svetikd

Having a diversified portfolio of moat-worthy companies is one of the best ways to sleeping well at night while generating strong returns. While the market has been rather topsy turvy over the past several months, insurance companies have held up rather well.

This includes the healthcare insurance giant, Cigna (NYSE:CI), which has had relatively steady performance since the start of May, while many other sectors have endured plenty of pain. In this article, I highlight what makes a quality buy at the current price for potentially strong returns, so let’s get started.

Why CI?

Cigna is one of the largest global health insurers, with presence in over 30 countries, and it has 190 million customer and patient relationships. Cigna benefits from its massive scale and coverage, as it contracts with 99% of U.S. pharmacies. Cigna also greatly expanded its presence in the growing pharmacy benefits management space through its massive acquisition of Express Scripts, giving it more negotiating leverage with pharmacies on drug pricing.

Cigna has several avenues for growth, as it has the ability to offer bulked up services through cross-selling PBM services into its manage-care client set. Moreover, its Accredo specialty pharmacy opens up avenues for treatment of higher margin oncology and rare-disease therapies. It also has opportunities to expand both organically and through external growth, as noted by Morningstar in its recent analyst report:

Cigna also continues to expand geographically, especially in government and international markets. Cigna has highlighted a disciplined expansion strategy in the U.S. government channel with a focus on areas where it already has a significant commercial book of business to serve patients as they retire from existing employer clients and age into Medicare Advantage offerings.

We view this type of geographic expansion as supportive of Cigna’s moat. With these opportunities, Cigna aims for 6%-8% organic profit growth that expands to 10% to 13% earnings growth primarily through capital-allocation activities like repurchases and acquisitions in the long run.

Meanwhile, Cigna is posting strong top and bottom line growth that beat analyst expectations during the first quarter, with revenue growing by a robust 7.4% YoY to $44.0 billion. This was driven by healthy growth in total medical customer base by 698K to 17.8 million.

The medical care ratio, which is the percentage of healthcare payouts divided by premiums collected is expected to remain at a reasonably stable 82-83.5% for the balance of the year. Importantly, Cigna maintains a high level of profitability with an A+ grade and an 11.4% return on equity.

Looking forward, management is guiding for strong growth. They highlighted 10-13% long-term EPS during its Investor Day conference last month, as it seeks to grow through its multiple lines of business, including PBM, Specialty Pharmacy, U.S. Commercial and Government. Also encouraging, management is targeting robust capital returns to shareholders, as noted during the recent conference call:

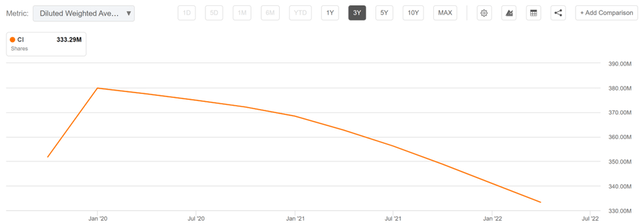

For full year 2022, we continue to expect at least $8.25 billion of cash flow from operations and to deploy at least $7 billion to share repurchases. We now expect full year weighted average shares of 310 million to 314 million shares, an increase of two million shares at the midpoint from our prior guidance, primarily due to our updated expectation for the timing of closing the international divestiture.

As shown below, Cigna has materially reduced its share count by 12%, from 380 million at the start of 2020 to 333 million in the latest reported quarter.

CI Shares Outstanding (Seeking Alpha)

Cigna also maintains a strong A- rated balance sheet and pays a well-covered dividend with a 19% payout ratio. While the 1.6% dividend yield is rather low, it raised the dividend by a respectable 12% this year, and this could result in meaningful returns in combination with share buybacks and EPS growth.

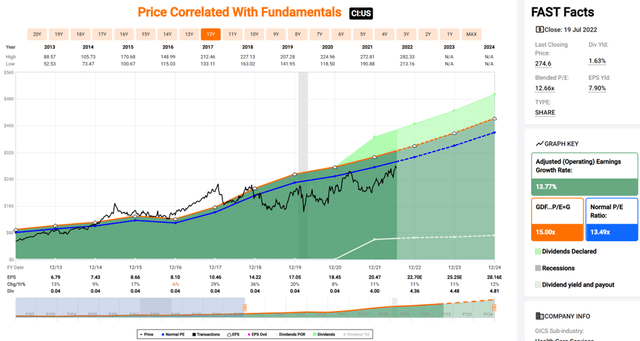

I see value in the stock at the current price of $266.72, with a forward PE of just 11.7, sitting well below the normal PE of 13.5 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $296, implying a potential one-year 13% total return including dividends.

(Note: The following graph is based on the $274.60 share price on 7/19)

CI Valuation (FAST Graphs)

Investor Takeaway

Cigna is a high-quality insurer with a moat that differentiates it from competitors. It has a long runway for growth and is shareholder-friendly, returning capital via share repurchases and dividend increases. I believe the stock is attractively valued at current levels and offer investors good potential upside in the coming years.

Be the first to comment