Natalia SERDYUK

Thesis

Sentiment towards Apple (NASDAQ:AAPL) stock has weakened in recent weeks, given the deteriorating macro-economic outlook, as well as an unexpected cut in smartphone production numbers. Now investors are nervously waiting to analyze Apple’s Q4 results for further guidance, not just to take pulse for Apple, but for the broad economy in general.

In my opinion, Apple’s Q4 results are likely going to be better than expected — or feared. Investors should consider that LVMH (OTCPK:LVMUY) recently reported strong consumer demand in the USA, Japan and most surprisingly Europe. Moreover, digital search trends do not yet highlight a slowing interest for Apple. The production cut reported by Bloomberg, will likely affect — if at all — Apple’s Q1 2023 and Q2 2023 results. I remain ‘Buy’ rated.

Earnings Preview

According to the Bloomberg Terminal, as of October 12th, 29 analysts have submitted their estimates for Apple’s Q4 results. Total sales are expected to be between $85.14 billion and $92.80 billion, with the average estimate being $88.85 billion. So, the dispersion is actually quite wide. If an investor would assume the average as the anchor, AAPL’s Q4 sales are estimated to grow at about 6.6% as compared to the same quarter in 2021. EPS estimates are between $1.13 and $1.35. The average is $1.27, which would imply a year over year growth of only 2.3%.

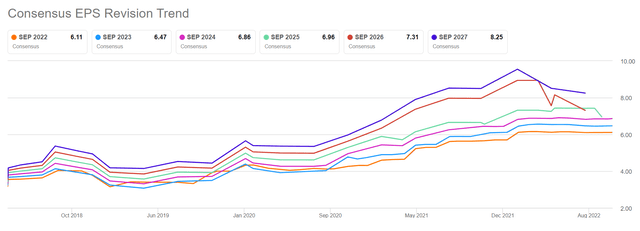

Notably, earnings expectations (EPS revisions) for Q4 have flattened during the past few months, with little downward/upward revision since December 2021.

Apple will report Q4 results on October 27, post market close.

Lower iPhone Sales?

Even though Apple has broadly diversified its revenue exposure, iPhone sales still account for almost 50% of total top-line, and perhaps even more for Apple’s bottom-line. Thus, Apple’s iPhone sales volume will be key.

Following a Bloomberg report, which suggested that Apple has scaled back smartphone production in the second half of 2022 by about 7% versus previous targets, investors are nervous that Apple’s iPhone sales will be lower than expected. But I do not think this worry is justified.

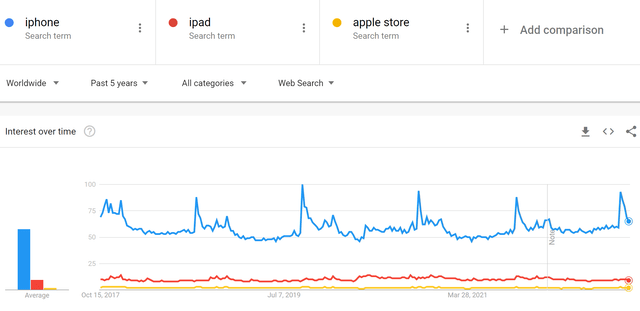

First, investors should note that the online search interest for iPhone products has consistently increased throughout 2022, and total interest remains higher than in 2021.

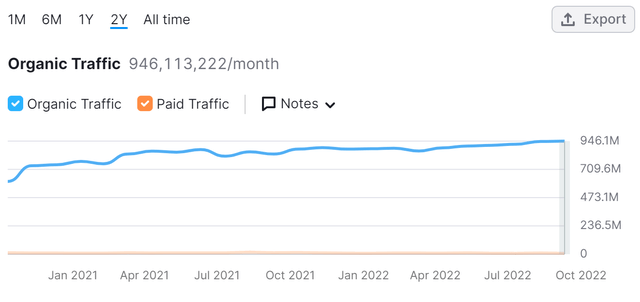

Moreover, the search trend is confirmed by web-traffic to Apple’s website and e-store. According to Semrush data, traffic to ‘Apple.com’ during June to September 2022 is about 8% higher than for the same period in 2021.

Second, investors should also consider that the impact of lower production volume will likely not materialize before Q1 2023. (So, Apple’s management commentary about the business outlook will be key to analyze)

Demand For Luxury Remains Strong

Against the odds, LVMH posted an exceptionally strong Q3 quarter, clearly beating analyst consensus estimates with regards to both revenue and earnings. In fact, LVMH recorded a 19% year over year sales increase in the September quarter, despite the reportedly weak consumer sentiment.

Most notably, LVMH highlighted surprisingly strong demand in the United States, Japan and Europe. In my opinion, Apple and LVMH are very similar — both companies enjoy unmatched consumer-centric luxury/premium brand value. So, if LVMH can deliver exceptionally strong results despite inflationary pressures, rising interest rates, falling asset prices and a weak economy in China, then Apple could very likely do so as well.

Apple Results Matter

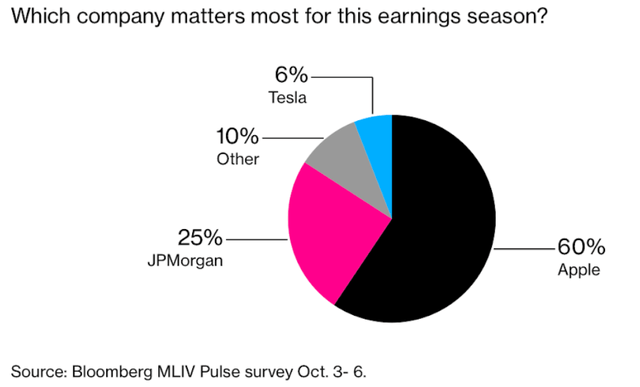

Investors will look to Apple’s Q4 results to judge if the market’s vulnerability to an economic slowdown. According to the Bloomberg MLIV pulse survey, 60% of investors see Apple as the most important pulse monitor for the global economy, as well as investor sentiment.

(J.P. Morgan (JPM) is second, with 25% of the voting share. I have written about JPM’s preview -> here.)

Accordingly, strong Q4 results from Apple could spark a buying party in the S&P 500 (SPX). And given that Apple is the largest component of both the S&P 500 and the Nasdaq 100, Apple stock will indirectly enjoy additional buying pressure.

Risks To Q4 Earnings

The major risk I see with Q4 earnings is not connected to the September quarter financials, but connected to a disappointing guidance. Investors should consider that investing in Apple is a levered play on the global economy, global investor sentiment and global politics. Arguing that Apple is unaffected by a challenging macro backdrop just does not make sense from an intellectual perspective – given that Apple is selling almost 200 million >$800 smartphones a year to consumers globally. Accordingly, the commentary surrounding inflation, the prospects of a recession and the accumulating challenges in China will be key to watch.

Conclusion

I am confident going into Apple’s Q4 announcement, as I believe the market has discounted too much negativity already, and various data does not indicate that the global economic slowdown has already taken a toll on Apple. As a consequence, I think an upside surprise is likely. To trade the thesis, investors could consider buying exposure to Apple directly, or indirectly through the market (S&P 500) — given Apple’s enormous importance for investor confidence.

Be the first to comment