Baloncici/iStock Editorial via Getty Images

While in our banking coverage, our buy rating provided tangible results in stock price appreciation (Intesa Sanpaolo, UniCredit and Erste Group Bank are the latest clear examples), Crédit Agricole (OTCPK:CRARF) is still lagging behind its closest peers. We have a good understanding of banks and it is been a while since our initiation of coverage of the French leading bank. We have written five previous articles on CRARF and those articles form the basis of our buy case:

- Immaterial exposure from Russia;

- Track record of solid results (Q1 and half-year performances were above Wall Street consensus estimates);

- M&A optionality, especially in Italy – (we also follow up on the latest M&A);

- Acceleration of the bank’s new business plan called ‘Ambitions 2025 Plan’ thanks to an “integrated bank-insurance-asset management business model“. To get acquainted with the story, we recommend that our followers check up on our June publication;

- Related to point 4), our team was forecasting a higher turnover increase compared to consensus and we are confident that the company will exceed our internal estimates thanks to the macroeconomic environment with higher interest rate development.

Q3 results

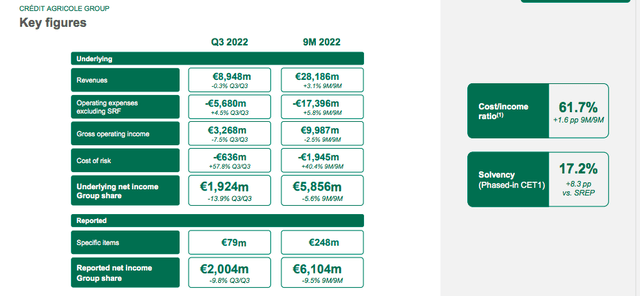

Starting with the negative results, Crédit Agricole missed expectations on the revenue line by just 2%. This was due to one miss, the Corporate Centre division which reported a loss of -€254 million versus an average estimate of -€150 million. Higher taxes and lower top-line sales were the main reason.

The French bank recorded a third-quarter net profit group share of €1.35 billion, down 3.6% on a reported basis and 10% if non-recurring items are excluded. This drop is explained by “the exceptional results of the third quarter of 2021“. In detail, during the past quarter, Crédit Agricole benefited from positive exceptional items for a total amount of €79 million with La Médicale sale to Generali which generated a capital gain of more than €100 million. This was partially offset by Lyxor integration in the asset management division and the moratorium on mortgage loans in Poland, which allows borrowers to postpone their next eight maturities. These negative items delivered a negative result of €4 million and €17 million respectively. Excluding these items, Crédit Agricole’s underlying profit amounted to €1.27 billion in the third quarter, against €1.4 billion a year earlier.

Crédit Agricole financials in a snap

Source: Crédit Agricole Q3 results presentation

Another negative number to report was the CET1 ratio evolution, which was down by 30 basis points on a quarterly basis and reached 10.7% versus an expectation of 11.1%. Looking at the nine-month aggregate, CASA’s CET1 solvency ratio also fell by 90 basis points compared to last year’s December end. This decrease is explained by the impact of the rise in interest rates generating unrealized capital losses in life insurance, market impact, in particular foreign exchange, and Russia.

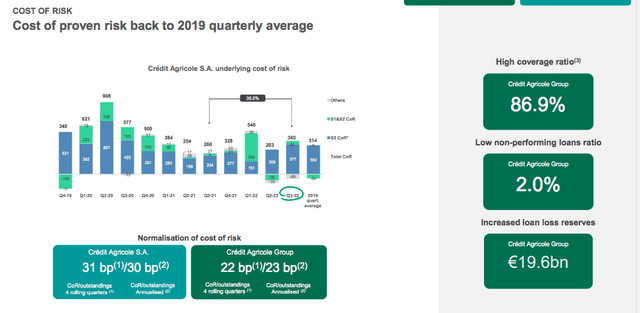

It was not all negative; the key takeaway was Crédit Agricole’s cost of risks which reached 30 basis points in the third quarter, a level equivalent to the one recorded before the COVID-19 crisis in 2019. However, it increased by 35% compared to the third quarter of 2021, with a net allocation of -€360 million. In detail, consensus expectation was estimated at -€556 million; but the French bank managed to control its risk base across all divisions. The company’s exposure to Russia further declined by €0.2 billion to €3.7 billion. Large Costumers, Insurance, Asset Management, French retails, International retail and Specialised Services were all above Wall Street forecasted numbers.

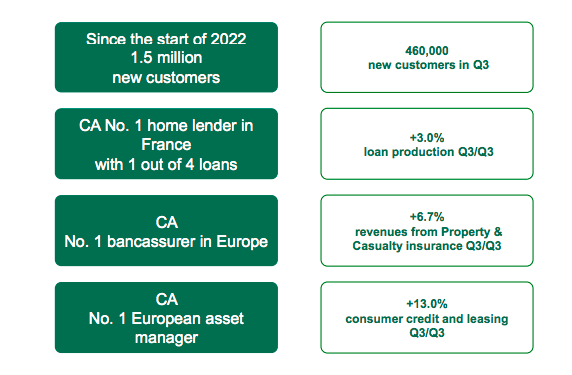

It is clear that the company’s aim is volume growth rather than earnings growth. In Q3, the French bank added 287k new clients and confirmed its positive trend. Year-to-date, the total number of new clients reached 912k.

Crédit Agricole new clients

Source: Crédit Agricole Q3 results presentation

Conclusion and Valuation

Despite a mixed quarter, Crédit Agricole confirmed a positive evolution and we believe that in this context of rapidly rising interest rates, the bank will, later on, benefit from its Net Interest Income development. Crédit Agricole’s sensitivity to the rising interest rates is much higher than market expectation, and with the 1-month Euribor at 2%, the additional benefit expected on the CASA’s interest margin is expected to be around €2.5 billion. We should also not forget about the good cost of risks control just disclosed in Q3. Therefore, we continue to value the French leading bank with a €13 share price. The company is trading at a discount compared to its historical average on its TBV (0.42x versus 0.6x) and already accounted for more than 5% dividend yield for 2023 – with an expectation to reach 6.5% in the latest quarter.

Crédit Agricole cost of risk evolution

Source: Crédit Agricole Q3 results presentation

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment