ablokhin

Citigroup Inc. (C) and Bank of America Corporation (NYSE:BAC) have become investor favorites in recent days after both banks reported better-than-expected second-quarter results.

Despite the fact that both banks have benefited from increasing net interest income courtesy of the central bank, I believe it is extremely dangerous to invest in cyclical banks at a time when growth is declining. Bank of America is likely to face even stronger headwinds in the future, as provisions for credit losses have begun to climb.

I continue to believe that Bank of America’s stock will trade at a discount to book value within the next year.

A Strong Quarter But Headwinds Are Growing

Citigroup and Bank of America stock rose 13% and 7% on Friday, respectively, after Citigroup reported good 2Q-22 earnings that showed strong trade outcomes and higher earnings amid higher interest rates.

In terms of sales and earnings per share, Citigroup’s second-quarter performance also beat analysts’ forecasts. EPS was significantly higher than expected ($2.19 vs. $1.68 projected), while revenue of $19.64 billion exceeded the average analyst forecast of $18.22 billion.

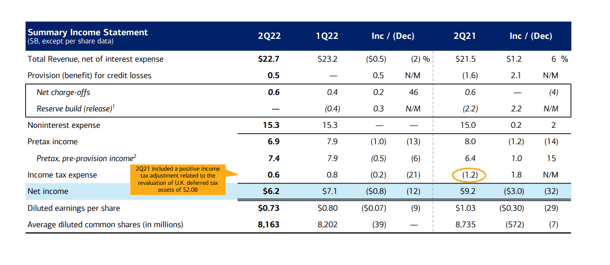

Bank of America earned $0.73 per share versus a consensus expectation of $0.78 per share, on revenue of $22.69 billion versus a consensus of $22.67 billion.

Bank of America experienced a strong second quarter. Bank of America’s Consumer Bank continued to perform well in 2Q-22, with net interest income increasing and a total profit of $6.25 billion remaining at the end of the day. Despite billions in second-quarter revenues, Bank of America’s profits fell 32% year on year.

Summary Income Statement (Bank of America)

There are two areas of Bank of America’s second-quarter earnings that I believe require further discussion.

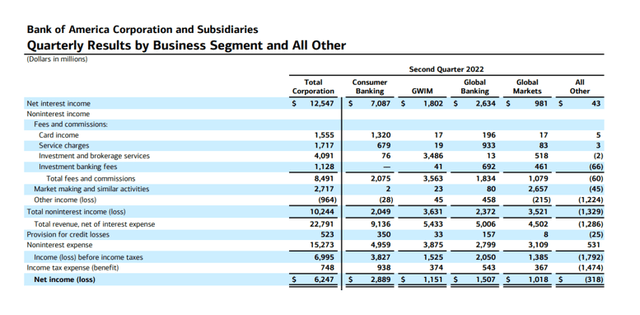

First, Bank of America’s second-quarter performance were once again bolstered by a solid showing from the Consumer Bank. Bank of America’s Consumer Bank is the customer-facing division that accepts deposits, makes personal loans to borrowers, consults customers in Bank of America’s financial centers, and issues credit cards.

During last year’s economic boom, Bank of America’s performance was mostly driven by the Consumer Bank. The division earned $2.89 billion in profits in 2Q-22, the biggest of any business segment. Profits from consumer banks accounted for nearly half of Bank of America’s total second-quarter profit of $6.25 billion.

Quarterly Results By Business Segment (Bank of America)

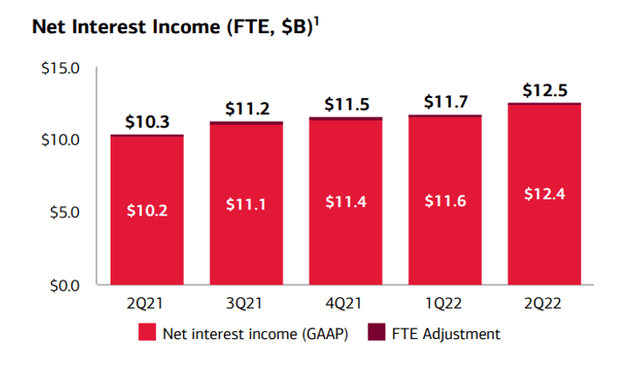

The increase in net interest income was the second reason for Bank of America’s strong earnings report. Banks benefit in the near term from rising interest rates because they can lend money at greater rates.

Bank of America benefited from the rise in interest rates in the second quarter, with net interest income increasing $800 million QoQ to $12.5 billion in 2Q-22.

Net interest income is a significant source of income for banks that is directly influenced by the central bank’s monetary policy. Bank of America’s net interest income climbed by $2.2 billion in the last year.

Net Interest Income (Bank of America)

However, present net interest income gains do not capture the whole story because higher interest rates cool the economy. The central bank boosts interest rates to prevent the economy from overheating, which is generally interpreted as a sign of a recession.

Highly cyclical, economy-dependent firms, such as Bank of America’s Consumer Bank, are poised to suffer from a recession, which often results in reduced loan volumes, decreased credit card use, and greater defaults.

Asset Quality Is Deteriorating

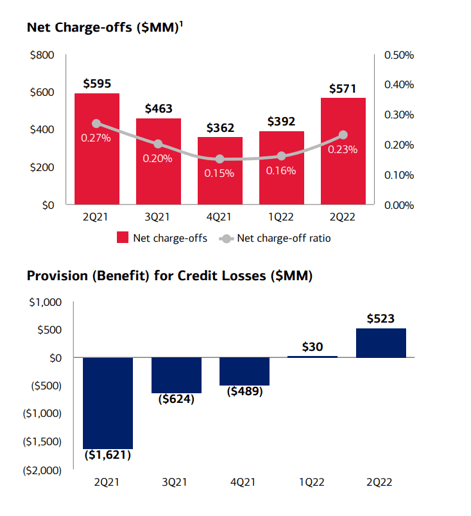

Strong Consumer Bank earnings and rising net interest income are both good things, but Bank of America’s deteriorating asset quality is a concern, especially if present trends continue into the second half of the year.

The bank’s net charge-off ratio climbed from 0.16% in 1Q-22 to 0.23% in 2Q-22 which is a pretty substantial increase. At the same time, Bank of America’s provision for credit losses increased from $30 million to $523 million. Larger net charge-off ratios and provisions indicate higher predicted loan losses in the future due to the bank’s customers’ deteriorating financial health.

Net Charge-Offs (Bank of America)

Why Bank of America Could See A Higher Stock Price

Analysts are still debating when, not if, a recession will occur. However, if a recession is avoided and the central bank controls inflation, the way may be cleared for Bank of America’s shares to surge higher. The same may be said for asset quality trends. Bank of America might be a winner in the future if its credit troubles do not worsen and credit provisions do not rise.

Expect Bank of America To Trade At A Discount To Book Value

In my opinion, the U.S. economy is on the verge of entering a recession, which might occur in the second part of the year or in 2023. Investing in cyclical stocks such as banks in a deflating economy with rising inflation carries extremely high risks for investors.

Bank of America is trading at 1.09x book value, representing a 9% premium. Bank of America has traded at large discount to book value in more difficult economic times, and I believe this is where we are headed.

My Conclusion

Bank of America’s 2Q-22 earnings report was positive, but I don’t believe the euphoria for bank stocks in general is justified given the state of the economy. Earnings were strong, and net interest income increased.

Provisions for credit losses, on the other hand, indicate that asset quality issues are emerging on Bank of America’s balance sheet. Long-term, higher interest rates translate into cyclical earnings risks for consumer banks.

Because of cyclical and economic headwinds, I believe Bank of America will begin to trade at a discount to book value within the next year.

Be the first to comment