Nikada/E+ via Getty Images

By Sean Bogda, CFA | Grace Su | Jean Yu, CFA, PhD

Macro Tailwinds Bolster International Markets

Market Overview

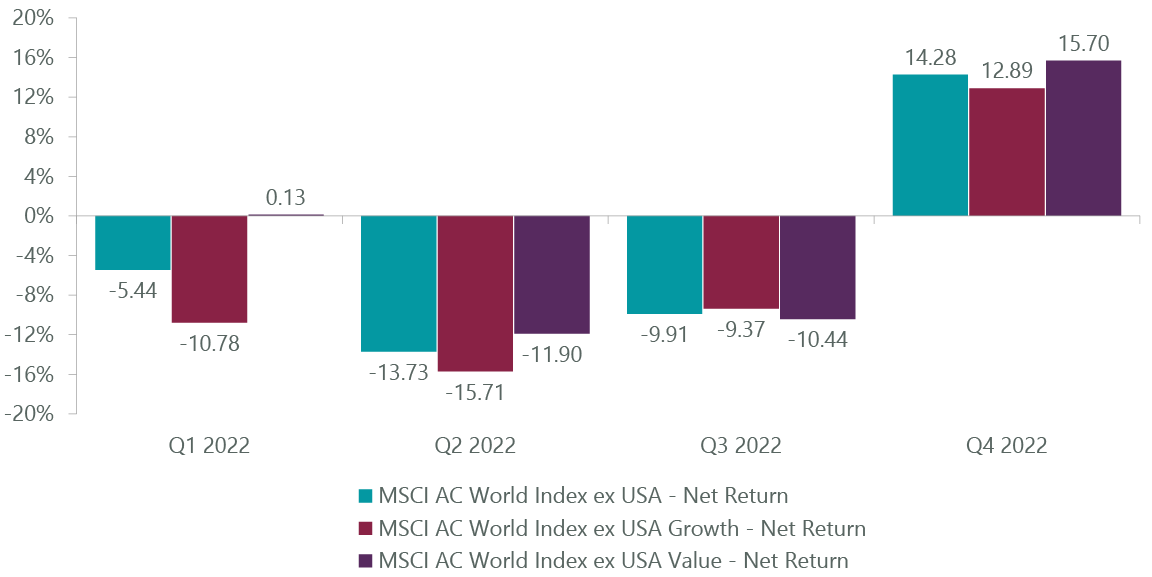

International markets capped off a tumultuous 2022 with positive returns in the fourth quarter, with the benchmark MSCI All Country World Ex U.S. Index returning 14.28%, as easing inflationary pressures, the reopening of the Chinese economy and prospects of a shallower recession spurred optimism. Value stocks outperformed growth stocks for the quarter, with the MSCI ACWI Ex U.S. Value Index returning 15.70% versus the 12.89% return of the MSCI ACWI Ex U.S. Growth Index (Exhibit 1). The strong fourth-quarter performance helped trim the decline in value to -8.59% for the year but still outperformed growth by over 1,400 basis points.

Exhibit 1: MSCI ACWI ex USA Value vs. Growth Performance

As of Dec. 31, 2022 (FactSet)

Signs of peaking inflation and evidence of slowing in the U.S. economy proved enough for the Federal Reserve to end its streak of 75-basis point hikes in favor of a 50-basis point hike, but candid statements from policymakers dispelled the notion of a dovish policy pivot in the foreseeable future. Likewise, Europe began to see an easing of inflationary pressures during the quarter. This, combined with declining fears of an energy crisis and a recessionary hard landing helped bolster investor optimism in the region and in cyclical sectors. In the U.K., political turmoil dissipated as Prime Minister Liz Truss was replaced by the more fiscally conservative Rishi Sunak, which helped to reduce uncertainty and assure investors. Japanese markets benefited from the country’s reopening from COVID-19 restrictions, and a weakening yen helped prompt an improved outlook for corporate earnings. China’s bearish economic projections and COVID-19 lockdowns initially weighed on performance but reversed on lifting of restrictions and government support for the flagging real estate sector. Meanwhile, in Brazil, the election of Worker’s Party candidate Luiz Inácio Lula da Silva to the presidency spurred a market pullback over concerns that economic policy may shift further to the left.

All 11 sectors of the MSCI All Country World Ex U.S. Index posted positive returns for the fourth quarter. Performance was led by the industrials (+17.34%), materials (+16.56%), financials (+15.59%), and consumer discretionary (+14.70%) sectors as concerns over the depth of a potential global recession seemed to ease. Likewise, the communication services (+11.93%), utilities (12.97%), energy (+13.26%), information technology (IT, +13.52%), and health care (+14.05%) sectors generated positive returns but trailed the broader benchmark’s performance. The rally in cyclicals and value stocks limited the performance of the consumer staples (+9.75%) sector while the interest-rate sensitive real estate (+10.44%) sector also underperformed. Ultimately, the ClearBridge International Value Strategy outperformed its benchmark for the fourth quarter, as strong company-specific drivers in the financials, energy, and other sectors helped propel high-quality companies to strong performance.

Stock selection in the financials sector was the primary contributor to relative outperformance and included two of the Strategy’s top five individual performers. Financials benefited from interest rate hikes by major central banks, particularly in Europe as the ECB indicated it would maintain a hawkish approach. Combined with investors becoming less bearish on the European economy, these tailwinds helped to propel our holdings in the sector. For example, Banco Bilbao Vizcaya Argentaria (BBVA) (also known as BBVA), a Spanish multinational financial services company, was the individual performer during the quarter. The company continues to improve revenues from strong loan growth and increasing credit spreads. Additionally, its strong brand presence in Mexico has helped drive earnings growth through its profitable deposit mix and growing market share in financial transactions. Likewise, BNP Paribas (OTCPK:BNPZY), based in France, also benefited from tailwinds in the European financials sector. In addition to the improvement in net interest income, BNP’s global footprint has helped it be a leader in trade finance which benefited from increased activity in Asia. Despite the recent positive performance, we believe financials continue to trade at compelling valuations.

Stock selection in the energy sector was also a strong driver of returns, benefiting from an improving global macro outlook. Prospects for a milder recession, increased demand from China reopening from its COVID-19 restrictions, and the recognition that the market hasn’t discounted oil company valuations based on commodity prices all served to benefit energy company stock prices. Holdings such as TotalEnergies (TTE), a leading French oil, and natural gas company, was a recipient of these macro tailwinds. Investor optimism also helped to bolster companies in the oil and gas equipment and services industry like Tenaris (TS). As a leading producer of pipes designed for the oil and natural gas industry, a greater need for energy likely means an increase in drilling activity and greater demand for the materials needed for extraction. We are constructive on the long-term prospects of the energy sector, with it being the second largest relative overweight in the portfolio. We believe that as the market becomes more comfortable with the industry’s intermediate earnings and capital discipline from producers, our high-quality companies in the sector should continue to perform.

The healthcare sector detracted from relative performance. However, rather than the broad headwinds that the sector faced in the third quarter, performance results were driven by specific stock narratives. Roche (OTCQX:RHHBY), a Swiss pharmaceutical company, saw its share price decline after the company’s Alzheimer’s drug, Gantenerumab, failed its phase 3 trials. Despite market expectations for success being subdued, the failed tests and subsequent announcement that it would be shuttering all trials of the drug spurred increased investor concern over the overall viability and outcome of the company’s drug development pipeline. However, just as we recognize that one data point does not make a trend, so too do we believe that one failed trial does not mean disaster. We continue to have high conviction in the company and believe that pharmaceuticals offer downside protection and liquidity within the global healthcare sector.

Portfolio Positioning

The portfolio continues to favor economically sensitive sectors, despite the increasing drumbeat around recession. Typically, the playbook for a recession scenario would be to sell cyclicals due to overcapacity, negative operating leverage, and overstretched balance sheets, but we believe that the difference between this cycle and prior ones is where the “excess” is in the economy. The past decade saw a massive shift in capital to the digital economy at the expense of the real economy, resulting in commodity and supply chain shortages, so we believe it is unlikely there are excesses in these areas. Rather, as the economy adjusts under monetary tightening, we are seeing more layoffs and bankruptcies from the technology sector and digital ecosystem rather than the real economy, hinting at where the excesses may truly lie. We think the capital discipline from commodity and industrial sectors will be a difference maker this time and that even major banks, who have been hampered with severe regulations since the Global Financial Crisis, are entering this downturn with overcapitalized balance sheets due to low rates disincentivizing lending growth.

The past decade saw a massive shift in capital to the digital economy at the expense of the real economy.”

Overall, it feels like the usual weak links are starting from a much stronger position this time around. Related to the capital discipline are the markedly improved balance sheets across many of the real economy sectors. Due to the skepticism about the sustainability of current cash flows, many of these more cyclical stocks continue to be priced very cheaply. We like this combination of low valuation and short-duration cash flows and think they will be important buffers in the face of an uncertain economic outlook.

Entering 2023, we have a high degree of conviction in our current portfolio holdings and positioning. However, we are vigilant for new opportunities that we feel would improve the risk/reward profile of the portfolio. We maintain an extensive watchlist of companies we think could be potential additions to the portfolio under the right conditions. As a result, we both initiated and exited four positions during the quarter.

We added Anglo American (OTCQX:AAUKF), in the materials sector, a British-based diversified mining company and the world’s largest producer of platinum. We believe the company is well positioned to take advantage of the long-term traits surrounding electrification and the global energy transition, as well as short-term drivers such as the reopening of China, due to its strong assets in copper and nickel extraction. Additionally, the company’s new Peruvian copper mine should help enhance the overall production growth of the company over the coming decade. Finally, we believe that unlike many of its peers, Anglo American’s focus on diversifying its mineral opportunities provides greater growth prospects than companies with more reliance on iron ore extraction.

We also initiated a position in Mitsubishi UFJ Financial (MUFG), a Japanese financial company that provides retail and commercial banking, investment banking, capital markets, and asset management services globally. We believe the Bank of Japan’s Yield Curve Control policies have proved a major headwind to Japanese banking earnings since first introduced in 2016. However, as Japan finds itself facing the same rising inflationary pressures that have forced most other global central banks to embark on a path of interest rate normalization, we believe the Bank of Japan is likely to follow suit. This should help remove the headwinds that have weighed on Mitsubishi UFJ’s net interest income for the last six years and help to spur greater increases in income, margins, and profitability.

We elected to exit Honda Motor (HMC), a manufacturer of cars, motorcycles, general-purpose engines, and a range of other power products in the consumer discretionary sector. The company has struggled to make progress in improving its recent mediocre sales trends while its current plan for transitioning to electric vehicles and motors is less compelling than its more transparent peers. Given the risk of the Japanese yen strengthening as yet another headwind to the company’s intermediate performance, we elected to close the position in favor of other opportunities.

From a regional standpoint, we continue to maintain overweight to Europe and the U.K., where the turmoil of 2022 has acted as a reset and allowed us to obtain a number of high-quality franchises at tremendous discounts. However, we are increasingly finding greater opportunities within Asia. As a result, we expect to continue gradually shifting our portfolio positioning from being Europe-heavy to a more balanced allocation between East and West. We believe this will not only help to capture opportunities unknown or overlooked by western investors, but also provide greater diversification and strengthen the portfolio’s earnings base from uncorrelated sources.

Outlook

We believe China will be a key variable for international markets in 2023. Beyond the reversals of COVID-19 controls, we are seeing what appear to be policy reversals in critical areas such as the real estate, fintech, and internet sectors that previously proved barriers to overseas investors. While there are different theories surrounding the reasons for such abrupt policy changes, it is apparent that the government is re-prioritizing economic growth. Coupled with the high savings balances of Chinese consumers, we believe China could experience an economic cycle that is somewhat decoupled from the developed world. This would have positive implications for commodity markets, particularly energy-related, as well as benefits to China’s largest trading partners in Asia and Europe.

Overall, we are optimistic entering into 2023 and what the year will bring for international markets. After years of underperforming the U.S., investors are beginning to recognize the valuation discrepancy between high-cost U.S. companies and their relatively cheap international counterparts and send capital abroad. Additionally, with the U.S. markets disproportionately weighted towards mega-cap and IT stocks, international stocks offer greater diversification and greater opportunities to seize value even as value stocks appreciated in 2022. U.S. economic trends such as consumers subsidizing spending with savings and lack of labor force slack, features that could pose greater threats under a recession, are not evident in countries like China. Finally, U.S. dollar strength could unwind as the Fed finishes tightening, making foreign investments more attractive for U.S. investors from a currency perspective. As such, we believe that international equities, and international value stocks in particular, are well-positioned to continue to generate attractive returns in the coming year.

Portfolio Highlights

The ClearBridge International Value Strategy outperformed its MSCI All Country World Ex-U.S. Index benchmark during the fourth quarter. On an absolute basis, the Strategy had gains across 10 sectors in which it was invested (out of 11 sectors total). The financials, industrials, and energy sectors were the main contributors, while the communication services and real estate sectors trailed performance.

On a relative basis, stock selection effects positively contributed to performance. Specifically, stock selection in the financials, energy, consumer staples, industrials, IT, consumer discretionary, and materials sectors aided performance. Conversely, stock selection in the healthcare sector and the Strategy’s cash allocation weighed on returns.

On a regional basis, stock selection in Europe Ex U.K., emerging markets, Japan, and the U.K., an underweight allocation to emerging markets, and overweight allocations to Europe Ex U.K. and the U.K. contributed to performance. Stock selection in Asia Ex Japan weighed on performance.

On an individual stock basis, BBVA, TotalEnergies, BNP Paribas, and CNH Industrial (CNHI) were the leading contributors to absolute returns during the quarter. The largest detractors were Jardine Cycle & Carriage (OTCPK:JCYCF), Nutrien (NTR), Roche, and Vodafone (VOD).

During the quarter, in addition to the transactions mentioned above, the Strategy initiated positions in AIA Group (OTCPK:AAGIY) in the financials sector and Arcos Dorados Holdings (ARCO) in the consumer discretionary sector. The Strategy exited its positions in Bombardier (OTCQX:BDRBF) in the industrials sector, Wienerberger (OTCPK:WBRBY) in the materials sector, and Melia Hotels International (OTCPK:SMIZF) in the consumer discretionary sector.

Sean Bogda, CFA, Managing Director, Portfolio Manager

Grace Su, Managing Director, Portfolio Manager

Jean Yu, CFA, PhD, Managing Director, Portfolio Manager

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results, or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing, or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates, or any third party involved in or related to compiling, computing, or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment