Hispanolistic/E+ via Getty Images

Matterport (NASDAQ:MTTR) is an American multinational spatial design company that is headquartered in Sunnyvale, California. The company garnered the attention of investors when it went public via a SPAC reverse merger which, if you remember, was extremely popular a year or two ago. As SPACs tend to do, the stock has since fallen apart post-merger and trades at a meager $3.79 per share, well away from its 52-week highs of $37.60. Its overall market is just over $1 billion, which is surprisingly small when you consider the strong brand strength of its products. With that said, one has to ask, has Matterport fallen too far, and is it a buy at current levels?

What does Matterport Do?

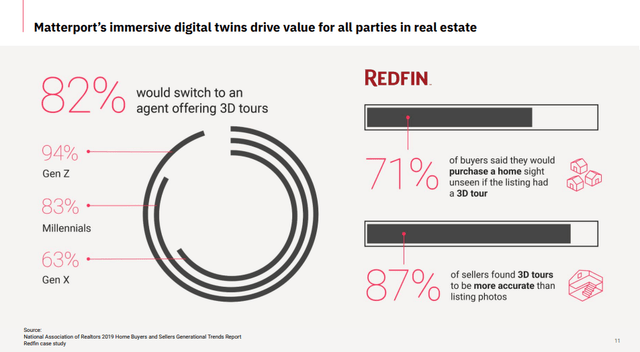

Matterport’s main service is providing people with a virtual view of the interior of buildings, mainly in the real estate market. As the world becomes more digitized and transactions via the Internet become more and more popular, companies like Matterport have started to see some success by helping to facilitate online transactions. Matterport connects a prospective buyer to a property even if they are a thousand miles away. As you can imagine, this is extremely valuable for any real estate company as the number of eyes on a given piece of property is exponentially higher than if the seller was relying on in-person visits to do tours.

This type of technology also connects high-value buyers to modestly priced markets in a way that we have not seen in the past.

The company has two main revenue streams. They sell the specialized hardware and cameras to make these virtual tours. But they also sell the software platform that goes along with the process, which brings in attractive recurring revenues from subscription costs.

The company has also aligned itself with the metaverse. Matterport’s platform and services seem like a perfect match for the Metaverse, particularly because it just acquired a company called VHT Studios which allows it to create a digital twin of things like the interiors of buildings or vehicles. Some analysts believe the Metaverse to be a trillion-dollar industry in the future, and Matterport seems positioned to be a major player in the future.

As with most subscription models, investors were excited at the prospect of recurring revenue-generating high-margin profits, but things haven’t panned out as expected. The stock has been selling off sharply due to profitability challenges and widespread volatility in equity markets.

Strong Partnerships & Subscription Figures

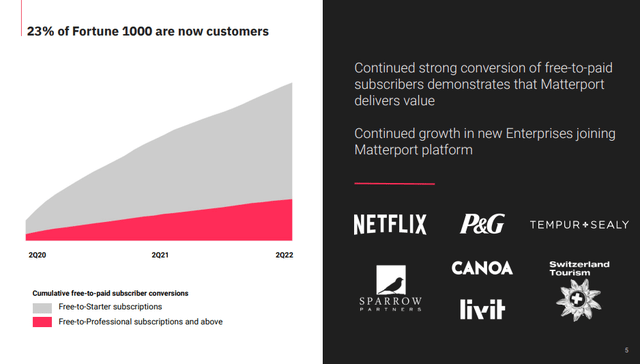

Matterport has been one of the now numerous instances of a company that continues to grow despite its stock price continuing to fall. The company now has 23% of the Fortune 1000 as customers, including newly added clients like Netflix, Procter & Gamble, and Tempur + Sealy.

With the acquisition of VHT Studios, Matterport expanded its customer base to include 7 of the top 10 real estate brokers in America, like ReMax, Berkshire Hathaway, Coldwell Banker, and Century 21. The travel industry continues to be a major boost for Matterport, especially as global travel reopens following the pandemic. Vacasa, Lindner, and KLM are all companies that have recently signed on with Matterport to provide interior 3D views of rental properties, hotels, and aircraft. Investors will want to monitor the effect of a global slowdown on this segment closely going forward.

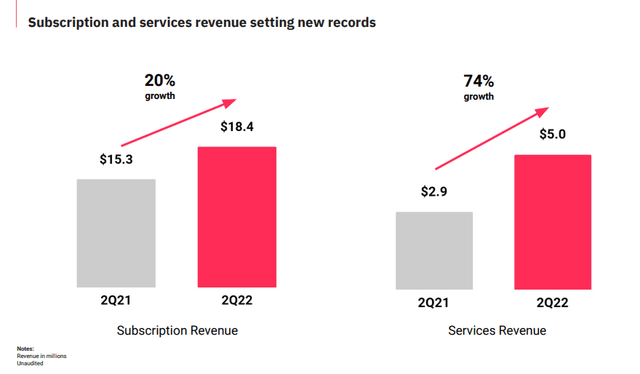

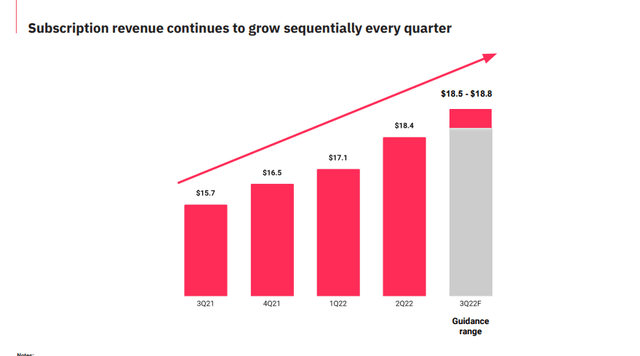

In the most recent quarter, Matterport saw a 20% year-over-year growth in subscription revenues and a 74% year-over-year growth in services revenues.

Subscription revenues now account for 65% of total revenues and have continued to grow sequentially for the past five quarters.

The stock is beaten down, and perhaps growth isn’t as high as it needs to be for some investors. Matterport has shown clear signs of growth in one of the most difficult economic environments since the company was established in 2011.

Forward-looking Commentary

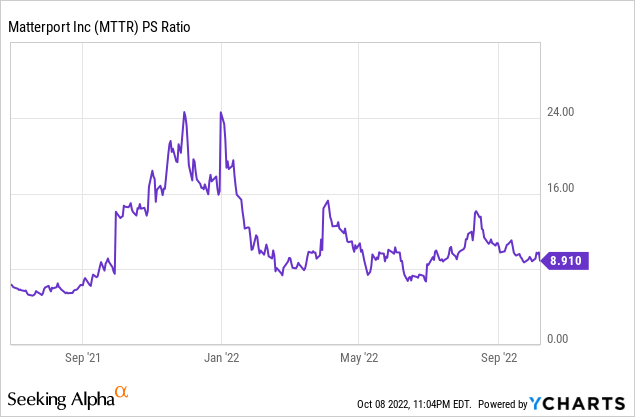

Matterport is currently an unprofitable company. While the growth prospects look compelling, and there is certainly a credible argument for the company becoming an acquisition target at some point, the reality is this stock is far from being a top-quality opportunity going into a global economic slowdown. Even with the selloff, investors are still paying almost 9 dollars for each dollar of the company’s revenue which is pretty rich.

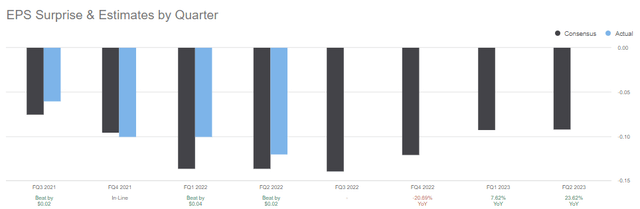

The company has also been losing between $0.05 and $0.10 per share quarterly. This isn’t an outrageous loss for a small company looking to improve and is perhaps the biggest saving grace for bulls. I would attribute much of the EPS stability to the company’s successful subscription model and the prudent guidance of the leadership team. We can see below that management has done a reasonably good job at delivering the EPS expectations over the last four quarters, managing to beat estimates in three of the last four reports. This is not typical in speculative opportunities like Matterport.

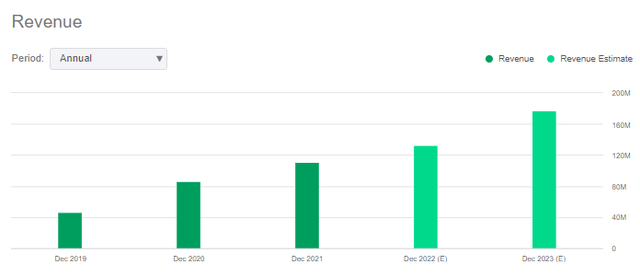

We can also see that the revenue growth story looks set to continue for the foreseeable future. It is important to note that a financial crisis can quickly change expectations.

I would, however, argue that due to the changing real estate market that Matterport’s offerings will be quite sticky. In times of slowing deal volumes, it is unlikely that companies will slow down digital marketing efforts on real estate properties if they’re trying to move inventory.

The Takeaway

Matterport has sold off sharply, but it’s not a buy just yet. We will likely see more volatile conditions for speculative opportunities, and during times like these, it is perhaps best for investors to focus on high-quality opportunities. Matterport doesn’t check all the boxes here, and we may see much lower prices over the short to medium term. I would encourage patience at these levels. It isn’t completely clear how a real estate slowdown could impact the company, but I think they should be just fine. This one is worth keeping on your watchlist. I rate Matterport as a Hold.

Be the first to comment