jiefeng jiang

Investment Thesis

Photronics (NASDAQ:PLAB) is the world’s leading manufacturer of photomasks for semiconductor companies. A photomask is a high precision photographic quartz containing microscopic images of electronic circuits, and it is an essential element for manufacturing semiconductors. Riding the semiconductor boom, Photronics has been growing rapidly in the past several years, and I expect the trend to continue for several more. Its business resilience is easily demonstrated by the fact that they are one of the few tech companies whose stock price rose (77% in the past twelve months) in this volatile market. I believe Photronics is a great investment option because:

- Photronics is technologically superior to their peers, and the technological superiority provides a clear competitive edge.

- The building of new semiconductor manufacturing sites in the future will bring large tailwinds to Photronics.

- Photronics is a fundamentally strong company with an exceptional balance sheet and great profit margins.

Leadership Position in Photomask

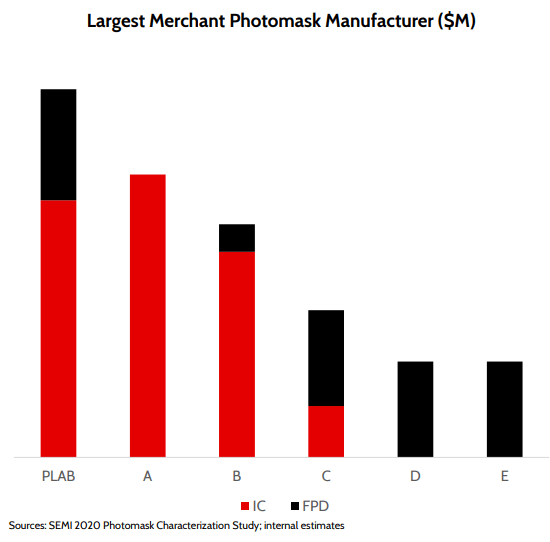

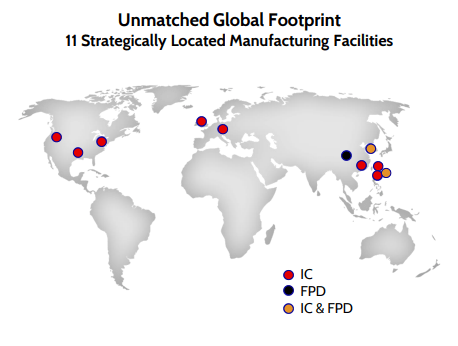

Photronics is a leader in the photomask manufacturing space that is critical to semiconductor manufacturing. They have undergone substantial growth, and captured a large market share in both Integrated Circuit (IC) and Flat Panel Display (FPD) segments through a combination of technological superiority and careful execution of their strategic investment plan.

Even as they grow, Photronics’ management has managed to increase the operating efficiency. Their gross margin improved from 22% in 2020 to 34% in 2022, and operating margin improved from 10% to 23% in the same time span. The company has optimized its asset utilization, invested strategically, and managed costs effectively. This has all come together in a well-managed growth plan.

Largest Photomask Manufacturer (Photronics Investor Relations) Manufacturing Sites of Photronics (Photronics Investor Relations)

Tailwinds from the Semiconductor Boom

As we are well aware, the demand for semiconductors is only increasing as more and more things in our lives rely on these chips. Countries around the world have been investing heavily in semiconductors to meet this demand. China has been trying to move away from labor intensive industries into technology oriented industries with their “Made in China 2025” plan. Investing in the semiconductor business is one of the main pillars of the plan. The U.S. has also started to formulate a plan to increase investment on semiconductors in an effort to ease the severe supply chain and chip shortage crises which have been lingering since the start of the pandemic.

I expect Photronics to ride high with the tailwinds from this Chinese and U.S. investment. They already have manufacturing sites strategically located in China and U.S., and they have strong relationships with customers. Also, they are planning on expanding manufacturing capacity to meet the increasing demand. Therefore, I expect Photronics to continue their upward growth trajectory well into the future.

Strong Fundamentals to Support Growth

Photronics has outstanding fundamentals. They are a financially stable company with a very well managed balance sheet. Photronics has plenty of cash & equivalents ($329.3 M) coming from the strong operating cash flow ($195.8 M in the past twelve months). Compared to their strong cash position, they have much smaller long-term debt ($42.3 M), which gives them the cushion to invest in capacity expansion and acquisition, if they need to.

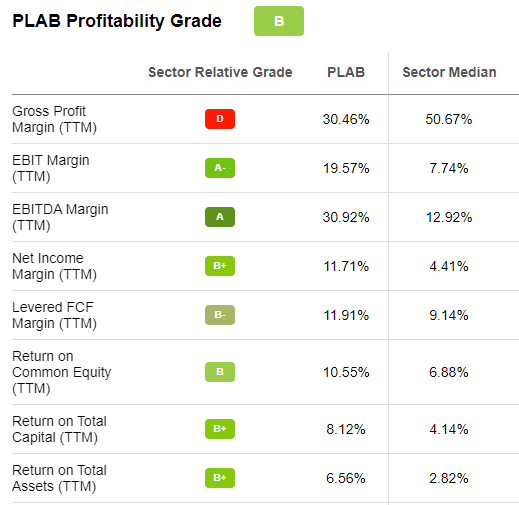

The profit margins are superior to their peers as well. EBIT, EBITDA, and net income margins are far higher than the sector median, demonstrating their competitive edge. Also, high returns on common equity and total capital demonstrate the management’s effective strategic investment and capital usage. These strong fundamentals will ensure that Photronics can sustain growth going into the future.

Photronics Profitability (Seeking Alpha)

Intrinsic Value

I used a DCF model to estimate the intrinsic value of Photronics. For the estimation, I utilized free cash flow ($90 M) and current WACC of 8.0% as the discount rate. For the base case, I assumed free cash flow growth of 13% (Seeking Alpha Estimate) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish cases, I assumed cash flow growth of 15% and 18%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price represents 15-30% upside. Given the strong tailwind from both China and U.S., I expect Photronics to achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$26.14 |

10% |

|

Bullish Case |

$28.19 |

18% |

|

Very Bullish Case |

$31.53 |

32% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Free Cash Flow Growth Rate: 13% (Base Case), 15% (Bullish Case), 18% (Very Bullish Case)

- Current Free Cash Flow: $90 M

- Current Stock Price: $23.81 (07/29/2022)

- Tax rate: 20%

Risk

U.S. GDP recorded two consecutive negative growth (technical indicator of recession), and an economic slowdown seems inevitable, given the high inflation rate and hawkish Federal Reserve stance. While I don’t expect a severe recession or financial meltdown, I do expect lower economic growth for a while. An economic slowdown will tighten up the capital available in the market, making it harder for small cap companies to get investment. Lower availability of capital could pose a negative impact on Photronics’ expansion plan.

As a response to the global chip shortage, many countries around the world are building up their semiconductor manufacturing sites. While larger semiconductor output will positively impact Photronics’ business, potential oversupply in the future could introduce pricing competition for semiconductors and financial pressure on the semiconductor companies. Therefore, the investor should monitor the balance of supply and demand in the semiconductor business.

Conclusion

Photronics has been strategically growing for the past several years. Riding the semiconductor boom, I expect Photronics to thrive in the next couple of years. Given their technological superiority and strategic locations of their sites, I believe they will manage to grow successfully. Lower availability of capital and potential oversupply of semiconductors in the future could pose some challenges to Photronics, but they have a strong balance sheet and good operating cash flow to manage a downturn. Overall, I expect 15-30% upside in the future.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment