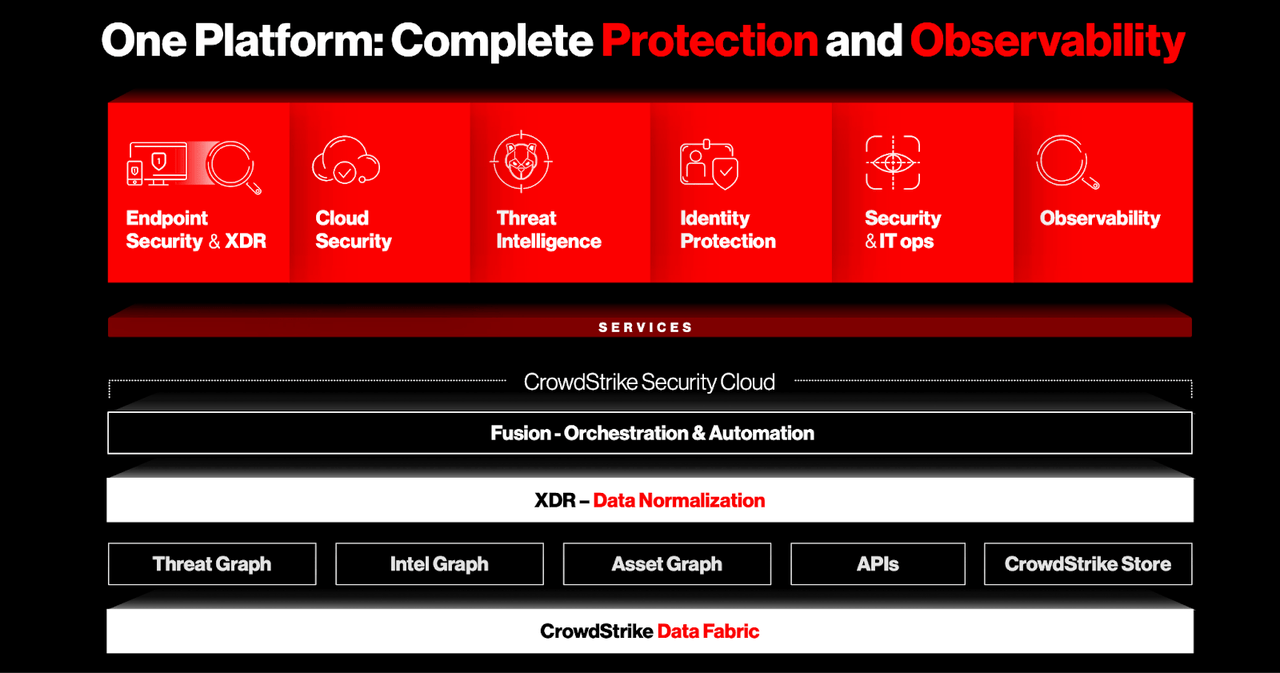

In addition to its endpoint security, CRWD has developed its product offering to include a full suite of cybersecurity services.

2022 Q2 Presentation

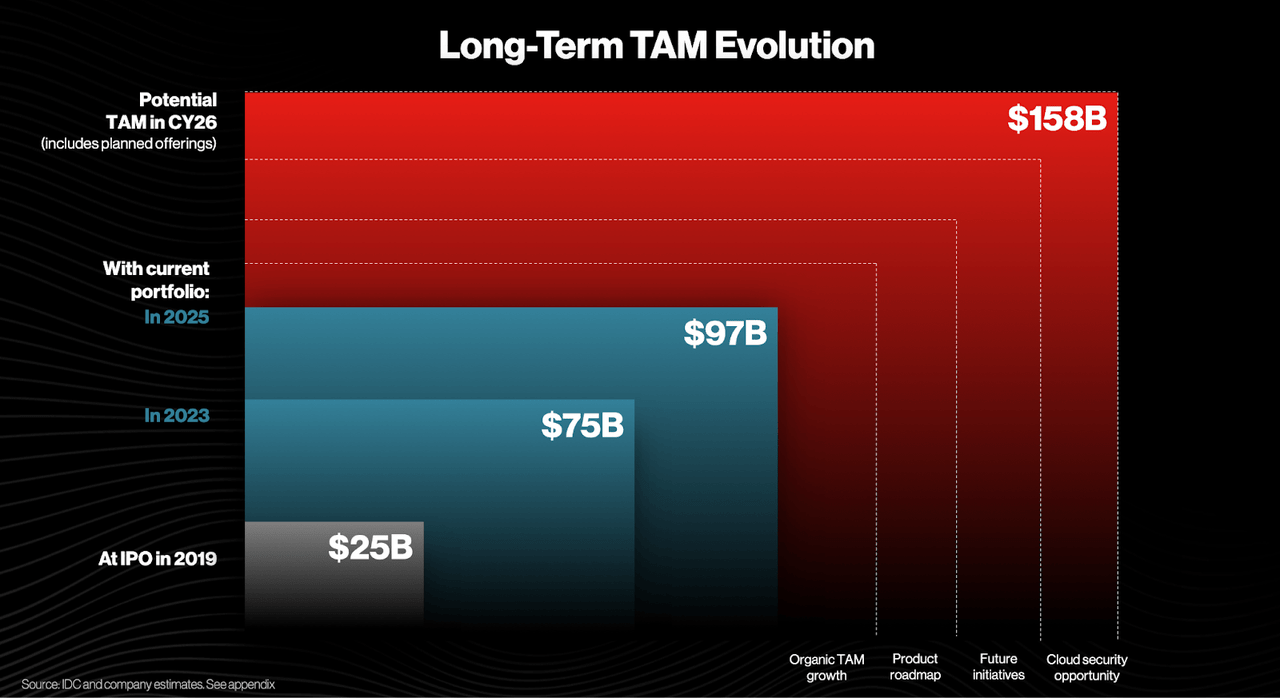

CRWD believes that its total addressable market based on its current portfolio will be $97 billion in 2025, but that it can also increase that TAM to $158 billion by then by unveiling new offerings.

2022 Q2 Presentation

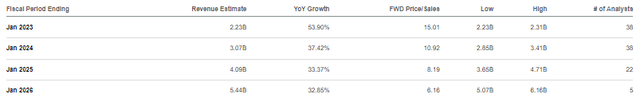

That projected increase in TAM is expected to enable CRWD to sustain elevated growth rates. We can see that CRWD is expected to generate above 35% average growth over the next three years following 2022.

Seeking Alpha

With the stock trading at 15x sales, CRWD will need to execute in order to justify its big premium to peers. For instance, SentlinelOne (S), a direct endpoint competitor, is trading at just 3.3x FY26 revenues – representing a 46% discount to CRWD.

I can see CRWD achieving at least 25% net margins over the long term. Applying a 2x price to earnings growth ratio (‘PEG ratio’), CRWD might trade at 10x sales by 2026, representing a stock price of $297 per share. The stock price is currently offering just over 20% potential annual returns to that price target.

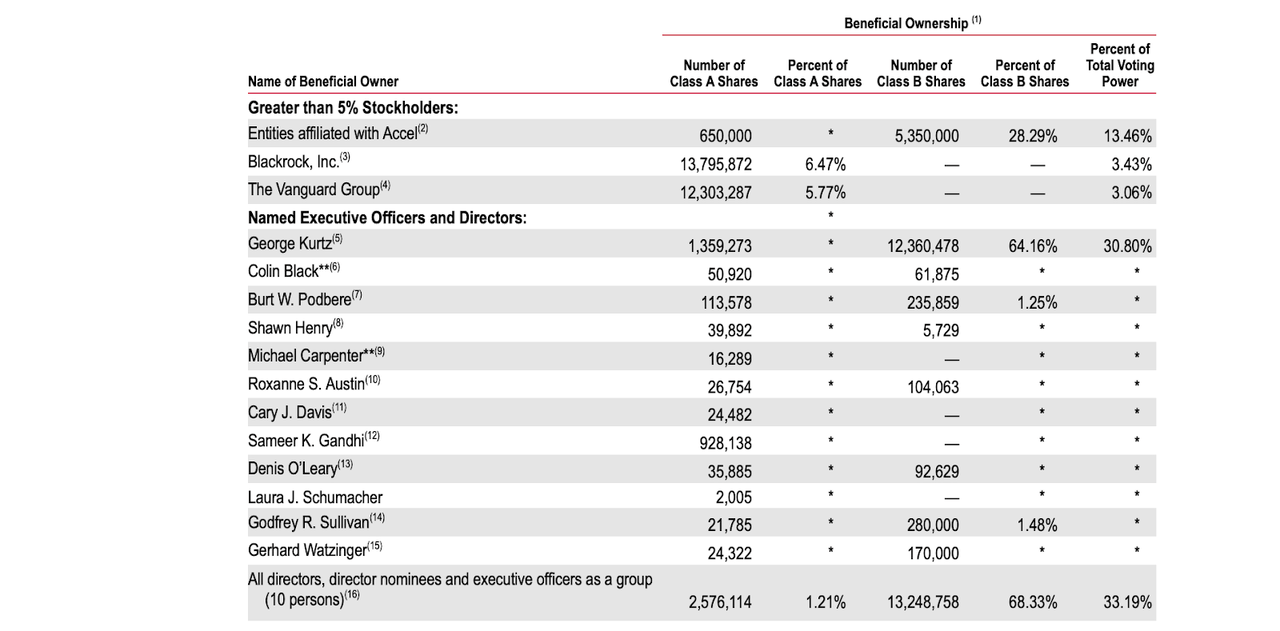

It is worth noting that co-founder and CEO George Kurtz owns a sizable stake in the company, totaling 13.7 million shares or 5.7% of shares outstanding (worth around $2.2 billion).

2022 DEF14A

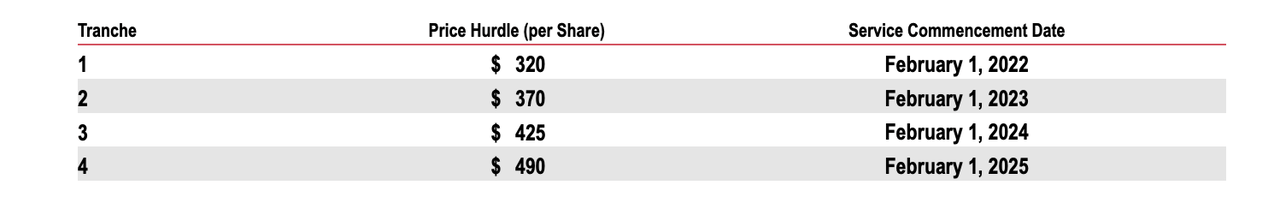

What’s more, both CEO Kurtz and CFO Podbere have been awarded a performance stock compensation plan with aggressive price hurdles as seen below.

2022 DEF14A

The performance stock plan expires in 2027, meaning that CRWD must increase nearly 250% before they can achieve all the allocated stock units. There is of course no guarantee that CRWD will accomplish that goal, but this compensation plan potentially highlights management’s conviction in the long term outlook for the company.

What are the key risks? Valuation risk remains real, as CRWD is trading at a huge premium to other tech stocks, many of which are down 90% or more and trade at low single digit multiples of revenue. The cybersecurity sector as a whole has held up better than other tech sectors – it is possible that investors eventually lose faith in cybersecurity stocks leading to substantial multiple compression. Another risk is that of competition. It is not immediately clear if CRWD or S offers the superior cybersecurity product, or which is better received by the broader market. While the cybersecurity opportunity remains very large, it is possible that over the long term this becomes a saturated market in which price competition becomes necessary.

As discussed with Best of Breed Growth Stocks subscribers, a selective basket of beaten-down tech stocks is my chosen approach to take advantage of the tech stock crash. CRWD could count as a higher quality allocation in such a basket – I rate the stock a buy for long term growth investors.

Be the first to comment