Editor’s note: Seeking Alpha is proud to welcome Andrew Harvey as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto/iStock Editorial via Getty Images

The market is underestimating the value that Cardinal Health (NYSE:CAH) provides. There are multiple reasons why I think the market is mispricing the stock, such as having a new management team and an above-average balance sheet. In my opinion, the market is overestimating the litigation risk that CAH faces since it recently settled a large national settlement, which will alleviate a lot of risk in terms of litigation. In my research, I have found that, using a free cash flow to the firm model and relative valuation model, there is significant upside in this stock.

Overview

Cardinal Health is a pharmaceutical distributor that is one of the country’s three main sources of this service, with McKesson (MCK) and AmerisourceBergen (ABC) being the other two. For years, this company has seen constant and steady growth on both the top and bottom lines, but there are still a few mispricings that I see the market making. As noted in its most recent earnings report, there was a significant management change, including the departure of CEO Mike Kaufmann. Entering this spot is Jason Hollar, who previously served as CFO of CAH, with previous stops at other well-known companies where he made major improvements. I see the change in management as a huge win for investors, as this team is known for having new ideas that could create new initiatives and can work to improve margins.

Another thing to note is that the company recently announced a national settlement, including paying about $6 billion over 18 years. And this is being paid by a number of companies, not just Cardinal Health. This is a win for investors because even though this is a major settlement, it is important to note that payments will be over 18 years. Given that the company has revenue of close to $200 billion, paying this settlement will have little effect on CAH long term. I believe that the market overreacted negatively to this news.

Lastly, the company has paid down its long-term debt from over $9 billion in 2017 to just over $4.6 billion in the company’s most recent filing. The company has a solid balance sheet and is determined to keep lowering this debt over time. The company is also very active in terms of buying back shares, which benefits shareholders more directly.

Cardinal Health plans on continuing to lower debt and buy back more shares on top of increasing margin over time (Cardinal Health Investor Relations Page)

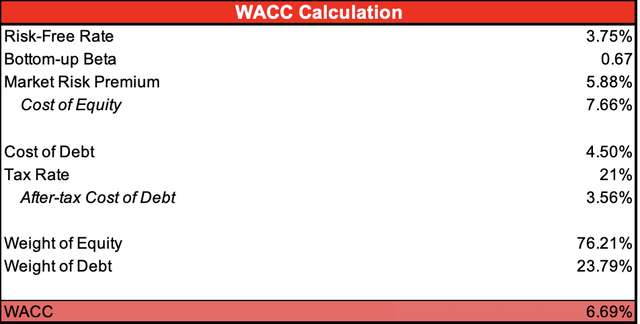

Looking at the Weighted Average Cost of Capital

For my WACC (weighted average cost of capital), I decided to use a bottom-up beta approach because it encompasses the risk of the company and its relative peers. I chose five comparable companies that I used in my calculation for WACC: AmerisourceBergen, McKesson, Owen’s & Minor (OMI), Henry Shein (HSIC), and AdaptHealth (AHCO). I took the average unlevered betas for each of those companies, including Cardinal Health, and then relevered it using the debt/equity ratio of Cardinal Health. In doing that, I arrived at a relevered beta of 0.67. Using a market risk premium of 5.88% and a risk-free rate of 3.75% (30-year Treasury rate), I arrived at a WACC for Cardinal Health of 6.69%.

This is my calculation for the weighted average cost of capital for Cardinal Health (My Model)

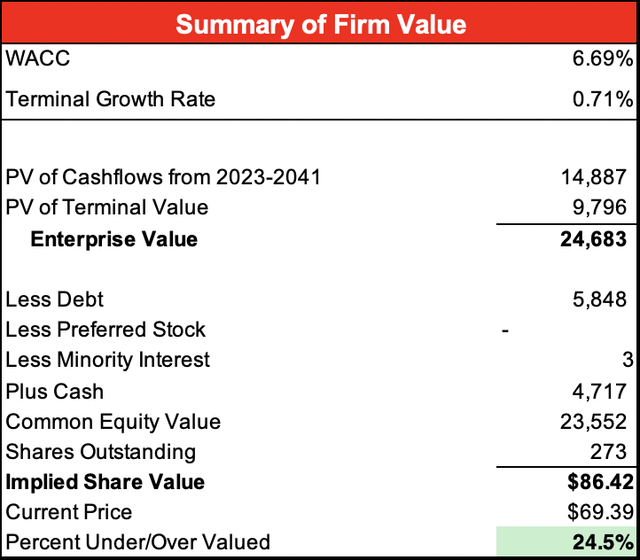

Examining the Free Cash Flow to the Firm Valuation

For my free cash flow to the firm model, I made a couple of assumptions. I have revenue growth continuing at a constant rate starting at 9% in 2023, and then trending down to 3% in 2030. For cost of goods sold, this metric is very important to the company because it represents about 96% of its expenses. Since Cardinal Health is in the business of pharmaceutical distribution, the gross margin for the industry is small. For the purposes of my model, I decided to keep cost of goods sold as a percentage of revenue at 96.25% after looking at Cardinal Health’s historical data and the industry average.

Other expenses – such as SG&A expense, depreciation and amortization, and the tax rate – are fairly constant, so I took a historical average of those as I feel that they are representative of the company. With those assumptions, I calculated the free cash flow to the firm out to 2041 (20 years) and discounted each one by the discount rate, which was my WACC. After my calculations, I arrived at an implied share price of $86.42, representing a current undervaluation of the stock at 24.5%.

My calculation of implied share price using a free cash flow to the firm model (My Model)

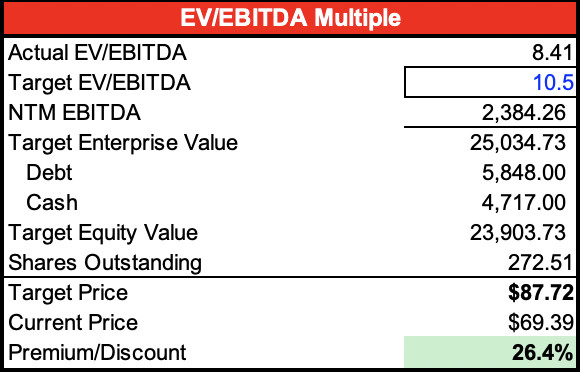

Relative Valuation Method

The last method of valuation I used was relative valuation – i.e., using comparable companies to assess how Cardinal Health is valued on a relative scale. I used almost all of the same companies as in my WACC calculation, with the exception being AdaptHealth because it did not meet my relative valuation minimum requirements. I decided to use an enterprise value-to-EBITDA multiple instead of a more common multiple, such as P/E, because Cardinal Health’s net income has not been very consistent over the past few years. I believe using an EV-to-EBTIDA multiple is more representative of the company to compare it against its peers.

In this group of five companies, I believe that CAH is the third-best company in this group. I also wanted to mainly focus on AmerisourceBergen and McKesson, because those are the main competitors, given that the three companies make up about 95% of the U.S. pharmaceutical distribution industry. Using an NTM (next 12 months) EV-to-EBITDA multiple, I arrived at a target multiple of 10.5, which is an increase from the current multiple of just under 8.5. My reasoning for the multiple increase is that I believe that those three companies are fairly equal, and the average multiple between them is around 10.5. In my opinion, the market is undervaluing Cardinal Health more than the other two, so that’s why they have a lower multiple currently. Using this approach, I arrived at an implied share price of $87.72, representing an undervaluation of 26.4%.

My calculation of implied share pricing using the relative valuation approach (My Model)

Risks

While I am very bullish on Cardinal Health, it’s important that investors recognize the risks associated with this company, as well as the industry as a whole. Given that it’s in the pharmaceutical industry, there will always be pricing pressures due to possible legislation to mandate lower pricing of drugs, which will have an impact on Cardinal Health directly.

Investors should also be wary about the medical segment of the company. I have not talked about it much since it only makes up about 10% of overall revenue, but many large institutional and activists investors want Cardinal Health to divest this segment as they see it as unprofitable. Some feel that those resources would be better off used in the pharmaceutical segment.

Another major risk that I see investing in Cardinal Health is litigation risk. While I have discussed the recent national settlement, there is always the possibility that, in the future, Cardinal Health and its competitors face more litigation on the state and national levels. That’s because there are mounting calls to hold companies responsible for the opioid epidemic.

The last major risk is that they are customer-dependent. What I mean is that CVS Health (CVS) represents about 25% of the total revenue for the company. While the two sides recently agreed to an extension until 2027, if CVS decides that it wants to work with another pharmaceutical distributor, that would have a significant effect on CAH’s top and bottom lines.

Conclusion

I have spent many days researching and doing due diligence on Cardinal Health. I strongly believe that this company is being very undervalued by the market right now. There are certain risks that are present – such as pricing pressures and the medical segment not being very profitable – but those are not significant enough to change my model in any major way. With the balance sheet being as good as it is, with the new management team coming in and being able to infuse their ideas and create margin improvements, and with the biggest litigation risk behind them, Cardinal Health presents a very valuable opportunity to investors to buy in before the market realizes these mispricings.

Be the first to comment