Tim Boyle

Overview

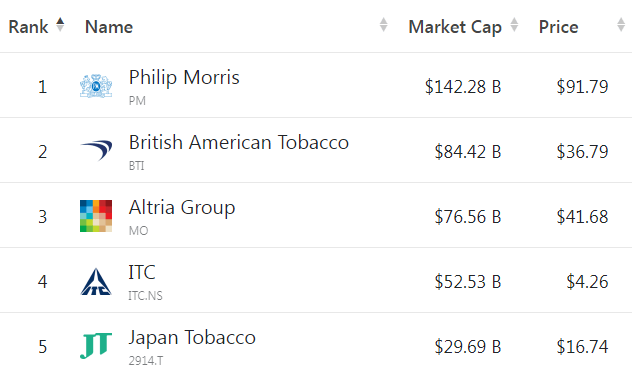

Altria Group, Inc. (NYSE:MO) and Philip Morris International Inc. (PM) are two of the largest cigarette companies in the world with a combined MV (Market Value) of over $200 billion.

Originally, of course, they were part of the same company until they split up in 2003.

companiesmarketcap.com

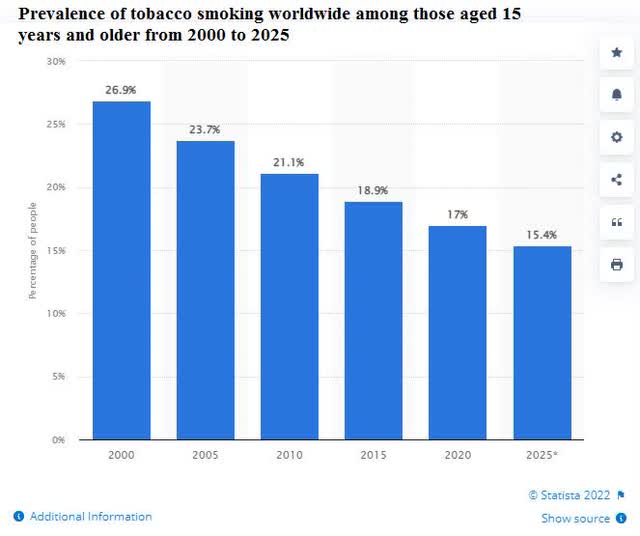

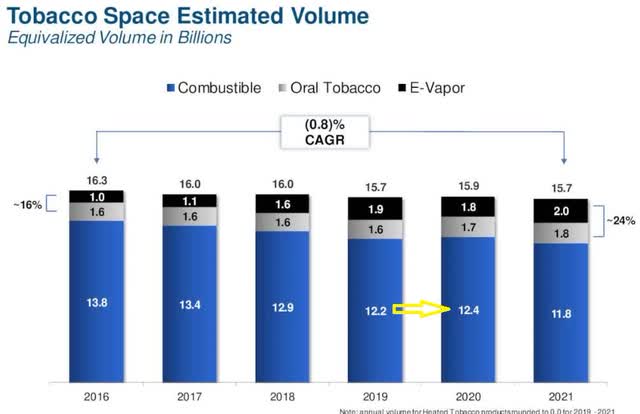

Serving a declining cigarette market, both have expanded into other non-tobacco products such as e-vapor and oral tobacco in order to expand their sales potential going forward.

One way to make up for the declining cigarette market is to expand the alternative smoking market which both companies are doing albeit slowly.

Note the yellow arrow shows that volume actually went up during the big COVID-19 year of 2020.

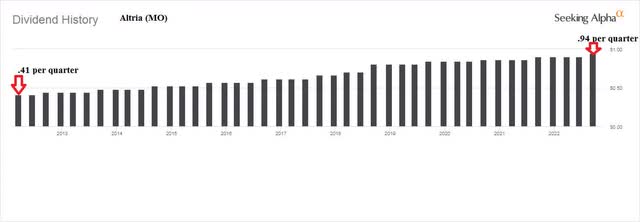

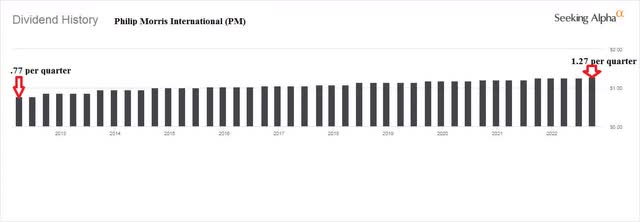

In the case of MO, they have increased their dividend every year for 52 years, an enviable record to say the least. PM has increased its dividend for 13 straight years, wimpy compared to Altria but impressive nonetheless.

The question to answer in this article is which company will be the most reliable dividend payer going forward.

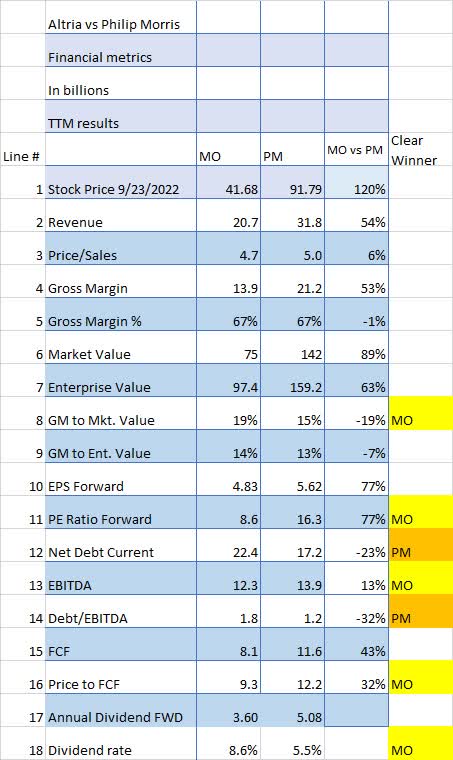

Altria and Philip Morris Stock Key Metrics

One interesting note is the Gross margin (line 5) where both companies clock in at exactly the same 67%. That means both companies have the same percentage of revenue to work with after cost-of-goods-sold meaning the end results will be based on how well management uses that margin. Various uses include R&D, employee expenses (usually directly related to headcount), marketing, and CAPEX (Capital Expenditures).

Another interesting comparison is Revenue (Line 2) to Market Value (line 6). Note that although PM has 54% more revenue its MV is 89% higher implying that Altria may be undervalued compared to Philip Morris. The same holds true in the Revenue to Enterprise Value (line 7) at 63% but to a lesser extent. The reason for that is MO’s net Debt (Line 12) is 23% higher than PM’s even though MO’s revenue (Line 2) is 1/3rd less than Philp Morris’.

Much of the Net Debt difference is due to Altria Management making some very bad investment decisions regarding JUUL which resulted in a $13 billion write off.

Another area where MO looks better than PM is the Forward PE Ratio (Line 11) at 8.6x compared to PM’s 16.3x. Also, Altria’s EBITDA (Line 13) is almost equal to Philip Morris’s even though MO’s revenue is 1/3 less.

Additionally, MO’s Price to FCF (Line 16) is less than PM’s another indicator that MO may be underpriced relative to PM.

And finally, the current projected dividend rate (Line 18) favors MO considerably at 8.6% to 5.5%.

In the following table, yellow line numbers are those that favor MO and orange line numbers are those that favor PM.

Seeking Alpha

On financial metrics alone, Altria looks relatively undervalued compared to PM.

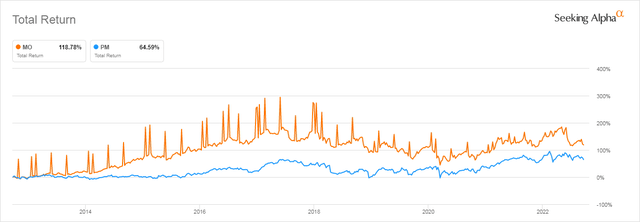

However, based on Total Return (including dividends paid) results for the last three years, PM is the clear winner 51% to 29%.

But if you go back 10 years, MO is the clear winner on a Total Return of 119% versus 65% for PM.

Are Altria And Philip Morris Direct Competitors?

MO and PM are not direct competitors but are generally in the same product markets. MO has the US market for the key product for both companies, Marlboro cigarettes, while PM has the international i.e. not US marketing rights to Marlboro. Although both companies are trying to build up their non-smoking product lines, smokable products are still the key to sales volume and profits.

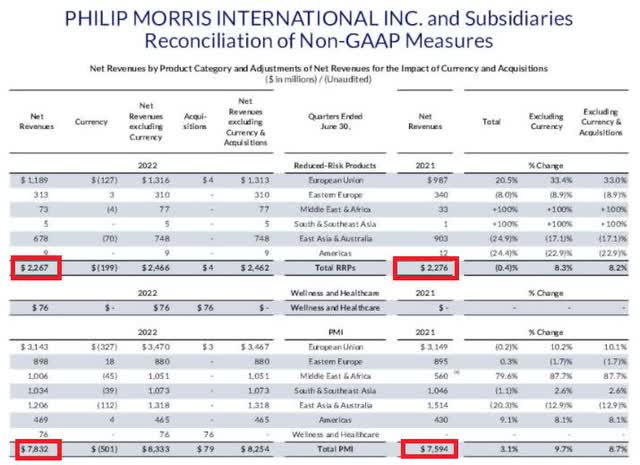

For PM in Q2 2022, the smokable product lines, including Marlboro represent 78% of revenue and most of the profits. Here are the numbers for PMI (Philip Morris International) compared to RRP’s (Reduced Risk Products). Note that 78% of revenue is still smokable products (PMI) compared to Reduced-Risk Products.

Also note RRP revenue actually went down, albeit marginally, while PMI’s went up. In other words, there is still a lot of work to do to move RRP’s into the mainstream.

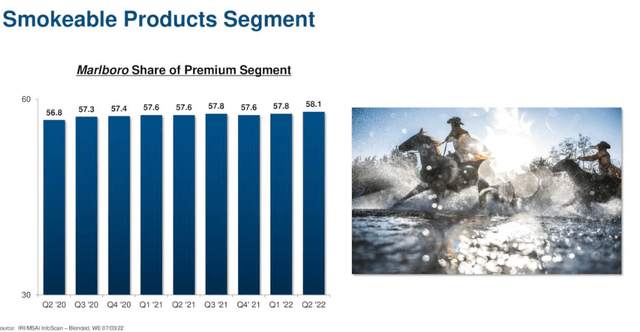

How important is Marlboro to both companies? Well, after 99 years since it was first released in 1923 as “America’s Luxury Cigarette”, Marlboro is still gaining market share. Marlboro is arguably the best brand name in history.

What Is The Difference Between Philip Morris And Altria Regarding Dividends?

As we have seen above in the Financial metrics section, Altria has a significantly higher dividend right now at 8.6% versus Philip Morris’s 5.3%.

As is easily seen MO has raised its dividend at a much faster rate (129%) than PM (78%) over the last 10 years.

So we have Altria raising its dividend for the last 52 years with a higher current yield and a faster-growing dividend over the last 10 years than Philip Morris.

That makes answering the question in this article’s title “Which Is The Best Dividend Stock?” easy to answer.

The best dividend stock is Altria.

Are MO And PM Stock Overvalued?

With the current markets in a severe swoon, it would be hard to say either company is overvalued.

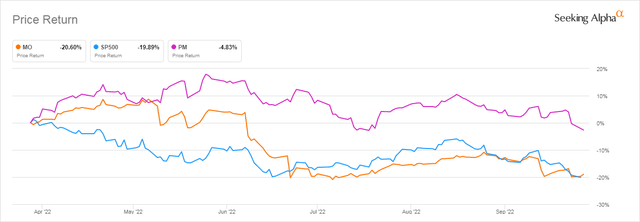

But by comparing MO and PM to SPY (S&P 500) we can see that both MO and SPY have dropped 20% in the last six months compared to PM’s relatively modest 5%.

I would say this makes Altria undervalued and Philip Morris is overvalued at least relative to the S&P 500.

Is Altria or Philip Morris Stock A Better Long-Term Buy?

Based on the following 4 points I would have to say Altria is a better long-term buy.

1. MO’s price is as depressed as the S&P 500 so recovery is probable in the short to medium term.

2. MO’s 8.6% dividend is extremely high for a company that has increased its dividend for 52 years.

3. MO’s PE ratio of 8.6x and Price to FCF 9.3x are well below PM’s 16.3 and 12.2 respectively.

4. MO’s EBITDA is 88% of PM’s even though its revenue is only 65% of PM’s indicating higher margins and more potential debt retirement and/or higher dividends.

Altria is a Buy for those with a long-term view seeking steady and increasing dividends.

Philip Morris is a Hold.

Be the first to comment