EvgeniyShkolenko/iStock via Getty Images

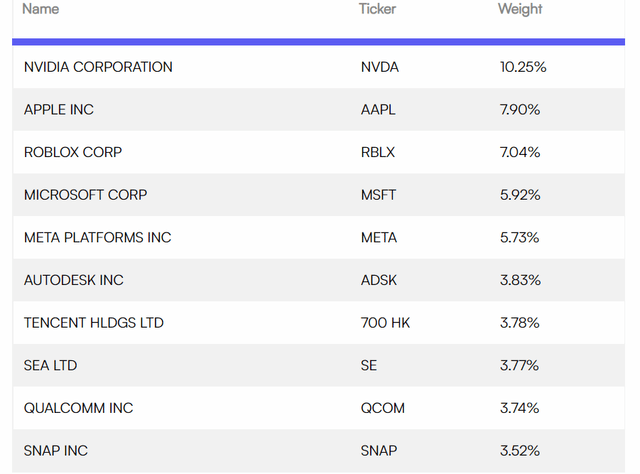

According to a new report by research consultancy firm Deloitte, “the metaverse is no longer science fiction.” The report adds that millions are already using early versions of metaverse platforms, spending both their time and dollars on gaming platforms such as those proposed by a number of companies, including Roblox (RBLX), which is one of the Roundhill Ball Metaverse ETF (NYSEARCA:METV) top holdings as shown in the table below.

METV-Top Holdings (www.roundhillinvestments.com)

Still, as shown above, another of its top holdings consists of Meta Platforms (NASDAQ:META) whose market cap has fallen by more than 65% during the last year, in turn impacting METV’s share price as well.

There is also software giant Microsoft (NASDAQ:MSFT) which should be more skewed toward gaming with its anticipated Activision Blizzard (NASDAQ:ATVI) acquisition, without forgetting Nvidia (NASDAQ:NVDA) with its gaming GPUs (Graphics Processing Units).

Thus, I start by assessing METV’s opportunities in the gaming industry as a building block for the metaverse.

Gaming, as the Main Building Block For The Metaverse

First, behind the success of games like Roblox’s Quid or Epic Game’s Fortnite, lies the concept of Massively Multiplayer Online or “MMO.” These are like virtual universes, each one with its own set of rules and which can be used simultaneously by thousands of players. The basic idea here is interaction on a massive scale, whether for strategy or war games.

Additionally, online games which we know about and where you fight against a monster by first choosing a character to represent you as the hero from a list of items, are different from metaverse-oriented games. Here, the participants can create their own virtual representations or avatars, based on a theme. Furthermore, they can play simultaneously with other players, buy virtual items with their real money, create their own game campaigns, or join predefined games.

Going one step further, there are the sandbox MMOs provided by Roblox and Minecraft which transfer some degree of creative control into the hands of gamers who are then relatively free to create their own virtual spaces or universes to interact with others. These games have many adepts including a large number coming from Asia with Roblox’s platform now having more than 57.8 million daily active users. This figure was 47.3 million in October 2021 and in addition to playing games, users can also connect to share positive experiences in an immersive environment.

The number of users should go higher, as Walmart (WMT) has partnered with the interactive entertainment company as it experiments with innovative ways to reach shoppers including using augmented reality or AR. This provides for more real experiences including footage from the actual physical world compared to virtual reality or VR which is unreal and incorporates fictitious characters.

Now, consider the fact that Roblox, which has been around since 2004 just like Meta or Facebook, has registered 10.5 million new users from around October 2021 to date, compared to only around 200K monthly active users for Meta Horizon World (or Facebook’s metaverse) during about the same period. You clearly see that the gaming approach to building the metaverse appears to be working better than social media.

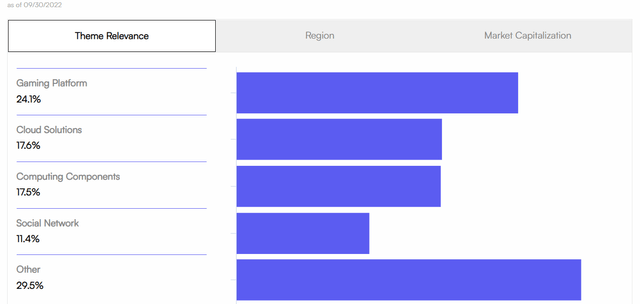

This may explain why METV dedicates 24.1% of its assets to gaming platforms compared to only 11.4% to social media, as pictured below.

Percentage of Assets per Theme (www.roundhillinvestments.com)

Moreover, despite investments made, Meta Platforms is not delivering on metaverse expectations, with monthly users expected to reach 500K by end of 2022. Still, with 3.71 billion monthly users for its whole family of apps including Instagram and Facebook, Meta has a large pool of people to convert to the metaverse. This is the reason METV dedicates 5.73% of its assets to Meta Platforms.

Continuing with gaming, there is Microsoft and Apple (NASDAQ:AAPL).

More Gaming, Cloud, Computing Components and the Risks

Microsoft, which is already a public cloud giant with Azure, should now become the world’s second-largest gaming company after Sony (SONY) with the Activision acquisition. There is also Apple, which does not report gaming revenues separately but is also a major player in this industry with its iPhone and AppStore ecosystems.

Coming to computing components (above table), there is Nvidia.

This company is primarily known for its RTX GPUs used in gaming PCs. However, it has also made its GPUs available through its omniverse platform for building and managing metaverse applications. These can be used by artists, developers, and graphic designers. Moreover, the fact that Nvidia is providing its technology in a Software-as-a-Service, or SaaS, format means it comes on a pay-per-usage basis. This should be more Capex light, in turn increasing the probability of gaining wider adoption.

Nvidia launches omniverse for industrial metaverse applications (nvidianews.nvidia.com)

Continuing on a more cautious note, all the companies I have talked about are growth stocks, and, as such, these have been heavily impacted by the Federal Reserve’s aggressively raising interest rates since the beginning of this year. Also, as tech plays, their valuations remain higher than the more value stocks, as I recently explained in a thesis by taking the example of Technology Select Sector SPDR ETF (NYSEARCA:XLK).

Tech is also under pressure, as a stronger dollar makes its products less attractive in the rest of the world. Also, there are economic slowdown concerns globally which means that revenue growth is likely to be impacted, in turn casting doubts about tech’s ability to drive earnings higher. In these circumstances, it becomes difficult to justify their higher price-to-earnings multiples. This is why, in case the Federal Reserve raises rates by 75 basis points on December 13-14 instead of 50 as many market participants are expecting, the technology sector should fall more than the traditional sectors of the economy, where the more value-oriented stocks (or the ones with lower price to earnings multiples) come from.

Then, for those who are patient enough for the clouds on the horizon to dissipate, there are opportunities.

Assessing Metaverse Opportunities

Coming back to the report by Deloitte, mentions that most opportunities are in Asia where 60% of the world’s youth are located. That region also has the largest player base consisting of about 1.3 billion people. This number could surge to 5 billion according to Roundhill, in its estimates for the global number of unique metaverse users by 2030.

This will in turn give rise to $8 trillion to $13 trillion TAM which is really enormous, and in order to benefit from the opportunities, the exchange-traded fund (“ETF”) has 45 holdings that track the Ball Metaverse Index.

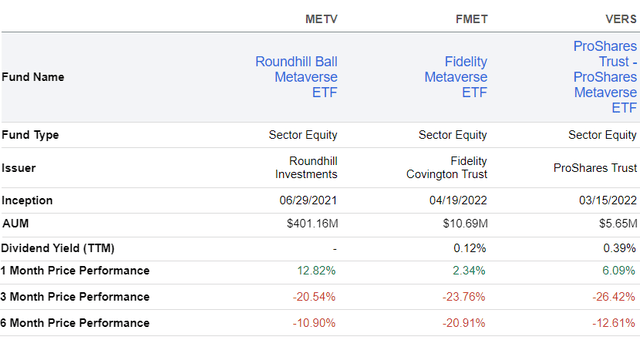

Looking across the industry, there are other ETFs that provide exposure to gaming, with two of them being the Fidelity Metaverse ETF (FMET) and the ProShares Metaverse ETF (VERS), which were both incepted earlier this year, after Facebook rebranded to Meta in October 2021. On the other hand, METV was incepted in June 2021 and its ticker symbol was previously “META”, which was changed to the most recent one on January 31 this year.

Comparison with peers (www.seekingalpha.com)

Looking beyond names, the Roundhill Ball Metaverse ETF has delivered a superior one-month performance while providing better mitigation against volatility during the last six months. For growth investors, this price outperformance by a hefty margin of at least 6% during the last month more than compensates for the fact that it does not pay any dividends. Noteworthily, METV comes with an expense ratio of 0.59%.

Conclusion

As per the above comparison and for those who believe in the billions of dollars of opportunities the Metaverse can offer, METV is the most appropriate choice in case you want to opt for a fund instead of individual stocks. But, as I have said before, the ETF’s holdings are tech stocks, and, as such, they will continue to be impacted by a higher degree of volatility than the broader market as they are more dependent on the pace of interest rate hikes than value stocks. From this perspective, METV’s share price should continue to be volatile. Subsequently, it could again rise to $10, a support level it has reached two times this year, but only in 2023, as the Federal Reserve comes closer to the terminal rate.

Along the same lines, do note that metaverses are still at an early stage of development considering that MMOs are built around specific themes and have limited interactions with each other. This is completely different from interaction in the physical or real world where you can move to different venues easily, like shifting from a football match to a boxing arena, after having paid for your tickets with money from your wallet. This is because you are easily recognizable as a human being, which is not the case in the virtual world unless different MMO universes become linked together and players can move freely from one to the other using a single avatar.

Finally, with its holdings, Roundhill Ball Metaverse ETF does cover the entire metaverse ecosystem right from components, platforms, and themes. These are the very building blocks for virtual worlds. Adding a dose of caution, Roundhill’s belief that the metaverse “will become the successor of the current internet and will build an experience that spans the virtual and real world” may take some time to materialize, though.

Be the first to comment