Justin Sullivan/Getty Images News

Thesis

Zoom Video Communications, Inc. (NASDAQ:ZM) stock surged to a recent high in July but has since collapsed dramatically, breaking below its May lows.

In our previous update, we urged investors to sell, suggesting that the stock has not capitulated. Notwithstanding, our timing could have been better, given its July surge, but ZM has not convinced us that investors should add exposure even though it has been battered profusely.

We believe that the digestion in Zoom’s small and medium business (SMB) segment is still ongoing, exacerbated by the recessionary headwinds. It also led to the company revising its Q3 forecasts in August. However, we believe the market has likely priced in further headwinds, which could further delay the inflection point in its SMB/online segment.

Furthermore, while its enterprise momentum has been pretty robust in Q2, Zoom will come under pressure to maintain its cadence in H2. Given its ex-US exposure and intense competition with SaaS behemoth Microsoft (MSFT), we postulate that further cuts in Zoom’s earnings estimates could occur.

Accordingly, we deduce that the continued weakness seen in ZM reflects the anticipation of the market, suggesting lowered confidence in Zoom meeting its H2 guidance.

Notwithstanding, we gleaned that ZM seemed to be consolidating at the current levels, complicating a sell entry. Therefore, investors looking to unload exposure should consider waiting for a relief rally first to improve their exit points.

As such, we revise our rating on ZM from Sell to Hold for now.

At 11.2x NTM EBITDA, ZM’s Valuation Seems Well-Battered

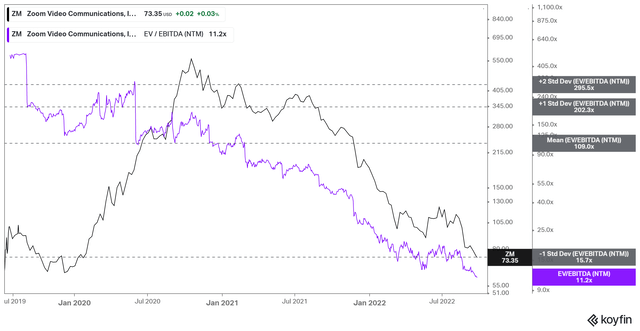

ZM NTM EBITDA multiples valuation trend (koyfin)

ZM’s meteoric rise and spectacular fall, all within three years, will likely be used as an excellent case study on the bursting of “bubble” stocks that rode their one-off tailwind through the COVID pandemic.

As seen above, ZM’s NTM EBITDA multiples have continued their fall from the sky, touching the 11.2x levels at the one standard deviation zone under its mean.

The question is whether ZM is cheap relative to its peers at the current levels. MSFT’s 16x NTM EBITDA represents a 43% premium against ZM’s valuation. However, the King of SaaS is a formidable long-term return compounder for investors, with a wide competitive moat and well-diversified revenue streams.

Therefore, we believe investors need to ask whether the discount in ZM is sufficient to justify adding exposure at the current levels, to bet on its medium-term recovery.

We don’t think it’s a good idea yet, even at the current levels.

Not Cheap Enough For Low-Growth Estimates

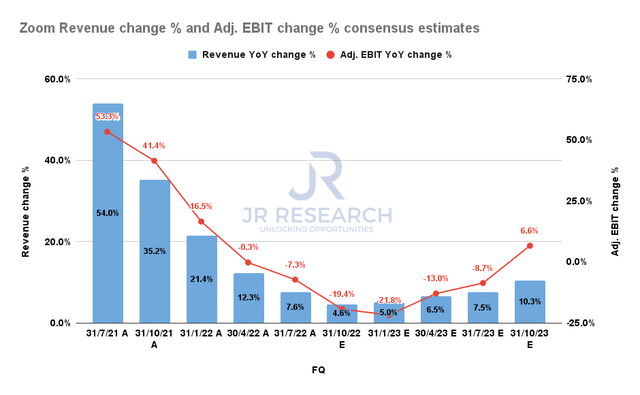

Zoom Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that Zoom’s revenue and adjusted EBIT growth profile could likely bottom out in FQ3 before recovering through 2023. But a 10% growth by CQ3’23 is nothing to shout about for a growth stock.

Notwithstanding, the bottoming process should help stanch a further decline in ZM. However, the price action over the past month suggests that the market remains unconvinced about Zoom’s potential recovery, given the worsening macro headwinds on its SMB segment.

As a result, we believe that ZM’s valuations need to be digested further to account for potentially lower growth estimates.

Furthermore, we parse that given the limited upside potential in the near- to medium term, the market needs a more significant discount to account for potential underperformance at the current levels.

Is ZM Stock A Buy, Sell, Or Hold?

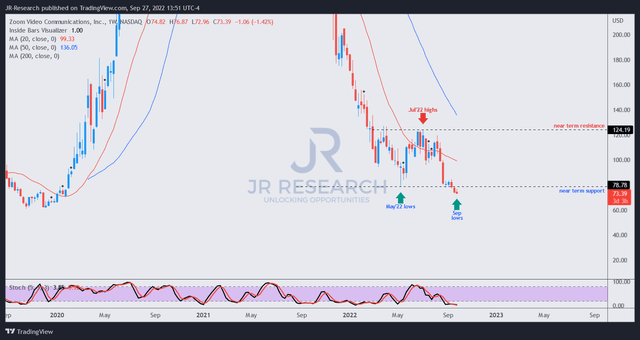

ZM price chart (weekly) (TradingView)

ZM’s price action remains in a bearish flow after breaking below its May lows decisively. We postulate that a potential re-test of its long-term support of $60 is in store, implying a potential downside of about 18% is possible before a more sustainable consolidation.

Therefore, we urge investors against pulling the buy trigger on ZM, as it has clearly been de-rated by the market for its weak competitive moat.

As ZM nears its all-time lows last seen in 2019, it’s a timely reminder for investors to invest in high-quality, wide-moat companies that investors can depend on to ride through turbulent times.

Notwithstanding, given its near-term bottom, we revise our rating from Sell to Hold for now.

Be the first to comment