EUR/USD News and Analysis

- EURUSD resilient after missile lands in Poland, Emergency NATO meeting set for 09:00 GMT

- EUR/USD retesting significant zone of resistance ahead of EU inflation data for October.

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free EUR Forecast

EUR/USD Resilient after Missile Lands in Poland, Emergency NATO Meeting set for 09:00 GMT

EUR/USD has shown great resilience to trade higher this morning despite yesterday’s unease following reports of a missile landing in Poland. Comments from Joe Biden suggest that based on the trajectory, it is unlikely the missile was fired by Russia. The projectile has Europe, NATO and financial markets on alert due to the potential of a wider conflict now that a NATO ally has been adversely affected by the Russia/Ukraine conflict.

NATO has scheduled an emergency meeting for 09:00 GMT to discuss the events of yesterday and the alliance’s response.

EUR/USD Technical Considerations

The daily chart shows how EUR/USD retraced over 100 pips from yesterday’s high, settling around the 2017 low of 1.0340. Today, there has been a continued move higher attempting to trade above that 1.0450 level which coincides with the upper bound of the significant zone of resistance. Admittedly, the zone is rather large but the weekly chart below shows how price action pivoted around the 1.0310 – 1.0450 zone previously.

1.0450 remains resistance followed by 1.0620 where price action had hovered at times during May and June this year. Support lies at 1.0340 followed by 1.0280.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

The weekly chart highlights the zone of resistance in blue and circles the inflection points in yellow. Therefore, an advance by EUR/USD above this zone with continued momentum bodes well for a possible euro bullish continuation.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

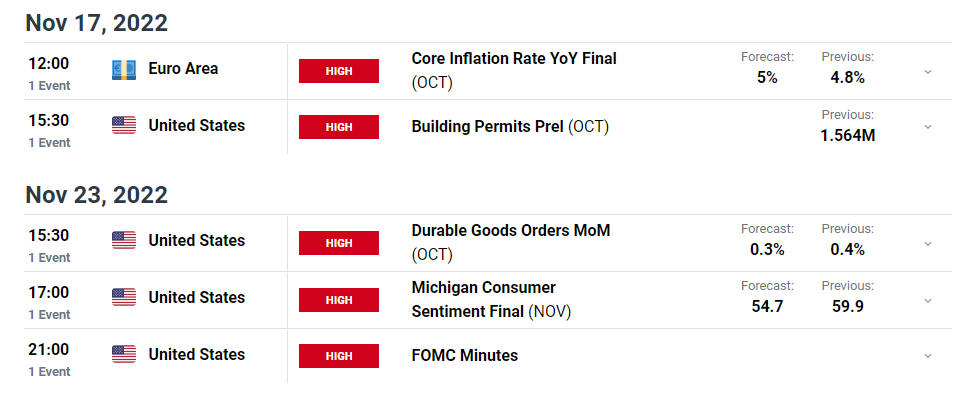

Risk Events for the Week Ahead

Today sees US retail sales forecast to rise 1% month on month after last months flat print, followed by a number of Fed speakers: Williams, Barr and Waller who are likely to reiterate that inflation is too high, at some point rate hikes will slow and that there is more to be done until inflation prints reveal “compelling evidence” of cooling towards the 2% target.

Sticking with the theme of central banks, ECB President Christine Lagarde is due to speak at 15:00 GMT today with the ECB’s Visco and Elderson getting things started at 10:00 GMT. The rest of the week welcomes the final EU inflation print with the headline reading forecast to reach 10.7%, not far from the UK’s 11.1% print earlier this morning. Next week markets will no doubt be looking for confirmation of what has been perceived as a more dovish tone from the Fed, which along with encouraging US CPI data, has resulted in a much softer dollar.

Customize and filter live economic data via our DaliyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Be the first to comment