10’000 Hours/DigitalVision via Getty Images

Article Thesis

AT&T (NYSE:T) has seen its shares come under a lot of pressure in the recent past. The weak performance was driven by worries about rising rates and an economic downturn to a significant degree, but I believe that those worries might be overblown, as I’ll lay out in the article. At current prices, AT&T is very cheap, offers a high dividend yield, and has ample total return potential over the coming years.

What The Market Fears Right Now

With AT&T having dropped 27% from recent highs that were hit just a couple of months ago, it’s pretty clear that sentiment right now is weak. There are two key headwinds that the market has identified, neither of them is company-specific but both are possibly impacting AT&T. I do not believe that they will be harsh enough to warrant a price drop of almost 30%, but the market seems to be at least somewhat fearful right now and has reacted very harshly to these trends.

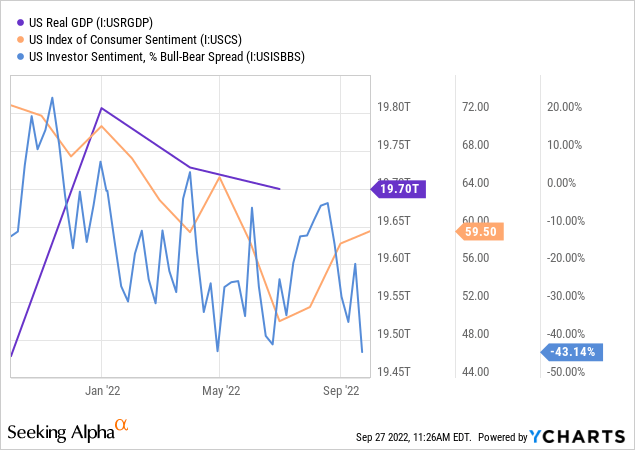

The first of these is the ongoing slowdown that the US economy and the global economy are experiencing. There are many signs of that slowdown, including the following ones:

Real GDP, i.e. accounting for the impact of inflation, has declined in the US in the last two quarters (= a technical recession). Consumer sentiment has improved from the lows seen in summer, but is still considerably weaker than it was a year ago. Investors are also pretty bearish, with the bull-bear spread at a very low level of -43%. The Fed is adamant on bringing down inflation and officials have stated repeatedly that an economic downturn might be necessary to achieve that goal. Overall, the macro picture is thus not too good for the US economy right now — although it is still better than in Europe, for example.

An economic downturn negatively impacts businesses, but the impact depends a lot on the industry a business is active in. Telecoms such as AT&T should be relatively well insulated, I believe. After all, consumers will reduce their spending on discretionary items when times are harsh, such as eating at restaurants, traveling, buying new vehicles, and so on. But consumers won’t stop using their smartphones, as those have become too essential for our way of life. On top of that, getting rid of a smartphone would not make an overly large difference in monthly expenses on an absolute basis — forgoing the purchase of a new vehicle does have a much larger impact, for example.

I thus believe that the market’s reaction to the ongoing economic slowdown is overblown, as this will not be too much of a threat for AT&T. In fact, smartphone manufacturers will likely feel a larger impact, as consumers might keep their existing phones for longer — but they won’t stop using phone services altogether. Somewhat surprisingly, Apple (AAPL), the most valuable smartphone maker in the world, has performed relatively well in recent months, despite the fact that it is more exposed to declining consumer spending, as more iPhone owners might decide to stick with their current model a little longer.

The other macro issue that the market fears is the rising rates environment. Rising rates mean that debt gets more expensive, all else equal. AT&T is heavily indebted, so at first sight, the Fed’s hikes are an issue for AT&T. But when we look more closely, we see that the actual impact is way more nuanced than what the market is pricing into AT&T’s stock.

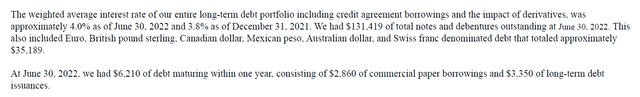

In order to look at the impact of rising rates on AT&T’s interest expenses, it makes sense to delve into the company’s 10-Q:

The company’s weighted average interest rate of 4.0% is highly compelling in the current environment — that’s almost exactly the yield on 10-year treasuries. AT&T thus has managed to add debt at very favorable terms in the past, with interest rates at deeply negative levels in real terms. The company’s total debt load of $131 billion costs the company around $5.2 billion in interest per year, or around $4 billion on a net basis once taxes are accounted for.

A pretty small portion of that debt is short-term, as debt maturities over the next year total just $6 billion — 5% of the total debt. Even if those $6 billion were to be refinanced at a rate that is 300 base points higher than the old rate, that would add just $180 million in expenses before taxes, or around $150 million after tax. Since AT&T is generating EBITDA of around $42 billion this year, the additional interest expenses are minuscule, even in a scenario where near-term debt needs to be refinanced at a +300 base point rate.

This does not yet account for AT&T’s ability to just pay off its near-term debt when it matures. After all, debt does not need to be refinanced automatically, as long as a company’s cash generation is sufficient to allow for debt paydown in absolute terms. That is the case with AT&T. The company has guided for free cash flows of $14 billion this year. When we account for dividends that should total $8 billion, then AT&T has surplus free cash of $6 billion this year — which is an almost perfect fit with the debt that comes due over the next twelve months. Even better, AT&T’s free cash flow this year will be at a below-average level, which is why free cash generation should be significantly stronger in 2023 and after. AT&T’s management has guided towards free cash generation of at least $20 billion next year. Assuming the dividend is held constant, AT&T could thus pay down $12 billion of debt on a net basis, which is roughly twice as high as the debt reduction potential this year (excluding the debt reduction via the Warner Media spinoff).

With debt reduction in the $12 billion range, AT&T could completely pay off its debt in 11 years. This does not yet account for organic growth in cash flows via the addition of new customers, price increases, and so on. On top of that, this also does not yet include the impact of lower interest expenses as debt is getting paid down over time. After all, if AT&T were to reduce its debt position by half over the next couple of years, its free cash flows should see a boost of $2 billion or so just from lower interest savings. There thus is a bit of a “snowball effect” in place: Debt being paid down leads to lower interest expenses, which leads to higher cash flows, which leads to more debt reduction potential, and so on. That does not work for all companies, of course, but it works for companies with considerable debt loads where cash generation is sufficiently high. In AT&T’s case, that holds true — cash generation is high enough to pay interest expenses, dividends, growth spending, and there’s still surplus cash left over for debt reduction in absolute terms.

Liquidity also isn’t an issue for AT&T, as the company has two credit facilities totaling $15 billion ($7.5 billion each). Both of these facilities are untapped. AT&T thus has massive liquidity reserves, even though it will most likely not need them as its free cash generation is strong enough to pay for everything the company wants to do — including growth investments, dividends, and some debt reduction. Still, the $15 billion in available liquidity gives AT&T an additional buffer and reduces risks further.

Overall, I believe that the market worries way too much about AT&T’s debt and the impact of rising rates. The well-laddered debt, with some notes expiring in the 2040s, 2050s, and even the 2060s, the fixed-rate nature of most notes, the hefty surplus free cash generation and the low interest rates AT&T pays today mean that AT&T is not in dire straits. The massive liquidity available via its credit facilities should further alleviate concerns.

AT&T: Attractive Right Here

So with AT&T not being harmed too much by higher rates, and with the stock down so much in the recent past, what’s the conclusion? I believe that this combination of (operational/financial) resilience and a steep share price drop makes for an investment opportunity.

Today, AT&T is trading at just 6.2x forward net profits. Of course, AT&T is not a high-growth company, and won’t turn into one. It will likely never trade at 15 or 20x net profits. But a company with huge free cash generation and some organic growth should be worth more than 6x net profits, I believe. It would not be outrageous at all for AT&T to trade at 10x net profits, which would translate in hefty 50%+ upside. That will most likely not happen in the near term, I believe. But as debt is being paid down and as the market worries subside, a recovery to that valuation level over a couple of years seems quite achievable, I think.

On top of that, investors get a compelling 7% dividend yield at current prices. With the dividend being resized earlier this year, and with dividend coverage at a very strong 230%, (payout ratio of 44%), there is little risk of a dividend cut, I believe. Investors could thus benefit from both a compelling dividend yield and serious upside potential over the next couple of years on top of that, making AT&T a very viable total return pick. That being said, many other income names have dropped a lot in recent weeks as well, and attractive deals can be had in a range of other names, too, thus AT&T isn’t a must-own stock.

Be the first to comment