Vitoria Holdings LLC/iStock via Getty Images

An Overall Unfavorable Picture for Gold and Even For Copper

The U.S. continues to struggle with inflation at its highest level in over 40 years. This showed some signs of regression, with the annual rate falling to 7.7% in October from 8.2% in the previous month.

But to return to the target of around 2%, which under the U.S. Federal Reserve’s dual mandate would allow for equilibrium in goods and services prices and healthy levels of employment, then the interest rate will inevitably rise from the current 3.75%-4% of the federal deposits.

The result is a further increase in fixed-income coupons (e.g., bonds) and greater demand for U.S. currency, leading to an appreciation of the U.S. dollar, for which borrowers pay a higher financial cost. The bond and the U.S. dollar protect against high inflation and market instability amid anti-inflationary monetary policy, the war in Ukraine and various geopolitical tensions. These investment vehicles dwarf gold, which has also been used for hedging purposes.

Against this backdrop, demand for gold should be impacted and then reflected in a lower price over the next several months. Any type of gold-denominated asset is likely to suffer from the expected bearish market for the precious metal, including most U.S.-listed gold producers and explorers.

Centerra Gold Will Suffer From the Expected Bear Market in Gold and Copper

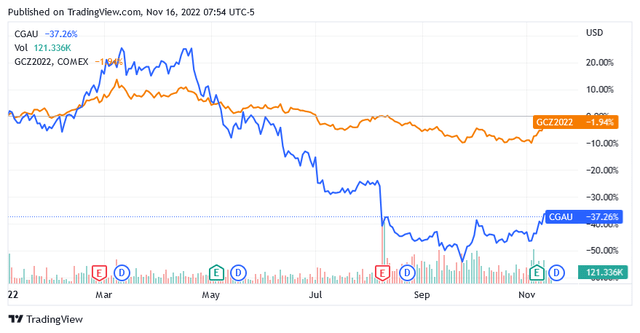

Centerra Gold (NYSE:CGAU)(TSX:CG:CA) shares face some downside risks amid an expected downtrend in gold prices and an asset base that is causing management more than a headache right now. Shares are characterized by elevated volatility compared to changes in the price of gold. Gold Futures – December 22 (GCZ2) – is a proxy index for gold price development as shown in the chart below.

Based on weekly prices over the past year, on average, a percentage decrease (or increase) in the price of the yellow metal has resulted in a nearly 2% decrease (or increase) in Centerra Gold’s stock price. Given a potential downturn in the yellow metal’s outlook, there is no incentive to hold a position in this U.S.-listed gold stock.

Year to date, a 1.94% drop in the price of the gold futures – December 22 (GCZ2022) – has been accompanied by a 37.26% drop in the stock price of Centerra Gold.

About Centerra Gold

Based in Toronto, Canada, Centerra Gold operates as a gold mining company engaged in exploration activities, metal property development and precious metals mining. The company is also an acquirer of metals projects and currently has an interest not only in gold properties, but also in copper and molybdenum projects.

Centerra Gold’s properties are located in British Columbia, Canada, where its 100% interest in the Mount Milligan gold-copper deposit is located, and in Turkey, where the Öksüt gold mine is located. Also, the company holds molybdenum operations in the U.S. and Canada.

Centerra Gold Is Not Just Gold

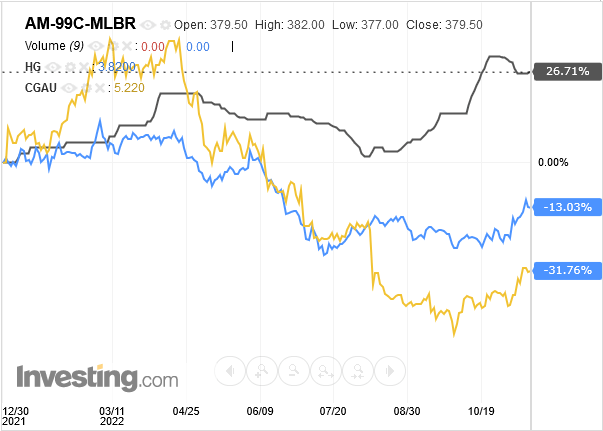

Centerra Gold’s business includes copper (≈ 30% of total sales) and molybdenum (≈30% of total sales) in addition to gold (≈40% of total sales). The chart below shows the correlation between Centerra Gold stock price and copper and molybdenum market prices since early 2022 to date.

investing/commodities/molybdenum-bar-99.9-min-china-futures

Aside from the inverse relationship with the molybdenum bar 99.9% Min China Spot price, which is a proxy index of molybdenum price, Centerra Gold’s stock price appears to have fallen more than proportionately compared to the copper price decline. Year to date, a 13.03% decline in the price of Copper Futures – December 2022 (HGZ2022) – was accompanied by a 31.76% decline in Centerra Gold stock price.

The correlation will drive Centerra Gold’s future performance, but not in the way shareholders would like if copper prices traded lower on an expected slowdown in the demand for the red metal. Lower copper prices are likely as galloping inflation combined with the rise in the cost of borrowing to finance private spending discourages purchases of a long list of durable goods that use copper (e.g., electronics).

Financial Results for Q3 2022

Financially, the third quarter of 2022 was not a good one for Centerra Gold. The company suffers from some operational inefficiencies consisting of higher production costs, lower sales volumes of gold, and below-market gold sales prices.

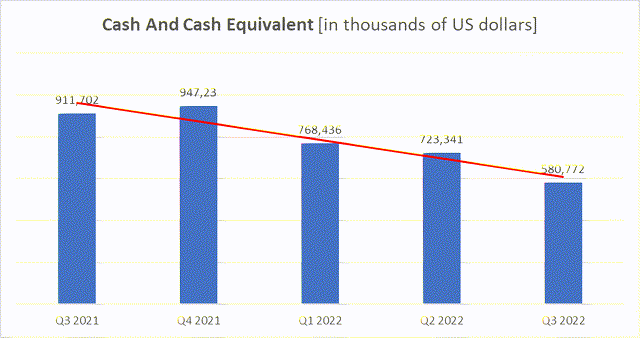

As a result, the company is unable to generate cash flow to supplement funds available on the balance sheet, which will be used to advance projects for future gold and other metals production. In fact, the period in question ended with a free cash flow deficit of $35.5 million. These inefficiencies are unlikely to impact exploration and development activities as long as the balance sheet remains robust.

Cash on hand as of Sept. 30, 2022, was $581.53 million, while total debt was $5.63 million. The current financial situation seems strong enough to support the annual budget for capex of approximately $65 to $75 million. However, without the positive contribution of operating cash flow, the balance sheet shows declining cash reserves from quarter to quarter, as shown in the chart below. This cannot please Centerra Gold shareholders.

seekingalpha/symbol/CGAU/balance-sheet

The balance sheet shows funds for a project called the Goldfield District Project in Esmeralda County, Nev., for the low-cost production of gold in doré bars. The project will utilize conventional open-pit mining techniques and heap leach activities to recover the precious metal. Centerra Gold commenced drilling activities on the property this year and plans to release a resource estimate along with a feasibility study sometime between June and July 2023.

The company is also involved in a project to extend the operating life of the Mount Milligan mine by many years to 2033, and to increase the proven and probable reserves of gold (≈1.1 million ounces) and copper (≈260 million pounds). In the third quarter of 2022, the miner also saw lower gold sales and lower realized gold prices, causing sales revenue to decline nearly 19% year over year to $179 million. On top of this, higher costs resulted in a pro forma net loss of $0.06 per share.

On a by-product basis, total costs were $1,376 per ounce due to higher spending on exploration and project development activities and the costly operation and maintenance of the mineral deposits.

The Situation at the Mines

Centerra Gold can only realize gold production (54,134 ounces in Q3 2022 vs. 76,913 ounces in Q3 2021) from the mining and metals operations of Mount Milligan Mine in Canada. This is because the other facility in Turkey, the Öksüt Gold Mine, halted the production of gold doré bars last March due to the discovery of mercury in some stages of material processing.

The Mount Milligan Mine

Mount Milligan also produced copper (19 million pounds in Q3 2022 vs. 17.9 million pounds in Q3 2021). Mount Milligan is selling gold at a price ($1,204 per ounce in Q3 2022 vs. $1,542 per ounce in Q3 2021) well below the market price ($1,728 per ounce in Q3 2022 versus $1,790 per ounce in Q3 2021).

A streaming agreement between Mount Milligan Mine and Royal Gold, Inc. (RGLD) determines the average realized gold price per ounce. Mount Milligan is required to sell a significant portion of 35% of total gold sales volume to Royal Gold at $435 per ounce, which is nearly four times less than the market price in Q3 2022.

In addition, Mount Milligan is struggling with rising production costs, mainly due to expensive energy bills. This situation will continue as long as fossil fuels remain expensive, while it does not seem possible to increase the amount of mined material shipped to the processing plant without increasing truck travel times.

Fuel prices and electricity are not expected to ease in the coming months as hydrocarbons should continue to rise. Analysts are forecasting that the price of Crude Oil WTI Futures – December 22 (CLZ2) – will rise by almost 23% over the next 12 months to reach $104.51 by the end of 2023. Referring to the natural gas market price, to which the price of electricity is normally linked, analysts estimate that a million British thermal units traded via futures – December 22 (NGZ2) – will rise nearly 30% to $7.61 by the end of 2023.

The Öksüt Gold Mine

Mining, ore crushing, and stockpiling continue at the Öksüt Gold Mine in Turkey. However, to resume gold production, an environmental permit is required from the Turkish authorities after the mercury contamination incident. To date, it is not known when the asset will be authorized to resume activity.

Once mining operations in Turkey are 100% permitted, the Öksüt Gold Mine can restart immediately with approximately 100,000 ounces of gold for recovery from activated carbon. This is because the conversion activities of the mineral in the form of gold into carbon in the Öksüt Gold have continued since the cessation of gold production.

However, before the mineral deposit is fully permitted to operate, the price of the precious metal in the marketplace might have fallen significantly due to the factors discussed above. So, for the Öksüt gold mine, there is a risk of missing the opportunity to sell the ounces at a higher market price.

Analysts estimate that the price of gold, traded via Gold Futures – December 22 (GCZ2), will fall from the current $1,777 an ounce to $1,687.66 an ounce within a few months.

The Molybdenum Business Unit

The company’s molybdenum business unit includes a metallurgical processing facility in Pennsylvania and two molybdenum plants in Idaho and British Columbia. There are care and maintenance costs associated with these assets, as well as some reclamation costs. These issues, combined with a longer-than-expected closing time for molybdenum sales, resulted in negative free cash flow ($19 million for the first nine months of 2022). The molybdenum business unit might face similar issues in the coming months, while the molybdenum price is not expected to rise substantially from the current market price of $46.50 per kg to $48.90 per kg within 12 months.

As seen above, there is no positive correlation between the market price of molybdenum and Centerra Gold’s stock price. This might be due to the stock being more affected by the change in gold and copper prices. Therefore, an increase in the market price of molybdenum is unlikely to have a direct positive impact on the share price, while lower prices in the gold and copper markets will probably have a significant negative impact on Centerra Gold’s share price.

Stock Valuation: Shares Trade Significantly Lower Vs. Last Year, But Not Triggering a Buy

Shares were trading at $5.16 at the time of this writing, giving a market cap of $1.15 billion and a 52-week range of $3.77 to $10.57.

After falling 38% over the past year, shares of Centerra Gold are trading in the lower half of the 52-week range and well below the long-term trend of the 200-day moving average of $6.99. Shares are on track to move further down due to expected declines in gold and copper prices, coupled with some operational issues that will weigh on mining performance.

The stock has a 14-day relative strength index of 63, meaning there’s ample room for further downside if the stock price wants to test lower levels. The ratio suggests that despite falling over the past year, the stock is still far from oversold levels. What could boost the stock price instead is a bull market in gold and copper, which currently has little chance due to higher bond yields, a stronger dollar and recession risks. The first two factors increase the cost opportunity of holding gold in place of bonds and U.S. dollars, while the third factor weighs on copper demand.

As for Centerra Gold’s operational issues, some might be structural, such as a low realization price on gold and copper sales, while some are being resolved. But the process might take longer than expected.

Conclusion: Shares Well on Their Way to Testing Lower Price Levels

There are some downside risks to Centerra Gold shares. The stock price will suffer from the expected declines in gold and copper prices, while mining presents a number of issues that may turn out to be more entrenched than expected. This stock is probably not a buy, and the position might need to be lowered.

Be the first to comment