Ariel Skelley

Thesis: Battening Down The Hatches

M.D.C. Holdings (NYSE:MDC) is a large homebuilder in the United States, operating through its wholly owned brand of Richmond American Homes.

Back in September, I wrote my first article on MDC, highlighting it as a great way for income-oriented investors to gain exposure to the new home market. In my view, the low homeownership rate among Millennials represents a huge amount of pent-up demand that is waiting for mortgage rates to drop to be released. MDC has done a good job of shifting to build more homes in its affordable lines and thus should capture a decent amount of this future demand.

In this article, I want to update that original thesis based on Q3 2022 results and show how MDC has been battening down the hatches and preparing for a long winter (literally and metaphorically). The housing market is undoubtedly in for some pain ahead, but MDC has the financial wherewithal to get through it. And on the other side, greener pastures await in the form of another wave of homebuyer demand.

MDC remains a good buy, although it seems likely that the situation in the new home market will get much worse before it gets better. The question is: Has it been fully priced in or not?

In my view, timing the bottom is an impossible task, but knowing when a company is a good value is not. MDC strikes me as a good value right now.

Fall 2022 Update

In the third quarter, MDC’s topline revenue grew 12% YoY to $1.4 billion. Much of that revenue came from home sales that had already been signed, wherein the buyers were simply waiting for MDC to finish construction. Presumably, most of these buyers had their financing already locked in or were buying all-cash.

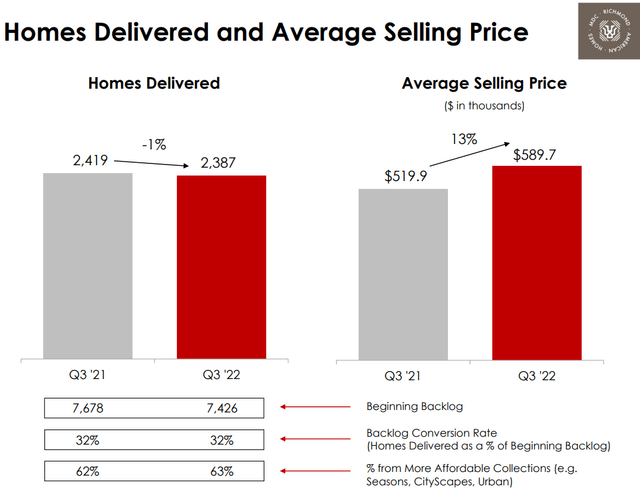

And though unit deliveries declined by 1% to 2,387 during the quarter, the average sale price of these home deliveries made up for it by rising 13% YoY to $590,000.

MDC Q3 2022 Presentation

This is down sequentially from Q2’s $628,000 average home sale price, which probably marked the peak in MDC’s home sale prices this cycle.

Management sees about the same unit deliveries in the fourth quarter but the sale price per home falling to the range of $570,000 to $580,000.

in Q3, net income declined 1% to $144.4 million, and EPS likewise declined 1% from $1.99 last year to $1.98 in this year’s third quarter.

Given the quarterly dividend of $0.50, MDC’s dividend remained well-covered in Q3 with a payout ratio of 25%.

So far, so good, right? Well, this is where the bad news comes in.

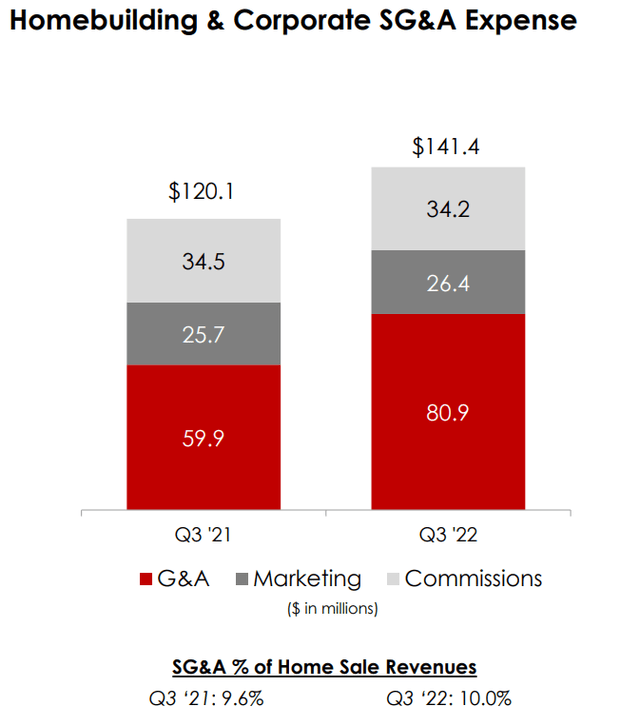

Gross margins declined slightly in Q3, largely due to the sequential decline in home sales prices plus a bump up in SG&A expenses, bringing SG&A as a share of revenue up from 9.6% in Q3 2021 to 10.0% in Q3 2022.

MDC Q3 2022 Presentation

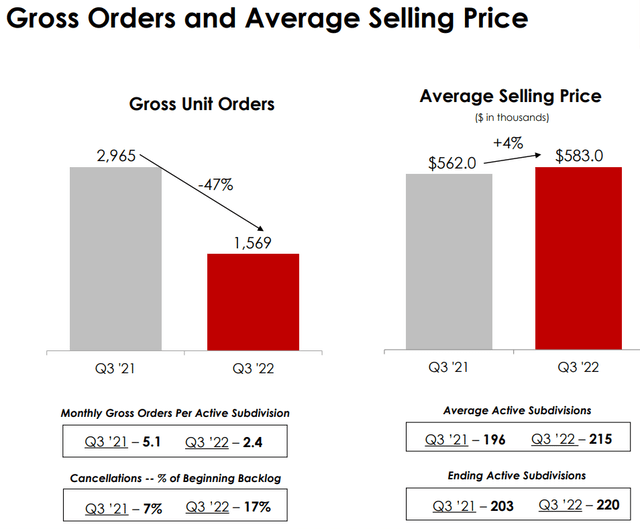

Moreover, gross unit orders (non-binding home sales) nearly halved YoY in the third quarter, a sign of the massive effect that high mortgage rates are having on the new home market. Cancellations spiked from 7% last year to 17% this year.

MDC Q3 2022 Presentation

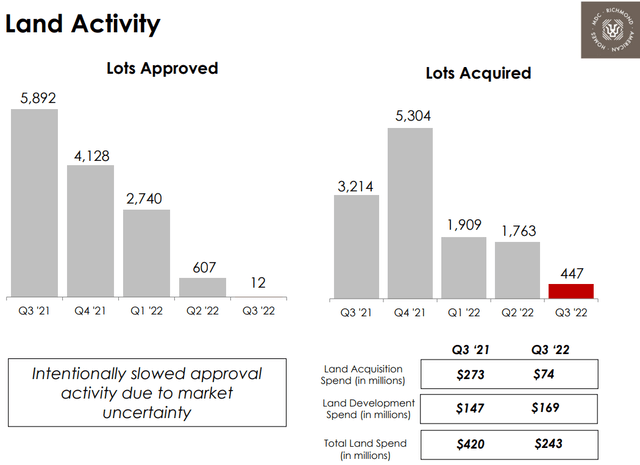

However, management has taken steps to batten down the hatches and strengthen MDC’s position in the face of a rapidly weakening housing market. They have quickly reduced the number of lots acquired for development, and among the lots they already own they have reduced new construction approvals and starts almost to zero.

MDC Q3 2022 Presentation

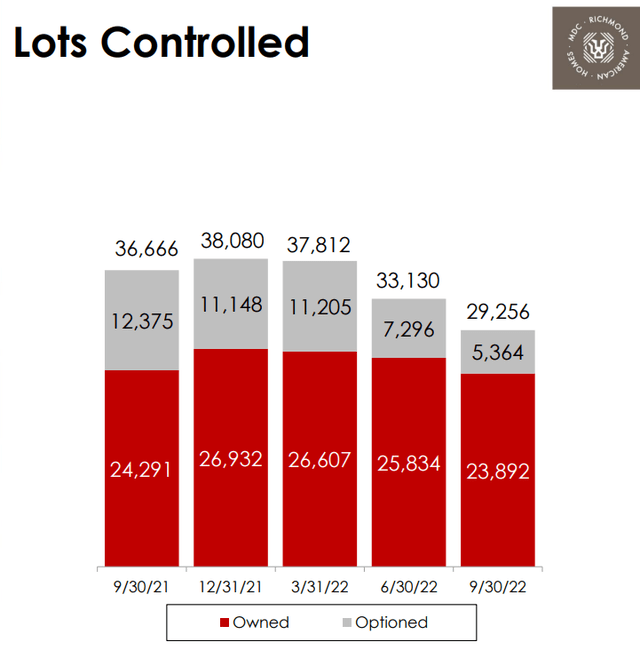

As a result of MDC’s intentional slowing of lot acquisition along with unit deliveries, MDC’s land bank of controlled lots (mostly owned, but some optioned) has shrank by over 20% since the end of 2021.

MDC Q3 2022 Presentation

Fortunately, many of these lots are already sold but not closed. MDC has a backlog of already sold houses worth $3.2 billion, down 25% YoY from Q3 2021’s $4.24 billion. This should provide a base of continue revenue and earnings even as sales drop and net income declines in the coming quarters.

Likewise encouraging is that the average sale price of homes in the backlog is $599,000, probably due to MDC continuing selling higher value homes or average-priced homes in higher cost areas like California.

Probably my favorite aspect of MDC, and what made me decide to buy the stock, is the balance sheet management. Cyclical businesses really ought to be less cavalier with their balance sheet than more stable companies. I find MDC to be a particularly good example of a cyclical company that actively prepares for the bad times during the good times.

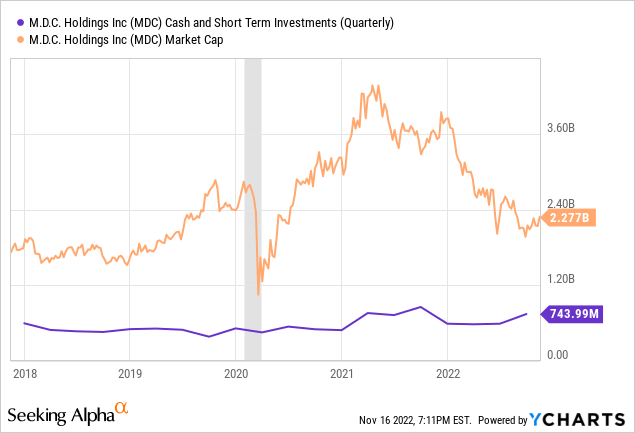

The way they do that is by constantly keeping a large cushion of cash and cash equivalents (short-term investments) on hand. Right now, as you can see below, MDC has cash & equivalents of ~$744 million, which amounts to approximately 1/3rd of its market cap.

That is extraordinary! This cash cushion is multiple times larger than the cash positions of any of its publicly traded homebuilder peers.

Also, MDC has no senior debt due until January 2030, and the weighted average maturity of its debt sits at 19 years. Like most developers, MDC uses short-term construction loans, but those will only become a problem if cancellations spike very high. Even so, MDC could simply use its huge cash pile to pay off those short-term loans.

Bottom Line

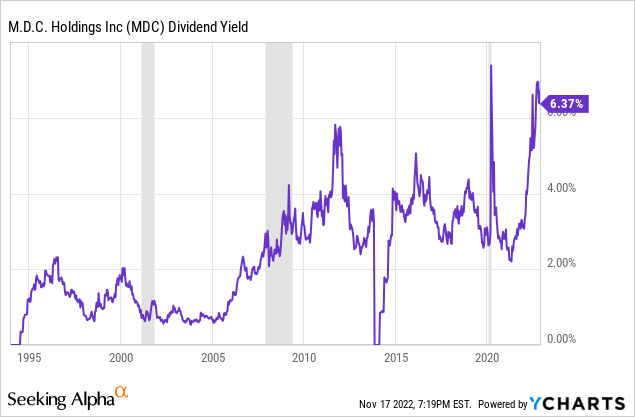

MDC has paid a continuous, uninterrupted and uncut dividend for 28 years, since 1994. There was admittedly a long period from 2005 through 2017 when the dividend remained flat, but that is better than a cut.

In my estimation, management has taken the appropriate steps to batten down the hatches and prepare for multiple quarters of weakness while continuing to pay its current 50 cent quarterly dividend.

Right now, MDC is trading at a P/E multiple of 3.85x, based on estimated 2022 earnings. You read that correctly. Admittedly, earnings are expected to collapse next year. But even measured against depressed earnings, MDC is still valued at only 9.4x 2023’s estimated earnings. That’s around the valuation at which MDC traded in the years preceding COVID-19.

But if you believe, as I do, that the Federal Reserve will have to begin lowering interest rates sometime in the next year or so, bringing mortgage rates down as well, then the pent-up demand for new homes from Millennials and others should cause MDC’s EPS to shoot back up to around its current (2022) level.

The housing shortage in the US combined with Millennials’ under-ownership of homes should bring back the demand for MDC’s products, whenever mortgage rates become compliant again.

In the meantime, MDC offers a ~6.4% dividend yield, which is near the highest level since the dividend was initiated in 1994.

I am buying MDC today for both its well-protected income and its upside.

Be the first to comment