Allan Akins

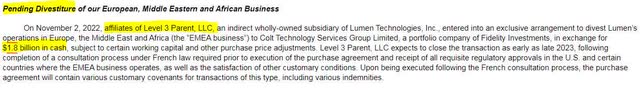

Earlier this month, Lumen Technologies (NYSE:LUMN) shares were sent tanking after the company announced it was eliminating its dividend and switching towards share buybacks. Lumen’s debt prices had already tanked in September and briefly rallied on the news. Yet, for the last couple of months, long-term debt of Lumen has been trading in a tight range and yielding around 12%. For long-term debt investors, I believe Lumen is a good investment opportunity, but there are certain debt offerings the company has that should be avoided.

FINRA

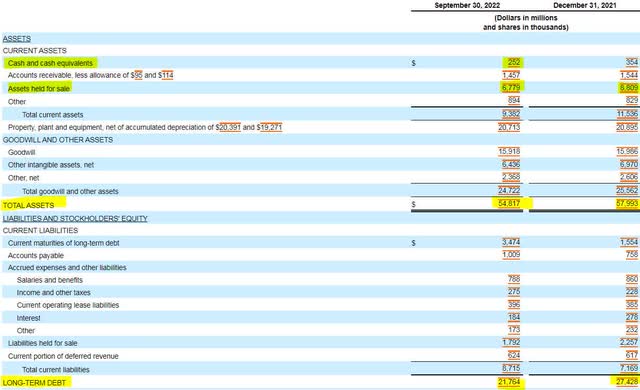

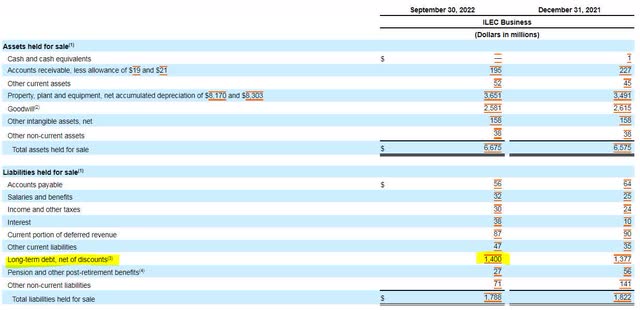

Lumen is engaged in asset divestitures and debt repayment as indicated by the company’s balance sheet. At the end of the third quarter, the company had isolated just under $6.8 billion in assets for sale with $1.8 billion in liabilities designated to those assets. Additionally, in the last nine months, Lumen has reduced its long-term debt by nearly $4 billion (differences in long-term debt and current maturities in long-term debt combined).

SEC Q3 2022 10-Q

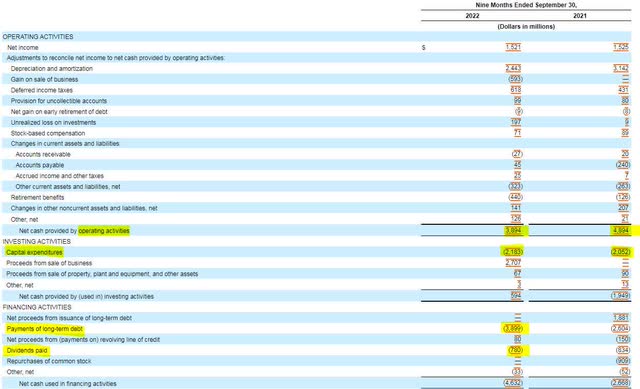

Lumen’s cash flow statement shows the company is still generating the cash required to support further deleveraging. While the nine-month operating cash flow declined by $1 billion from a year ago, $300 million was due to the funding of the company’s pension plan (fully funded for 2022 according to note 8 of the SEC 10-Q), and $700 million was due to a reduction in assets (indicated by the decline in depreciation).

Despite the decline, Lumen generated $1.7 billion in free cash flow for the first nine months of the year. Additionally, the elimination of the dividend should reduce the cash flow drain by approximately $1 billion per year. While the Board authorized a share repurchase plan, those funds may better serve shareholders and bond holders if they were used to reduce debt. As indicated in the balance sheet, the cash flow statement also shows the $3.8 billion reduction in long-term debt.

SEC Q3 2022 10-Q

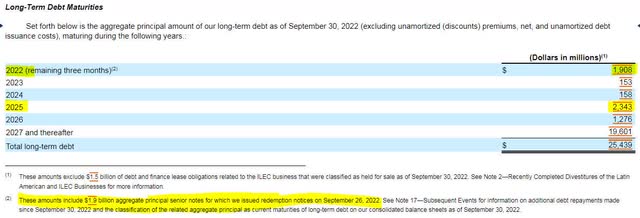

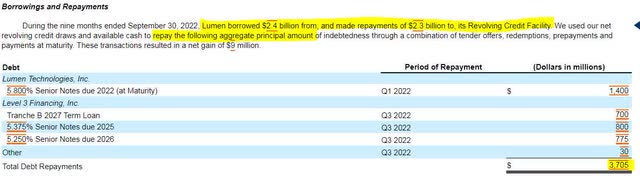

Lumen has nearly $2 billion of debt due in the fourth quarter. This is something to company has already issued redemption notices for and plans to pay back during the current quarter. While the company may be looking at the 2025 maturities as the rationale for stock buybacks over the next year, it may be a better allocation of capital to buy back the 2025 debt load, should it be priced below par. Fortunately, Lumen disclosed that it has already done some of this during the year, with repayments on notes due in 2025 and 2026 along with paying down a 2027 term loan.

SEC Q3 2022 10-Q

SEC Q3 2022 10-Q

When it comes to asset sales, Lumen details the assets for sale as the ILEC business, which was subsequently sold following the end of the third quarter. In the disclosure, $1.4 billion in long-term debt was included with the transaction. A check of the notes found that these notes are due in 2036 with a 7.995% coupon. They are designated to the company’s Embarq subsidiary. While the capitalization of the transaction looks sufficient, little is known about the financials of the acquiring entities and the ability of this segment to generate free cash flow, therefore, I am recommending investors avoid this bond.

SEC Q3 2022 10-Q

SEC Q3 2022 10-Q

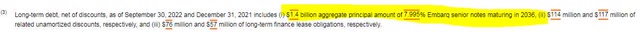

In addition to the ILEC transaction, Lumen announced in its 10-Q that would be engaged in a further divestiture involving assets related to its Level 3 subsidiary. It is likely that this deal may be like the ILEC deal where liabilities follow the assets, therefore I am recommending that investors also avoid any debt under the Level 3 name until more details become available.

SEC Q3 2022 10-Q

FINRA

FINRA

Asset divestitures naturally create nervousness amongst investors and Lumen’s recent actions are the driving force behind long-term debt trading at a significant premium to the average BB rated index of approximately 7%. I believe that Lumen’s strategy of conserving cash through the elimination of dividends and using free cash flow to pay down debt will benefit shareholders and bond holders alike.

CUSIP: 156700AM8

Price: $67.60

Coupon: 7.6%

Yield to Maturity: 12.166%

Maturity Date: 9/15/2039

Credit Rating (Moody’s/S&P): B2/BB-

Be the first to comment