cagkansayin

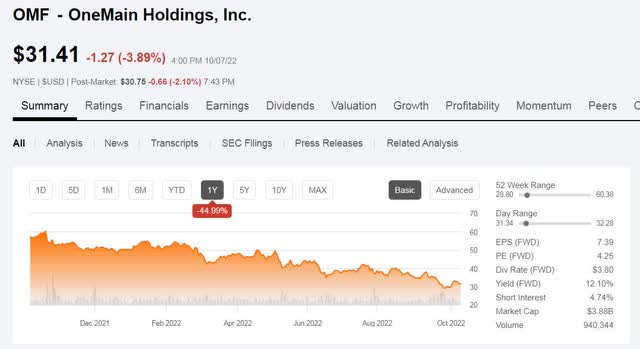

The recent surge in interest rates has sent shares of personal loans lender OneMain Holdings (NYSE:OMF) plunging. Over the last 52 weeks, the shares are down 45%. While value and income investors may be attracted to OneMain shares due to their recent decline combined with their now 12% dividend yield, investors may find high income and decent value through an investment in OneMain’s bonds.

Source: Seeking Alpha

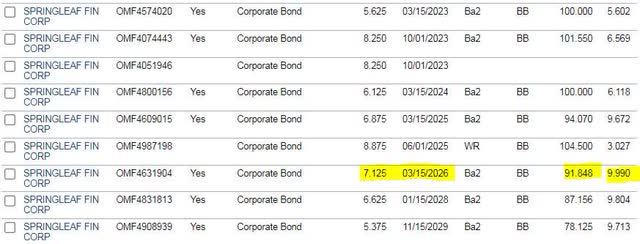

For example, OneMain’s March 2026 maturing debt, which pays a 7.125% semi-annual coupon, is priced at under 92 cents on the dollar, yielding just under 10 percent to maturity. Bonds are senior to common shares in that management cannot opt to not pay interest on debt or full principal at maturity without a bankruptcy. Management can change the dividend at any time.

Source: FINRA

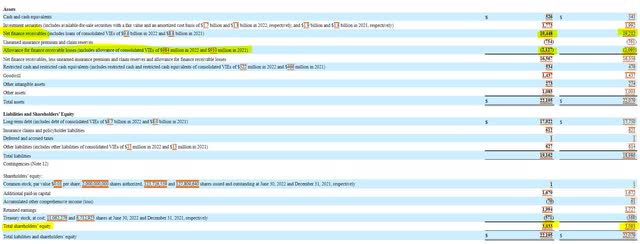

OneMain’s financial performance indicates that management is taking prudent steps to protect the company from rising interest rates. The company’s balance sheet is relatively uneventful as OneMain still holds slightly more than $3 billion in shareholder equity and similar leverage compared to the end of 2021. It’s also important to note that the company holds more than $2 billion in loan loss reserves against nearly $20 billion in loans. A further examination of the company financials will determine if this is sufficient.

Source: SEC 10-Q, Period Ending June 30, 2022

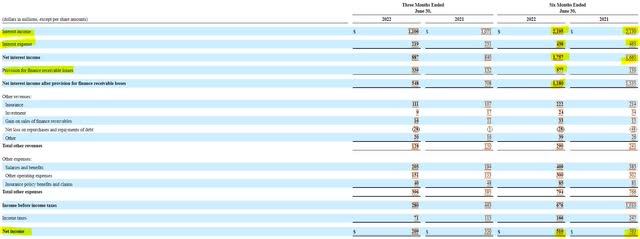

On a profit and loss basis, OneMain is experiencing higher net interest income compared to the same period a year ago, due to its ability to control interest expenses. The bottom line in 2022 was most impacted by its increasing provision for loan losses. These monies are not “sunk” but set aside in the event their loan portfolio experiences increasing defaults.

Source: SEC 10-Q, Period Ending June 30, 2022

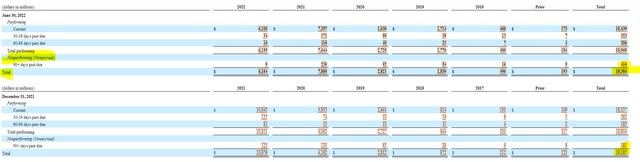

While the increase in loan loss provision may represent a major red flag to investors, the company is simply preparing itself in the event things would turn bad. Currently, the non performing rate on the company’s loans is 2.14% versus 2% at the end of last year. The loss provision covers more than 10% of the company’s loans.

Source: SEC 10-Q, Period Ending June 30, 2022

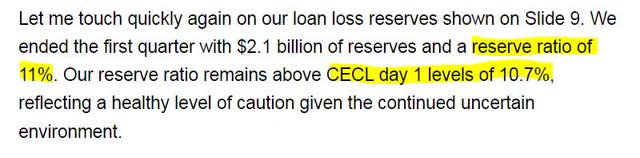

On the last earnings call, management took the opportunity to discuss the loan loss reserves compared to the industry standard.

Seeking Alpha Earnings Transcript

Source: Q2 2022 Earnings Call Transcript comments by Micah Conrad

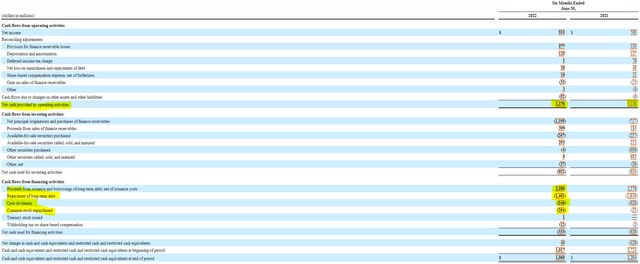

OneMain’s cash flow is likely the most reassuring data for debt investors. In the first six months of 2022, OneMain’s cash flow from operations remained stable at $1.1 billion. The company did opt to use that cash to invest in more loans, pay cash dividends, and buy back shares. Should the company experience cash flow declines, they could easily suspend the buyback of shares and dividends to preserve hundreds of millions in cash flow. Additionally, the company could sell some of its loans to raise cash if need be.

Source: SEC 10-Q, Period Ending June 30, 2022

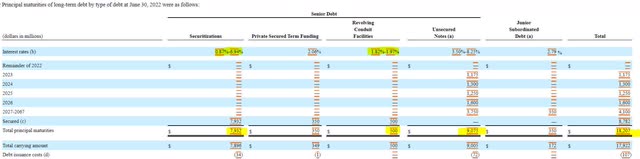

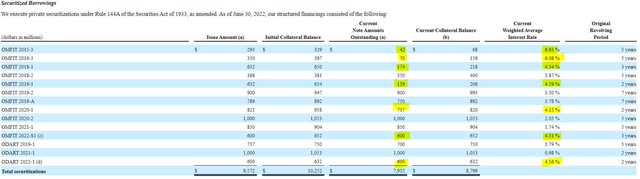

OneMain’s debt structure may create the greatest concern for investors. Nearly $8 million of the company’s $18 million in debt is in variable interest securitizations. Additionally, the company is facing over $5 billion in notes maturing between now and the March 2026 maturity. It could be difficult for OneMain to refinance this debt with a BB credit rating and a high interest rate credit market.

Source: SEC 10-Q, Period Ending June 30, 2022

Fortunately, OneMain’s $8 billion in securitized loans have staggered maturities and only $112 million is being charged at an interest rate of greater than 6%. Furthermore, $5.5 billion of the securitized debt is at an interest rate of less than 4%. Despite this, investors can expect profitability to erode in the near term as some of these loans roll over to higher interest rate renewals. If OneMain cannot underwrite new notes when its notes come due over the next four years, the company has $5.3 billion in undrawn capacity on its revolving conduit facility.

Source: SEC 10-Q, Period Ending June 30, 2022

Overall, I believe that the current credit markets and economic headwinds will erode OneMain’s profitability, creating risk to the company’s dividend. Despite the possibility of share declines, management has positioned to weather the storm by increasing its loan loss provisions and keeping over $5 billion undrawn from its credit facilities to fund eventual debt maturities. For bond investors, these tactics provide a great exit by 2026 with a return of 10%.

Information on 2026 maturing OneMain Financial bond:

CUSIP: 85172FAN9

Price: 91.85

Coupon: 7.125%

Yield to Maturity: 9.990%

Maturity Date: 3/15/2026

Credit Rating (Moody’s/S&P): Ba2/BB

Be the first to comment