anyaberkut/iStock via Getty Images

Investment Thesis

Digital Turbine (NASDAQ:APPS) is a rapidly growing tech company focused primarily on mobile advertising. I have had several people mention Digital Turbine in the comments for other articles asking for a write up on the company. They were very bullish on the company long term, so I figured I would write a piece on the company. Shares have had a rough start to 2022 and are down over 30% YTD. The company made a couple acquisitions in 2021 which helped boost revenue growth but hindered profitability.

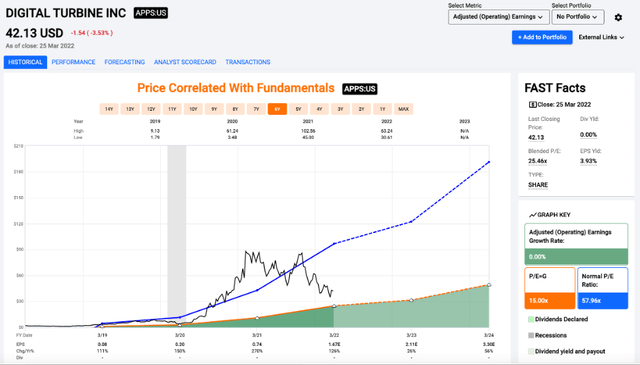

The valuation is reasonably attractive right now, with shares trading near an earnings multiple of 25x. Projections show impressive expected growth in EPS in the next couple years and the Chairman of the Board recently bought shares in the low-$30s range. Mobile advertising has secular tailwinds, but the biggest reason I haven’t bought shares is the margin profile. If you aren’t as concerned with the margin profile or think the EPS estimates are likely to be low, shares of Digital Turbine are a solid buy at current prices.

The Business

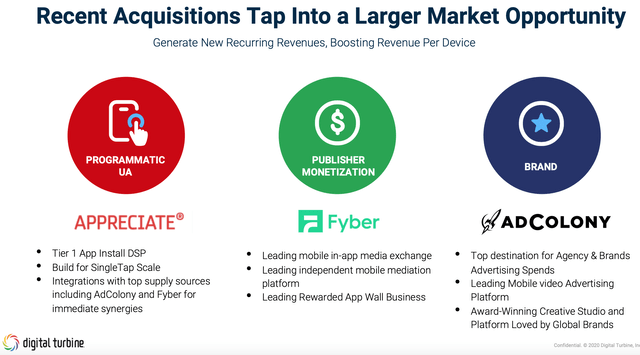

Digital Turbine is profitable, which separates it from many other high flying tech stocks. The margins and earnings actually declined in the first nine months of FY21 (Digital Turbine’s year end is 3/31), despite impressive revenue growth. This is likely due to the acquisitions of Fyber and AdColony in 2021, which boosted revenue but was a drag on margins.

2021 Acquisitions (digitalturbine.com)

I will be watching to see what the yearend results look like when they are released in a couple months. I’m curious to see what the full year margins look like, as that is the main sticking point for me right now. I like the revenue growth a lot, but the low operating margins have me waiting on the sidelines for now. If things look significantly better for the last quarter of FY21, I will look to start a position, especially if shares stay near the current price.

The bull case for Digital Turbine rests on continued revenue growth. Based on the secular tailwinds for the mobile advertising industry, the company should be able to grow revenues well over a 20% clip for several years. If you think that the revenue growth is going to continue at an impressive rate, and part of this revenue growth will eventually flow to the bottom line via margin expansion, shares are attractive based on the current valuation.

Valuation

Shares of Digital Turbine currently trade at a reasonable 25.5x earnings. Since becoming profitable in 2019, shares have had an impressive run. If earnings continue to grow at a rapid rate, buying shares in the $40 range will look very cheap in a couple years. If the company can grow the top and bottom line to a projected $3.30 in EPS in 2024, I think it’s highly unlikely that shares will be stuck in the $40s. If they manage to beat bottom line estimates, I think we could see shares head much higher in a couple years based on the fundamental growth of the business.

Price/Earnings (fastgraphs.com)

Other contributors are not the only ones that are bullish on Digital Turbine right now either. Chairman of the Board Rob Deutschman recently purchased $470K worth of shares when they were trading at $31.66. If shares drop into the high 20s or low 30s range, that’s where I would switch my rating to very bullish. I think that it is entirely possible with the volatile markets in the last couple months, but I will certainly keep Digital Turbine on my watchlist to see what happens with the price of the stock.

Conclusion

Digital Turbine is a rapidly growing business in a sector with secular tailwinds. More phones and more products/services will lead to continued revenue growth for the company. The acquisitions made in 2021 will likely be beneficial for the company in the long run but had an impact on the short-term profitability. This is the main reason I’m still waiting on the sidelines. The margins are not that appealing, but if they start to expand, shares could have significant upside over the next couple years. I will probably wait until the yearend results are reported in the next couple months.

The valuation is fairly attractive for Digital Turbine when you look at the revenue growth and the expected EPS growth in the next couple years. With an earnings multiple near 25x, I think that shares are a buy today, but a larger margin of safety can be had if shares drop into the $30s. The sizable insider purchase by the Chairman of the Board at $31.66 seems to suggest that insiders come to same conclusion with the company’s valuation. If you think the margins are a nonissue and the rapid growth is likely to continue, shares of Digital Turbine are a solid buy near $40.

Be the first to comment