Khosrork/iStock via Getty Images

Investment Thesis

Amazon’s (NASDAQ:AMZN) AWS won’t be enough to save this investment thesis. Even if Amazon has already seen its multiple come down, I believe that the bulk of Amazon, its retail business ends up reporting losses and does not support a strong multiple on the stock.

Meanwhile, even though the AWS segment has proven very resilient up until now, I believe that since enterprises are struggling in this global environment, this will lead to AWS’ near-term growth prospects slowing down too.

Altogether, I don’t believe that paying up 51x next year’s EPS figures is reflective of Amazon’s intrinsic value. This is a high multiple for what’s on offer today.

Secular Growth Businesses

Secular growth stories worked so well for so long that we stopped to check under the hood. A friend of mine calls this investment style the ”it doesn’t matter until it matters” style.

And we are all so guilty of this. I know I am. We seek out information that conforms to and confirms our points of view. While we do like to hear a different point of view, we do so only provided that it doesn’t stray too far from our own beliefs.

Yet, ultimately, we seek more information that allows us to increase our confidence in our own point of view. We don’t truly seek out more rounded information, to build a more accurate mosaic. That’s not how brains are designed. Our brains are designed to figure out if an animal is coming to hunt us or not. Our survival path was binomial. There is too little space for nuances.

What’s more, the problem here is that in a period of 0% interest rates, any business that wasn’t investing for growth was delivering a disservice to its shareholders. And that vision was more than adequately rewarded by investors. Investing for growth, while being marginally profitable made a lot of sense.

But like anything that starts out as resoundingly positive at the start, investors have a tendency to take those ideas to the extreme.

What’s Happening Right Now?

Amazon has two main segments, its retail business, and its AWS business. I’ll address these in turn.

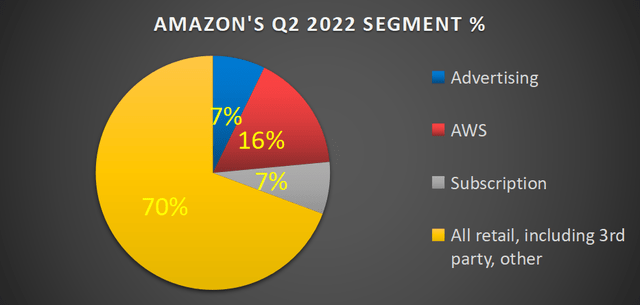

Author’s work

Amazon’s retail segment makes up approximately 84% of its total business mode. Within that, a very strong business exists, Amazon’s advertising business.

Amazon’s advertising business is amazing. It’s a high-margin business. Furthermore, any brand looking to carve out a business on Amazon is practically forced to pay for advertising otherwise it gets relegated to later pages on Amazon where few customers bother to search. And even though it’s easy to recognize the moat of Amazon’s advertising business, we are only talking about 7% of Amazon’s total business.

Consequently, I argue that 70% of Amazon is really what’s at play, that’s the yellow section of the pie above.

It’s that 70% of Amazon that as of right now is struggling to be profitable. So, from the investment perspective, investors were understandably willing to look beyond its lack of profitability, because Amazon was growing at more than 20% CAGR very consistently.

But today, even the most bullish of shareholders would struggle to admit that Amazon is going to return to growing at 20% CAGR. That’s simply not going to happen, for a while.

There’s a widespread cost of living crisis. Not only across the whole of Europe and Canada, but the US too. Essentially, consumers are now increasingly likely to cost compare products before simply looking on Amazon.

Simply put, does Amazon offer consumers a dramatically higher value proposition, as consumers are today penny-pinching? I don’t believe that to be accurate.

With this framework in mind, let’s now turn our focus to AWS.

Putting a Fair Multiple on AWS

AWS is the crown jewel. Just under 20% of Amazon’s total revenues is AWS. That’s an area of resilient growth. However, we’ve seen evidence from a broad spectrum of enterprise businesses, that the sales cycle today has started to elongate.

For evidence to back up this assertion, we can look towards Salesforce’s (CRM) Investors Day or ServiceNow’s (NOW) recent results. Enterprises are not immune to the underlying pressures in the economy.

So, this is the key question that investors need to get answered, can AWS continue to grow at 30% CAGR in the coming year?

Or could it be that AWS pulled forward a lot of its future growth and will now enter a period of slowing revenue growth rates? Or could it be that Azure (MSFT) and Google Cloud (GOOG)(GOOGL) could impact AWS’ ability to grow at 30% CAGR over the coming year?

Also, even if AWS’s margins are able to remain resilient in the face of rising inflation, could AWS end up with 25% operating margins?

All considered I don’t believe that AWS is worth more than a $700 to $800 million market cap. For this, I assumed that AWS’s operating income grows in 2023 to $30 billion and I’ve put a 25x multiple on its operating income. I hope you’ll agree that’s a very fair assumption.

AMZN Stock Valuation — 51x Next Year’s EPS

Next, the problem gets compounded because Amazon’s valuation simply leaves investors with no room for potential surprises. As I’ve alluded to throughout, I believe that Amazon’s near-term earnings will negatively surprise investors.

However, even if I allow myself some room for a margin of error, and acquiesce that analysts’ EPS estimates are right, there’s simply no justification for Amazon to be priced at 51x next year’s EPS.

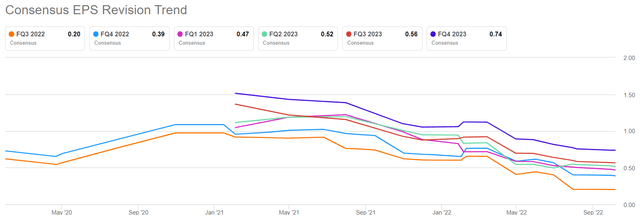

AMZN EPS consensus

Moreover, out of the vast majority of mega tech names, Amazon appears to be the one where analysts have most significantly downwardly revised their EPS estimates. So, with this in mind, it’s very likely these EPS estimates have now come down to a level that is more measured.

And then, we once again circle back, are investors justified in paying 51x next year’s EPS when Amazon’s top line is growing at less than 20% CAGR?

The Bottom Line

The hallmark of an open mind is not letting your ideas become your identity. If you define yourself by your opinions, questioning them is a threat to your integrity. (Adam Grant)

Adam Grant has this habit of making the complex sound simple. It’s always so easy to see the writing on the wall when we detach ourselves from our position. But we become entrenched in our points of view because we too readily identify with our stocks as a reflection of who we are!

I believe that Amazon’s Q4 2022 guidance could negatively surprise investors, particularly if its AWS business doesn’t live up to expectations.

Be the first to comment