Feverpitched

Thesis

We present a timely update to our previous article on United States Steel (NYSE:X) as worsening economic headwinds have accelerated. The Fed’s hawkish stance in accelerating its rate hikes has increased fears that it could bring the economy to its knees, driving it into a hard landing in 2023.

As a result, we believe the market has been pricing in these headwinds accordingly into economically sensitive stocks like X, given their highly cyclical business model. It’s critical for investors to assess whether the recent pullback from its August highs warrants adding more positions as X goes through the cycle.

Our analysis suggests it’s still too early to add more exposure, as we have not yet gleaned significant earnings compression in the consensus estimates. Notwithstanding, the market has already started anticipating further cuts, as it justifiably de-rated X, despite a remarkable Q2. Investors need to note that the market is forward-looking.

We discuss why we are not ready to re-rate X yet. We also discuss the critical price and valuation levels that investors can start getting excited with X subsequently to ride the next wave up.

As such, we reiterate our Hold rating.

Prepare For A Major Recession

Even though the equity markets are already in the doldrums, we think Fed Chair Jerome Powell and his committee are sparing no effort to inflict more pain on the economy with their #1 goal of bringing down inflation expeditiously.

Therefore, we believe the market remains in a price discovery phase as investors battle to assess whether Powell’s objective could lead to a soft or hard landing for the economy.

Famed Wharton professor Jeremy Siegel accentuated that the Fed is making yet another policy stumble that could cause a severe recession in 2023. He articulated:

Now when all those very same commodities and asset prices are going down, [Powell] says: ‘Stubborn inflation that requires the Fed to stay tight all the way through 2023.’ It makes absolutely no sense to me whatsoever, way too tight. If tightening actions from the Fed continue through 2023, you can make sure that there’s a major recession on the other side. – Insider

Notwithstanding, Princeton economics professor Alan S. Blinder highlighted in a recent commentary that it’s not all doom and gloom, and we shouldn’t write off the Fed yet. He stressed in a recent commentary that “landing the economy softly is a tall order, but success is not unthinkable. The Fed has done it before.” Blinder articulated:

A careful historical analysis suggests, however, that the Fed has a much more encouraging record. By my reckoning, it managed a soft landing or came close in six of the 11 cases. In the other five, it was either not trying to land the economy softly-because a hard landing was needed to crush high inflation-or its policy was overwhelmed by events out of the Fed’s control. – WSJ

Therefore, we believe the price discovery in the market leading to volatility will likely continue as the bulls and bears battle their conviction. Undoubtedly, the initiative remains with the sellers, betting that Powell and his team will unlikely achieve a soft landing, given the malaise in the equity markets.

So, Prepare For U.S. Steel’s Earnings Compression

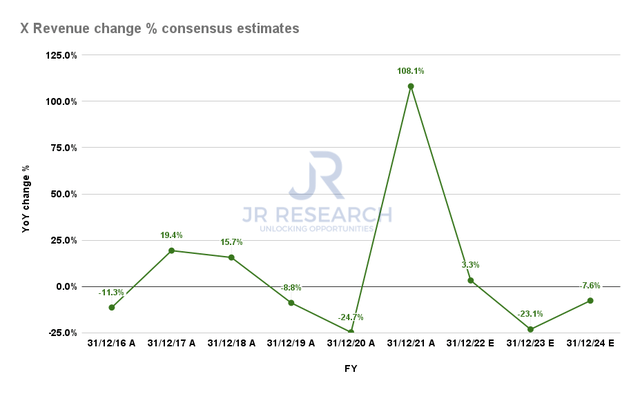

U.S. Steel Revenue change % consensus estimates (S&P Cap IQ)

Interestingly, the consensus estimates (neutral) suggest that X’s revenue growth should slide further through 2023 before recovering. Therefore, the Street could already have priced in a significant downturn in U.S. Steel’s growth momentum.

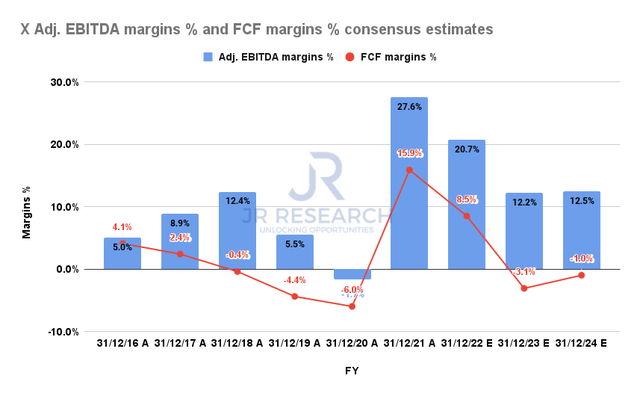

U.S. Steel Adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

However, the Street is still projecting for U.S. Steel to post adjusted EBITDA margins that are way higher than its previous significant downturns in 2016 and 2020.

Therefore, we postulate that the Street’s consensus is still overly-optimistic about the company’s earnings prospects through the cycle. Accordingly, we parsed that the earnings compression revision has yet to impact U.S. Steel’s operating metrics.

Wait For X’s Valuation To Spike Upward

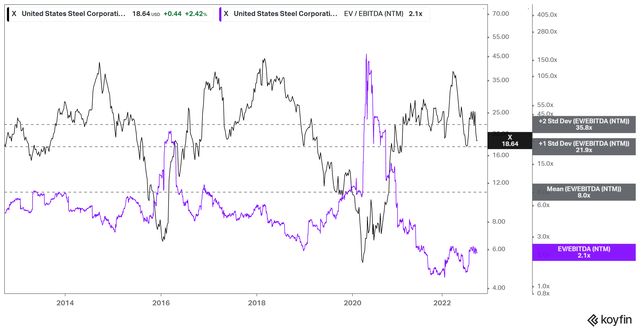

X NTM EBITDA multiples valuation trend (S&P Cap IQ)

We gleaned that X’s last significant bottoms in 2016 and 2020 occurred after its estimates were cut markedly, sending its EBITDA multiples surging above the one standard deviation zone over its 10Y mean.

Therefore, we deduce that X’s valuation has likely not bottomed out, as the Street has yet to turn overly pessimistic on its earnings prospects. Accordingly, investors should wait patiently on the sidelines for the Street to turn negative en masse, which could then send X’s EBITDA multiples way above the one standard deviation zone.

Is X Stock A Buy, Sell, Or Hold?

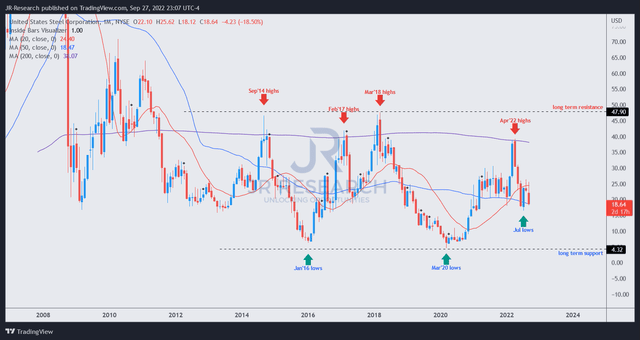

X price chart (monthly) (TradingView)

When investors aren’t sure whether a particular stock has a highly cyclical nature, we will point them to its long-term chart.

As seen above, X’s long-term chart suggests nothing to us that the market is convinced of a secular growth story, supporting a long-term uptrend. Instead, it’s just a highly cyclical chart indicating a boom (sell) and bust (buy) growth story over time.

X remains well above the lows in 2016 and 2020. We have yet to observe the Street turning overly pessimistic over its downcycle. Therefore, we postulate that investors must be patient and wait for the “bust” opportunity to add exposure in X.

As such, we reiterate our Hold rating on X.

Be the first to comment