Evgenii Mitroshin

From 26 September 2022 to 25 November 2022, Crescent Point Energy’s (NYSE:CPG) stock price increased from $5.54 per share to $7.84 per share, up 42%. In the third quarter of 2022, driven by a higher netback asset base, CPG generated Cdn$234 million on excess cash flow. Crude oil prices in 4Q 2022 will not be as high as in the first nine months of the year. Also, crude oil prices in 2023 will most likely be lower than in 2022. However, Oil prices are still significantly higher than the pre-pandemic levels. Crescent Point is well-positioned to make huge profits in the following quarters. The stock is a buy.

Quarterly results

In its 3Q 2022 financial results, CPG reported a net income of Cdn$466 million, compared with a 3Q 2021 net income of Cdn$78 million. The company’s cash flow from operating activities increased from Cdn$414 million in 3Q 2021 to Cdn$647 million in 3Q 2022. CPG’s adjusted funds flow from operations increased from Cdn$394 million in 3Q 2021 to Cdn$577 million in 3Q 2022. Crescent declared a 3Q 2022 dividend per share of Cdn$0.0800, compared with Cdn$0.0325 in the same period last year. The company’s net debt decreased from Cdn$2139 million in 3Q 2021 to Cdn$1198 million in 3Q 2022.

For the third quarter of 2022, CPG reported crude oil and condensate production of 91762 bbls/d (with an average selling price of Cdn$111.46 per barrel), compared with 92206 bbls/d in 3Q 2021 (with an average selling price of Cdn$82.45 per barrel). The company’s NGLs production decreased from 18176 bbls/d in 3Q 2021 (with an average selling price of Cdn$45.25 per barrel) to 17198 bbls/d in 3Q 2022 (with an average selling price of Cdn$43.83 per barrel). Also, Crescent’s natural gas production increased from 130823 mcf/d in 3Q 2021 (with an average selling price of Cdn$4.29 per mcf) to 144356 mcf/d in 3Q 2022 (with an average selling price of Cdn$6.55 per mcf). The company’s total capital expenditures increased from Cdn$187.1 million in 3Q 2021 to Cdn$309 million in 3Q 2022.

CPG’s total average daily production increased from 132186 boe/d in 3Q 2021 to 133019 boe/d in 3Q 2022. For the full-year 2022, Crescent expects to report total annual average production of 132000 boe/d, compared with the previous total annual average production estimation of 130000 to 134000 boe/d. CPG expects its total capital expenditures in 2022 to be Cdn$950 million, compared with the previous capital expenditure estimation of Cdn$915 to Cdn$940 million. In full-year 2023, CPG expects its total annual average production to be between 134000 to 138000 boe/d. Also, the company expects its capital expenditures in 2023 to be between Cdn$1040 to Cdn$1140 million. Crescent estimates excess cash flow generation of Cdn$1.1 to Cdn$1.5 billion at WTI crude oil price of US$75/bbl to US$85/bbl.

“We bolstered our resource base through a land acquisition during the quarter while also advancing other operational initiatives to further enhance our long-term sustainability. Our 2023 and five-year outlook are expected to generate significant excess cash flow and returns for shareholders, further building on our continued execution,” the CEO commented.

The market outlook

In the past few weeks, COVID-19 new cases in China spiked and hit records as the Chinese government eased some of its COVID-19 restrictions. Regarding the increased COVID-19 cases in China, restrictions may increase again, implying that crude oil imports into China, which is the world’s top crude importer, may drop significantly. Thus, crude oil prices plunged in the past few weeks. Figure 1 shows that WTI crude oil price decreased from $91 per barrel on 4 November 2022 to $76 on 25 November 2022. According to IEA’s oil market report in November 2022, China’s persistently weak economy, Europe’s energy crisis, burgeoning product cracks, and the strong US dollar are all weighing heavily on consumption. IEA expects the global oil consumption in the fourth quarter of 2022 to be 240 kb/d lower than in 4Q 2021.

On the other hand, the outcome of the OPEC+ meeting on 4 November 2022 could support crude oil prices. Saudi Arabia has recently announced that OPEC+ may take further measures to balance the market amid falling prices. Moreover, the European Union embargo on Russian crude oil that will come into effect on 5 December 2022, supports oil prices. IEA estimates world oil supply to fall by 1 mb/d for the rest of the year. Also, West sanctions against Iranian oil are still continuing and there is no sign of a peaceful agreement between Western countries and Iran.

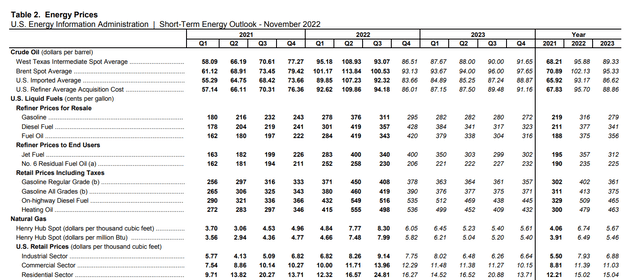

According to EIA’s short-term energy outlook, WTI crude oil price in 4Q 2022 will be $86.51 per barrel, compared with $77.27 per barrel in 4Q 2021 and $93.07 per barrel in 3Q 2022 (see Figure 2). EIA expects WTI oil prices to increase to $91.65 per barrel in 4Q 2023. Also, EIA expects Henry Hub natural gas prices to be $5.82 per MMBtu in 4Q 2022, compared with $4.77 per MMBtu in 4Q 2021 and $6.21 MMBtu in 1Q 2023. EIA estimated Henry Hub natural gas spot prices to increase to $6.21 per MMBtu in 1Q 2023 (as a result of colder temperatures) and then, decrease to below $5.50 per MMBtu for the rest of 2023.

Figure 1 – WTI oil price

Figure 2 – Energy prices outlook

CPG’s performance outlook

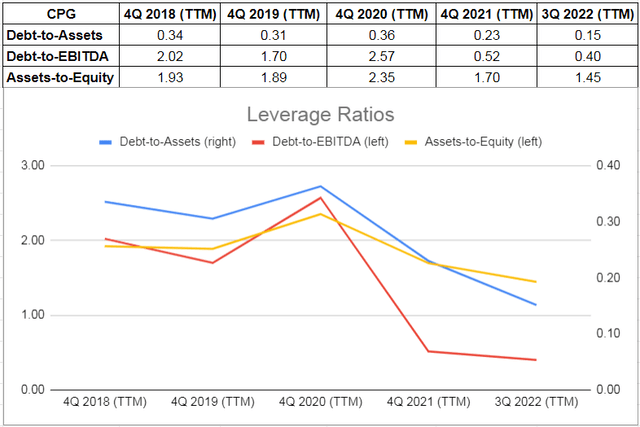

The debt-to-assets ratio is one of the significant calculations that measure the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. CPG’s debt-to-asset ratio dropped from 0.36 in 2020 to 0.15 in 2021 and decreased further to 0.15 at the end of 3Q 2022. CPG’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) plunged from 2.57 at the end of 2020 to 0.52 at the end of 2021. It decreased further to 0.40 on 30 September 2022. Finally, CPG’s asset-to-equity ratio decreased from 2.35 at the end of 2020 to 1.70 at the end of 2021 and 1.45 on 30 September 2022. The decreasing assets-to-equity ratio during the past years indicates that the company has been using lower debt to finance its assets. Due to the company’s developments and the energy market outlook, I expect CPG’s leverage ratios to improve in the upcoming quarters. The leverage ratios of Crescent Point Energy show that the company can meet its current and future obligations (see Figure 3).

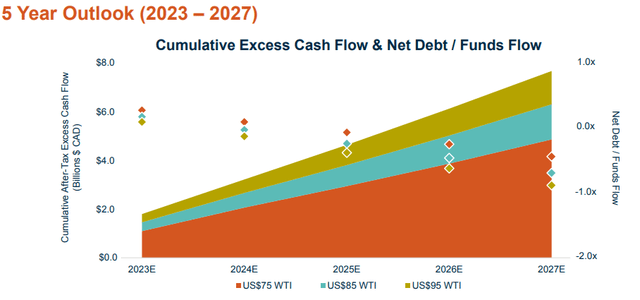

According to Crescent’s October corporate presentation, with WTI crude oil price of US$85 per barrel, the company’s cumulative excess cash flow will increase to more than Cdn$2 billion in 2024 and to more than Cdn$6 billion in 2027. Moreover, the company estimates that with a WTI crude oil price of US$85 per barrel, its net debt to funds flow ratio should decrease to below zero in 2025 (see Figure 4). If WTI crude oil prices average US$95 per barrel in 2023, CPG’s cumulative excess cash flow will increase to about Cdn$2 by the end of 2023. Also, the company’s net debt to funds flow ratio will improve at a faster pace. On the other hand, with WTI crude oil price of US$75 per barrel, CPG’s cumulative cash flow is estimated to be around Cdn$1.5 billion in 2023. Altogether, the company’s 5-year outlook reflects a continued focus on returns and long-term sustainability.

Figure 3 – CPG’s leverage ratios

Figure 4 – Cumulative excess cash flow & net debt / funds flow

Summary

Recently, as a result of spiking COVID-19 new cases in China, oil prices decreased. However, due to the continuing war in Ukraine and OPEC+ plans, I expect oil prices to remain significantly higher than the pre-pandemic levels. Thus, the oil market condition is still in favor of Crescent Point Energy. With WTI crude oil prices of US$85 per barrel, which is a reasonable price, CPG’s net debt to funds flow ratio should decrease to below zero in 2025. The stock is a buy.

Be the first to comment